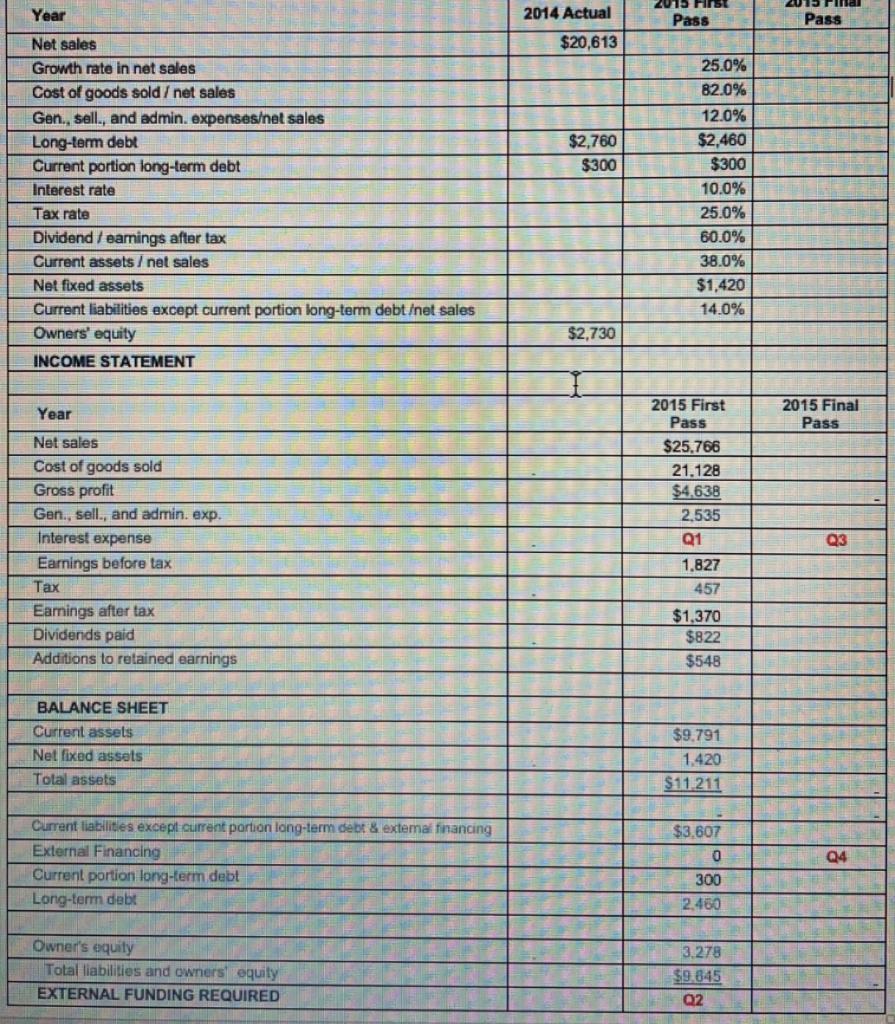

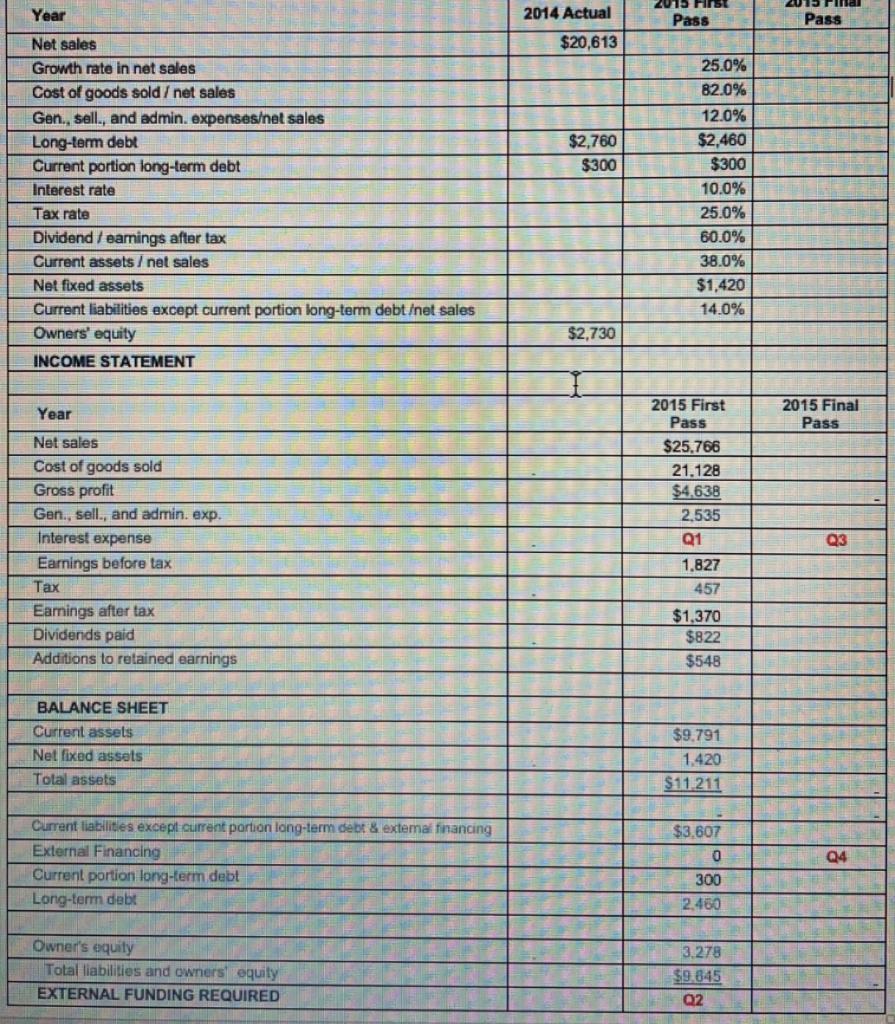

Please answer four questions in red. Thank you

2014 Actual ist Pass Pass $20,613 $2,760 $300 Year Net sales Growth rate in net sales Cost of goods sold / net sales Gen, sell, and admin. expensesinet sales Long-term debt Current portion long-term debt Interest rate Tax rate Dividend / earnings after tax Current assets / net sales Net fixed assets Current liabilities except current portion long-term debt et sales Owners' equity INCOME STATEMENT 25.0% 82.0% 12.0% $2,460 $300 10.0% 25.0% 60.0% 38.0% $1,420 14.0% $2,730 Year 2015 Final Pass 2015 First Pass $25.766 21.128 $4,638 2.535 Q1 1.827 457 $1,370 $822 $548 Net sales Cost of goods sold Gross profit Gen., sell, and admin. exp. Interest expense Earnings before tax Tax Earnings after tax Dividends paid Additions to retained earnings Q3 BALANCE SHEET Current assets Net fixed assets Total assets $9.791 1,420 $11211 Current liabilities except current portion long-term debt & extema financing External Financing Current portion long-term debt Long-term debt Q4 $3,607 0 300 2.460 Owner's equity Total liabilities and owners equity EXTERNAL FUNDING REQUIRED 3.278 $9.845 Q2 2014 Actual ist Pass Pass $20,613 $2,760 $300 Year Net sales Growth rate in net sales Cost of goods sold / net sales Gen, sell, and admin. expensesinet sales Long-term debt Current portion long-term debt Interest rate Tax rate Dividend / earnings after tax Current assets / net sales Net fixed assets Current liabilities except current portion long-term debt et sales Owners' equity INCOME STATEMENT 25.0% 82.0% 12.0% $2,460 $300 10.0% 25.0% 60.0% 38.0% $1,420 14.0% $2,730 Year 2015 Final Pass 2015 First Pass $25.766 21.128 $4,638 2.535 Q1 1.827 457 $1,370 $822 $548 Net sales Cost of goods sold Gross profit Gen., sell, and admin. exp. Interest expense Earnings before tax Tax Earnings after tax Dividends paid Additions to retained earnings Q3 BALANCE SHEET Current assets Net fixed assets Total assets $9.791 1,420 $11211 Current liabilities except current portion long-term debt & extema financing External Financing Current portion long-term debt Long-term debt Q4 $3,607 0 300 2.460 Owner's equity Total liabilities and owners equity EXTERNAL FUNDING REQUIRED 3.278 $9.845 Q2