Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer correctly. Thank you in advance. On August 1, 2021, Rocket Retailers adopted a plan to discontinue its catalog sales division, which qualifies as

Please answer correctly. Thank you in advance.

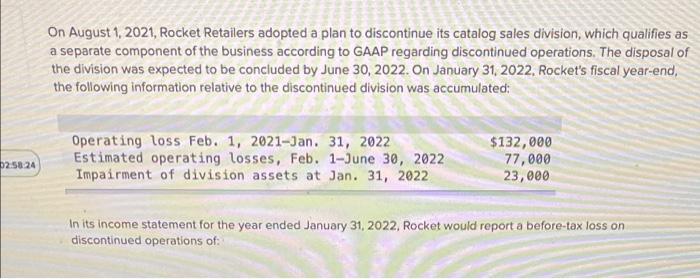

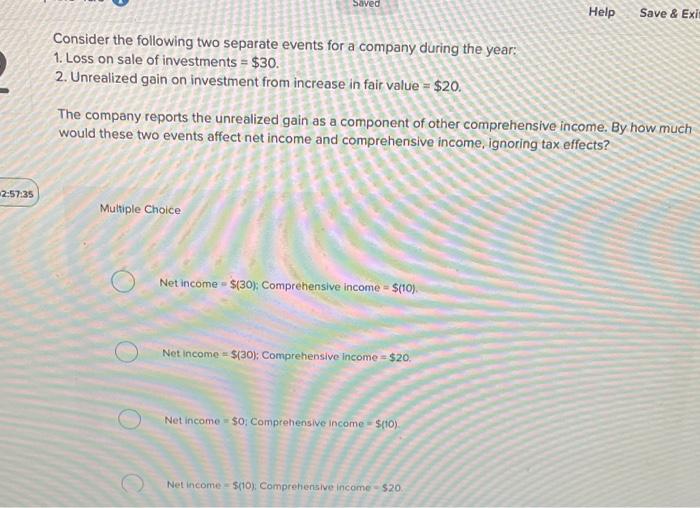

On August 1, 2021, Rocket Retailers adopted a plan to discontinue its catalog sales division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by June 30, 2022. On January 31, 2022, Rocket's fiscal year-end, the following information relative to the discontinued division was accumulated: 02:58:24 Operating loss Feb. 1, 2021-Jan. 31, 2022 Estimated operating losses, Feb. 1-June 30, 2022 Impairment of division assets at Jan. 31, 2022 $132,000 77,000 23,000 In its income statement for the year ended January 31, 2022, Rocket would report a before-tax loss on discontinued operations of: Saved Help Save & Exit Consider the following two separate events for a company during the year: 1. Loss on sale of investments = $30. 2. Unrealized gain on investment from increase in fair value = $20. The company reports the unrealized gain as a component of other comprehensive income. By how much would these two events affect net income and comprehensive income, ignoring tax effects? 2:57:35 Multiple Choice Net income - $(30): Comprehensive income - $(10). Net Income = $(30): Comprehensive Income = $20, Net income - $0: Comprehensive Income $(10) Net Income - $(10): Comprehensive income $20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started