Answered step by step

Verified Expert Solution

Question

1 Approved Answer

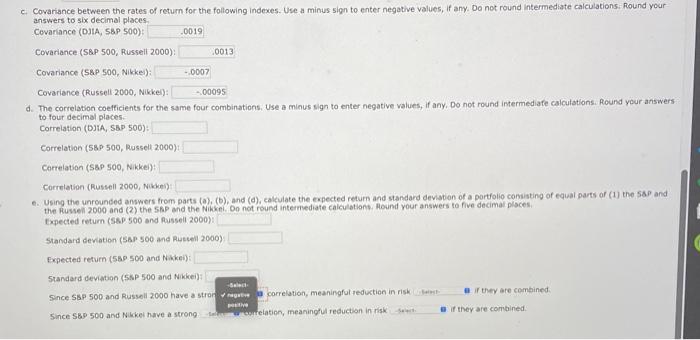

Please answer d and e. Thank you The following are monthly percentage price changes for four market indexes. answers to six decimal places. Covariance (DJtA,

Please answer d and e. Thank you

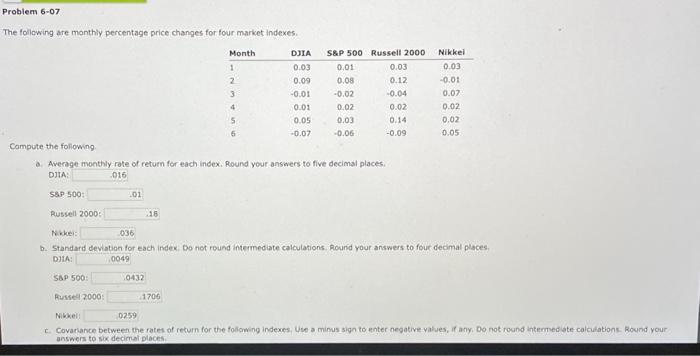

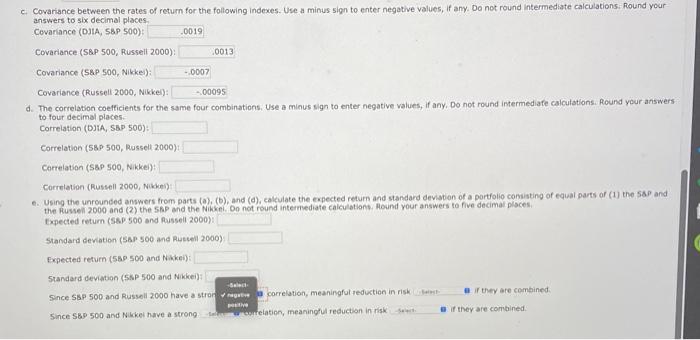

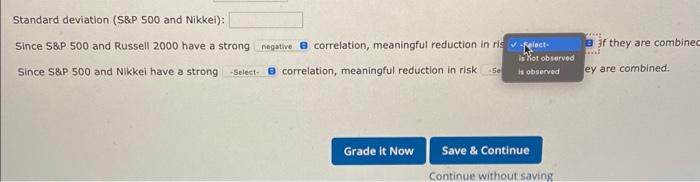

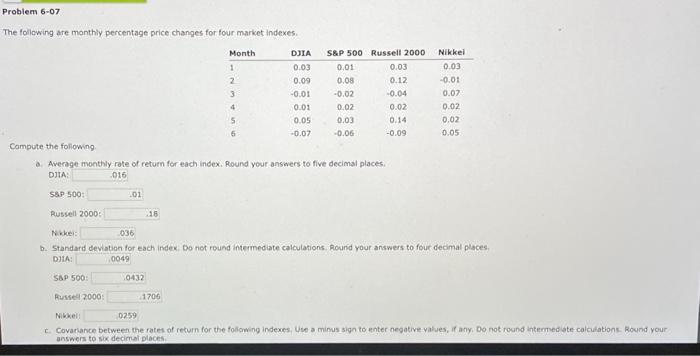

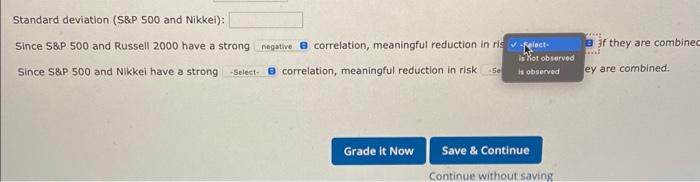

The following are monthly percentage price changes for four market indexes. answers to six decimal places. Covariance (DJtA, 589500 ) Covariance (S8P 500, Russell 2000): Covariance (S8P 500, Nikke): Covariance (Russell:2000, Nikkel): d. The correlation coetficients for the same four combinations. Use a minus sign to enter negative values, if any, Do not round intermediate calculations. Aound your answers to four decimal places. Correiation (DJiA, SBP 500): Correlation (580500, Russell 2000) Correiation (Ssp 500 , Nikkei): Correlation (Russell 2000, Nikkei) 6. Using the unrounded anwwers from parts (a), (b), and (a), cakculate the expected return and standard deviabion of a portfolio consisting of equal parts af (1) the 5s. and the Russell 2000 and (2) the 5kP and the Nikkei. On not round intermediate caiculations. Round your answers to five decimal ploces. fxpected return (SAP 500 and Rassell 2000): Standard deviation (SEP 500 and Austell 2000) Expected retum (589 500 and Nikkei): 5tandard deviation (5\$P 500 and Nikkei): Since SBE 500 and Russell 2000 have a str correlation, meaningful reduction in risk If they are combined. if they are combined Since SBP 500 and Nikkel have a strong tsion, meaninghul reductian in risk Standard deviation (S\&P 500 and Nikkei): Since S8P 500 and Russell 2000 have a strong correlation, meaningful reduction in r : If they are combine Since S\&P 500 and Nikkei have a strong correlation, meaningful reduction in risk y are combined

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started