Question: please answer fast thanks. ill thumbs up requirements attached Requirements 1. Use the PV function in Excel (D) to calculate the issue price of the

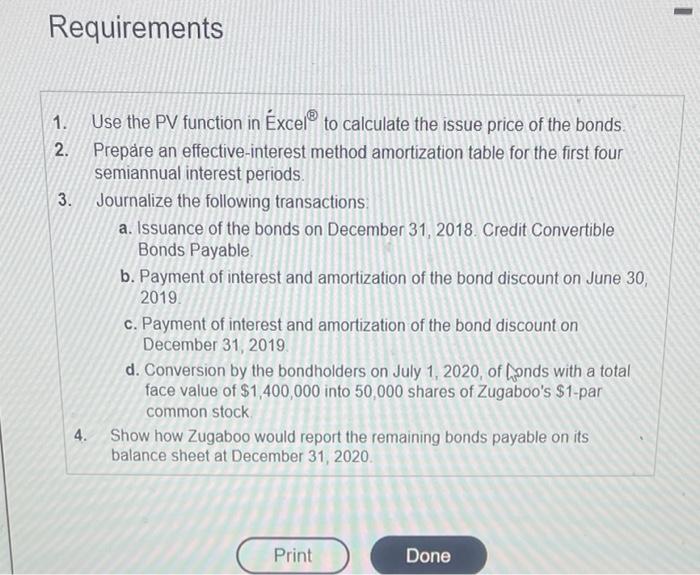

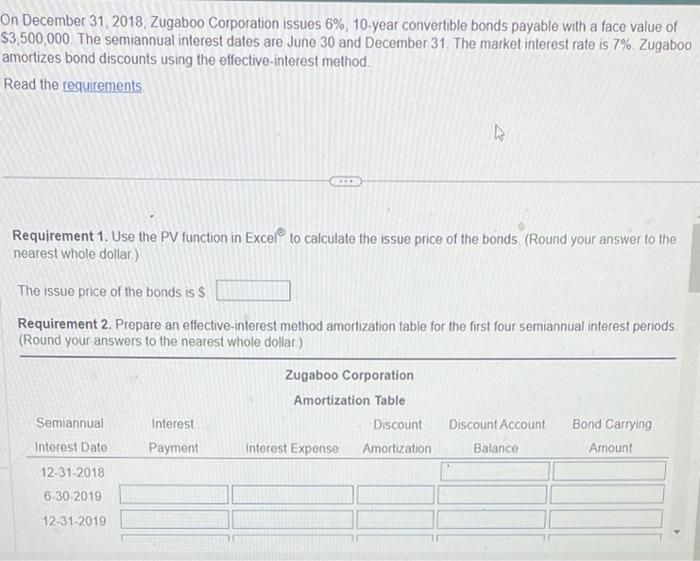

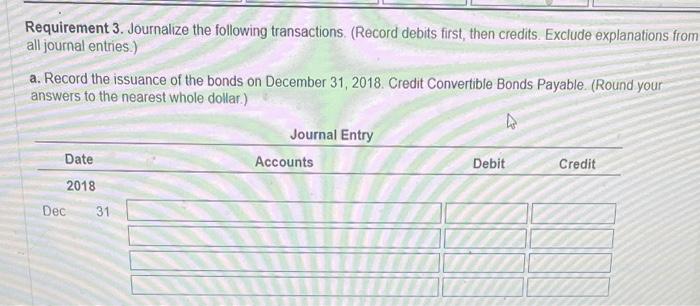

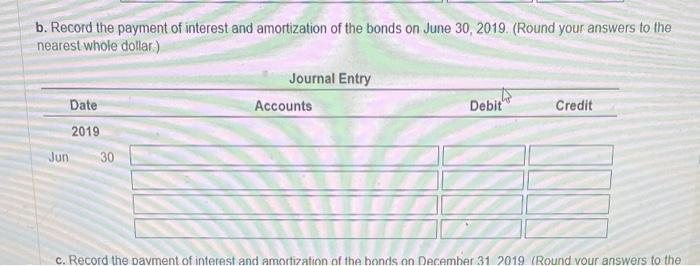

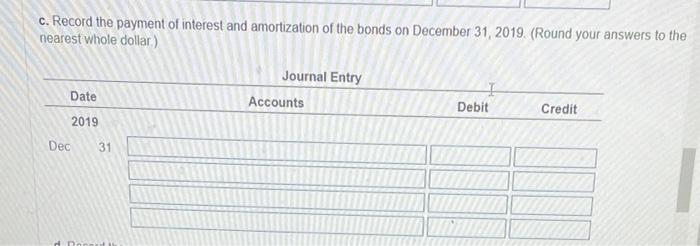

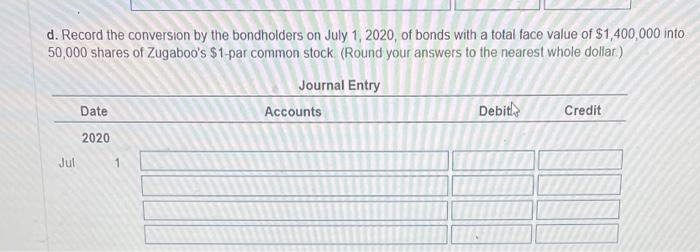

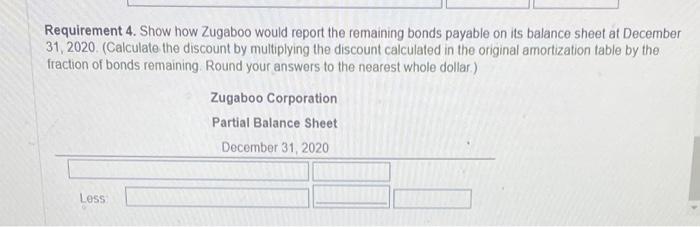

Requirements 1. Use the PV function in Excel (D) to calculate the issue price of the bonds. 2. Prepare an effective-interest method amortization table for the first four semiannual interest periods. 3. Journalize the following transactions: a. Issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable. b. Payment of interest and amortization of the bond discount on June 30 , 2019 c. Payment of interest and amortization of the bond discount on December 31, 2019. d. Conversion by the bondholders on July 1,2020 , of honds with a total face value of $1,400,000 into 50,000 shares of Zugaboo's $1-par common stock 4. Show how Zugaboo would report the remaining bonds payable on its balance sheet at December 31, 2020. On December 31, 2018, Zugaboo Corporation issues 6%,10-year convertible bonds payable with a face value of $3,500,000. The semiannual interest dates are June 30 and December 31 . The market interest rate is 7%. Zugaboo amortizes bond discounts using the effective-interest method. Read the requirements Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds. (Round your answer to the . nearest whole dollar.) The issue price of the bonds is $ Requirement 2. Prepare an effective-interest method amortization table for the first four semiannual interest periods. (Round your answers to the nearest whole dollar) Requirement 3. Journalize the following transactions. (Record debits first, then credits. Exclude explanations fron all journal entries.) a. Record the issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable. (Round your answers to the nearest whole dollar.) b. Record the payment of interest and amortization of the bonds on June 30, 2019. (Round your answers to the nearest whole dollar.) c. Record the payment of interest and amortization of the bonds on December 31, 2019. (Round your answers to the nearest whole dollar.) d. Record the conversion by the bondholders on July 1,2020 , of bonds with a total face value of $1,400,000 into 50,000 shares of Zugaboo's $1-par common stock (Round your answers to the nearest whole dollar.) Requirement 4. Show how Zugaboo would report the remaining bonds payable on its balance sheet at December 31, 2020. (Calculate the discount by multiplying the discount calculated in the original amortization table by the fraction of bonds remaining. Round your answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts