Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer correctly and fully ive posted this three times already please HELP!!! Complete this question by entering your answers in the tabs below. Required

please answer correctly and fully ive posted this three times already please HELP!!!

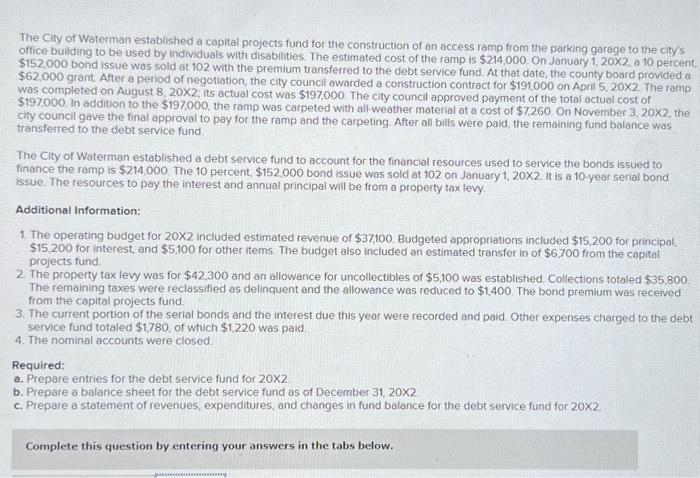

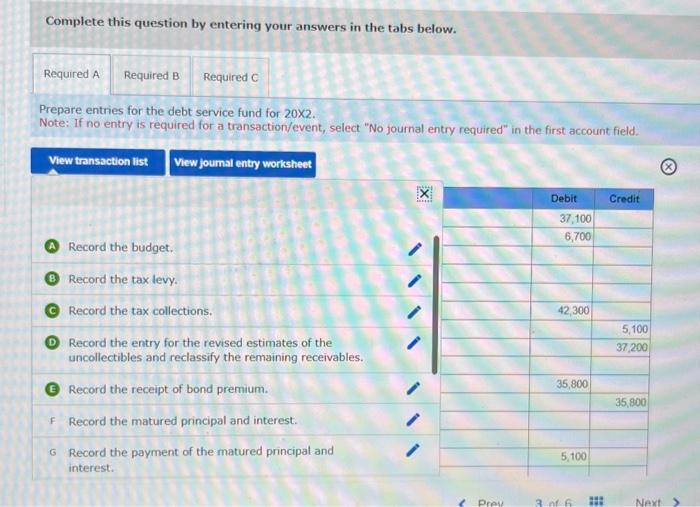

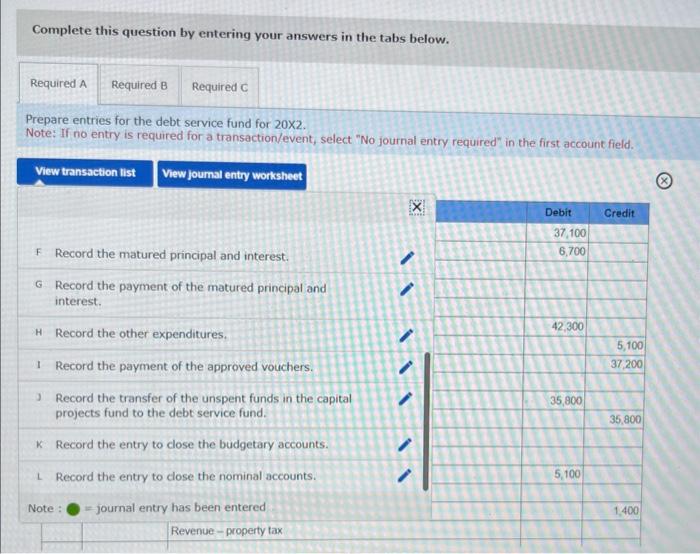

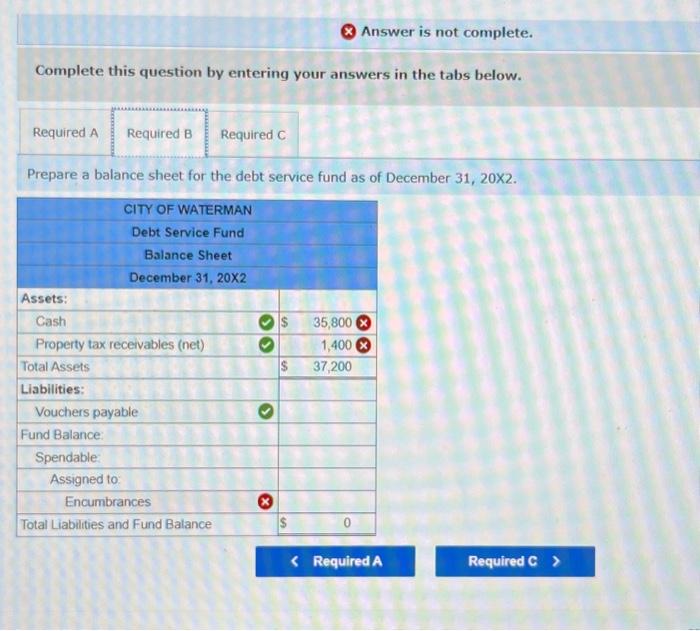

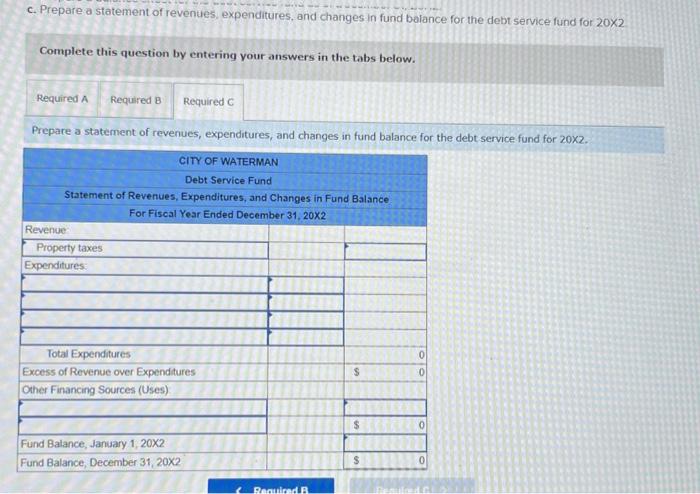

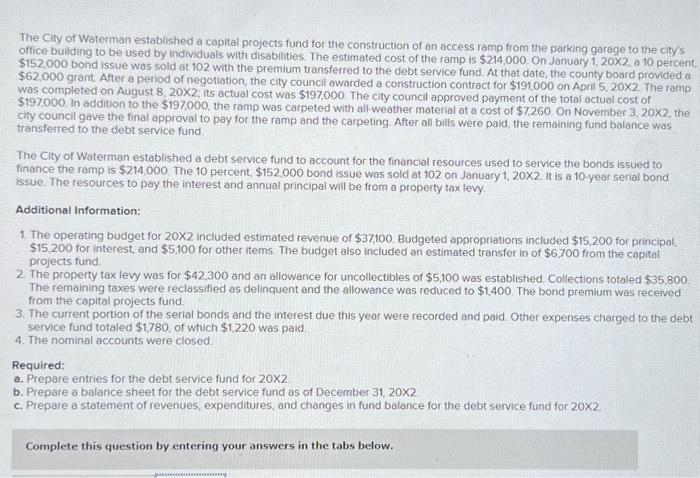

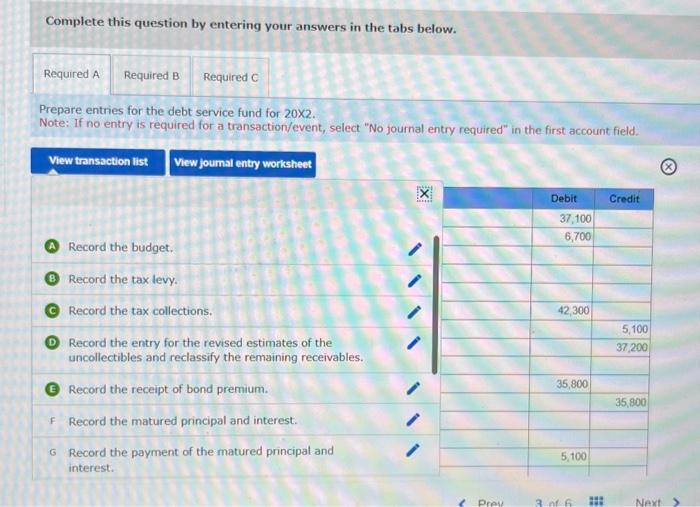

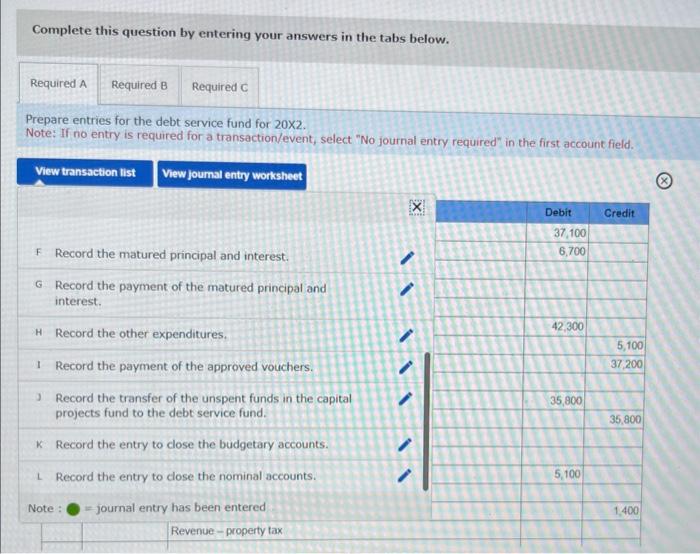

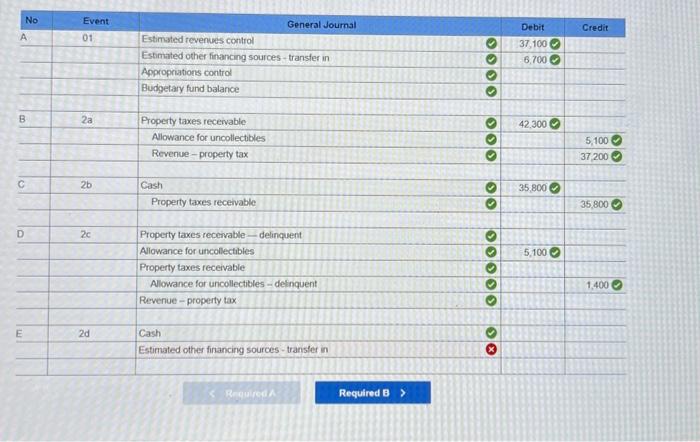

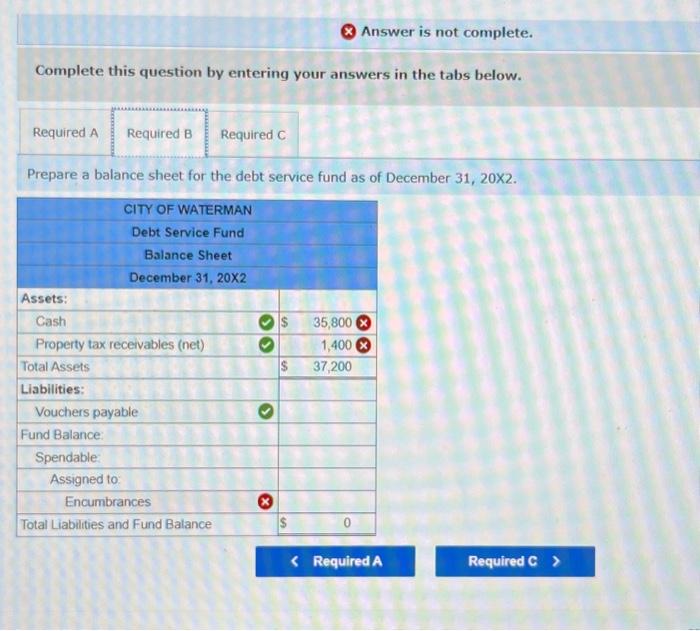

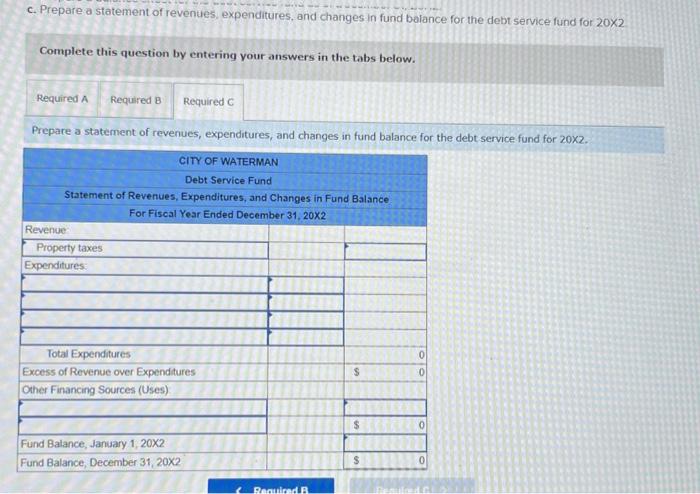

Complete this question by entering your answers in the tabs below. Required B Prepare entries for the debt service fund for 202. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. F. Record the matured principal and interest. G Record the payment of the matured principal and interest. H Record the other expenditures. 1 Record the payment of the approved vouchers. 3. Record the transfer of the unspent funds in the capital projects fund to the debt service fund. K Record the entry to close the budgetary accounts. L Record the entry to close the nominal accounts. Note : = journal entry has been entered Note : = journal entry has been entered \begin{tabular}{|l|l|} \hline Rinenue-property tax \\ \hline \end{tabular} X , , , Required B > Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for the debt service fund as of December 31, 202. The City of Waterman established a capital projects fund for the construction of an access ramp from the parking garage to the city's office buliding to be used by individuals with disabilities. The estimated cost of the ramp is $214,000. On Jonuary 1,202, a 10 percent. $152.000 bond issue was sold at 102 with the premium transferred to the debt service fund. At that date, the county board provided a $62.000 grant. After a period of negotiation, the city council awarded a construction contract for $191,000 on Aprit 5,202. The ramp city council gave the final approval to pay for the ramp and the carpeting. After all bills were paid; the remaining fund balance was transferred to the debt service fund The City of Woterman established a debt service fund to account for the financial resources used to service the bonds issued to finance the ramp is $214,000. The 10 percent, $152,000 bond issue was sold at 102 on January 1,202. It is a 10-year serial bond issue. The resources to pay the interest and annual principal will be from a property tax levy. Additional Information: 1. The operating budget for 202 included estimated revenue of $37,100. Budgeted appropriations included $15,200 for principal. $15,200 for interest, and $5,100 for other items. The budget also included an estimated transfer in of $6,700 from the capital projects fund. 2. The property tax levy was for $42,300 and an allowance for uncollectibles of $5,100 was established. Collections totaled $35,800 The remaining taxes were reclassified as delinquent and the allowance was reduced to $1,400. The bond premium was recerved from the capital projects fund. 3. The current portion of the serial bonds and the interest due this year were recorded and paid. Other expenses charged to the debt service fund totaled $1,780, of which $1,220 was paid 4. The nominal accounts were closed. Required: a. Prepare entries for the debt service fund for 202 b. Prepare a balance sheet for the debt service fund as of December 31,202 c. Prepare a statement of revenues, expenditures, and changes in fund balance for the debt service fund for 202 Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Prepare entries for the debt service fund for 202. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. c. Prepare a statement of revenues, expenditures, and changes in fund balance for the debt service fund for 202 Complete this question by entering your answers in the tabs below. Prepare a statement of revenues, expenditures, and changes in fund balance for the debt service fund for 202. Complete this question by entering your answers in the tabs below. Required B Prepare entries for the debt service fund for 202. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. F. Record the matured principal and interest. G Record the payment of the matured principal and interest. H Record the other expenditures. 1 Record the payment of the approved vouchers. 3. Record the transfer of the unspent funds in the capital projects fund to the debt service fund. K Record the entry to close the budgetary accounts. L Record the entry to close the nominal accounts. Note : = journal entry has been entered Note : = journal entry has been entered \begin{tabular}{|l|l|} \hline Rinenue-property tax \\ \hline \end{tabular} X , , , Required B > Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for the debt service fund as of December 31, 202. The City of Waterman established a capital projects fund for the construction of an access ramp from the parking garage to the city's office buliding to be used by individuals with disabilities. The estimated cost of the ramp is $214,000. On Jonuary 1,202, a 10 percent. $152.000 bond issue was sold at 102 with the premium transferred to the debt service fund. At that date, the county board provided a $62.000 grant. After a period of negotiation, the city council awarded a construction contract for $191,000 on Aprit 5,202. The ramp city council gave the final approval to pay for the ramp and the carpeting. After all bills were paid; the remaining fund balance was transferred to the debt service fund The City of Woterman established a debt service fund to account for the financial resources used to service the bonds issued to finance the ramp is $214,000. The 10 percent, $152,000 bond issue was sold at 102 on January 1,202. It is a 10-year serial bond issue. The resources to pay the interest and annual principal will be from a property tax levy. Additional Information: 1. The operating budget for 202 included estimated revenue of $37,100. Budgeted appropriations included $15,200 for principal. $15,200 for interest, and $5,100 for other items. The budget also included an estimated transfer in of $6,700 from the capital projects fund. 2. The property tax levy was for $42,300 and an allowance for uncollectibles of $5,100 was established. Collections totaled $35,800 The remaining taxes were reclassified as delinquent and the allowance was reduced to $1,400. The bond premium was recerved from the capital projects fund. 3. The current portion of the serial bonds and the interest due this year were recorded and paid. Other expenses charged to the debt service fund totaled $1,780, of which $1,220 was paid 4. The nominal accounts were closed. Required: a. Prepare entries for the debt service fund for 202 b. Prepare a balance sheet for the debt service fund as of December 31,202 c. Prepare a statement of revenues, expenditures, and changes in fund balance for the debt service fund for 202 Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Prepare entries for the debt service fund for 202. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. c. Prepare a statement of revenues, expenditures, and changes in fund balance for the debt service fund for 202 Complete this question by entering your answers in the tabs below. Prepare a statement of revenues, expenditures, and changes in fund balance for the debt service fund for 202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started