Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer fast In 1991, Headlands Limited completed the construction of a building at a cost of $1.69 million; it occupied the building in January

please answer fast

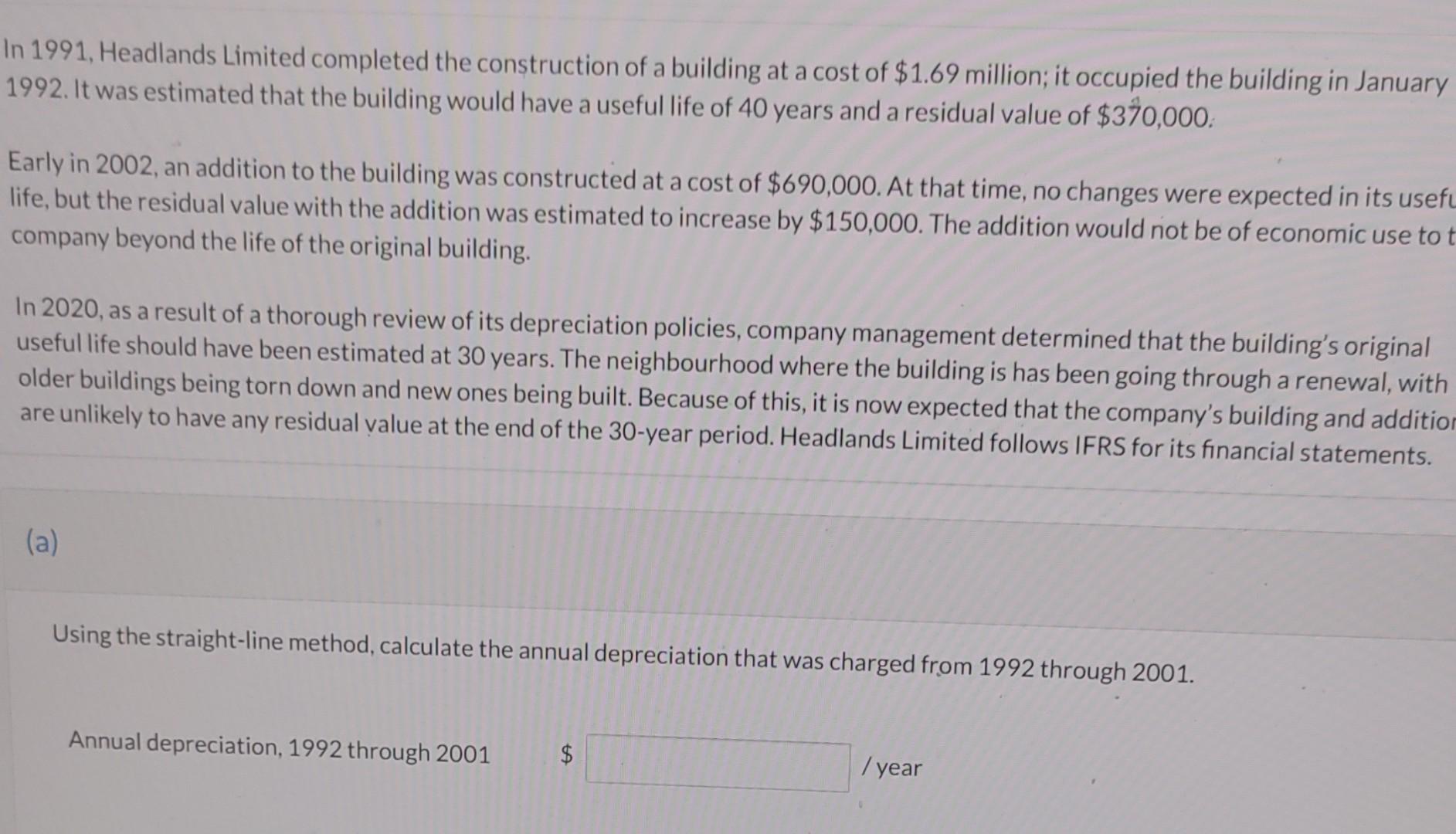

In 1991, Headlands Limited completed the construction of a building at a cost of $1.69 million; it occupied the building in January 1992. It was estimated that the building would have a useful life of 40 years and a residual value of $370,000. Early in 2002, an addition to the building was constructed at a cost of $690,000. At that time, no changes were expected in its usefu life, but the residual value with the addition was estimated to increase by $150,000. The addition would not be of economic use to t company beyond the life of the original building. In 2020, as a result of a thorough review of its depreciation policies, company management determined that the building's original useful life should have been estimated at 30 years. The neighbourhood where the building is has been going through a renewal, with older buildings being torn down and new ones being built. Because of this, it is now expected that the company's building and addition are unlikely to have any residual value at the end of the 30-year period. Headlands Limited follows IFRS for its financial statements. (a) Using the straight-line method, calculate the annual depreciation that was charged from 1992 through 2001. Annual depreciation, 1992 through 2001 $ /yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started