Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer full question Sandhill Company is considering the purchase of a new machine. The invoice price of the machine is $129,000, freight charges are

please answer full question

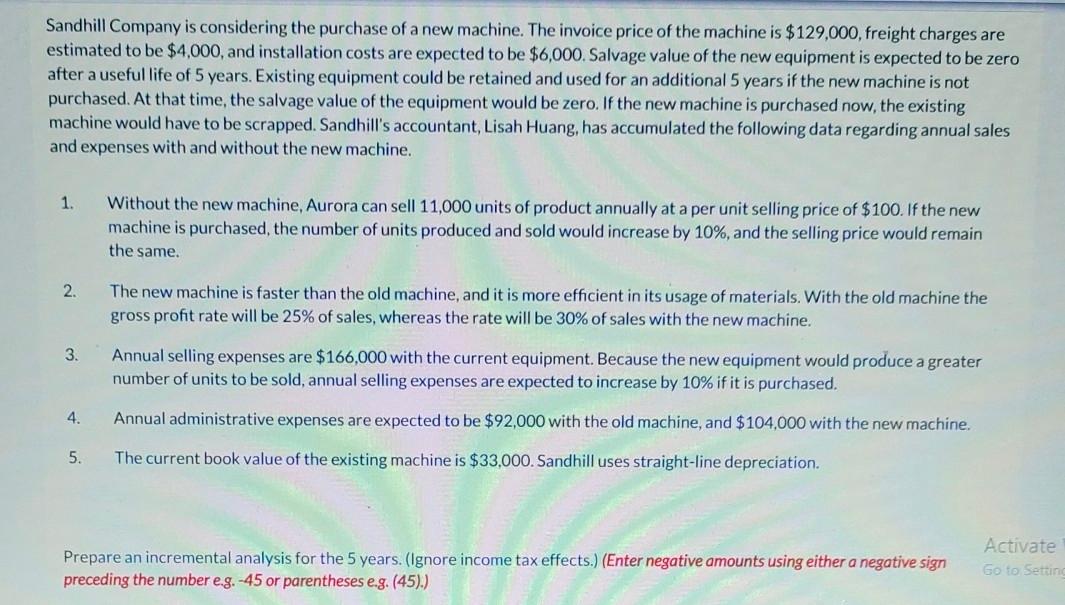

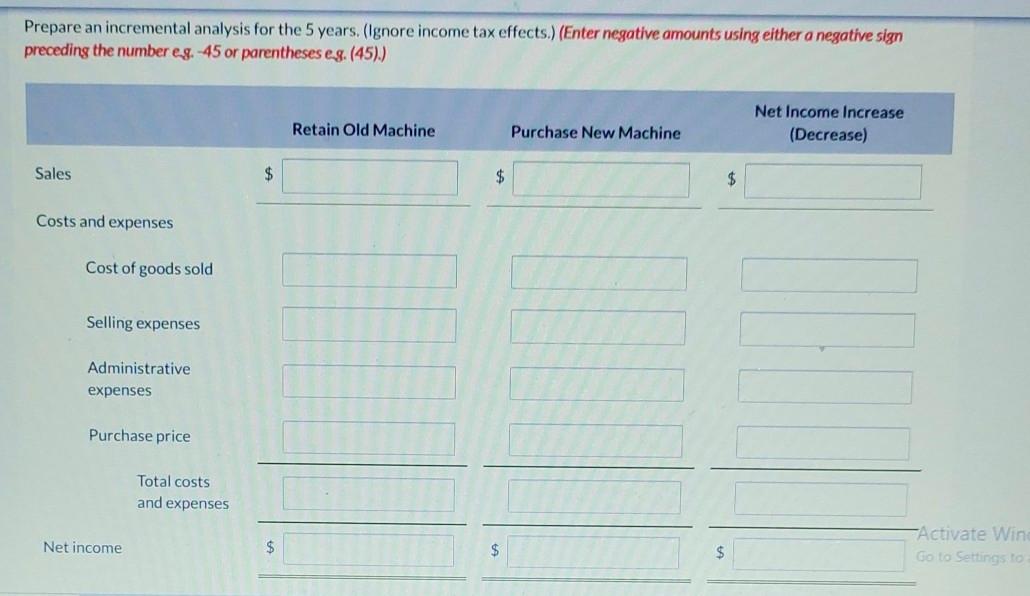

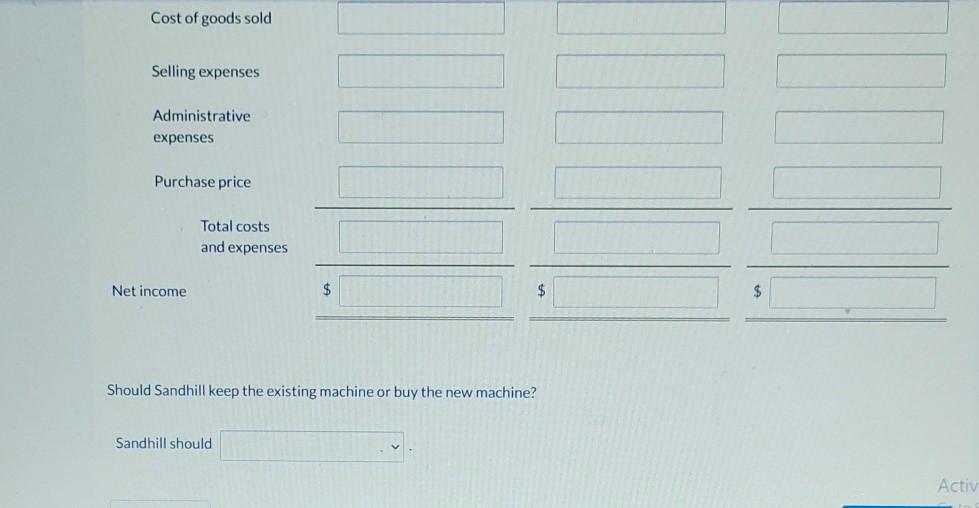

Sandhill Company is considering the purchase of a new machine. The invoice price of the machine is $129,000, freight charges are estimated to be $4,000, and installation costs are expected to be $6,000. Salvage value of the new equipment is expected to be zero after a useful life of 5 years. Existing equipment could be retained and used for an additional 5 years if the new machine is not purchased. At that time, the salvage value of the equipment would be zero. If the new machine is purchased now, the existing machine would have to be scrapped. Sandhill's accountant, Lisah Huang, has accumulated the following data regarding annual sales and expenses with and without the new machine. 1. Without the new machine, Aurora can sell 11,000 units of product annually at a per unit selling price of $100. If the new machine is purchased, the number of units produced and sold would increase by 10%, and the selling price would remain the same. 2. The new machine is faster than the old machine, and it is more efficient in its usage of materials. With the old machine the gross profit rate will be 25% of sales, whereas the rate will be 30% of sales with the new machine. 3. Annual selling expenses are $166,000 with the current equipment. Because the new equipment would produce a greater number of units to be sold, annual selling expenses are expected to increase by 10% if it is purchased. 4. Annual administrative expenses are expected to be $92,000 with the old machine, and $104,000 with the new machine. 5. The current book value of the existing machine is $33,000. Sandhill uses straight-line depreciation. Activate Prepare an incremental analysis for the 5 years. (Ignore income tax effects.) (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Go to Setting Prepare an incremental analysis for the 5 years. (Ignore income tax effects.) (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45)) Retain Old Machine Net Income Increase (Decrease) Purchase New Machine Sales $ $ Costs and expenses Cost of goods sold Selling expenses Administrative expenses Purchase price Total costs and expenses Net income $ $ Activate Wine Go to Settings to $ Cost of goods sold Selling expenses Administrative expenses Purchase price Total costs and expenses Net income $ $ $ Should Sandhill keep the existing machine or buy the new machine? Sandhill should ActiuStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started