please answer

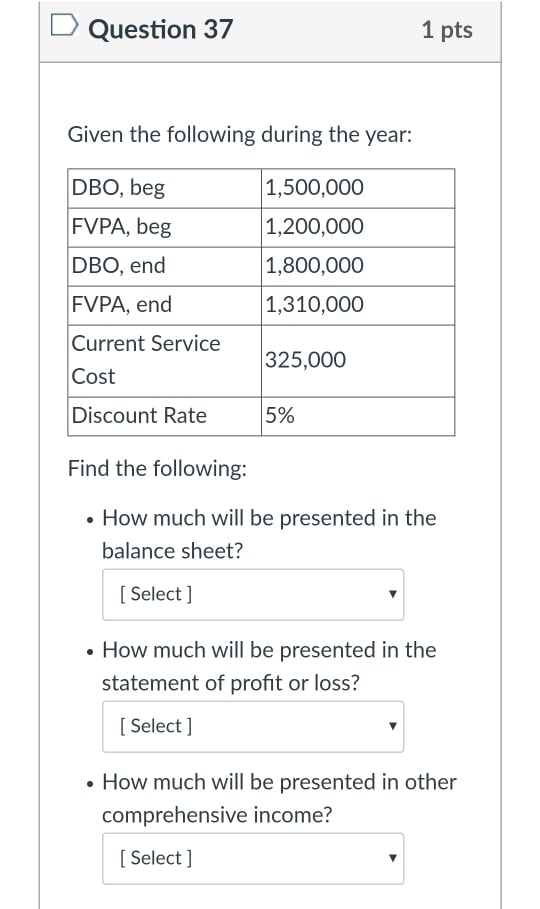

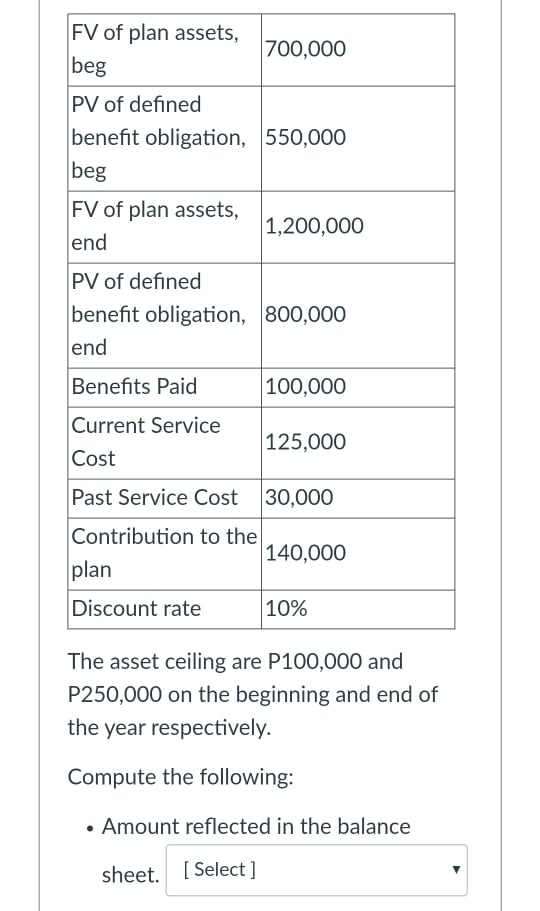

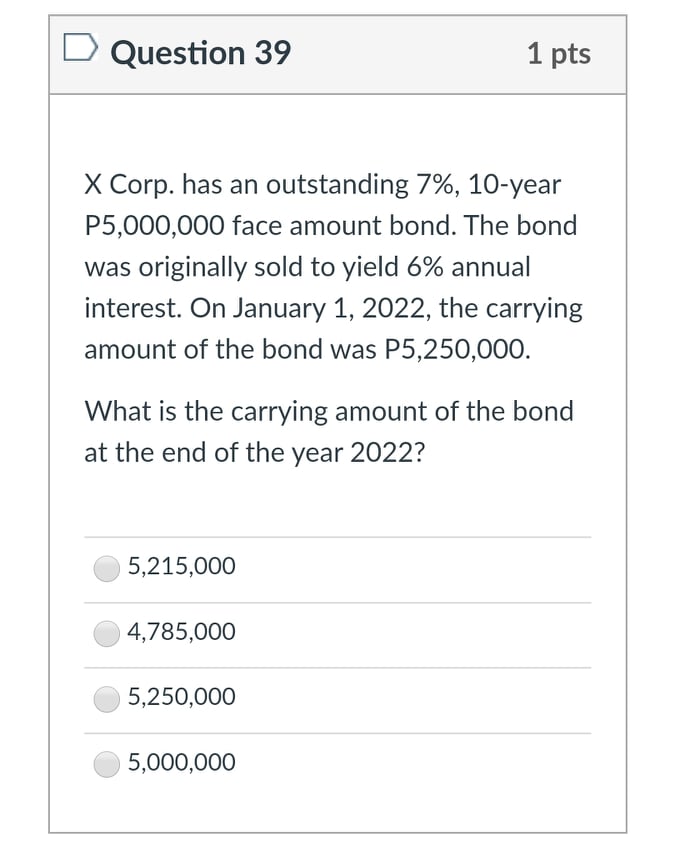

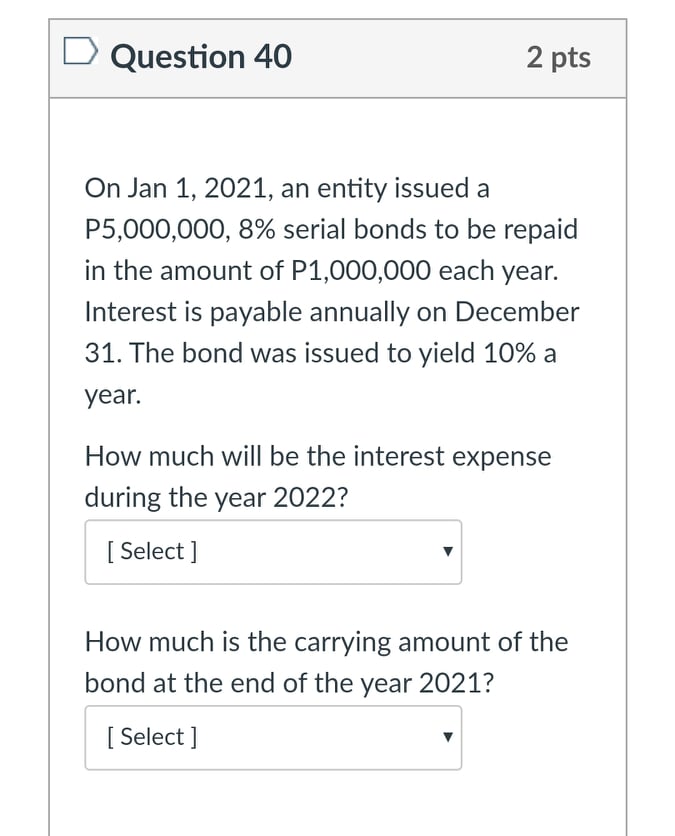

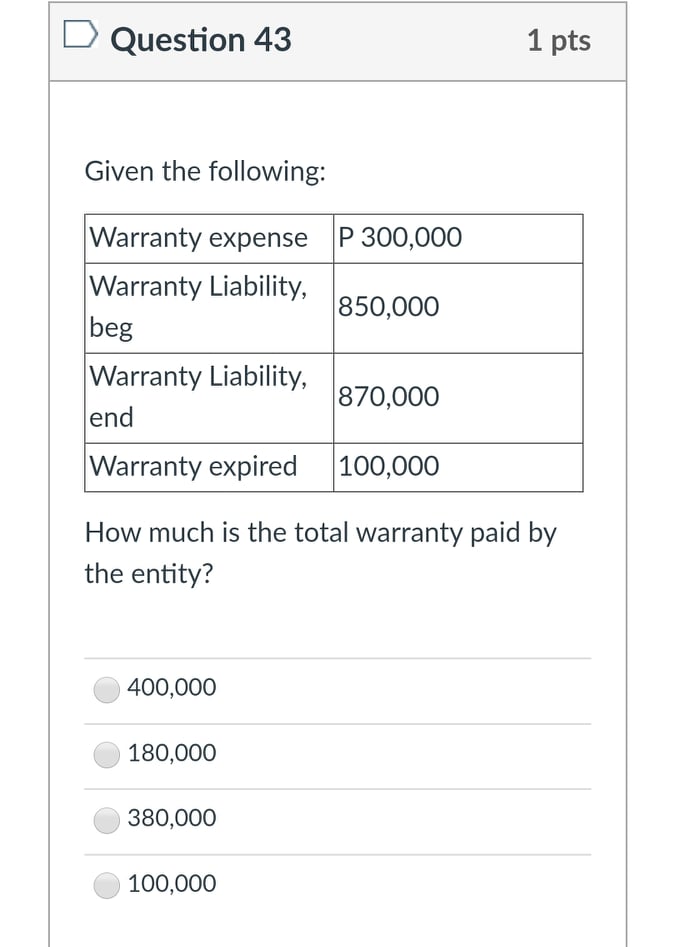

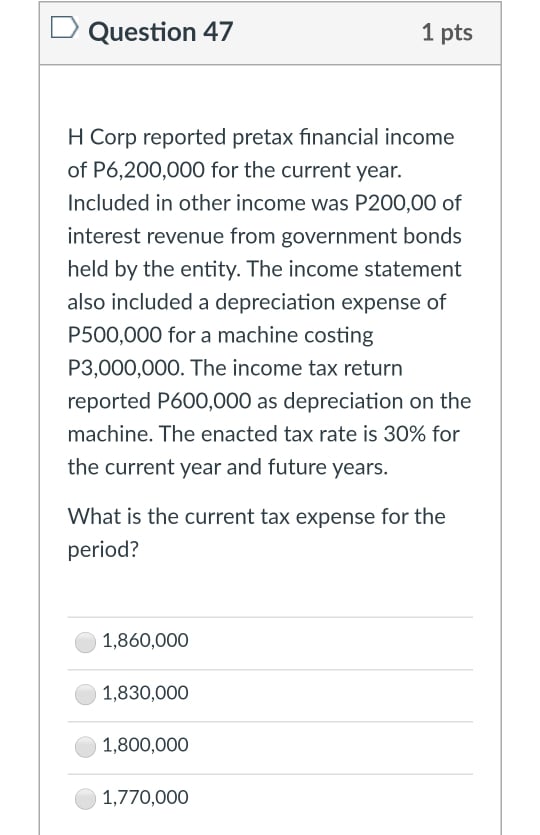

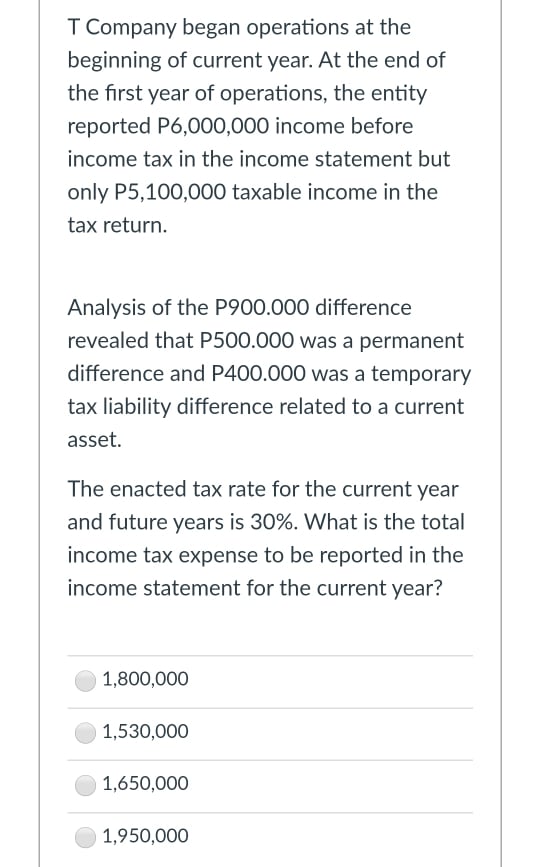

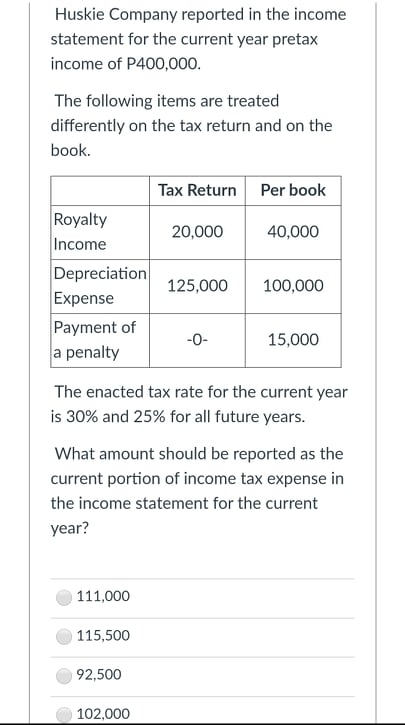

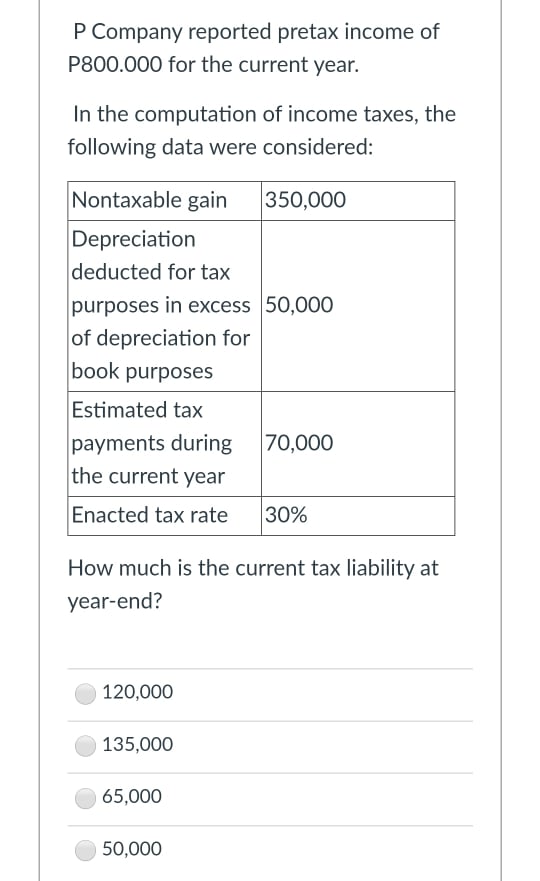

D Question 37 1 pts Given the following during the veer: DBD, beg 1,500,000 FVPA, beg 1,200,000 DBO, end 1,800,000 FVPA, end 1,310,000 Current Service Cost Find the following: - How much will be presented in the balance sheet? | [ Select] 1 - How much will be presented in the statement of prot or loss? | [Select] 1' - How much will be presented in other comprehensive income? | [ Select] 1 FV of plan assets, 700,000 beg PV of defined benefit obligation, 550,000 beg FV of plan assets, 1,200,000 end PV of defined benefit obligation, 800,000 end Benefits Paid 100,000 Current Service 125,000 Cost Past Service Cost 30,000 Contribution to the 140,000 plan Discount rate 10% The asset ceiling are P100,000 and P250,000 on the beginning and end of the year respectively. Compute the following: . Amount reflected in the balance sheet. [ Select ]D Question 39 1 pts X Corp. has an outstanding 7%, 10-year P5,000,000 face amount bond. The bond was originally sold to yield 6% annual interest. On January 1, 2022, the carrying amount of the bond was P5,250,000. What is the carrying amount of the bond at the end of the year 2022? a. ,1 5,215,000 U 4,785,000 Ll} 5,250,000 L; 5,000,000 D Question 40 2 pts On Jan 1, 2021,r an entity issued a P5,000,000, 8% serial bonds to be repaid in the amount of P1,000,000 each year. Interest is payable annually on December 31. The bond was issued to yield 10% a yeah How much will be the interest expense during the year 2022? | [ Select ] r How much is the carrying amount of the bond at the end of the year 2021? | [ Select ] 1' D Question 43 Given the following: Warranty expense P 300,000 Warranty Liability, 850,000 beg Warranty Liability, end Warranty expired 100,000 870,000 How much is the total warranty paid by the entity? Q 400,000 L; 180,000 (Hg-l 380,000 U 100,000 D Question 47 1 pts H Corp reported pretax nancial income of P6200000 for the current year. Included in other income was P200.00 of interest revenue from government bonds held by the entity. The income statement also included a depreciation expense of P500000 for a machine costing P3.000.000. The income tax return reported P600000 as depreciation on the machine. The enacted tax rate is 30% for the current year and future years. What is the current tax expense for the period? 1.860.000 1.030.000 ._ _. 1.000.000 1.000.000 T Company began operations at the beginning of current year. At the end of the rst year of operations. the entity reported P6000000 income before income tax in the income statement but only P5.100,000 taxable income in the tax return. Analysis of the P900000 difference revealed that P500000 was a permanent difference and P400000 was a temporary tax liability difference related to a current asset. The enacted tax rate for the current year and future years is 30%. What is the total income tax expense to be reported in the income statement for the current year? ._I 1.800.000 I. __I1.530.000 I__ I 1.650.000 I_._ I 1.950.000 Huskie Company reported in the income statement for the current year pretax income of P400,000. The following items are treated differently on the tax return and on the book. Tax Return Per book Royalty 20,000 40,000 Income Depreciation 125,000 100,000 Expense Payment of -0- 15,000 a penalty The enacted tax rate for the current year is 30% and 25% for all future years. What amount should be reported as the current portion of income tax expense in the income statement for the current year? 111,000 115,500 92,500 102,000P Company reported pretax income of P800000 for the current year. In the computation of income taxes, the following data were considered: Depreciation deducted for tax purposes in excess 50,000 of depreciation for book purposes Estimated tax payments during ?0,000 the current year Enacted tax rate 30% How much is the current tax liability at year-end? 120,000 _. 135,000 ._ 65,000 50,000