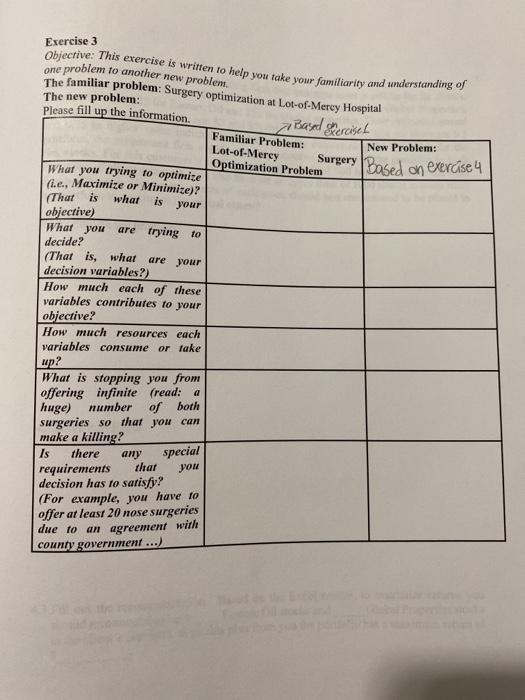

Please answer exercise 3(chart) and exercise 4 (4.1,4.2, and 4.3). exercise 1 is provided as reference to the questions on the left side of the chart on exercise 3.

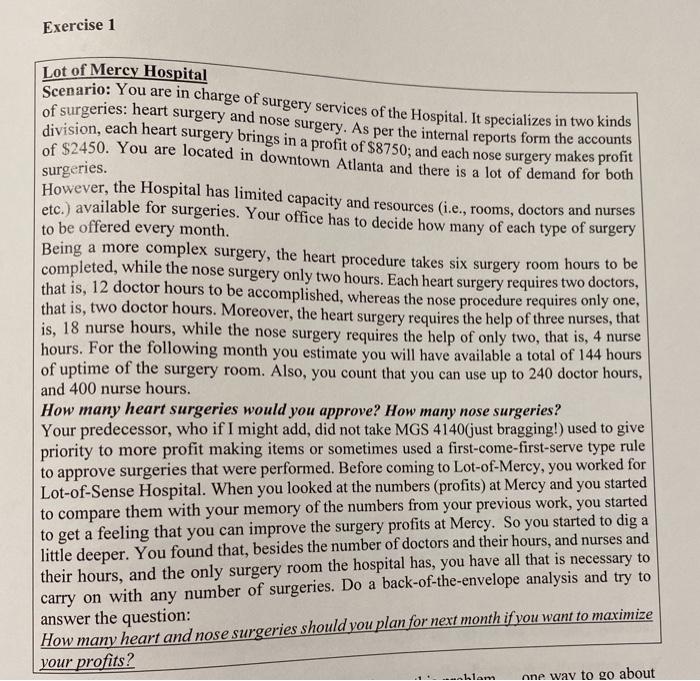

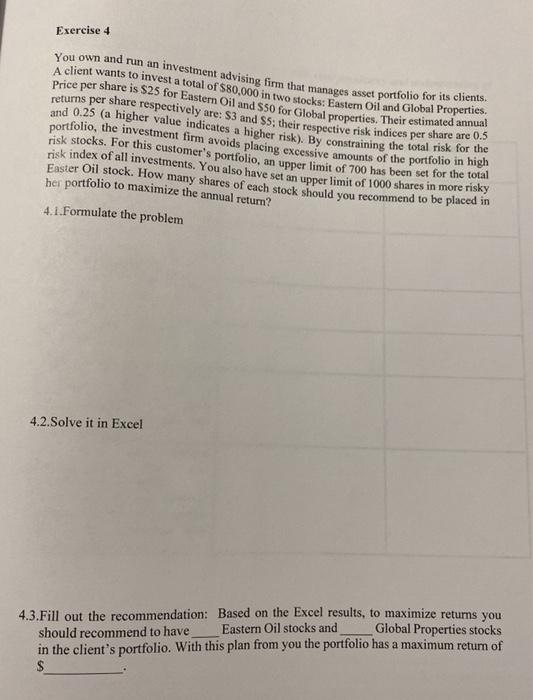

Exercise 3 Objective: This exercise is written to help you take your familiarity and understanding of one problem to another new problem The new problem: Please fill up The familiar problem: Surgery optimization at Lot-of-Mercy Hospital the information Bard Skercised Familiar Problem: Lot-of-Merey Surgery Based on exercise 4 Optimization Problem What you trying to optimize (i.e., Maximize or Minimize)? what is your New Problem: are your (That is objective) What you are trying to decide? (That is, what decision variables?) How much each of these variables contributes to your objective? How much resources each variables consume or take up? What is stopping you from offering infinite (read: huge) number of both surgeries so that you can make a killing? Is there any special requirements that you decision has to satisfy? (For example, you have to offer at least 20 nose surgeries due to an agreement with county government ...) Exercise 1 surgeries. Lot of Mercy Hospital Scenario: You are in charge of surgery services of the Hospital. It specializes in two kinds of surgeries: heart surgery and nose surgery. As per the internal reports form the accounts division, each heart surgery brings in a profit of $8750; and each nose surgery makes profit of $2450. You are located in downtown Atlanta and there is a lot of demand for both However, the Hospital has limited capacity and resources (i.e., rooms, doctors and nurses etc.) available for surgeries. Your office has to decide how many of each type of surgery to be offered every month. Being a more complex surgery, the heart procedure takes six surgery room hours to be completed, while the nose surgery only two hours. Each heart surgery requires two doctors, that is, 12 doctor hours to be accomplished, whereas the nose procedure requires only one, that is, two doctor hours. Moreover, the heart surgery requires the help of three nurses, that is, 18 nurse hours, while the nose surgery requires the help of only two, that is, 4 nurse hours. For the following month you estimate you will have available a total of 144 hours of uptime of the surgery room. Also, you count that you can use up to 240 doctor hours, and 400 nurse hours. How many heart surgeries would you approve? How many nose surgeries? Your predecessor, who if I might add, did not take MGS 4140(just bragging!) used to give priority to more profit making items or sometimes used a first-come-first-serve type rule to approve surgeries that were performed. Before coming to Lot-of-Mercy, you worked for Lot-of-Sense Hospital. When you looked at the numbers (profits) at Mercy and you started to compare them with your memory of the numbers from your previous work, you started to get a feeling that you can improve the surgery profits at Mercy. So you started to dig a little deeper. You found that, besides the number of doctors and their hours, and nurses and their hours, and the only surgery room the hospital has, you have all that is necessary to carry on with any number of surgeries. Do a back-of-the-envelope analysis and try to answer the question: How many heart and nose surgeries should you plan for next month if you want to maximize your profits? Alam Ane way to go about Exercise 4 You own and run an investment advising firm that manages asset portfolio for its clients. Price per share is $25 for Eastern Oil and S50 for Global properties. Their estimated annual returns per share respectively are: S3 and $5; their respective risk indices per share are 0.5 and 0.25 (a higher value indicates a higher risk). By constraining the total risk for the portfolio, the investment firm avoids placing excessive amounts of the portfolio in high risk stocks. For this customer's portfolio, an upper limit of 700 has been set for the total risk index of all investments. You also have set an upper limit of 1000 shares in more risky Easter Oil stock. How many shares of each stock should you recommend to be placed in her portfolio to maximize the annual return? 4.1.Formulate the problem 4.2.Solve it in Excel 4.3.Fill out the recommendation: Based on the Excel results, to maximize returns you should recommend to have Eastern Oil stocks and Global Properties stocks in the client's portfolio With this plan from you the portfolio has a maximum return of $