Please answer everything in 30-40mins i need to submit now its due.

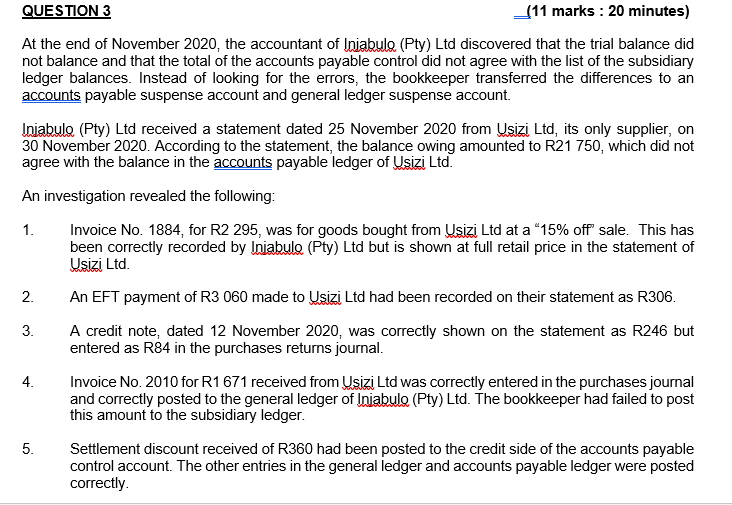

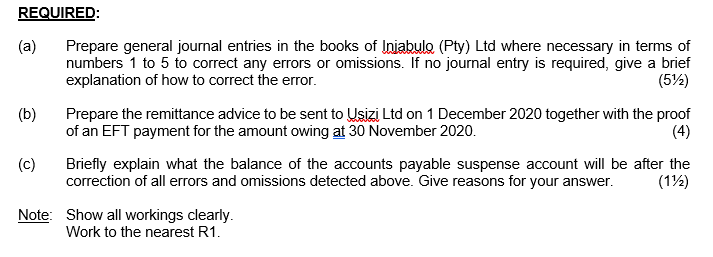

QUESTION 3 _11 marks : 20 minutes) At the end of November 2020, the accountant of Injabula (Pty) Ltd discovered that the trial balance did not balance and that the total of the accounts payable control did not agree with the list of the subsidiary ledger balances. Instead of looking for the errors, the bookkeeper transferred the differences to an accounts payable suspense account and general ledger suspense account. Injabulo (Pty) Ltd received a statement dated 25 November 2020 from Usizi Ltd, its only supplier, on 30 November 2020. According to the statement, the balance owing amounted to R21 750, which did not agree with the balance in the accounts payable ledger of Usizi Ltd. An investigation revealed the following: 1. Invoice No. 1884, for R2 295, was for goods bought from Usizi Ltd at a "15% off sale. This has been correctly recorded by Iniabule (Pty) Ltd but is shown at full retail price in the statement of Usizi Ltd. 2. An EFT payment of R3 060 made to Usizi Ltd had been recorded on their statement as R306. 3. A credit note, dated 12 November 2020, was correctly shown on the statement as R246 but entered as R84 in the purchases returns journal. 4. Invoice No. 2010 for R1 671 received from Usizi Ltd was correctly entered in the purchases journal and correctly posted to the general ledger of Iniabulo (PtyLtd. The bookkeeper had failed to post this amount to the subsidiary ledger. 5. Settlement discount received of R360 had been posted to the credit side of the accounts payable control account. The other entries in the general ledger and accounts payable ledger were posted correctly. REQUIRED: (a) Prepare general journal entries in the books of Iniabule (Pty) Ltd where necessary in terms of numbers 1 to 5 to correct any errors or omissions. If no journal entry is required, give a brief explanation of how to correct the error. (512) (b) Prepare the remittance advice to be sent to Usizi Ltd on 1 December 2020 together with the proof of an EFT payment for the amount owing at 30 November 2020. (4) (c) Briefly explain what the balance of the accounts payable suspense account will be after the correction of all errors and omissions detected above. Give reasons for your answer. (112) Note: Show all workings clearly. Work to the nearest R1