Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer fully and completely for a guaranteed thumbs up. please do it in a timely manner as well! let me know if more info

please answer fully and completely for a guaranteed thumbs up. please do it in a timely manner as well!

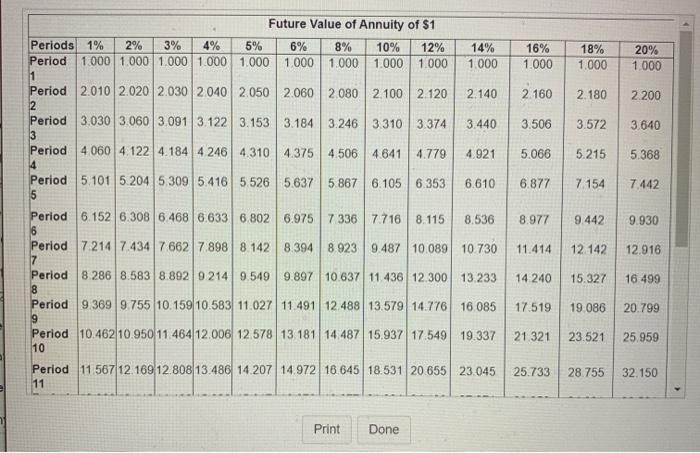

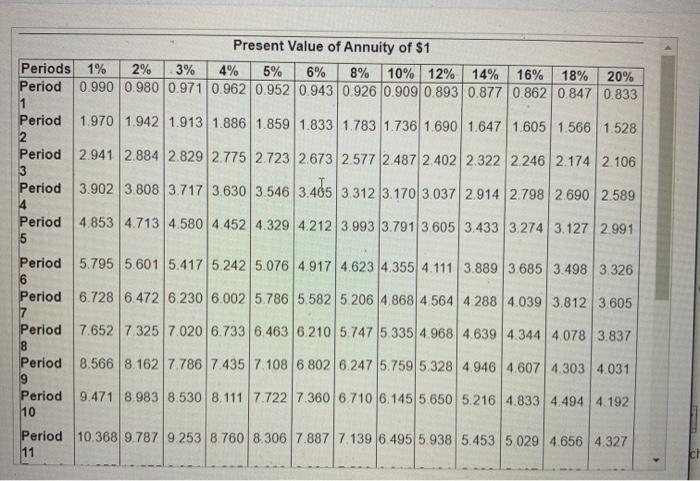

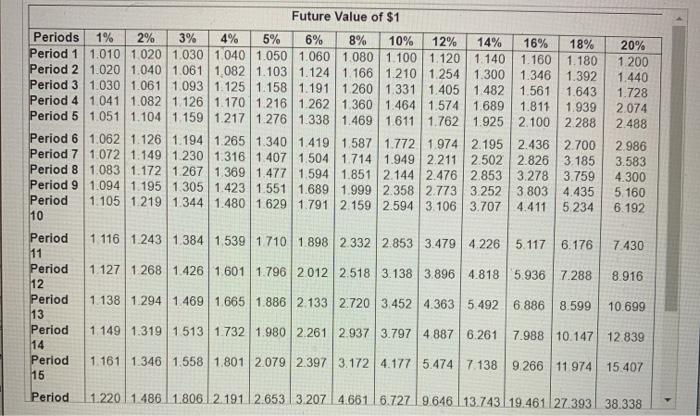

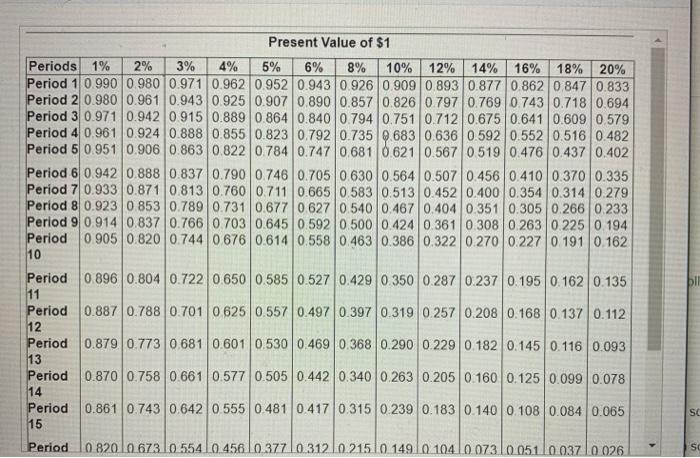

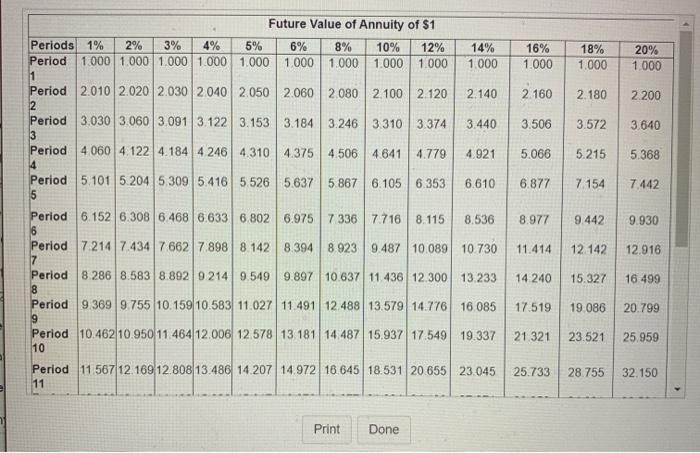

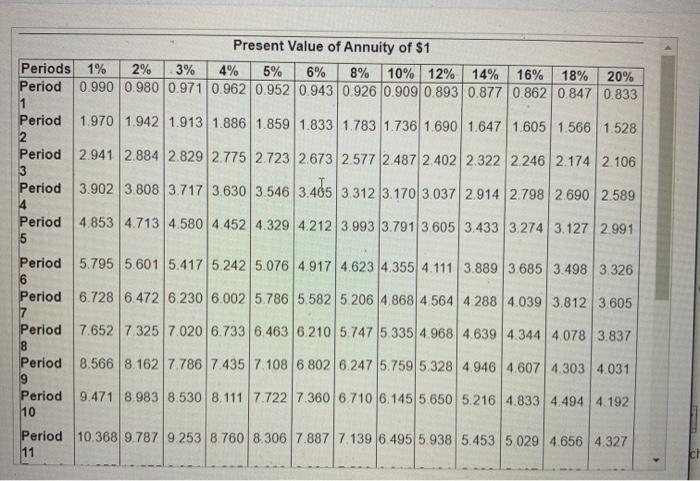

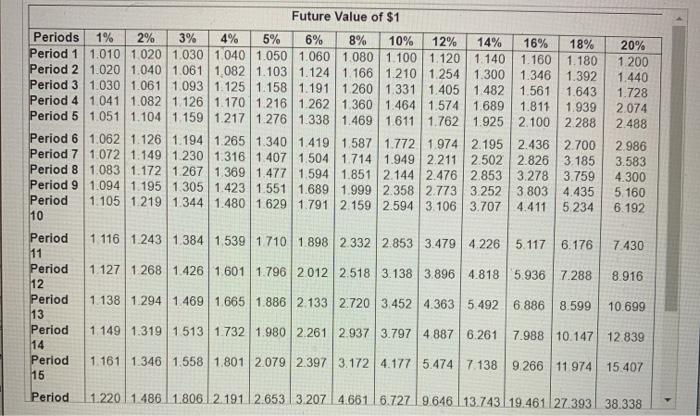

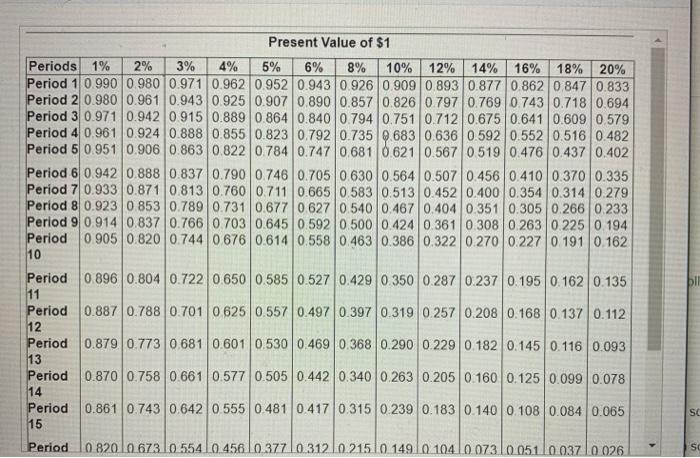

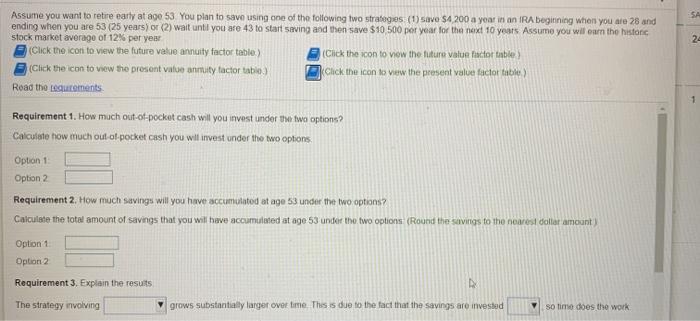

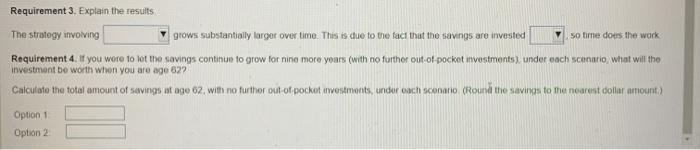

14% 1.000 16% 1.000 18% 1.000 20% 1.000 2.140 2 160 2.180 2.200 Future Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% Period 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1 Period 2.010 2.020 2030 2040 2050 2060 2080 2.100 2.120 2 Period 3.030 3.0603.091 3.122 3.153 3.184 3 246 3.310 3.374 3 Period 4 060 4 122 4.184 4 246 4.310 4.375 4.506 4.641 4.779 4 Period 5 101 5.204 5.309 5.416 5.526 5.637 5.8676.105 6.353 5 3.440 3.506 3.572 3.640 4.921 5.066 5.215 5.368 6.610 6.877 7154 7.442 8.977 9.442 9.930 11.414 12 142 12.916 14 240 15.327 16 499 Period 6.152 6.308 6.468 6.633 6.802 6.975 7 336 7.716 8.115 8,536 6 Period 7214 7.434 7 662 7898 8.142 8.394 8.9239.487 10.089 10.730 7 Period 8.286 8.5838.89292149.549 9.897 10.637 11 436 12 300 13.233 8 Period 9.369 9.755 10.159 10.583 11.02711 49112 48813.579 14.776 16 085 9 Period 10.462 10.950 11.464 12.006 12.578 13 181 14 487 15.937 17 549 19.337 10 Period 11 567 12 169 12.808 13.486 14.207 14.972 16.645 18.531 20655 23.045 11 17.519 19.086 20.799 21 321 23.521 25.959 25.733 28.755 32.150 Print Done Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 1 Period 1.970 1.942 1.913 1.886 1.859 1.833 1.783 1736 1.690 1.647 1.605 1.566 1.528 2 Period 2.941 2.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.246 2.174 2.106 3 Period 3.902 3.808 3.717 3.630 3.546 3.405 3.312 3.170 3.037 2.914 2.798 2.690 2.589 4 Period 4.853 4.713 4.580 4.452 4.329 4.2123.993 3.791 3.605 3.433 3 274 3.127 2.991 5 Period 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.111 3.8893.685 3.498 3.326 6 Period 6.728 6.4726.230 6.002 5.786 5.582 5.206 4.868 4564 4.288 4.039 3.812 3.605 7 Period 7.652 7.325 7.020 6.733 6.463 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 8 Period 8.566 8.162 7.786 7.435 7.108 6 802 6 247 5.759 5.328 4.946 4 607 4.303 4.031 Period 9.471 8.983 8.530 8.1117.722 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 10 Period 10.368 9.787 9.253 8.760 8.306 7.887 7 139 6.495 5.938 5.453 5.029 4.656 4.327 11 8% Future Value of $1 Periods 1% 2% 3% 4% 5% 6% 10% 12% 14% 16% 18% Period 1 1.010 1020 1.030 1040 1.050 1.060 1080 1.100 1.120 1 140 1.1601.180 Period 2 1.020 1.040 1.061 1 082 1.103 1.1241 166 1210 1254 1.300 1.346 1.392 Period 3 1.030 1061 10931.125 1.158 1.191 1260 1.331 1.405 1 482 1.561 1.643 Period 4 1 041 1.082 1126 1.1701.216 1.262 1.360 1.464 1.574 1.689 1.811 1.939 Period 5 1051 1.104 1.159 1.217 1.276 1.338 1.469 1611 1.762 1.925 2.100 2.288 Period 6 1.062 1.126 1.194 1.265 1.340 1.419 1.587 1.772 1.9742.195 2.436 2.700 Period 7 1.072 1.149 1.230 1.316 1.407 1.5041 714 1.949 2.211 2.502 2.826 3.185 Period 8 1.083 1.172126713691.4771.5941.851 2.144 2.476 2.853 3.278 3.759 Period 9 1.094 1195 1.305 1423 1.551 1.689 1.999 2.358 2.7733.252 3 803 4.435 Period 1.105 1219 1.344 1.480 1.6291.791 2.159 2.594 3 106 3.707 4.411 5234 10 20% 1 200 1.440 1.728 2.074 2.488 2986 3.583 4.300 5. 160 6.192 1 116 1.243 1.38415391 710 1.898 2.332 2.853 3.4794.226 5.117 6.176 7430 1.1271 268 1.4261 601 1.796 2012 2.518 3.138 3.896 4.818 5.936 7.288 8.916 Period 11 Period 12 Period 13 Period 14 Period 15 1.1381.2941 469 1.665 1.886 2 133 2.720 3.452 4.363 5.492 6 886 8.599 10.699 1 149 1.319 1 513 1.732 1.980 2.261 2.937 3.797 4 887 6.261 7.988 10.147 12.839 1 161 1.346 1.558 1.801 2.079 2.397 3.172 4.177 5.474 7 138 9 266 11 974 15.407 Period 1.220 1.486 1.806.12.1912.653 3.207 4661 1 6.7271 9.646 13.743 19.461 27393 38.338 Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 Period 20.980 0.961 0.943 0.925 0.907 0.890 0.857 0.826 0.797 0.769 0.743 0.7180.694 Period 3 0.971 0.942 0915 0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0.6090.579 Period 40.961 0.924 0.888 0.855 0.823 0.792 0.735683 0.636 0.592 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0784 0.7470.681 0 621 0.567 0 519 0.476 0.437 0.402 Period 6 0.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 Period 70.933 0.871 0.813 0.760 0.7110.665 0.583 0.513 0.452 0.400 0.354 0.3140.279 Period 8 0.923 0 853 0.789 0.731 0.677 0.627 0.540 0.467 0.4040.351 0.305 0.266 0233 Period 90.914 0.837 0.7660 703 0.6450.5920.500 0.424 0.361 0.308 0.2630 2250 194 Period 0.905 0.820 0.744 0676 0.614 0.558 0.463 0.386 0.322 0.270 0.2270 1910.162 10 Period 0.896 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.1950 162 0.135 11 Period 0.887 0.788 0.701 0 625 0.5570.497 0.397 0.319 0.257 0.2080.1680.137 0.112 12 Period 0.879 0.773 0.681 0.601 0.530 0.4690.368 0.290 0.229 0.1820.145 0.116 0.093 13 Period 0.870 0.758 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0 160 0.125 0.099 0.078 14 Period 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.239 0.183 0.1400 108 0.084 0.065 15 Period L0 820 10 673 1055410.456 10 377 10 31210.21510 149.10 10410.07310 051 0.037 10 026 SC SO SA 2 Assume you want to retire early at age 53. You plan to save using one of the following two strategies (t) save $4 200 a year in an IRA beginning when you are 28 and ending when you are 53 (25 years) or (2) wait until you are 43 to start saving and then save $10 500 per year for the next 10 years Assume you will earn the historic stock market average of 12% per year (Click the icon to view the future value annuity factor table) (Click the icon to view the future value factor table) (Click the icon to view the present vitae annuty factor table) Click the icon to view the present value factor table) Read the requrements Requirement 1. How much out-of-pocket cash will you invest under the two options? Calculato how much out of pocket cash you will invest under the two ophone, Option 1 Option 2 Requirement 2. How much savings will you have accumulated at age 53 under the two options? Calculate the total amount of savings that you will have accumulated at age 53 under the two options (Round the savings to the nearest dollar amount Option 1 Option 2 Requirement 3. Explain the results The strategy involving grows substantially larger over time. This is due to the fact that the savings are invested so time does the work Requirement 3. Explain the results, The strategy involving grows substantially larger over time. This is due to the fact that the savings are invested so time does the work Requirement 4. If you were to let the savings continue to grow for nine more years (with no further out of pocket investments ), under each scenario what will the investment be worth when you are age 822 Calculate the total amount of savings at age 62, with no further out of pocket inwestments, undur each scenario (Round the savings to the nearest dollar amount) Option 1 Option 2 let me know if more info is needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started