Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer every calculation correctly if you want me to like your answer. SHOW ALL YOUR WORK as well. Thank you! Rupeo's 2022 pro forma

Please answer every calculation correctly if you want me to like your answer. SHOW ALL YOUR WORK as well. Thank you!

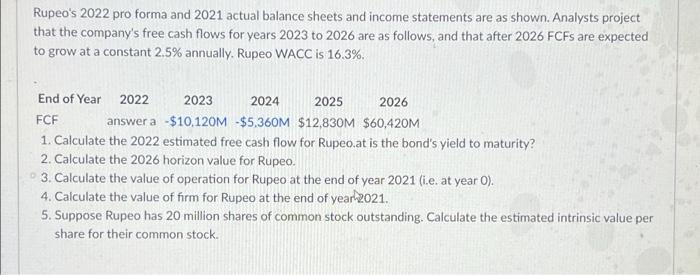

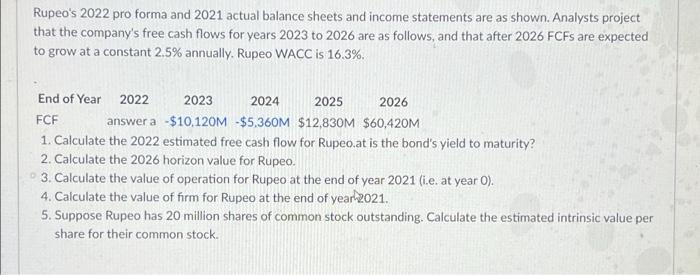

Rupeo's 2022 pro forma and 2021 actual balance sheets and income statements are as shown. Analysts project that the company's free cash flows for years 2023 to 2026 are as follows, and that after 2026 FCFs are expected to grow at a constant 2.5% annually. Rupeo WACC is 16,3%. End of Year 2022 2023 2024 2025 2026 FCF answer a -$10,120M -$5,360M $12,830M $60,420M 1. Calculate the 2022 estimated free cash flow for Rupeo.at is the bond's yield to maturity? 2. Calculate the 2026 horizon value for Rupeo. 3. Calculate the value of operation for Rupeo at the end of year 2021 (i.e. at year 0). 4. Calculate the value of form for Rupeo at the end of year 2021. 5. Suppose Rupeo has 20 million shares of common stock outstanding. Calculate the estimated intrinsic value per share for their common stock. Rupeo's 2022 pro forma and 2021 actual balance sheets and income statements are as shown. Analysts project that the company's free cash flows for years 2023 to 2026 are as follows, and that after 2026 FCFs are expected to grow at a constant 2.5% annually. Rupeo WACC is 16,3%. End of Year 2022 2023 2024 2025 2026 FCF answer a -$10,120M -$5,360M $12,830M $60,420M 1. Calculate the 2022 estimated free cash flow for Rupeo.at is the bond's yield to maturity? 2. Calculate the 2026 horizon value for Rupeo. 3. Calculate the value of operation for Rupeo at the end of year 2021 (i.e. at year 0). 4. Calculate the value of form for Rupeo at the end of year 2021. 5. Suppose Rupeo has 20 million shares of common stock outstanding. Calculate the estimated intrinsic value per share for their common stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started