Answered step by step

Verified Expert Solution

Question

1 Approved Answer

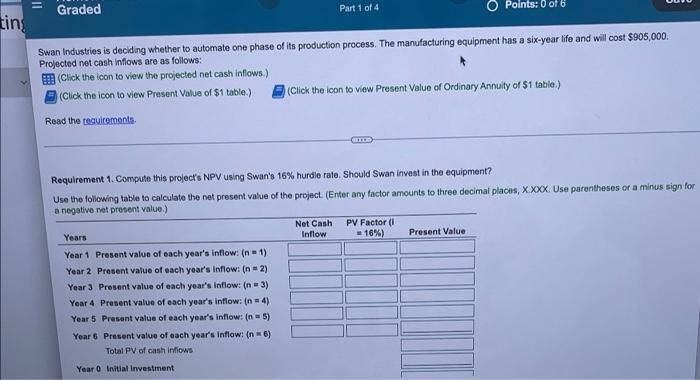

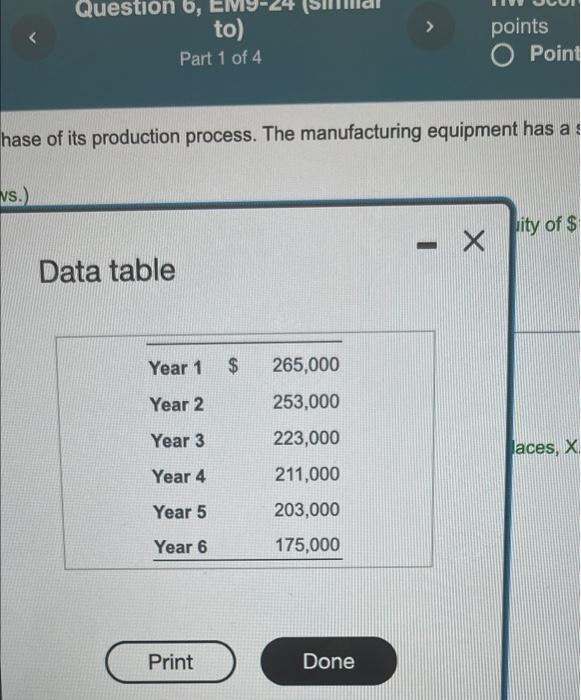

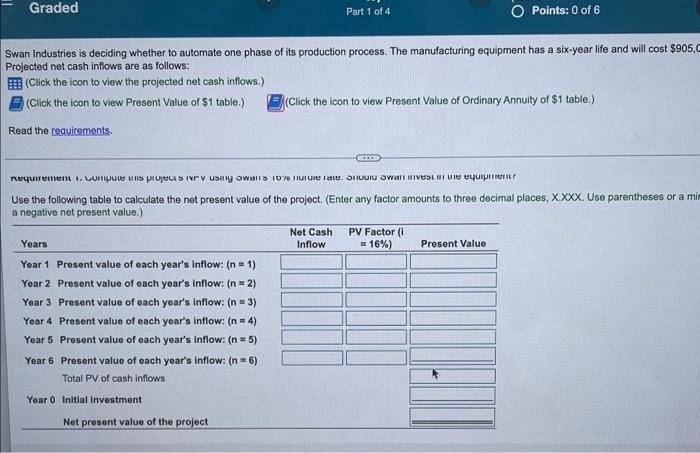

please answer completely. || Graded Part 1 of 4 Points: 0 of 6 tins Swan Industries is deciding whether to automate one phase of its

please answer completely.

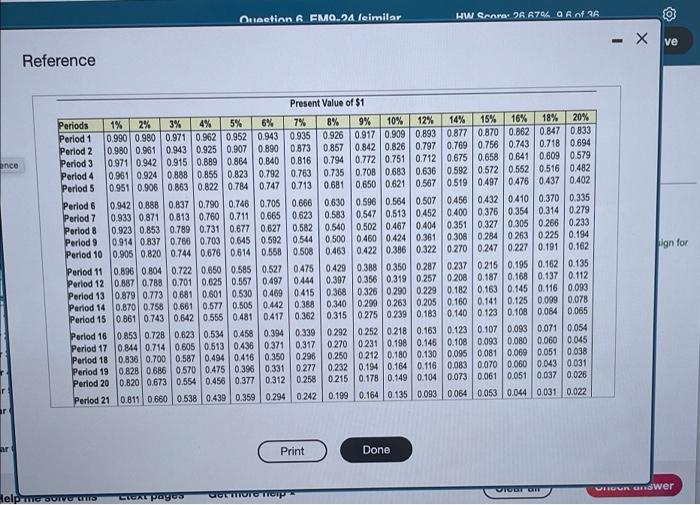

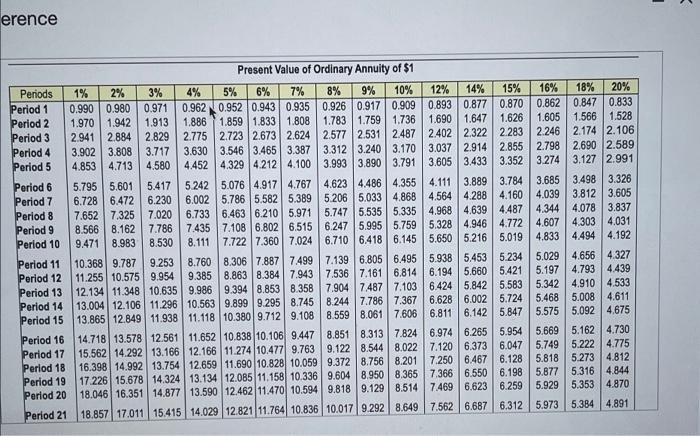

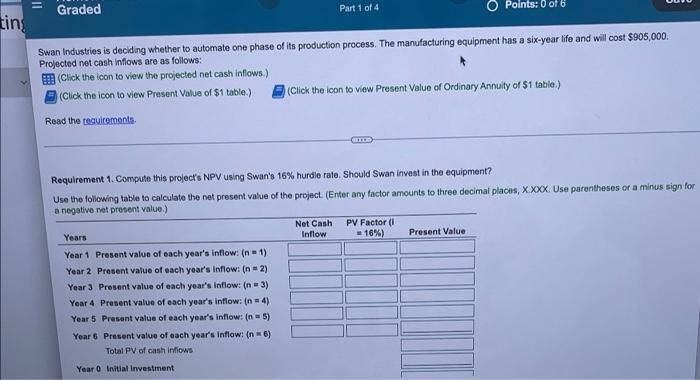

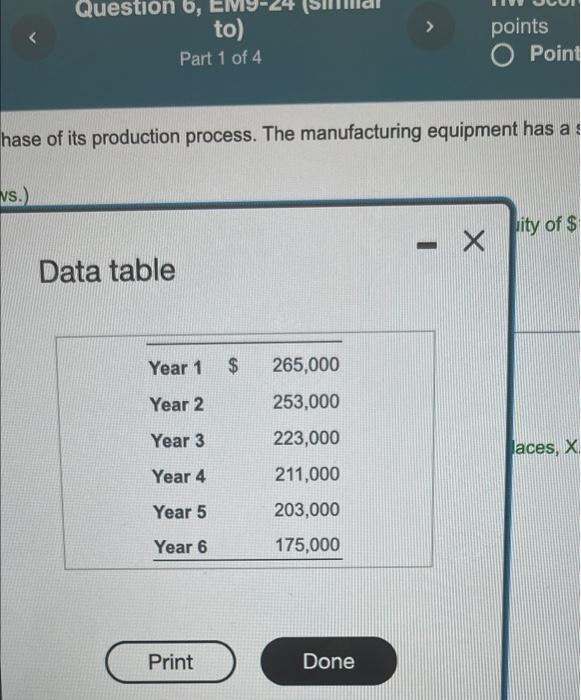

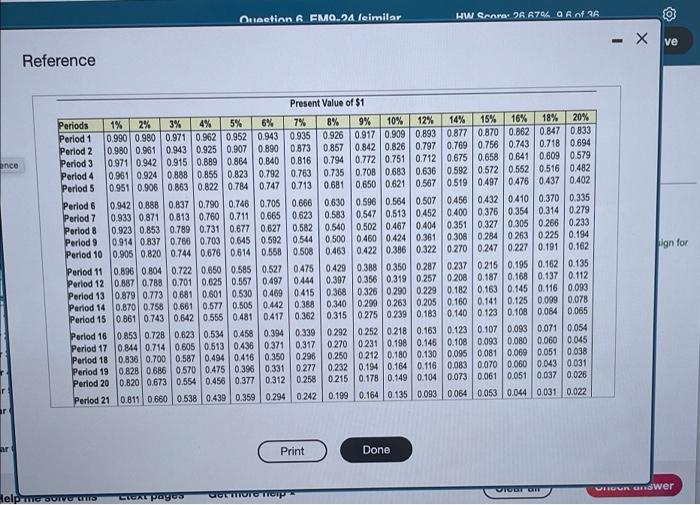

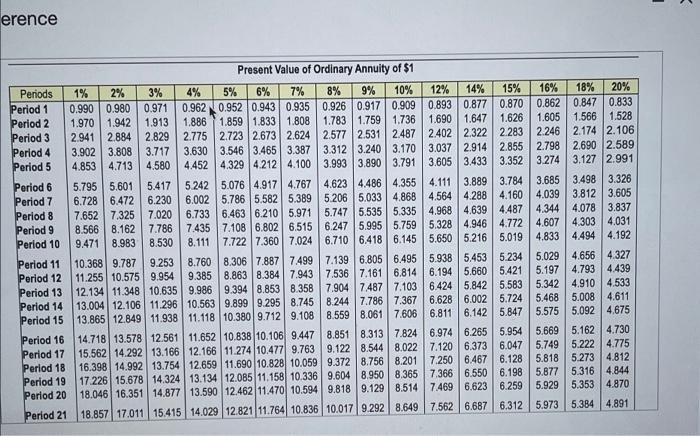

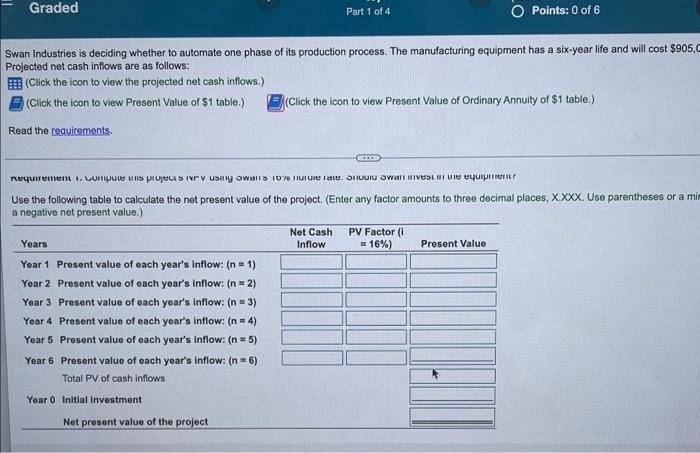

|| Graded Part 1 of 4 Points: 0 of 6 tins Swan Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $905,000. Projected net cash inflows are as follows: (Click the icon to view the projected net cash inflows.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. Compute this project's NPV using Swan's 16% hurdle rate. Should Swan invest in the equipment? Use the following table to calculate the net present value of the project. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Net Cash PV Factor (1) Inflow 16%) Years Present Value Year 1 Present value of each year's inflow: (n = 1) Year 2 Present value of each year's inflow: (n=2) Year 3 Present value of each year's inflow: (n = 3) Year 4 Present value of each year's inflow: (n = 4) Present value of each year's inflow: (n = 5) Year 5 Year 6 Present value of each year's Inflow: (n = 6) Total PV of cash inflows Year 0 Initial investment. Question 6, to) Part 1 of 4 points O Point hase of its production process. The manufacturing equipment has as vs.) ity of $ - X Data table 265,000 253,000 223,000 211,000 203,000 175,000 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Print $ Done aces, X nce Question & FMQ-24 leimilar HW Score: 26.67% 0 6 of 36 Reference Present Value of $1 Periods 1% 2% 3% 4% 5% 7% 9% 10% 12% 14% 15% 18% 16% 20% 6% 8% 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 Period 1 0.990 0.980 0.971 0.962 0.943 0.925 0.907 Period 2 0.980 0.961 Period 3 0.971 0.942 0.890 0.873 0.857 0.842 0.826 0.797 0.769 0.756 0.743 0.718 0.694 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.567 0.519 0.497 0.476 0.437 0.402 Period 4 0.961 0.951 Period 5 Period 6 0.942 0.888 0.837 0.813 Period 7 0.933 0.871 0.790 0.746 0.705 0.666 0.760 0.711 0.665 0.623 0.731 0.677 0.627 0.582 0.592 0.544 0.456 0.432 0.410 0.370 0.335 0.400 0.376 0.354 0.314 0.279 0.351 0.327 0.305 0.266 0.233 0.308 0.284 0.263 0225 0.194 Period 8 0.923 0.853 0.789 Period 9. 0.914 0.837 0.766 0.703 0.645 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 Period 11 0.896 0.804 Period 12 0.887 0.788 Period 13 Period 14 0.630 0.596 0.564 0.507 0.583 0.547 0.513 0.452 0.540 0.502 0.467 0.404 0.500 0.460 0.424 0.361 0.422 0.386 0.322 0.270 0.247 0.227 0.191 0.162 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.287 0.237 0.215 0.195 0.162 0.135 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.257 0.208 0.187 0.168 0.137 0.112 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0.861 0.743 0.642 0.555 0.481 0417 0.362 0.315 0.275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.163 0.123 0.107 0.093 0.071 0.054 0.844 0.714 0.605 0.513 0436 0.371 0.317 0270 0.231 0.198 0.146 0.108 0.093 0.080 0.060 0.045 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.130 0.095 0.081 0.069 0.051 0.038 0.277 0.232 0.194 0.164 0.116 0.083 0.070 0.060 0.043 0.031 0.828 0.686 0.570 0.475 0.396 0.331 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.104 0.073 0.061 0.051 0.037 0.026 0.199 0.164 0.135 0.093 0.064 0.053 0.044 0.031 0.022 0.811 0.660 0.538 0.439 0.359 0.294 0.242 Period 15 Period 16 0.853 0.728 0.623 Period 17 Perlod 18 Period 19 Period 20 Period 21 Print Done LIGAL pages Get more help Vigor Bir ar Help me suive the ve ign for VnGun andwer erence Periods Present Value of Ordinary Annuity of $1 1% 2% 3% 4% 12% 14% 15% 16% 20% Period 1 0.990 0.980 0.971 0.962 Period 2 1.970 1.942 1.913 Period 3 2.941 2.884 2.829 Period 4 3.902 3.808 3.717 Period 5 Period 6 4.853 4.713 4.580 5.417 6.728 6.472 6.230 5.795 5.601 3.498 3.326 3.812 3.605 Period 7 Period 8 Period 9 7.652 7.325 7.020 7.786 8.530 8.566 8.162 Period 10 9.471 8.983 5% 6% 7% 8% 9% 10% 18% 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.870 0.862 0.847 0.833 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.626 1.605 1.566 1.528 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 2.174 2.106 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.352 3.274 3.127 2.991 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.111 3.889 3.784 3.685 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.160 4.039 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.328 4.946 4.772 4.607 4.303 4.031 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 5.019 4.833 4.494 4.192 4.656 4.327 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.938 5.453 5.234 5.029 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 5.197 4.793 4.439 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.424 5.842 5.583 5.342 4.910 4.533 13.004 12.106 11.296 10.563 9.899 9.295 7.367 6.628 6.002 5.724 5.468 5.008 4.611 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 6.811 6.142 5.847 5.575 5.092 4.675 5.162 4.730 11.652 10.838 10.106 9.447 8.851 8.313 7.824 6.974 6.265 5.954 5.669 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.120 6.373 6.047 5.749 5.222 4.775 5.273 4.812 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 6.128 5.818 5.877 5.316 4.844 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 6.198 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.469 6.623 6.259 5.929 5.353 4.870 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 7.562 6.687 6.312 5.973 5.384 4.891 Period 11 10.368 9.787 6.194 5.660 5.421 Period 12 Period 13 Period 14 Period 15 8.745 8.244 7.786 Period 16 14.718 13.578 12.561 Period 17 Period 18 Period 19 Period 20 Period 21 X Graded Part 1 of 4 O Points: 0 of 6 Swan Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $905,C Projected net cash inflows are as follows: (Click the icon to view the projected net cash inflows.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement. Computer FV using walls 10% future rate our wallet quipment Use the following table to calculate the net present value of the project. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a mim a negative net present value.) Net Cash PV Factor (i Inflow = 16%) Years Present Value Year 1 Present value of each year's inflow: (n = 1) Year 2 Present value of each year's inflow: (n = 2) Year 3 Present value of each year's inflow: (n = 3) Year 4 Present value of each year's inflow: (n = 4) Year 5 Present value of each year's Inflow: (n = 5) Year 6 Present value of each year's inflow: (n = 6) Total PV of cash inflows Year 0 Initial investment Net present value of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started