Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER FAST. WILL UPVOTE IF YOU DO ALL THE PARTS. FAST. Question 3 a) Celsius Al issued its shares at an IPO for $10

PLEASE ANSWER FAST. WILL UPVOTE IF YOU DO ALL THE PARTS. FAST.

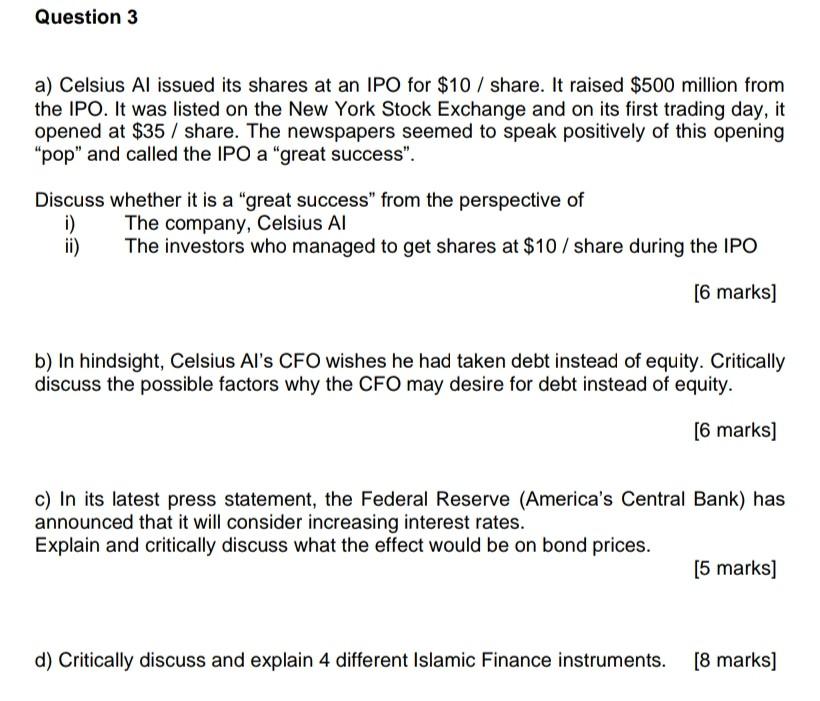

Question 3 a) Celsius Al issued its shares at an IPO for $10 / share. It raised $500 million from the IPO. It was listed on the New York Stock Exchange and on its first trading day, it opened at $35 / share. The newspapers seemed to speak positively of this opening "pop" and called the IPO a great success". Discuss whether it is a great success" from the perspective of i) The company, Celsius Al ii) The investors who managed to get shares at $10 / share during the IPO [6 marks] b) In hindsight, Celsius Al's CFO wishes he had taken debt instead of equity. Critically discuss the possible factors why the CFO may desire for debt instead of equity. [6 marks] c) In its latest press statement, the Federal Reserve (America's Central Bank) has announced that it will consider increasing interest rates. Explain and critically discuss what the effect would be on bond prices. [5 marks] d) Critically discuss and explain 4 different Islamic Finance instruments. [8 marks] Question 3 a) Celsius Al issued its shares at an IPO for $10 / share. It raised $500 million from the IPO. It was listed on the New York Stock Exchange and on its first trading day, it opened at $35 / share. The newspapers seemed to speak positively of this opening "pop" and called the IPO a great success". Discuss whether it is a great success" from the perspective of i) The company, Celsius Al ii) The investors who managed to get shares at $10 / share during the IPO [6 marks] b) In hindsight, Celsius Al's CFO wishes he had taken debt instead of equity. Critically discuss the possible factors why the CFO may desire for debt instead of equity. [6 marks] c) In its latest press statement, the Federal Reserve (America's Central Bank) has announced that it will consider increasing interest rates. Explain and critically discuss what the effect would be on bond prices. [5 marks] d) Critically discuss and explain 4 different Islamic Finance instruments. [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started