Question

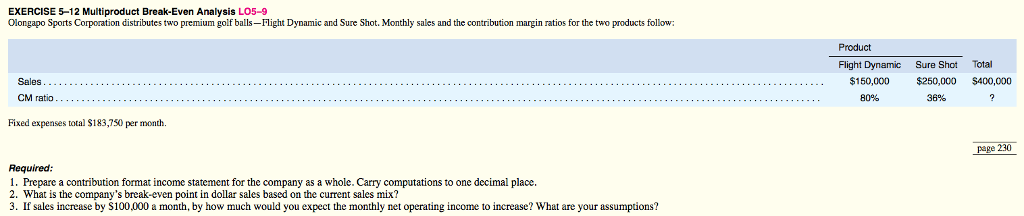

Please answer each of the following questions for the problem. Please also add the following information Units Sold: Sure Shot = 10,000 Flight Dynamic =

Please answer each of the following questions for the problem. Please also add the following information

Units Sold:

Sure Shot = 10,000

Flight Dynamic = 20,000

Requirements:

1. Prepare a contribution format income statement for the company as a whole. Be sure to include a total column, unit, and percentage for each product line and the company as a whole.

2. What is the sales mix in units? Sales mix in dollars?

3. Compute the break-even point for the company in both units and dollars. At break-even, how many units of Sure Shot and Flight Dynamic are assumed to be sold? At break-even, how much in dollar sales is assumed to be Sure Shot and Flight Dynamic.

4. If Sales are expected to increase by $100,000 next month, how much do you expect net income to increase by?

5. Assume there is a shift in sales mix such that relatively more units of the Flight Dynamic will be sold. Will the weighted average CM ratio CM per unit increase or decrease? Will Break-even increase or decrease? Will Margin of Safety increase or decrease?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started