please answer every photo. i need all photos answered please. its all one question.

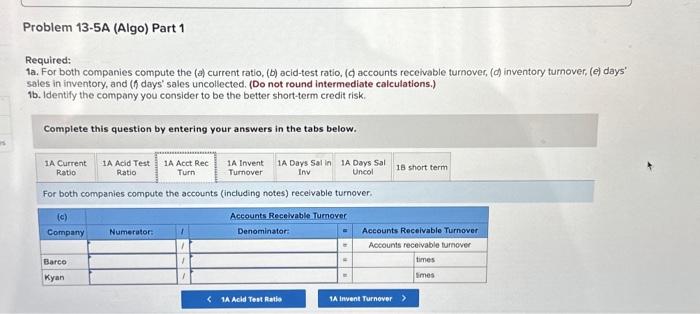

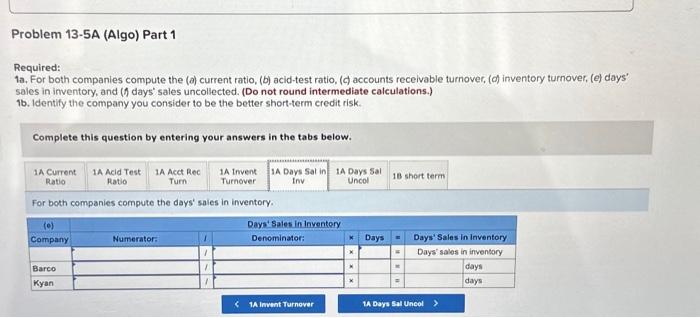

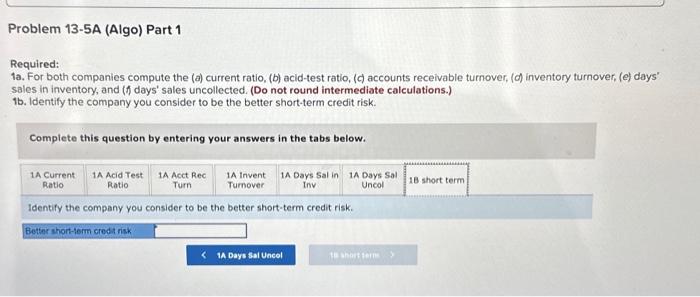

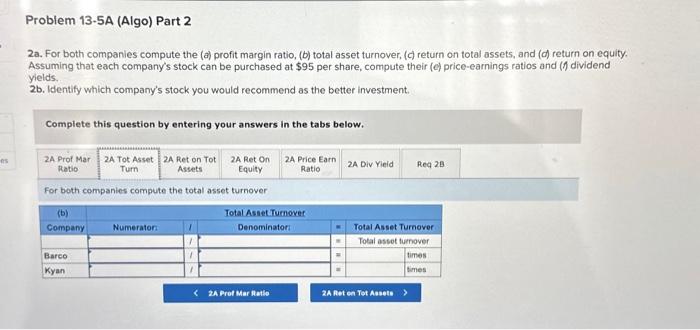

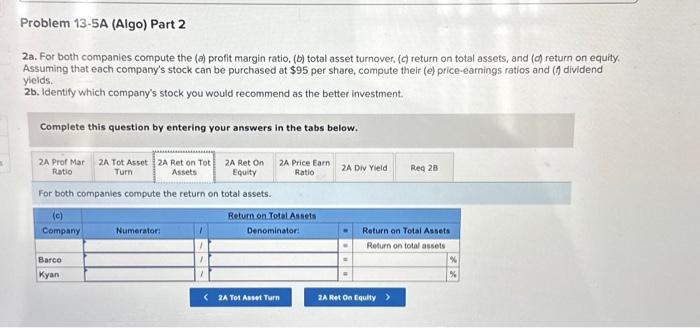

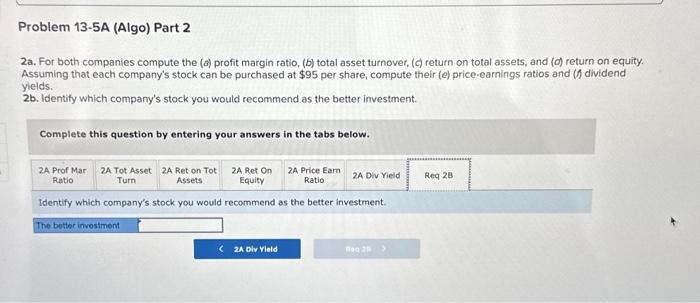

Required information Problem 13-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below] Summary information from the financial statements of two companies competing in the same industry follows. Problem 13-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover. ( d) inventory turnover, (c) days' sales in inventory, and ( f ) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the current ratio. Required: '19. For both companies compute the (a) current ratio, (b) acid-test ratio, ( ( accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and ( f days' sales uncollected, (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the acid-test ratio. Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, (d) inventory turnover, (e) days' sales in inventory, and (h) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the accounts (including notes) recelvable turnover. Required: 1a. For both companies compute the (b) current ratio, (b) acid-test ratio, (d) accounts recelvable turnover, (d) inventory turnover, ( c) days' sales in inventory, and (f) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the inventory turnover. Required: la. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts receivable turnover, ( d ) inventory turnover, ( e ) days' sales in inventory, and ( ) days' sales uncollected. (Do not round intermediate calculations.) 16. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' saies in inventory. Required: 1a. For both componies compute the (a) current ratio, ( ( ) acid-test ratio. ( (d accounts receivable tumover, ( (d) inventory turnover, (e) days' sales in inventory, and ( f ) days' sales uncoilected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. For both companies compute the days' sales uncolected. Required: 1a. For both companies compute the (d) current ratio, (b) acid-test ratio, ( ( ) accounts receivable turnover, ( (d) inventory tumover, (e) days' sales in inventory, and (f) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. Identify the company you consider to be the better short-term credit risk. 2a. For both companies compute the (d) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity Assuming that each company's stock can be purchased at $95 per share, compute their (e) price-earnings fatios and (h) dividend yicids. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the profit margin ratio. 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, ( c ) return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $95 per share, compute their (c) price-earnings ratios and (f) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the total asset turnover 2a. For both companies compute the (d) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity Assuming that each company's stock can be purchased at $95 per share, compute their (e) price-earnings ratios and ( f ) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. For both companies compute the return on total assets. 2a. For both companies compute the (d) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity. Assuming that each company's stock can be purchased at $95 per share, compute their ( ( ) price-earnings ratios and (f) dividend yicids. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below, For both companies compute the return on equity. 2a. For both companies compute the (d) profit margin ratio, (b) total asset turnover, (c) return on total assets, and ( ( ) return on equity. Assuming that each company's stock can be purchased at $95 per share, compute their (o) price-carnings ratios and ( ) dividend yields, 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. la. For both companies compute the (a) profit margin ratio, (b) total asset turnover, ( ( ) return on total assets, and (d) return on equity. sssuming that each company's stock can be purchased at $95 per share, compute their (e) price-earnings ratios and (f) dividend vield5. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. Assuming that each company's stock can be purchased at $95 per share, compute their dividend yields. 2a. For both companies compute the (b) profit margin ratio, (b) total asset turnover, ( c ) return on total assets, and ( d ) return on equity. Assuming that each company's stock can be purchased at $95 per share, compute their (e) price-earnings ratios and (f) dividend yields. 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. Identify which company's stock you would recommend as the better investment