Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer for question 5 through 8 only Provided Information: Coca-Cola's Debt You are aware that Coca-Cola recently issued a series of new 10-year notes.

please answer for question 5 through 8 only

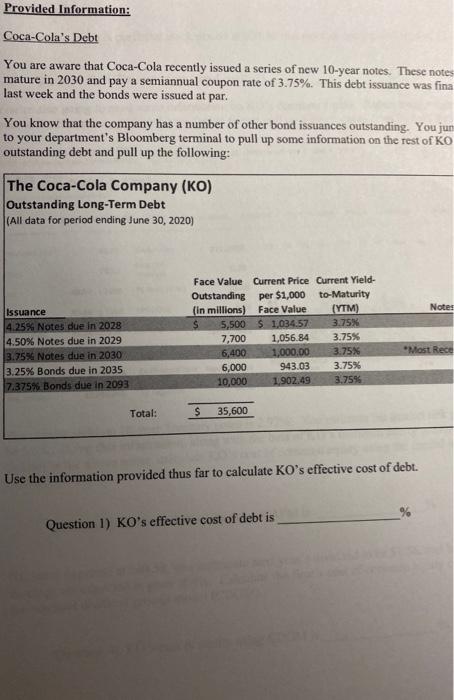

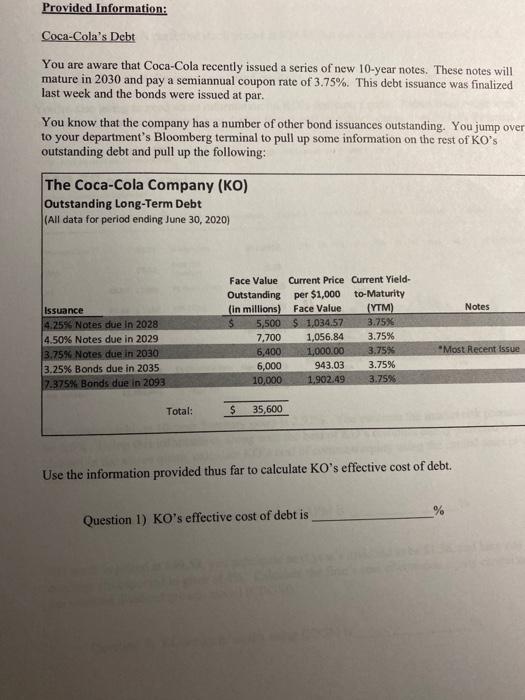

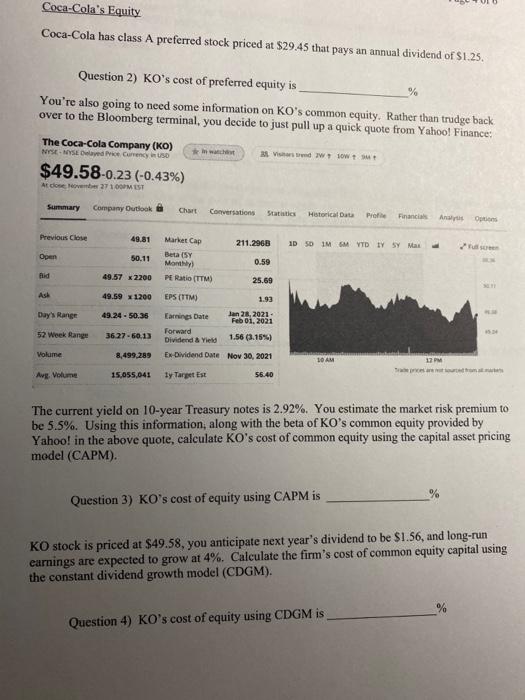

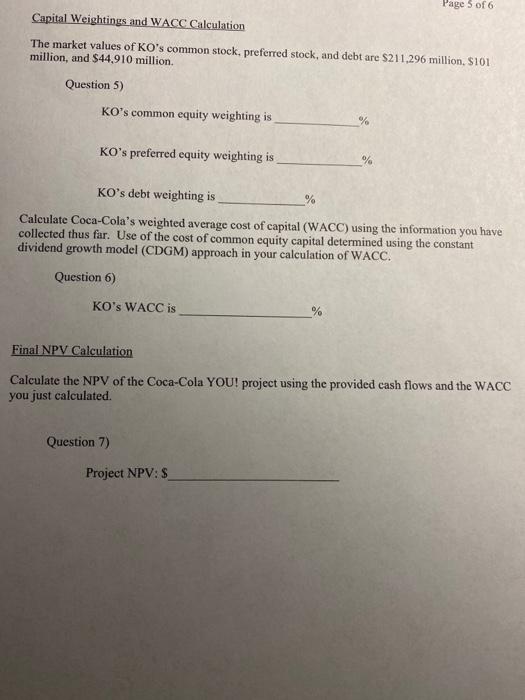

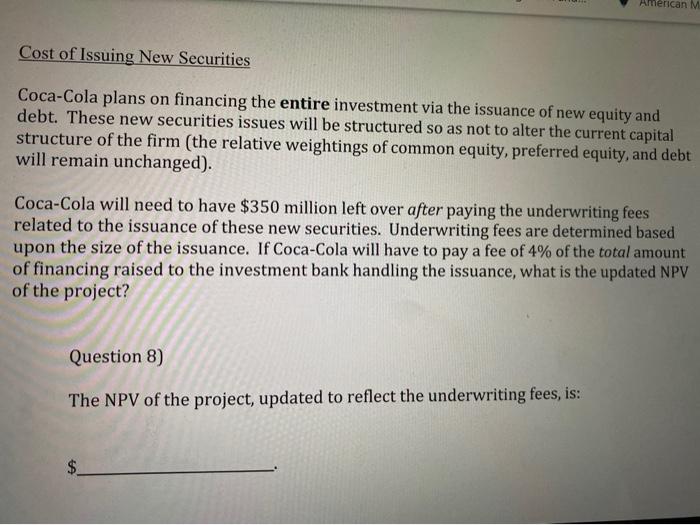

Provided Information: Coca-Cola's Debt You are aware that Coca-Cola recently issued a series of new 10-year notes. These notes mature in 2030 and pay a semiannual coupon rate of 3.75%. This debt issuance was fina last week and the bonds were issued at par. You know that the company has a number of other bond issuances outstanding. You jun to your department's Bloomberg terminal to pull up some information on the rest of Ko outstanding debt and pull up the following: The Coca-Cola Company (KO) Outstanding Long-Term Debt (All data for period ending June 30, 2020) Notes Issuance 4.25% Notes due in 2028 4.50% Notes due in 2029 3.75% Notes due in 2030 3.25% Bonds due in 2035 7.375% Bonds due in 2093 Face Value Current Price Current Yield- Outstanding per $1,000 to-Maturity (in millions) Face Value (YTM) $ 5,500 $ 1,034.57 3.75% 7,700 1,056.84 3.75% 6,400 1,000.00 3.75 6,000 943.03 3.75% 10,000 1.902.49 3.75% Most Rece Total: $ 35,600 Use the information provided thus far to calculate KO's effective cost of debt. Question 1) KO's effective cost of debt is Provided Information: Coca-Cola's Debt You are aware that Coca-Cola recently issued a series of new 10-year notes. These notes will mature in 2030 and pay a semiannual coupon rate of 3.75%. This debt issuance was finalized last week and the bonds were issued at par. You know that the company has a number of other bond issuances outstanding. You jump over to your department's Bloomberg terminal to pull up some information on the rest of KO's outstanding debt and pull up the following: The Coca-Cola Company (KO) Outstanding Long-Term Debt (All data for period ending June 30, 2020) Notes Issuance 4.25% Notes due in 2028 4.50% Notes due in 2029 3.75% Notes due in 2030 3.25% Bonds due in 2035 17.375% Bonds due in 2093 Face Value Current Price Current Yield- Outstanding per $1,000 to-Maturity (in millions) Face Value (YTM) 5,500 $ 1.034.57 3.75% 7.700 1,056.84 3.75% 6,400 1,000.00 3.75% 6,000 943.03 3.75% 10,000 1.902.49 3.75% Most Recent Issue Total: $ 35,600 Use the information provided thus far to calculate KO's effective cost of debt. % Question 1) KO's effective cost of debt is Coca-Cola's Equity Coca-Cola has class A preferred stock priced at $29.45 that pays an annual dividend of $1.25. Question 2) KO's cost of preferred equity is You're also going to need some information on KO's common equity. Rather than trudge back over to the Bloomberg terminal, you decide to just pull up a quick quote from Yahoo! Finance % The Coca-Cola Company (KO) NYSEMYSE Dved Currency USD w A Vid WoW + + $49.58-0.23 (-0.43%) Atom 2710M EST Summary Company Outlook Chart Conversations Statistics Historical Data Profe Financial Opis Previous Close 49.81 211.2968 1D 50 MM VTDTY SY Man Open 50.11 Market Cap Beta (SY Month PE Ratio (TTM) 0.59 flid 49.57 x 2200 25.69 Ash 49.59 * 1200 EPS (TTM) 1.93 Day's Range 49.24 - 50.35 52 Week Range 3627-60.13 Earrings Date Jan 28, 2021- Feb 01, 2021 Forward Dividend & Yield 1.56 (3.15%) Ex Dividend Date Nov 30, 2021 Volume 8,499.289 10 AM 17 PM Avg Volume 15,055,041 1y Tarpet Est 56.40 The current yield on 10-year Treasury notes is 2.92%. You estimate the market risk premium to be 5.5%. Using this information, along with the beta of KO's common equity provided by Yahoo! in the above quote, calculate KO's cost of common equity using the capital asse pricing model (CAPM). Question 3) KO's cost of equity using CAPM is KO stock is priced at $49.58, you anticipate next year's dividend to be $1.56, and long-run earnings are expected to grow at 4%. Calculate the firm's cost of common equity capital using the constant dividend growth model (CDGM). Question 4) KO's cost of equity using CDGM is Page 5 of 6 Capital Weightings and WACC Calculation The market values of KO's common stock, preferred stock, and debt are $211,296 million, 5101 million, and $44,910 million Question 5) KO's common equity weighting is % KO's preferred equity weighting is % KO's debt weighting is % Calculate Coca-Cola's weighted average cost of capital (WACC) using the information you have collected thus far. Use of the cost of common equity capital determined using the constant dividend growth model (CDGM) approach in your calculation of WACC. Question 6) KO's WACC is % Final NPV Calculation Calculate the NPV of the Coca-Cola YOU! project using the provided cash flows and the WACC you just calculated Question 7) Project NPV: $ American M Cost of Issuing New Securities Coca-Cola plans on financing the entire investment via the issuance of new equity and debt. These new securities issues will be structured so as not to alter the current capital structure of the firm (the relative weightings of common equity, preferred equity, and debt will remain unchanged). Coca-Cola will need to have $350 million left over after paying the underwriting fees related to the issuance of these new securities. Underwriting fees are determined based upon the size of the issuance. If Coca-Cola will have to pay a fee of 4% of the total amount of financing raised to the investment bank handling the issuance, what is the updated NPV of the project? Question 8) The NPV of the project, updated to reflect the underwriting fees, is: Provided Information: Coca-Cola's Debt You are aware that Coca-Cola recently issued a series of new 10-year notes. These notes mature in 2030 and pay a semiannual coupon rate of 3.75%. This debt issuance was fina last week and the bonds were issued at par. You know that the company has a number of other bond issuances outstanding. You jun to your department's Bloomberg terminal to pull up some information on the rest of Ko outstanding debt and pull up the following: The Coca-Cola Company (KO) Outstanding Long-Term Debt (All data for period ending June 30, 2020) Notes Issuance 4.25% Notes due in 2028 4.50% Notes due in 2029 3.75% Notes due in 2030 3.25% Bonds due in 2035 7.375% Bonds due in 2093 Face Value Current Price Current Yield- Outstanding per $1,000 to-Maturity (in millions) Face Value (YTM) $ 5,500 $ 1,034.57 3.75% 7,700 1,056.84 3.75% 6,400 1,000.00 3.75 6,000 943.03 3.75% 10,000 1.902.49 3.75% Most Rece Total: $ 35,600 Use the information provided thus far to calculate KO's effective cost of debt. Question 1) KO's effective cost of debt is Provided Information: Coca-Cola's Debt You are aware that Coca-Cola recently issued a series of new 10-year notes. These notes will mature in 2030 and pay a semiannual coupon rate of 3.75%. This debt issuance was finalized last week and the bonds were issued at par. You know that the company has a number of other bond issuances outstanding. You jump over to your department's Bloomberg terminal to pull up some information on the rest of KO's outstanding debt and pull up the following: The Coca-Cola Company (KO) Outstanding Long-Term Debt (All data for period ending June 30, 2020) Notes Issuance 4.25% Notes due in 2028 4.50% Notes due in 2029 3.75% Notes due in 2030 3.25% Bonds due in 2035 17.375% Bonds due in 2093 Face Value Current Price Current Yield- Outstanding per $1,000 to-Maturity (in millions) Face Value (YTM) 5,500 $ 1.034.57 3.75% 7.700 1,056.84 3.75% 6,400 1,000.00 3.75% 6,000 943.03 3.75% 10,000 1.902.49 3.75% Most Recent Issue Total: $ 35,600 Use the information provided thus far to calculate KO's effective cost of debt. % Question 1) KO's effective cost of debt is Coca-Cola's Equity Coca-Cola has class A preferred stock priced at $29.45 that pays an annual dividend of $1.25. Question 2) KO's cost of preferred equity is You're also going to need some information on KO's common equity. Rather than trudge back over to the Bloomberg terminal, you decide to just pull up a quick quote from Yahoo! Finance % The Coca-Cola Company (KO) NYSEMYSE Dved Currency USD w A Vid WoW + + $49.58-0.23 (-0.43%) Atom 2710M EST Summary Company Outlook Chart Conversations Statistics Historical Data Profe Financial Opis Previous Close 49.81 211.2968 1D 50 MM VTDTY SY Man Open 50.11 Market Cap Beta (SY Month PE Ratio (TTM) 0.59 flid 49.57 x 2200 25.69 Ash 49.59 * 1200 EPS (TTM) 1.93 Day's Range 49.24 - 50.35 52 Week Range 3627-60.13 Earrings Date Jan 28, 2021- Feb 01, 2021 Forward Dividend & Yield 1.56 (3.15%) Ex Dividend Date Nov 30, 2021 Volume 8,499.289 10 AM 17 PM Avg Volume 15,055,041 1y Tarpet Est 56.40 The current yield on 10-year Treasury notes is 2.92%. You estimate the market risk premium to be 5.5%. Using this information, along with the beta of KO's common equity provided by Yahoo! in the above quote, calculate KO's cost of common equity using the capital asse pricing model (CAPM). Question 3) KO's cost of equity using CAPM is KO stock is priced at $49.58, you anticipate next year's dividend to be $1.56, and long-run earnings are expected to grow at 4%. Calculate the firm's cost of common equity capital using the constant dividend growth model (CDGM). Question 4) KO's cost of equity using CDGM is Page 5 of 6 Capital Weightings and WACC Calculation The market values of KO's common stock, preferred stock, and debt are $211,296 million, 5101 million, and $44,910 million Question 5) KO's common equity weighting is % KO's preferred equity weighting is % KO's debt weighting is % Calculate Coca-Cola's weighted average cost of capital (WACC) using the information you have collected thus far. Use of the cost of common equity capital determined using the constant dividend growth model (CDGM) approach in your calculation of WACC. Question 6) KO's WACC is % Final NPV Calculation Calculate the NPV of the Coca-Cola YOU! project using the provided cash flows and the WACC you just calculated Question 7) Project NPV: $ American M Cost of Issuing New Securities Coca-Cola plans on financing the entire investment via the issuance of new equity and debt. These new securities issues will be structured so as not to alter the current capital structure of the firm (the relative weightings of common equity, preferred equity, and debt will remain unchanged). Coca-Cola will need to have $350 million left over after paying the underwriting fees related to the issuance of these new securities. Underwriting fees are determined based upon the size of the issuance. If Coca-Cola will have to pay a fee of 4% of the total amount of financing raised to the investment bank handling the issuance, what is the updated NPV of the project? Question 8) The NPV of the project, updated to reflect the underwriting fees, is Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started