PLEASE ANSWER EACH QUESTION CORRECTLY! IF SO, I WILL LEAVE AN UPVOTE!

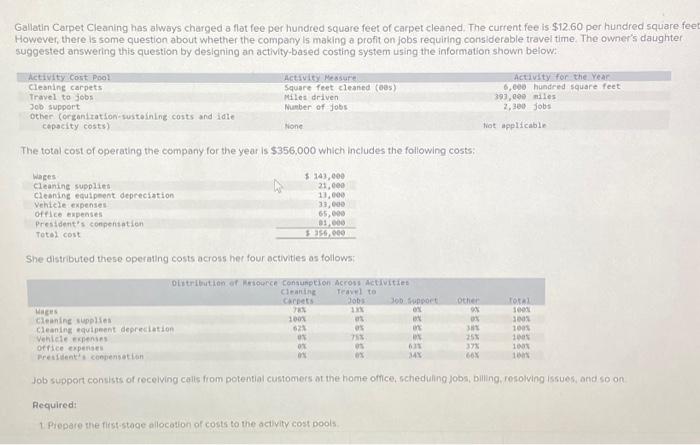

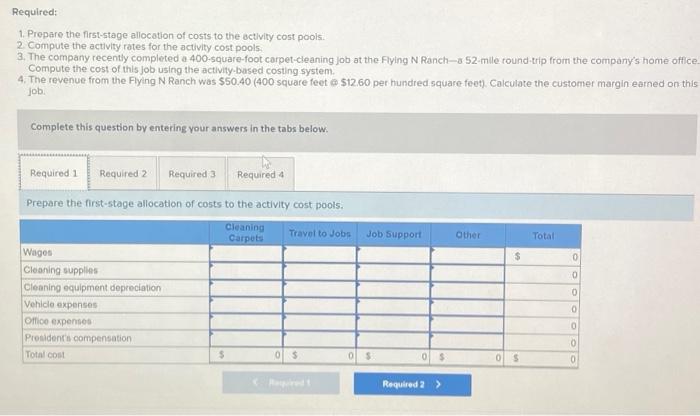

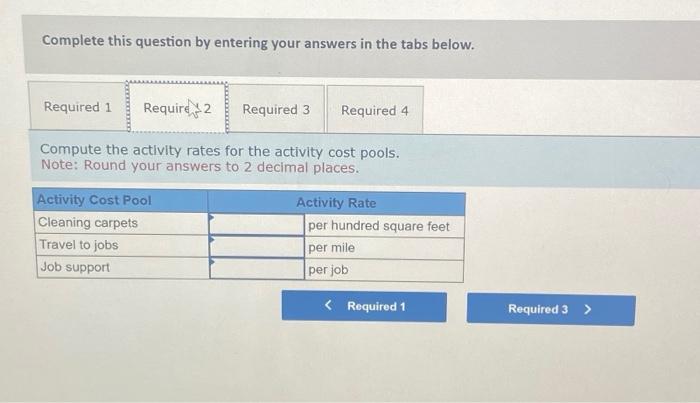

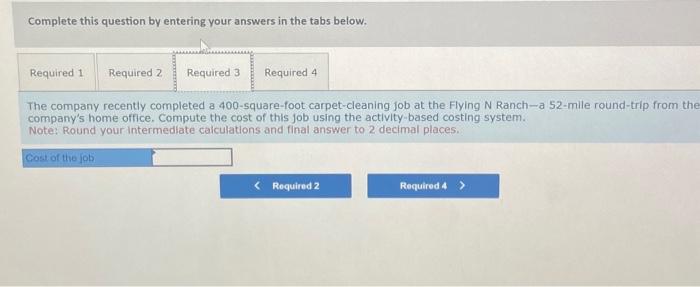

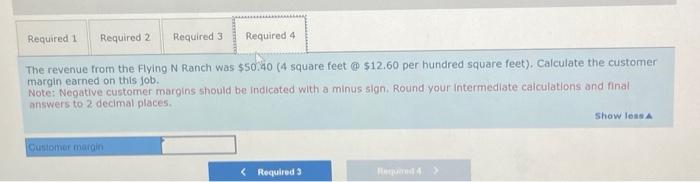

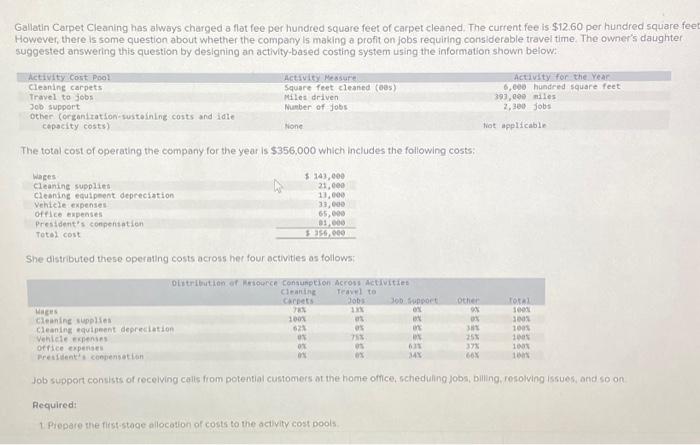

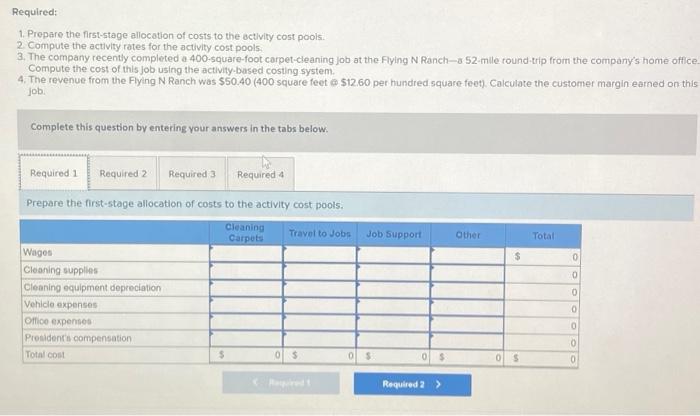

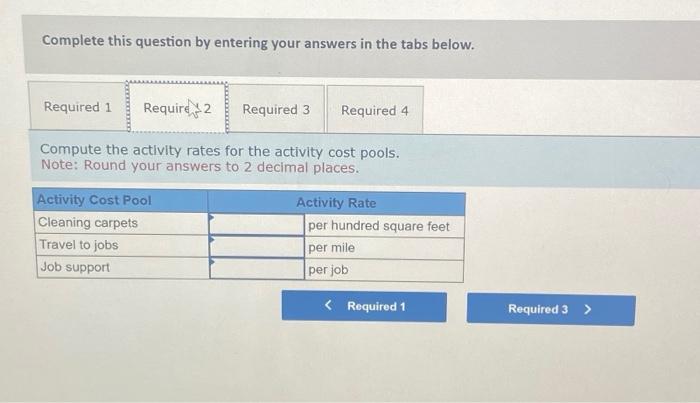

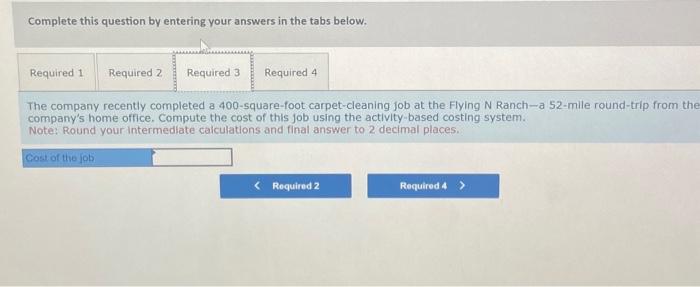

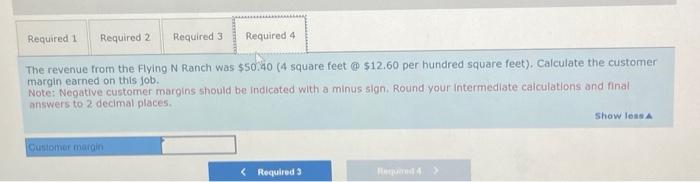

Complete this question by entering your answers in the tabs below. Compute the activity rates for the activity cost pools. Note: Round your answers to 2 decimal places. Required: 1. Prepare the first-stage allocation of costs to the actlvity cost pools: 2. Compute the activity rates for the activity cost pools 3. The company recently completed a 400 -square-foot carpet-cleaning job at the flying N Ranch-a 52 -mile round-trip from the company's home office. Compute the cost of this job using the activity-based costing system. 4. The revenue from the Flying N Ranch was $50,40 ( 400 square feet $12.60 per hundred square feet). Calculate the customer margin earned on this job. Complete this question by entering your answers in the tabs below. Prepare the first-stage allocation of costs to the activity cost pools. Gallatin Carpet Cleaning has always charged a flat fee per hundred square feet of carpet cleaned, The current fee is $12.60 per hundred square feet However, there is some question about whether the company is making a profit on jobs requiring considerable travel time. The owner's daughter. suggested answering this question by designing an activity-based costing system using the information shown below: The total cost of operating the company for the year is $356,000 which includes the following costs: She distributed these operating costs across her four activities as follows: Job support consists of receiving celis from potential customers at the home office, scheduling Jobs, billing, resolving issues, ond so on Aequired: 1 Piepare the first-stage allocation of costs to the activity cost pools The revenue from the Flying N Ranch was $50.40 ( 4 square feet @$12.60 per hundred square feet). Calculate the customer margin earned on this job. Note: Negative customer margins should be indicated with a minus sign. Round your intermediate caiculations and final answers to 2 decimal places. Complete this question by entering your answers in the tabs below. The company recently completed a 400-square-foot carpet-cleaning job at the Flying N Ranch-a 52 -mile round-trip from th company's home office. Compute the cost of this job using the activity-based costing system. Note: Round your intermedlate calculations and final answer to 2 decimal places