Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer each multiple choice question in Excel format with proper labels. These multiple choice questions do not count as separate from the entire question

Please answer each multiple choice question in Excel format with proper labels. These multiple choice questions do not count as separate from the entire question itself; answering only 4 results in only 25% completion of the entire problem. A positive rating will only be given to the correct answer that completes all multiple choices. Thank you!

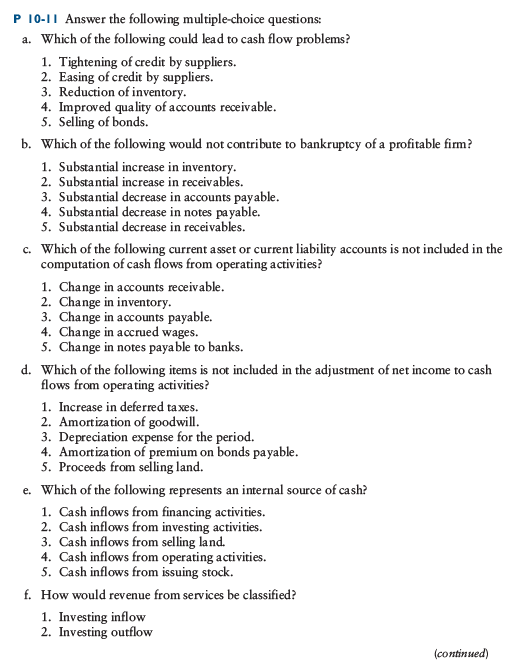

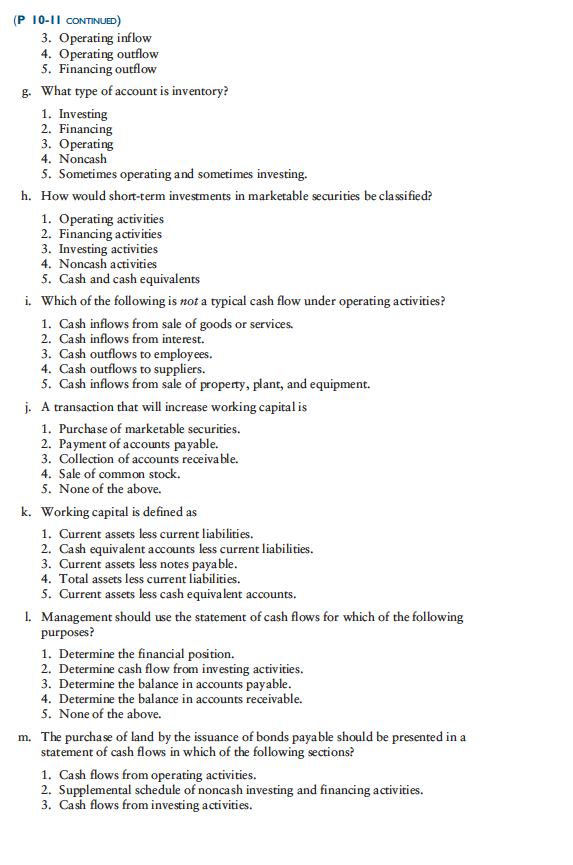

P 10-1 Answer the following multiple-choice questions: a. Which of the following could lead to cash flow problems? 1. Tightening of credit by suppliers. 2. Easing of credit by suppliers. 3. Reduction of inventory 4. Improved quality of accounts receivable 5. Selling of bonds. b. Which of the following would not contribute to bankruptcy of a profitable firm? 1. Substantial increase in inventory 2. Substantial increase in receivables. 3. Substantial decrease in accounts payable 4. Substantial decrease in notes payable. 5. Substantial decrease in receivables. Which of the following current asset or current liability accounts is not included in the computation of cash flows from operating activities? c. 1. Change in accounts receivable 2. Change in inventory 3. Change in accounts payable. 4. Change in accrued wages. 5. Change in notes paya ble to banks. d. Which of the following items is not included in the adjustment of net income to caslh flows from operating activities? 1. Increase in deferred taxes. 2. Amortization of goodwill 3. Depreciation expense for the period. 4. Amortization of premium on bonds payable 5. Proceeds from selling land. e. Which of the following represents an internal source of cash? 1. Cash inflows from financing activities. 2. Cash inflows from investing activities. 3. Cash inflows from selling land. 4. Cash inflows from operating activities. 5. Cash inflows from issuing stock. f. How would revenue from services be classified? 1. Investing inflow 2. Investing outflow (continued)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started