Answered step by step

Verified Expert Solution

Question

1 Approved Answer

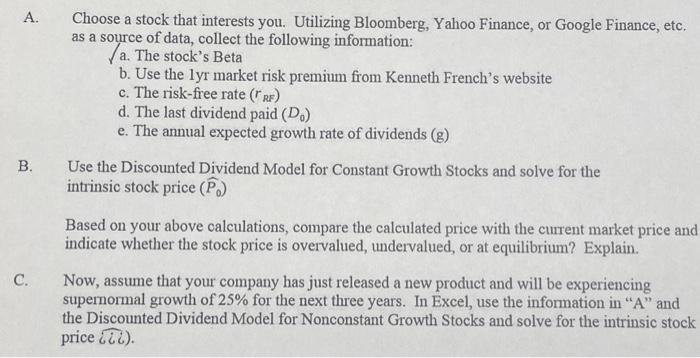

PLEASE ANSWER FOR UPVOTE I APPRECIATE ANY HELP I CAN GET IM LOST USE NIKE STOCK. the following questions to be answered: A. Nike Stock

PLEASE ANSWER FOR UPVOTE I APPRECIATE ANY HELP I CAN GET IM LOST

A. Nike Stock

a. Stock Price

b. most eecent dividend payout

c. stock Beta

d. lyre market risk premium from website

e. Risk free Rate

f. last dividend paid

g. annual expected growth rate from dividends

B. Solve for intrinsic stock price using Discounted Dividend model for constant growth stocks

a. using intrinsic stock price, compare with current market price and evaluate whether over valued, undervalued, or equilibrium

C. use the information in part A. to evaluate intrinsic stock price using exce if the company experiences a supernormal growth of 25% for the next 3 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started