Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer each part of the questions 2. Who is included in the profit sharing plan? -All people at the company? -All full-time (or FT

please answer each part of the questions

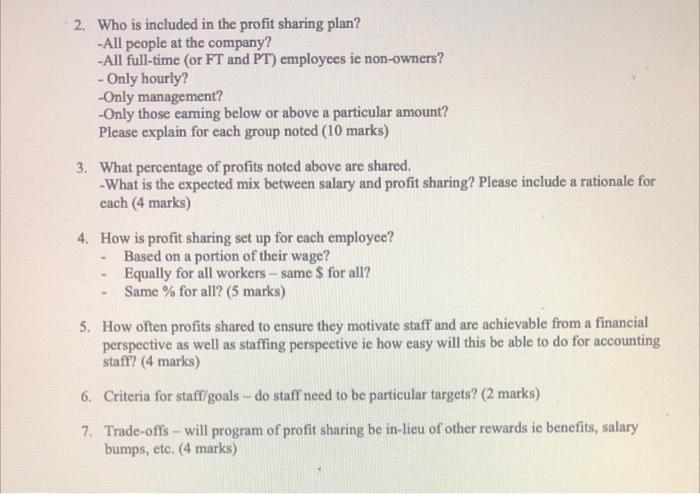

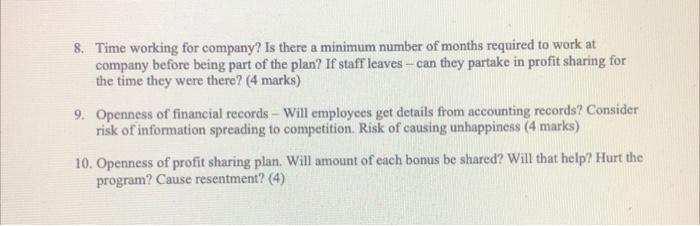

2. Who is included in the profit sharing plan? -All people at the company? -All full-time (or FT and PT) employees ie non-owners? - Only hourly? Only management? -Only those caming below or above a particular amount? Please explain for each group noted (10 marks) 3. What percentage of profits noted above are shared. -What is the expected mix between salary and profit sharing? Please include a rationale for each (4 marks) 4. How is profit sharing set up for each employee? Based on a portion of their wage? Equally for all workers - same $ for all? Same % for all? (5 marks) 5. How often profits shared to ensure they motivate staff and are achievable from a financial perspective as well as staffing perspective ie how easy will this be able to do for accounting staff? (4 marks) 6. Criteria for staff/goals - do staff need to be particular targets? (2 marks) 7. Trade-offs - will program of profit sharing be in-lieu of other rewards ie benefits, salary bumps, etc. (4 marks) 8. Time working for company? Is there a minimum number of months required to work at company before being part of the plan? If staff leaves - can they partake in profit sharing for the time they were there? (4 marks) 9. Openness of financial records - Will employees get details from accounting records? Consider risk of information spreading to competition. Risk of causing unhappiness (4 marks) 10. Openness of profit sharing plan. Will amount of each bonus be shared? Will that help? Hurt the program? Cause resentment? (4) 2. Who is included in the profit sharing plan? -All people at the company? -All full-time (or FT and PT) employees ie non-owners? - Only hourly? Only management? -Only those caming below or above a particular amount? Please explain for each group noted (10 marks) 3. What percentage of profits noted above are shared. -What is the expected mix between salary and profit sharing? Please include a rationale for each (4 marks) 4. How is profit sharing set up for each employee? Based on a portion of their wage? Equally for all workers - same $ for all? Same % for all? (5 marks) 5. How often profits shared to ensure they motivate staff and are achievable from a financial perspective as well as staffing perspective ie how easy will this be able to do for accounting staff? (4 marks) 6. Criteria for staff/goals - do staff need to be particular targets? (2 marks) 7. Trade-offs - will program of profit sharing be in-lieu of other rewards ie benefits, salary bumps, etc. (4 marks) 8. Time working for company? Is there a minimum number of months required to work at company before being part of the plan? If staff leaves - can they partake in profit sharing for the time they were there? (4 marks) 9. Openness of financial records - Will employees get details from accounting records? Consider risk of information spreading to competition. Risk of causing unhappiness (4 marks) 10. Openness of profit sharing plan. Will amount of each bonus be shared? Will that help? Hurt the program? Cause resentment? (4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started