Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer each clearly 1. a b. the options a.42,000/47,250/5,250 b. 42,000/47,250/5,250 c. d.cannot/can also e.outweighs/doesnt outweigh C. options a. b. c.commercial/residental d.an open-end/a closed-end

please answer each clearly

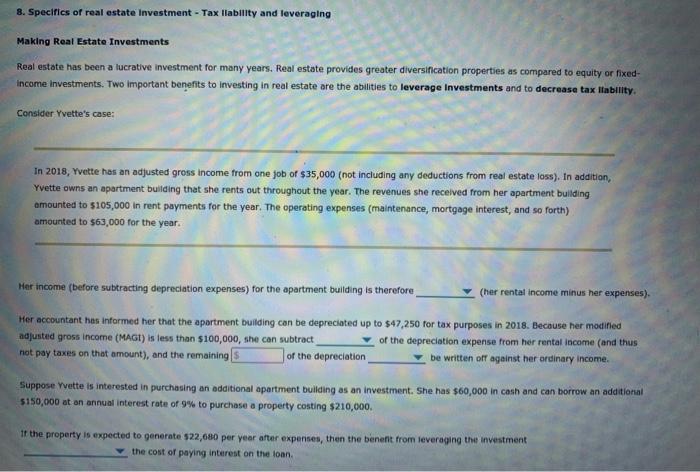

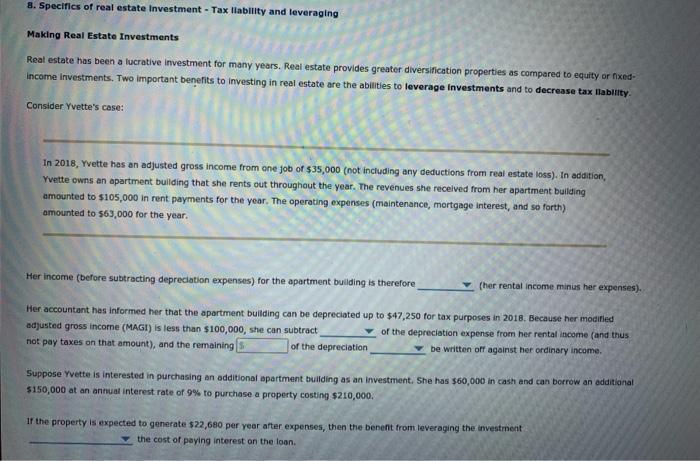

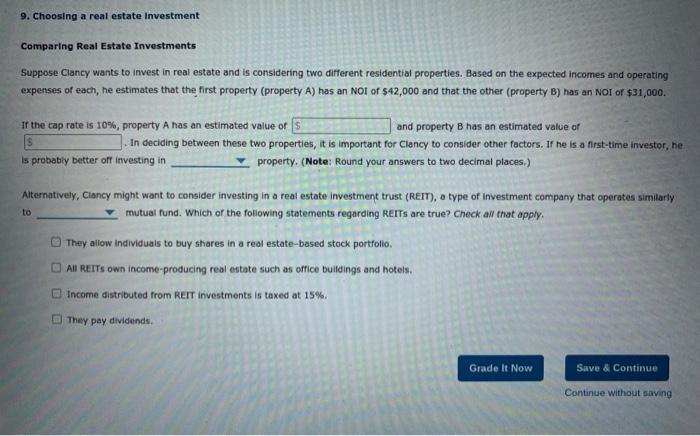

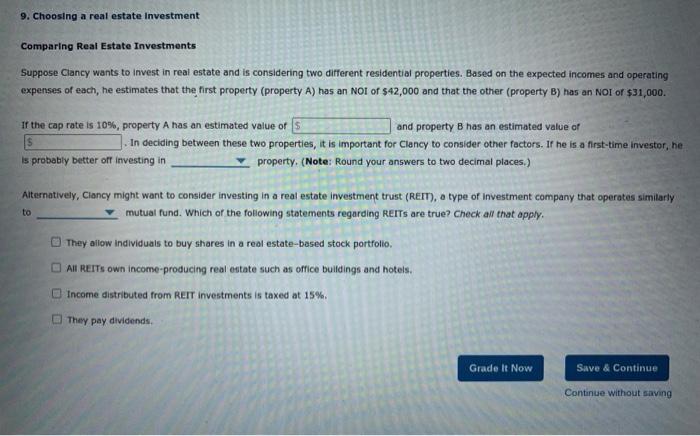

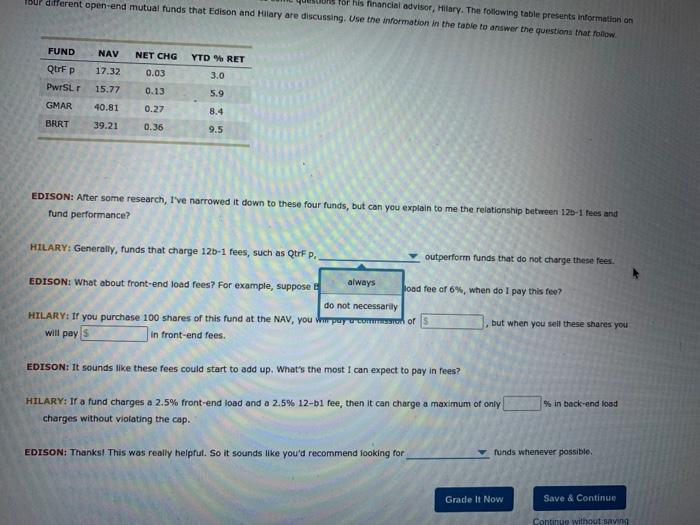

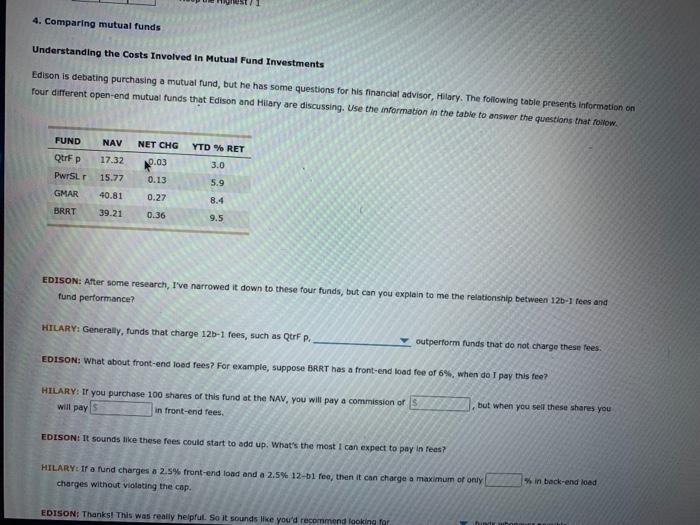

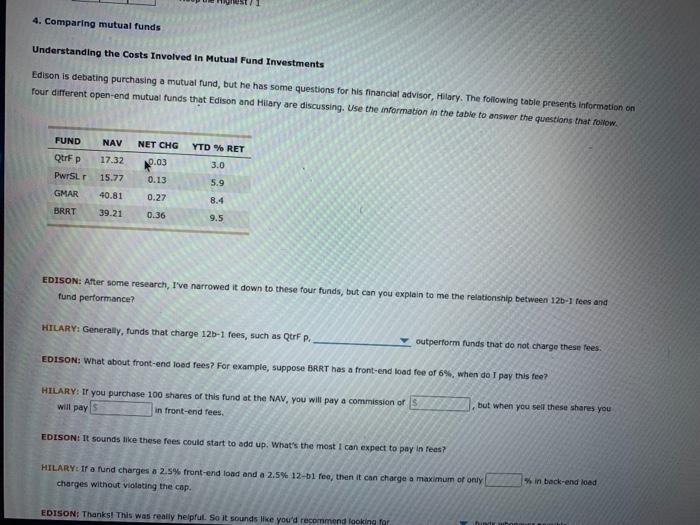

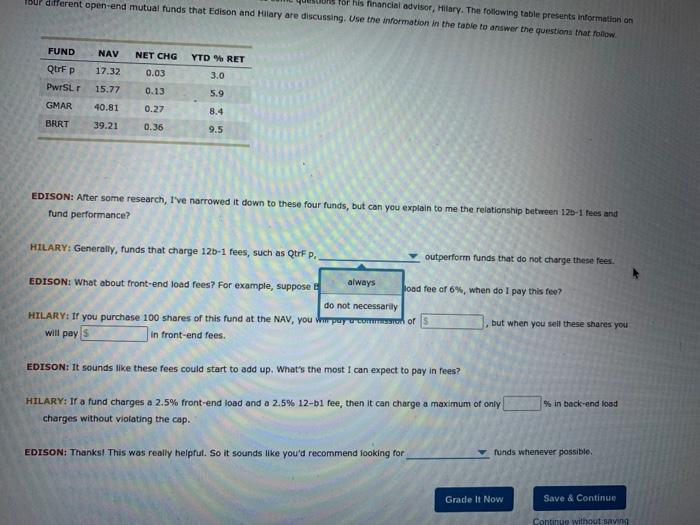

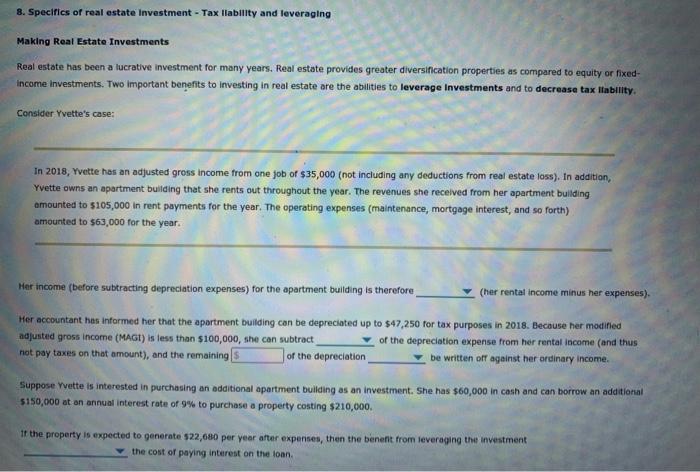

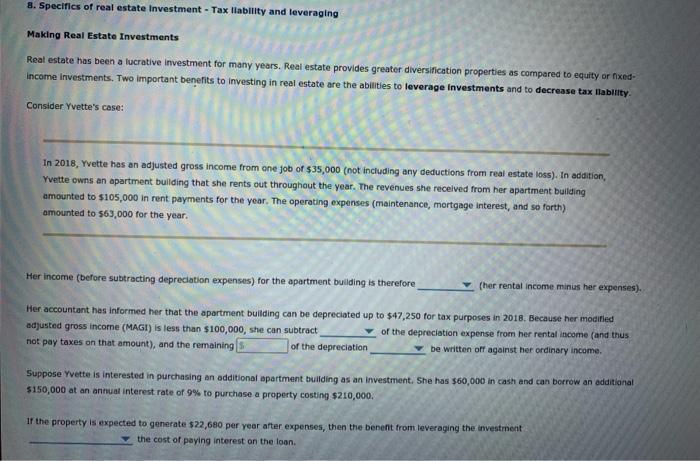

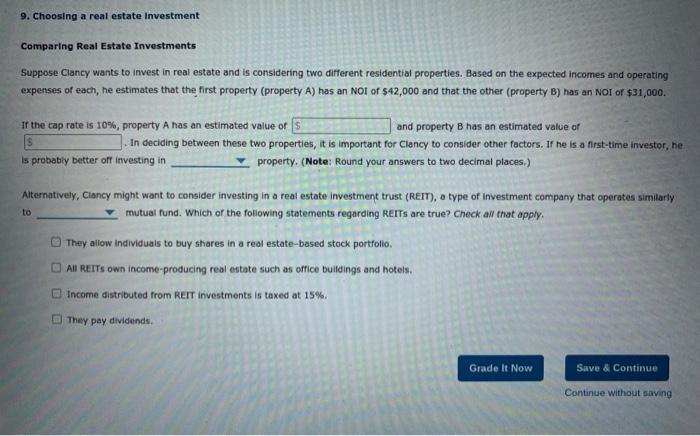

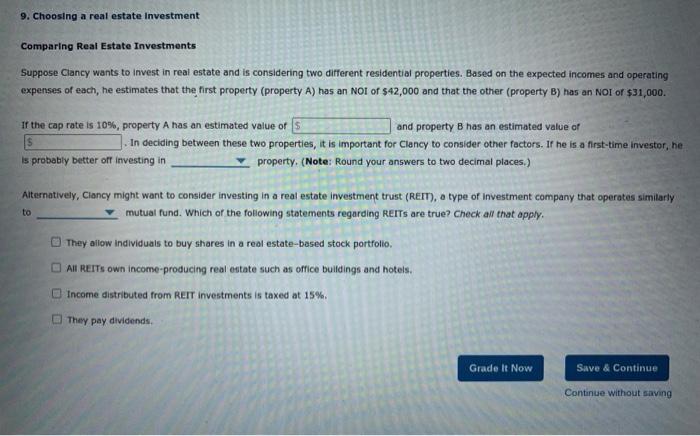

4. Comparing mutual funds Understanding the Costs Involved in Mutual Fund Investments Edison is debating purchasing a mutual fund, but he has some questions for his financial advisor, Hilary. The following table presents information on four different open-end mutual funds that Edison and Hilary are discussing. Use the information in the table to answer the questions that follow. FUND NAV NET CHG YTD % RET QtrF p 17.32 0.03 3.0 PwrSL r 15.77 0.13 5.9 GMAR 40.81 0.27 8.4 BRRT 39.21 0.36 9.5 EDISON: After some research, I've narrowed it down to these four funds, but can you explain to me the relationship between 12b-1 fees and fund performance? HILARY: Generally, funds that charge 12b-1 fees, such as QtrF p. outperform funds that do not charge these fees. EDISON: What about front-end load fees? For example, suppose BRRT has a front-end load fee of 6%, when do I pay this fee? , but when you sell these shares you HILARY: If you purchase 100 shares of this fund at the NAV, you will pay a commission of S will pay $ in front-end fees. EDISON: It sounds like these fees could start to add up. What's the most I can expect to pay in fees? % in back-end load HILARY: If a fund charges a 2.5% front-end load and a 2.5% 12-b1 fee, then it can charge a maximum of only charges without violating the cap. EDISON: Thanks! This was really helpful. So it sounds like you'd recommend looking for in hundr whonaut Bur different open-end mutual funds that Edison and Hillary are discussing. Use the information in the table to answer the questions that follow. for his financial advisor, Hilary. The following table presents information on FUND NAV NET CHG YTD % RET QtrF p 17.32 0.03 3.0 PwrSL r 15.77 0.13 5.9 GMAR 40.81 0.27 8.4 BRRT 39.21 0.36 9.5 EDISON: After some research, I've narrowed it down to these four funds, but can you explain to me the relationship between 120-1 fees and fund performance? HILARY: Generally, funds that charge 12b-1 fees, such as QtrF p. outperform funds that do not charge these fees. EDISON: What about front-end load fees? For example, suppose load fee of 6%, when do I pay this fee? always do not necessarily of but when you sell these shares you HILARY: If you purchase 100 shares of this fund at the NAV, you pay will pay in front-end fees. EDISON: It sounds like these fees could start to add up. What's the most I can expect to pay in fees? % in back-end load HILARY: If a fund charges a 2.5% front-end load and a 2.5% 12-b1 fee, then it can charge a maximum of only charges without violating the cap. EDISON: Thanks! This was really helpful. So it sounds like you'd recommend looking for Grade It Now funds whenever possible. Save & Continue Continue without saving 8. Specifics of real estate Investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed- income investments. Two important benefits to investing in real estate are the abilities to leverage Investments and to decrease tax liability. Consider Yvette's case: In 2018, Yvette has an adjusted gross income from one job of $35,000 (not including any deductions from real estate loss). In addition, Yvette owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $105,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $63,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore (her rental income minus her expenses). Her accountant has informed her that the apartment building can be depreciated up to $47,250 for tax purposes in 2018. Because her modified adjusted gross income (MAGI) is less than $100,000, she can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount), and the remaining S of the depreciation be written off against her ordinary income. Suppose Yvette is interested in purchasing an additional apartment building as an investment. She has $60,000 in cash and can borrow an additional $150,000 at an annual interest rate of 9% to purchase a property costing $210,000. If the property is expected to generate $22,680 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan. 8. Specifics of real estate Investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed- income investments. Two important benefits to investing in real estate are the abilities to leverage investments and to decrease tax llability. Consider Yvette's case: In 2018, Yvette has an adjusted gross income from one job of $35,000 (not including any deductions from real estate loss). In addition, Yvette owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $105,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $63,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore (her rental income minus her expenses). Her accountant has informed her that the apartment building can be depreciated up to $47,250 for tax purposes in 2018. Because her modified adjusted gross income (MAGI) is less than $100,000, she can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount), and the remaining of the depreciation be written off against her ordinary income. Suppose Yvette is interested in purchasing an additional apartment building as an investment. She has $60,000 in cash and can borrow an additional $150,000 at an annual interest rate of 9% to purchase a property costing $210,000. If the property is expected to generate $22,680 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan. 9. Choosing a real estate Investment Comparing Real Estate Investments Suppose Clancy wants to invest in real estate and is considering two different residential properties. Based on the expected incomes and operating expenses of each, he estimates that the first property (property A) has an NOI of $42,000 and that the other (property B) has an NOI of $31,000. If the cap rate is 10%, property A has an estimated value of $ and property B has an estimated value of In deciding between these two properties, it is important for Clancy to consider other factors. If he is a first-time investor, he is probably better off investing in property. (Note: Round your answers to two decimal places.) Alternatively, Clancy might want to consider investing in a real estate investment trust (REIT), a type of investment company that operates similarly mutual fund. Which of the following statements regarding REITs are true? Check all that apply. to They allow individuals to buy shares in a real estate-based stock portfolio. All REITs own income-producing real estate such as office buildings and hotels. Income distributed from REIT investments is taxed at 15%. They pay dividends. Grade It Now Save & Continue Continue without saving 9. Choosing a real estate Investment Comparing Real Estate Investments Suppose Clancy wants to invest in real estate and is considering two different residential properties. Based on the expected incomes and operating expenses of each, he estimates that the first property (property A) has an NOI of $42,000 and that the other (property B) has an NOI of $31,000. If the cap rate is 10%, property A has an estimated value of $ and property B has an estimated value of In deciding between these two properties, it is important for Clancy to consider other factors. If he is a first-time investor, he is probably better off investing in property. (Note: Round your answers to two decimal places.) Alternatively, Clancy might want to consider investing in a real estate investment trust (REIT), a type of investment company that operates similarly mutual fund. Which of the following statements regarding REITs are true? Check all that apply. to They allow individuals to buy shares in a real estate-based stock portfolio. All REITs own income-producing real estate such as office buildings and hotels. Income distributed from REIT investments is taxed at 15%. They pay dividends. Grade It Now Save & Continue Continue without saving 4. Comparing mutual funds Understanding the Costs Involved in Mutual Fund Investments Edison is debating purchasing a mutual fund, but he has some questions for his financial advisor, Hilary. The following table presents information on four different open-end mutual funds that Edison and Hilary are discussing. Use the information in the table to answer the questions that follow. FUND NAV NET CHG YTD % RET QtrF p 17.32 0.03 3.0 PwrSL r 15.77 0.13 5.9 GMAR 40.81 0.27 8.4 BRRT 39.21 0.36 9.5 EDISON: After some research, I've narrowed it down to these four funds, but can you explain to me the relationship between 12b-1 fees and fund performance? HILARY: Generally, funds that charge 12b-1 fees, such as QtrF p. outperform funds that do not charge these fees. EDISON: What about front-end load fees? For example, suppose BRRT has a front-end load fee of 6%, when do I pay this fee? , but when you sell these shares you HILARY: If you purchase 100 shares of this fund at the NAV, you will pay a commission of S will pay $ in front-end fees. EDISON: It sounds like these fees could start to add up. What's the most I can expect to pay in fees? % in back-end load HILARY: If a fund charges a 2.5% front-end load and a 2.5% 12-b1 fee, then it can charge a maximum of only charges without violating the cap. EDISON: Thanks! This was really helpful. So it sounds like you'd recommend looking for in hundr whonaut Bur different open-end mutual funds that Edison and Hillary are discussing. Use the information in the table to answer the questions that follow. for his financial advisor, Hilary. The following table presents information on FUND NAV NET CHG YTD % RET QtrF p 17.32 0.03 3.0 PwrSL r 15.77 0.13 5.9 GMAR 40.81 0.27 8.4 BRRT 39.21 0.36 9.5 EDISON: After some research, I've narrowed it down to these four funds, but can you explain to me the relationship between 120-1 fees and fund performance? HILARY: Generally, funds that charge 12b-1 fees, such as QtrF p. outperform funds that do not charge these fees. EDISON: What about front-end load fees? For example, suppose load fee of 6%, when do I pay this fee? always do not necessarily of but when you sell these shares you HILARY: If you purchase 100 shares of this fund at the NAV, you pay will pay in front-end fees. EDISON: It sounds like these fees could start to add up. What's the most I can expect to pay in fees? % in back-end load HILARY: If a fund charges a 2.5% front-end load and a 2.5% 12-b1 fee, then it can charge a maximum of only charges without violating the cap. EDISON: Thanks! This was really helpful. So it sounds like you'd recommend looking for Grade It Now funds whenever possible. Save & Continue Continue without saving 8. Specifics of real estate Investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed- income investments. Two important benefits to investing in real estate are the abilities to leverage Investments and to decrease tax liability. Consider Yvette's case: In 2018, Yvette has an adjusted gross income from one job of $35,000 (not including any deductions from real estate loss). In addition, Yvette owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $105,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $63,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore (her rental income minus her expenses). Her accountant has informed her that the apartment building can be depreciated up to $47,250 for tax purposes in 2018. Because her modified adjusted gross income (MAGI) is less than $100,000, she can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount), and the remaining S of the depreciation be written off against her ordinary income. Suppose Yvette is interested in purchasing an additional apartment building as an investment. She has $60,000 in cash and can borrow an additional $150,000 at an annual interest rate of 9% to purchase a property costing $210,000. If the property is expected to generate $22,680 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan. 8. Specifics of real estate Investment - Tax liability and leveraging Making Real Estate Investments Real estate has been a lucrative investment for many years. Real estate provides greater diversification properties as compared to equity or fixed- income investments. Two important benefits to investing in real estate are the abilities to leverage investments and to decrease tax llability. Consider Yvette's case: In 2018, Yvette has an adjusted gross income from one job of $35,000 (not including any deductions from real estate loss). In addition, Yvette owns an apartment building that she rents out throughout the year. The revenues she received from her apartment building amounted to $105,000 in rent payments for the year. The operating expenses (maintenance, mortgage interest, and so forth) amounted to $63,000 for the year. Her income (before subtracting depreciation expenses) for the apartment building is therefore (her rental income minus her expenses). Her accountant has informed her that the apartment building can be depreciated up to $47,250 for tax purposes in 2018. Because her modified adjusted gross income (MAGI) is less than $100,000, she can subtract of the depreciation expense from her rental income (and thus not pay taxes on that amount), and the remaining of the depreciation be written off against her ordinary income. Suppose Yvette is interested in purchasing an additional apartment building as an investment. She has $60,000 in cash and can borrow an additional $150,000 at an annual interest rate of 9% to purchase a property costing $210,000. If the property is expected to generate $22,680 per year after expenses, then the benefit from leveraging the investment the cost of paying interest on the loan. 9. Choosing a real estate Investment Comparing Real Estate Investments Suppose Clancy wants to invest in real estate and is considering two different residential properties. Based on the expected incomes and operating expenses of each, he estimates that the first property (property A) has an NOI of $42,000 and that the other (property B) has an NOI of $31,000. If the cap rate is 10%, property A has an estimated value of $ and property B has an estimated value of In deciding between these two properties, it is important for Clancy to consider other factors. If he is a first-time investor, he is probably better off investing in property. (Note: Round your answers to two decimal places.) Alternatively, Clancy might want to consider investing in a real estate investment trust (REIT), a type of investment company that operates similarly mutual fund. Which of the following statements regarding REITs are true? Check all that apply. to They allow individuals to buy shares in a real estate-based stock portfolio. All REITs own income-producing real estate such as office buildings and hotels. Income distributed from REIT investments is taxed at 15%. They pay dividends. Grade It Now Save & Continue Continue without saving 9. Choosing a real estate Investment Comparing Real Estate Investments Suppose Clancy wants to invest in real estate and is considering two different residential properties. Based on the expected incomes and operating expenses of each, he estimates that the first property (property A) has an NOI of $42,000 and that the other (property B) has an NOI of $31,000. If the cap rate is 10%, property A has an estimated value of $ and property B has an estimated value of In deciding between these two properties, it is important for Clancy to consider other factors. If he is a first-time investor, he is probably better off investing in property. (Note: Round your answers to two decimal places.) Alternatively, Clancy might want to consider investing in a real estate investment trust (REIT), a type of investment company that operates similarly mutual fund. Which of the following statements regarding REITs are true? Check all that apply. to They allow individuals to buy shares in a real estate-based stock portfolio. All REITs own income-producing real estate such as office buildings and hotels. Income distributed from REIT investments is taxed at 15%. They pay dividends. Grade It Now Save & Continue Continue without saving 1.

a

b.

the options

a.42,000/47,250/5,250

b. 42,000/47,250/5,250

c.

d.cannot/can also

e.outweighs/doesnt outweigh

C.

options

a.

b.

c.commercial/residental

d.an open-end/a closed-end

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started