Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer everything highlighted yellow. Please answer everything highlighted yellow. Reformulating Financial Statements for Pension Contributions American Airlines reports the following pension and retiree health

Please answer everything highlighted yellow.

Please answer everything highlighted yellow.

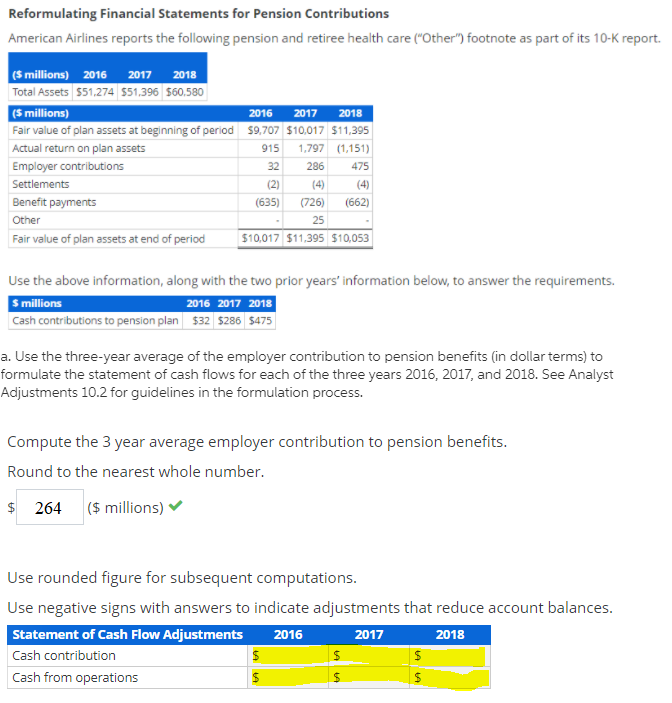

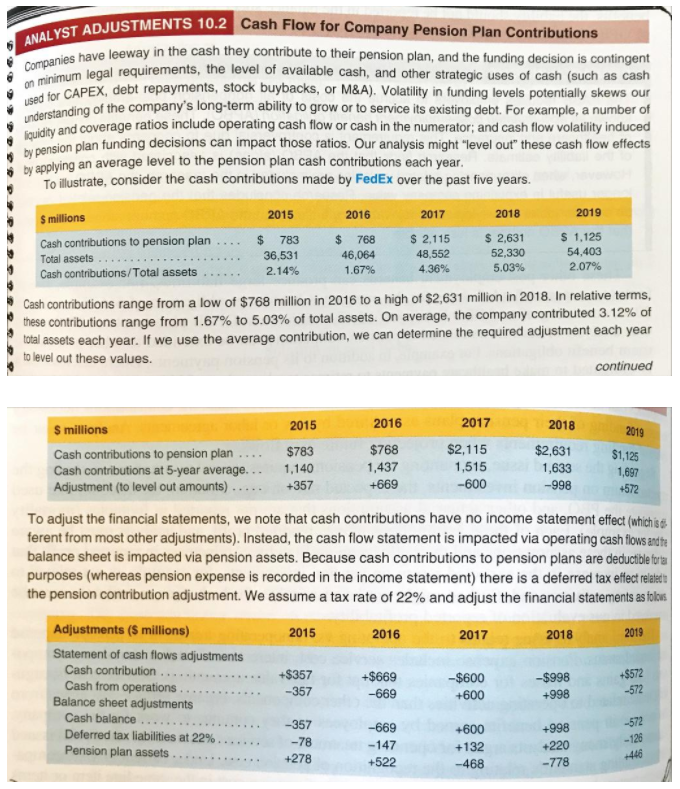

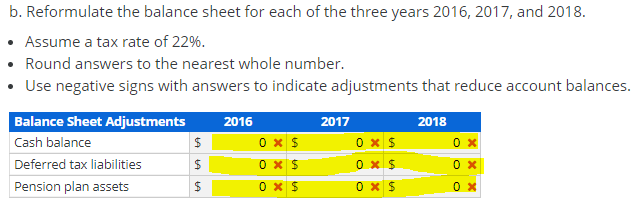

Reformulating Financial Statements for Pension Contributions American Airlines reports the following pension and retiree health care ("Other") footnote as part of its 10-K report. (5 millions) 2016 2017 2018 Total Assets 551,274 551,396 $60,580 (5 millions) 2016 2017 2018 Fair value of plan assets at beginning of period 89,707 $10,017 $11,395 Actual return on plan assets 915 1,797 (1,151) Employer contributions 32 286 475 Settlements (2) (4) Benefit payments (635) (726) (662) Other 25 Fair value of plan assets at end of period $10,017 $11,395 $10,053 Use the above information, along with the two prior years' information below, to answer the requirements. S millions 2016 2017 2018 Cash contributions to pension plan $32 5286 $475 a. Use the three-year average of the employer contribution to pension benefits (in dollar terms) to formulate the statement of cash flows for each of the three years 2016, 2017, and 2018. See Analyst Adjustments 10.2 for guidelines in the formulation process. Compute the 3 year average employer contribution to pension benefits. Round to the nearest whole number. $ 264 ($ millions) Use rounded figure for subsequent computations. Use negative signs with answers to indicate adjustments that reduce account balances. Statement of Cash Flow Adjustments 2016 2017 2018 Cash contribution Cash from operations $ $ $ $ $ $ ANALYST ADJUSTMENTS 10.2 Cash Flow for Company Pension Plan Contributions Companies have leeway in the cash they contribute to their pension plan, and the funding decision is contingent on minimum legal requirements, the level of available cash, and other strategic uses of cash (such as cash used for CAPEX, debt repayments stork buybacks, or M&A) . Volatility in funding levels potentially skews our understanding of the company's long-term ability to grow or to service its existing debt . For example, a number of liquidity and coverage ratios include operating cash flow or cash in the numerator; and cash flow volatility induced by pension plan funding decisions can impact those ratios. Our analysis might level out these cash flow effects by applying an average level to the pension plan cash contributions each year, To illustrate, consider the cash contributions made by FedEx over the past five years. 2016 2017 2018 $ 783 $ 768 $ 2.115 1.67% 4.36% 5.03% $ millions 2015 2019 Cash contributions to pension plan $ 2,631 $ 1.125 Total assets 36,531 46,064 48,552 52,330 54,403 Cash contributions/Total assets 2.14% 2.07% Cash contributions range from a low of $768 million in 2016 to a high of $2,631 million in 2018. In relative terms, these contributions range from 1.67% to 5.03% of total assets. On average, the company contributed 3.12% of total assets each year. If we use the average contribution, we can determine the required adjustment each year to level out these values. continued 2018 2019 $1,125 1,697 +572 2015 2016 S millions 2017 Cash contributions to pension plan .... $783 $768 $2,115 $2,631 Cash contributions at 5-year average... 1,140 1,437 1,515 1,633 Adjustment (to level out amounts) .. +357 +669 -600 -998 To adjust the financial statements, we note that cash contributions have no income statement effect (which is to ferent from most other adjustments). Instead, the cash flow statement is impacted via operating cash flows and te balance sheet is impacted via pension assets. Because cash contributions to pension plans are deductible forta purposes (whereas pension expense is recorded in the income statement) there is a deferred tax effect related the pension contribution adjustment. We assume a tax rate of 22% and adjust the financial statements as folos Adjustments (5 millions) 2015 2016 2017 2018 2019 Statement of cash flows adjustments Cash contribution +$357 +$669 -$600 -$998 Cash from operations -357 -669 +600 Balance sheet adjustments +998 Cash balance .... -357 -669 Deferred tax liabilities at 22% +600 +998 -78 -147 Pension plan assets +132 +278 +522 - 778 $572 -572 -572 -126 +220 -446 -468 b. Reformulate the balance sheet for each of the three years 2016, 2017, and 2018. Assume a tax rate of 22%. Round answers to the nearest whole number. Use negative signs with answers to indicate adjustments that reduce account balances. Balance Sheet Adjustments 2016 2017 2018 Cash balance $ 0x $ Ox $ 0x Deferred tax liabilities $ Pension plan assets $ 0 x $ 0 x $ 0 X $ 0 x $ 0 X $ 0 X Reformulating Financial Statements for Pension Contributions American Airlines reports the following pension and retiree health care ("Other") footnote as part of its 10-K report. (5 millions) 2016 2017 2018 Total Assets 551,274 551,396 $60,580 (5 millions) 2016 2017 2018 Fair value of plan assets at beginning of period 89,707 $10,017 $11,395 Actual return on plan assets 915 1,797 (1,151) Employer contributions 32 286 475 Settlements (2) (4) Benefit payments (635) (726) (662) Other 25 Fair value of plan assets at end of period $10,017 $11,395 $10,053 Use the above information, along with the two prior years' information below, to answer the requirements. S millions 2016 2017 2018 Cash contributions to pension plan $32 5286 $475 a. Use the three-year average of the employer contribution to pension benefits (in dollar terms) to formulate the statement of cash flows for each of the three years 2016, 2017, and 2018. See Analyst Adjustments 10.2 for guidelines in the formulation process. Compute the 3 year average employer contribution to pension benefits. Round to the nearest whole number. $ 264 ($ millions) Use rounded figure for subsequent computations. Use negative signs with answers to indicate adjustments that reduce account balances. Statement of Cash Flow Adjustments 2016 2017 2018 Cash contribution Cash from operations $ $ $ $ $ $ ANALYST ADJUSTMENTS 10.2 Cash Flow for Company Pension Plan Contributions Companies have leeway in the cash they contribute to their pension plan, and the funding decision is contingent on minimum legal requirements, the level of available cash, and other strategic uses of cash (such as cash used for CAPEX, debt repayments stork buybacks, or M&A) . Volatility in funding levels potentially skews our understanding of the company's long-term ability to grow or to service its existing debt . For example, a number of liquidity and coverage ratios include operating cash flow or cash in the numerator; and cash flow volatility induced by pension plan funding decisions can impact those ratios. Our analysis might level out these cash flow effects by applying an average level to the pension plan cash contributions each year, To illustrate, consider the cash contributions made by FedEx over the past five years. 2016 2017 2018 $ 783 $ 768 $ 2.115 1.67% 4.36% 5.03% $ millions 2015 2019 Cash contributions to pension plan $ 2,631 $ 1.125 Total assets 36,531 46,064 48,552 52,330 54,403 Cash contributions/Total assets 2.14% 2.07% Cash contributions range from a low of $768 million in 2016 to a high of $2,631 million in 2018. In relative terms, these contributions range from 1.67% to 5.03% of total assets. On average, the company contributed 3.12% of total assets each year. If we use the average contribution, we can determine the required adjustment each year to level out these values. continued 2018 2019 $1,125 1,697 +572 2015 2016 S millions 2017 Cash contributions to pension plan .... $783 $768 $2,115 $2,631 Cash contributions at 5-year average... 1,140 1,437 1,515 1,633 Adjustment (to level out amounts) .. +357 +669 -600 -998 To adjust the financial statements, we note that cash contributions have no income statement effect (which is to ferent from most other adjustments). Instead, the cash flow statement is impacted via operating cash flows and te balance sheet is impacted via pension assets. Because cash contributions to pension plans are deductible forta purposes (whereas pension expense is recorded in the income statement) there is a deferred tax effect related the pension contribution adjustment. We assume a tax rate of 22% and adjust the financial statements as folos Adjustments (5 millions) 2015 2016 2017 2018 2019 Statement of cash flows adjustments Cash contribution +$357 +$669 -$600 -$998 Cash from operations -357 -669 +600 Balance sheet adjustments +998 Cash balance .... -357 -669 Deferred tax liabilities at 22% +600 +998 -78 -147 Pension plan assets +132 +278 +522 - 778 $572 -572 -572 -126 +220 -446 -468 b. Reformulate the balance sheet for each of the three years 2016, 2017, and 2018. Assume a tax rate of 22%. Round answers to the nearest whole number. Use negative signs with answers to indicate adjustments that reduce account balances. Balance Sheet Adjustments 2016 2017 2018 Cash balance $ 0x $ Ox $ 0x Deferred tax liabilities $ Pension plan assets $ 0 x $ 0 x $ 0 X $ 0 x $ 0 X $ 0 XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started