Answered step by step

Verified Expert Solution

Question

1 Approved Answer

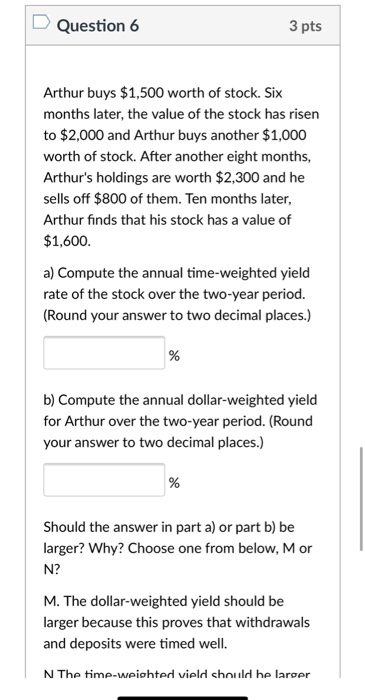

please answer correctly :) it is financial mathematics Question 6 3 pts Arthur buys $1,500 worth of stock. Six months later, the value of the

please answer correctly :) it is financial mathematics

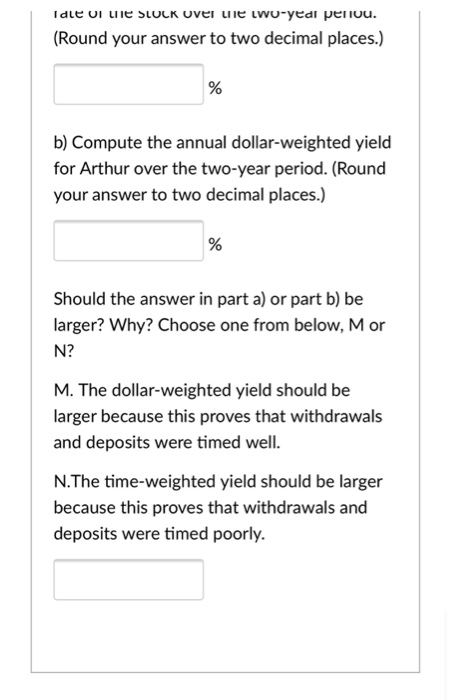

Question 6 3 pts Arthur buys $1,500 worth of stock. Six months later, the value of the stock has risen to $2,000 and Arthur buys another $1,000 worth of stock. After another eight months, Arthur's holdings are worth $2,300 and he sells off $800 of them. Ten months later, Arthur finds that his stock has a value of $1,600. a) Compute the annual time-weighted yield rate of the stock over the two-year period. (Round your answer to two decimal places.) % b) Compute the annual dollar-weighted yield for Arthur over the two-year period. (Round your answer to two decimal places.) % Should the answer in part a) or part b) be larger? Why? Choose one from below, Mor N? M. The dollar-weighted yield should be larger because this proves that withdrawals and deposits were timed well. N The time-weighted vield should be larger Tale UI LE SLOCK UVEI tie two-year penou. (Round your answer to two decimal places.) % b) Compute the annual dollar-weighted yield for Arthur over the two-year period. (Round your answer to two decimal places.) % Should the answer in part a) or part b) be larger? Why? Choose one from below, Mor N? M. The dollar-weighted yield should be larger because this proves that withdrawals and deposits were timed well. N.The time-weighted yield should be larger because this proves that withdrawals and deposits were timed poorly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started