Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer every scenario. its all one big question, and ive seen it be done before. do so for a guaranteed thumbs up! Must also

Please answer every scenario. its all one big question, and ive seen it be done before.

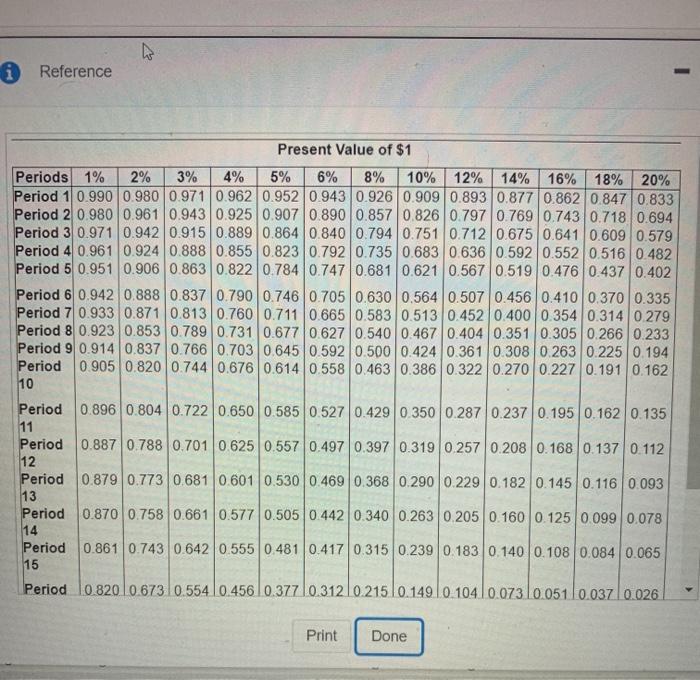

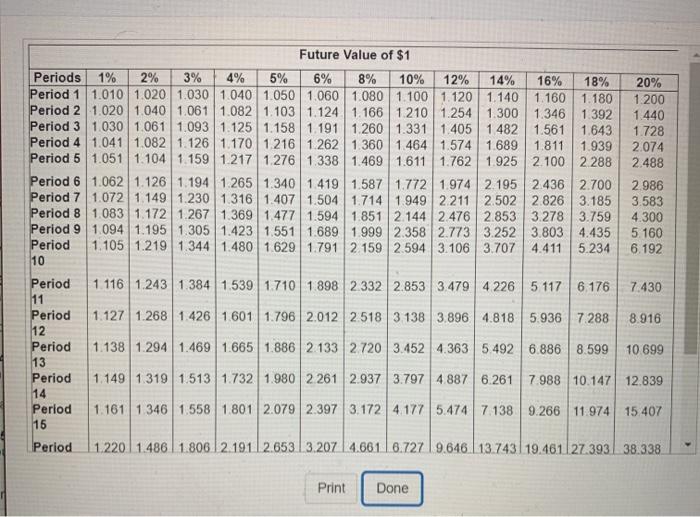

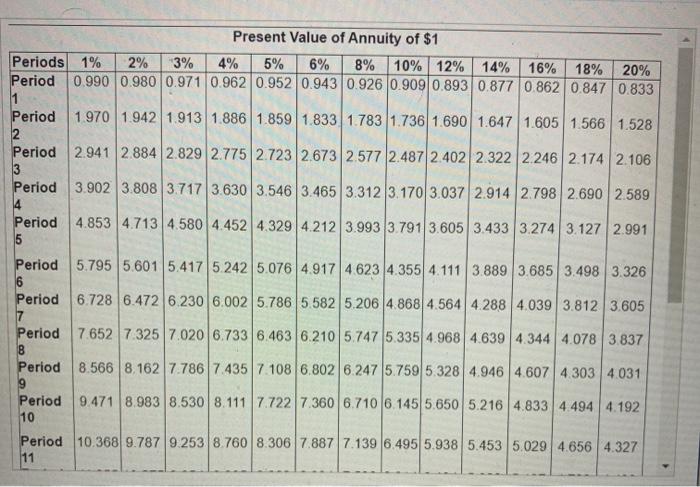

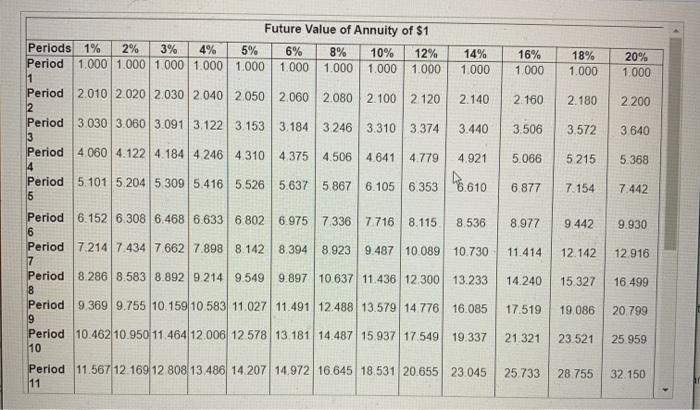

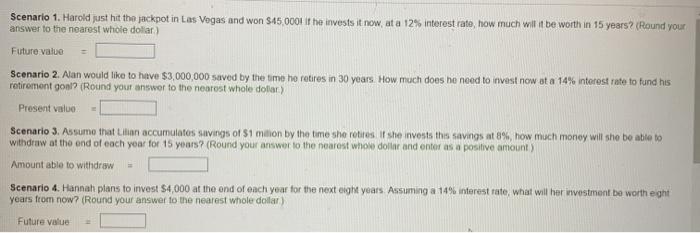

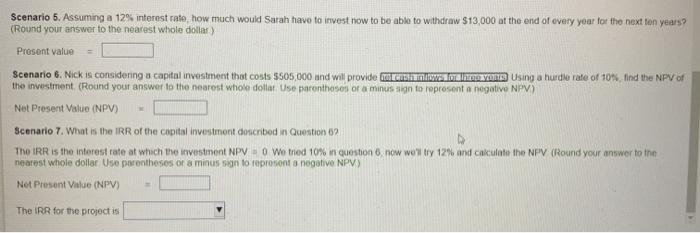

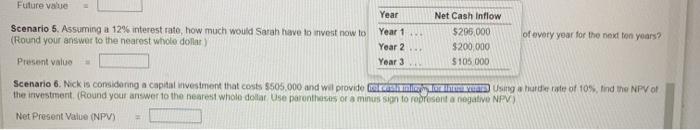

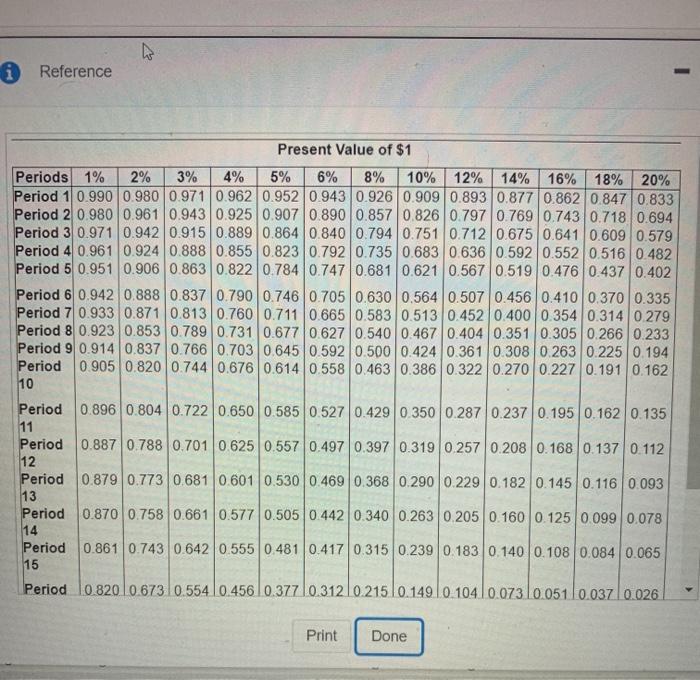

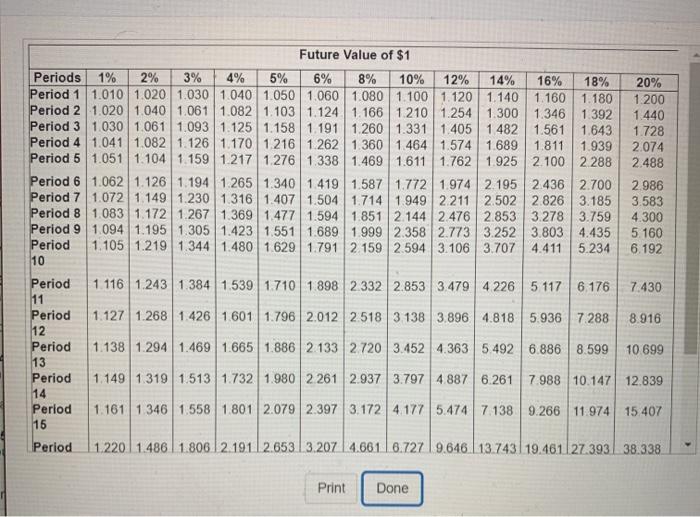

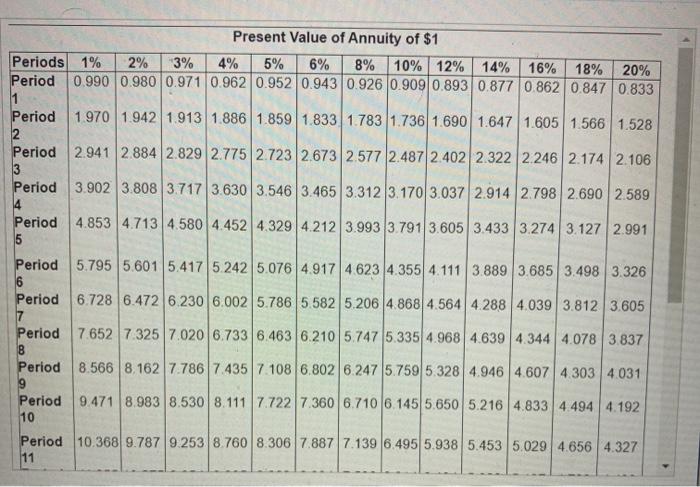

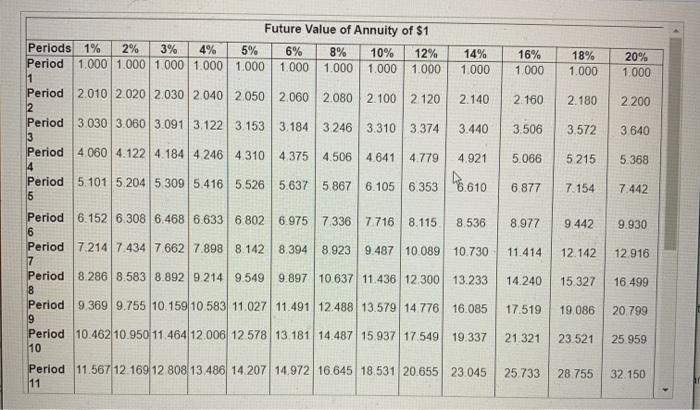

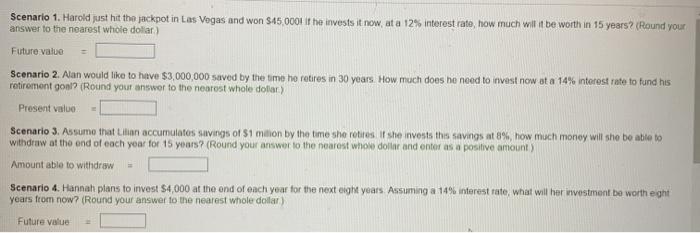

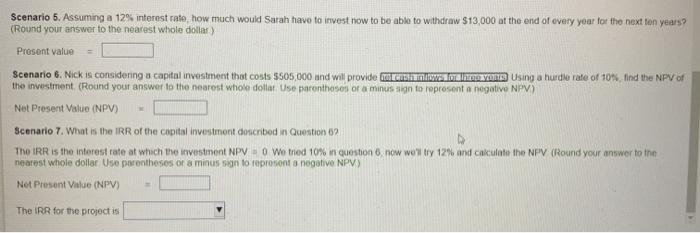

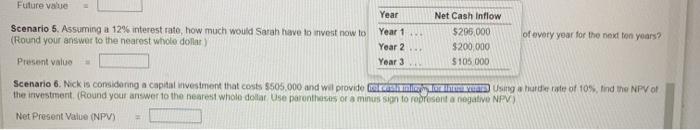

i Reference Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.8770.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.9070.890 0.857 0.826 0.797 0.769 0.743 0.718 0.694 Period 3 0.971 0.942 0.915 0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 Period 4 0.961 0.924 0.888 0.855 0.8230.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.621 0.567 0.519 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.6450.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 Period 0.905 0.820 0.744 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 10 Period 0.896 0.8040.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 11 Period 0.887 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.168 0.1370 112 12 Period 0.879 0.773 0.681 0.601 0.530 0.4690.368 0.290 0.229 0.182 0.145 0.116 0.093 13 Period 0.870 0.758 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 14 Period 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.239 0.183 0.1400.108 0.084 0.065 15 Period 10.820 10.673 0.554 0.456 0.377/0.31210.215.10.149 10 104 10.073 10.051 0.037 0.026 Print Done Future Value of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 1 1.010 1.020 1.030 1.040 1.050 1.060 1.080 1.100 1.120 1.140 1.160 1.180 1.200 Period 2 1.020 1.040 1.061 1.082 1.103 1.124 1.166 1.210 1.254 1.300 1.346 1.392 1.440 Period 3 1030 1.061 1.0931.125 1.1581.191 1.260 1.331 1.405 1 482 1.561 1.643 1.728 Period 4 1.041 1.082 1.126 1.170 1.2161 262 1.360 1.464 1.5741.689 1.811 1.939 2.074 Period 5 1.0511.104 1.159 1.217 1.276 1.338 1.469 1.611 1.762 1.925 2.100 2288 2.488 Period 6 1.062 1.126 1.194 1.265 1.340 1.419 1.587 1.772 1.9742.195 2436 2.700 2.986 Period 7 1.072 1.149 1.230 1316 1.407 1.504 1.714 1.949 2211 2.5022 826 3.185 3.583 Period 8 1083 1.172 1.267 1.3691477 1.594 1.851 2.144 2.476 2.853 3.278 3.759 4.300 Period 9 1.094 1.1951.305 1.423 1.551 1.689 1.999 2.3582.773 3.252 3.803 4.435 5.160 Period 1.105 1.219 1.344 1.480 1.629 1.791 2 159 2 594 3.106 3.707 4.411 5.234 6.192 10 Period 1 116 1.243 1384 1.539 1710 1 898 2.332 2.853 3.479 4 226 5 1176 176 7.430 11 Period 1.127 1.268 1.426 1601 1.796 2.012 2.518 3 138 3.896 4.818 5.9367288 8.916 12 Period 1.138 1.2941.469 1.665 1.886 2133 2.720 3.452 4.363 5.492 6.886 8.599 10.699 13 Period 1.149 1319 1.513 1.732 1.980 2261 2.937 3.797 4.8876.2617.988 10.147 12.839 14 Period 1.1611 346 1.558 1.801 2.079 2 397 3.172 4.177 5.474 7 138 9.266 11 974 15 407 15 Period 1220 1.486 1.806.12.19112.653 3.207 4.6616.727 9.646.13.743 19.461 27.393 38.338 Print Done Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 1 Period 1.970 1.942 1913 1.886 1.859 1.833 1783 1.736 1.690 1.647 1.605 1.566 1.528 2 Period 2.9412.884 2.829 2.775 2.723 2.673 2577 2.487 2.402 2.322 2.246 2.174 2.106 3 Period 3.902 3.808 3.7173.6303.546 3.465 3.312 3.1703.037 2.914 2.798 2.690 2.589 4 Period 4.853 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 5 Period 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.889 3.685 3.498 3.326 6 Period 6.728 6.472 6230 6.002 5.786 5.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605 Period 7.652 7.325 7.020 6.733 6.463 6210 5.747 5.335 4.9684.639 4 344 4.078 3.837 CD UN Period 8.566 8.162 7.786 7.435 7.108 6.8026.247 5.759 5.328 4.946 4.607 4.303 4.031 9 Period 9.471 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 10 Period 10.368 9.7879.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 11 16% 1.000 18% 1.000 20% 1.000 2.160 2.180 2 200 3.506 3.572 3.640 5.066 5 215 5.368 6.877 7.154 7 442 Future Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% Period 1.000 1.000 1.000 1.000 1.000 1 000 1.000 1.000 1.000 1.000 1 Period 2.010 2.020 2030 2040 2050 2060 2080 2.100 2120 2.140 2 Period 3.030 3.060 3.091 3.122 3 153 3.184 3 246 3.310 3.374 3.440 3 Period 4 060 4.122 4.184 4 246 4.310 4375 4.506 4.641 4.779 4.921 4 Period 5.101 5.204 5.309 5.416 5.526 5.637 5.867 6.105 6353 8610 5 Period 6.152 6.308 6.468 6.633 6 802 6.975 7 3367 716 8.115 8.536 6 Period 72147 434 7.662 7.898 8.142 8.3948.923 9.487 10.089 10.730 7 Period 8.286 8.5838.8929.214 9.549 9.897 10.637 11.436 12.300 13.233 8 Period 9.369 9.755 10.159 10.583 11.027 11.49112.488 13.579 14 776 16.085 9 Period 10.462 10.950 11 464 12.006 12 578 13 181 14 487 15 937 17.549 19.337 10 Period 11.567 12 169 12 808 13.486 14 207 14.972 16.645 18.531 20.655 23.045 11 8.977 9.442 9.930 11.414 12.142 12.916 14.240 15.327 16 499 17519 19 086 20 799 21.321 23.521 25.959 25.733 28 755 32.150 . Scenario 5. Assuming a 12% interest rate how much would Sarah have to invest now to be able to withdraw $13,000 at the end of every year for the next ton years? (Round your answer to the nearest whole dollar Present value = Scenario 6. Nick is considering a capital investment that costs $505,000 and will provide mercantil VARS Using a hurdle rate of 10%, find the NPV of the investment (Round your answer to the nearest whole dollar Use parentheses or a minssion to represent a negative NPV) Net Present Value (NPV) Scenario 7. What is the IRR of the capital investmont described in Question 02 The IRR is the interest rate at which the investment NPV - 0 We tried 10% in questione now we'll try 12% and calculate the NPV (Round your answer to the nearest whole dollar Uso parentheses of 8 minus sign to represent a negative NPV) Net Present Value (NPV) The IRR for the project is Future value Year Scenario 5. Assuming a 12% interest rate how much would Sarah have to invest now to (Round your answer to the nearest whole dollar) Net Cash Inflow $295.000 $200.000 $105 000 Year 1 Year 2 Year 3 of every year for the next ton years? Present value Scenario 6. Nick is considering a capital investment that costs $505,000 and will provide a gauderer of 10% find the NPV of the investment (Round your answer to the nearest whole dofar Use parents or a minussion to represent a negative NPV) Net Present Value (NPV) do so for a guaranteed thumbs up!

Must also be done in a timely manner. let me know if more info is needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started