Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer Everything begin{tabular}{|c|c|c|c|c|c|c|c|c|} hline & multicolumn{2}{|c|}{ Physical Units } & multicolumn{6}{|c|}{ Equivalent Units Processed } hline & multirow{3}{*}{ To account for } &

Please Answer Everything

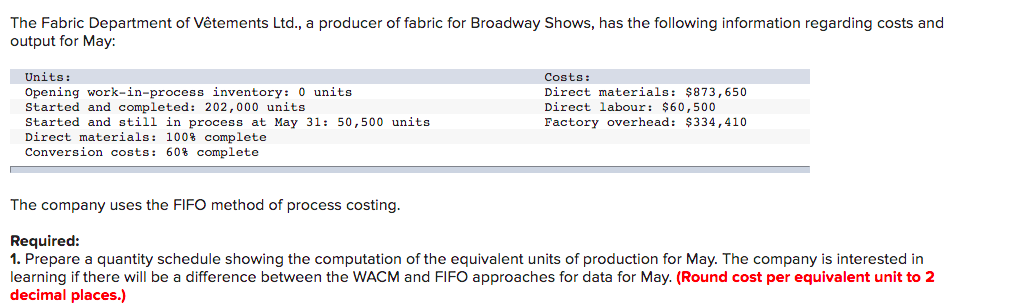

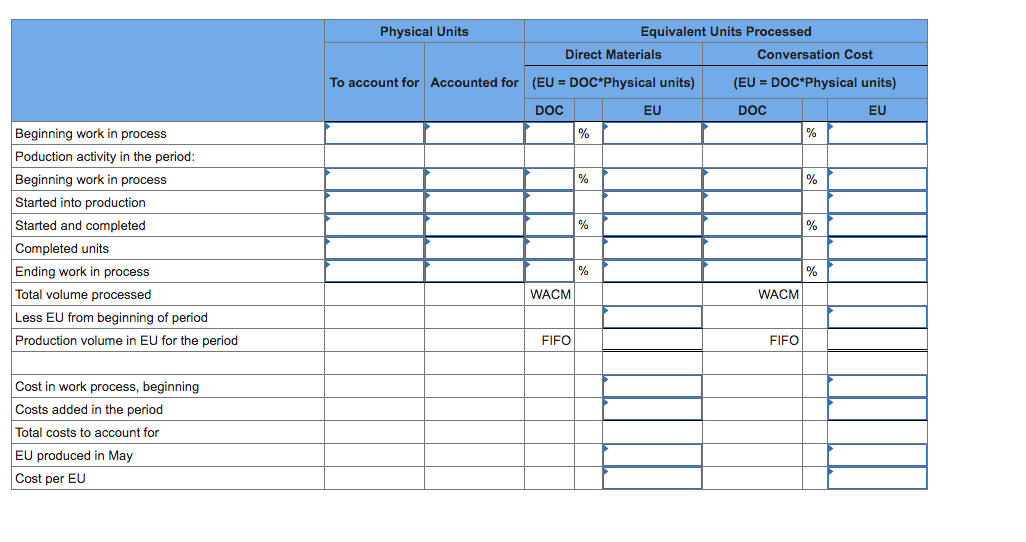

\begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Physical Units } & \multicolumn{6}{|c|}{ Equivalent Units Processed } \\ \hline & \multirow{3}{*}{ To account for } & \multirow{3}{*}{ Accounted for } & \multirow{2}{*}{\multicolumn{3}{|c|}{DirectMaterials(EU=DOC*Physicalunits)}} & \multirow{2}{*}{\multicolumn{3}{|c|}{(EU=DOC*Physicalunits)ConversationCost}} \\ \hline & & & & & & & & \\ \hline & & & DOC & & EU & DOC & & EU \\ \hline Beginning work in process & & & & % & & & % & \\ \hline \multicolumn{9}{|l|}{ Poduction activity in the period: } \\ \hline Beginning work in process & & & & % & & & % & r \\ \hline \multicolumn{9}{|l|}{ Started into production } \\ \hline Started and completed & & & & % & & & % & ? \\ \hline \multicolumn{9}{|l|}{ Completed units } \\ \hline Ending work in process & & & & % & & & % & \\ \hline Total volume processed & & & WACM & & & WACM & & \\ \hline \multicolumn{9}{|l|}{ Less EU from beginning of period } \\ \hline Production volume in EU for the period & & & FIFO & & & FIFO & & \\ \hline \multicolumn{9}{|l|}{ Cost in work process, beginning } \\ \hline \multicolumn{9}{|l|}{ Costs added in the period } \\ \hline \multicolumn{9}{|l|}{ Total costs to account for } \\ \hline \multicolumn{9}{|l|}{ EU produced in May } \\ \hline Cost per EU & & & & & & & & r \\ \hline \end{tabular} 2. Calculate the cost of 202,000 units transferred out in May. 3. Calculate the cost of ending inventory in May. (Do not round intermediate calculations.) The Fabric Department of Vtements Ltd., a producer of fabric for Broadway Shows, has the following information regarding costs and output for May: The company uses the FIFO method of process costing. Required: 1. Prepare a quantity schedule showing the computation of the equivalent units of production for May. The company is interested in learning if there will be a difference between the WACM and FIFO approaches for data for May. (Round cost per equivalent unit to 2 decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started