Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer fully and thoroughly! explain step by step! thank you :) A=L+E 79 954. 957.18 770.96 768.62 S8875 78266 Project #13 Ratio Analysis 1.99

please answer fully and thoroughly! explain step by step! thank you :)

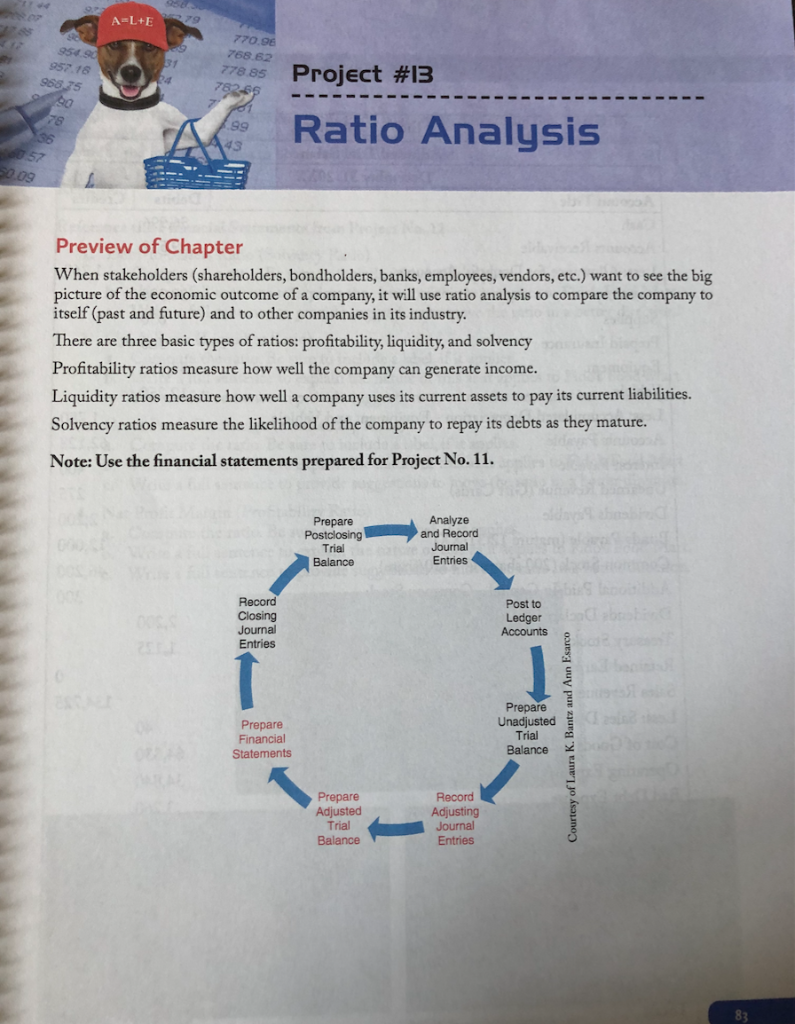

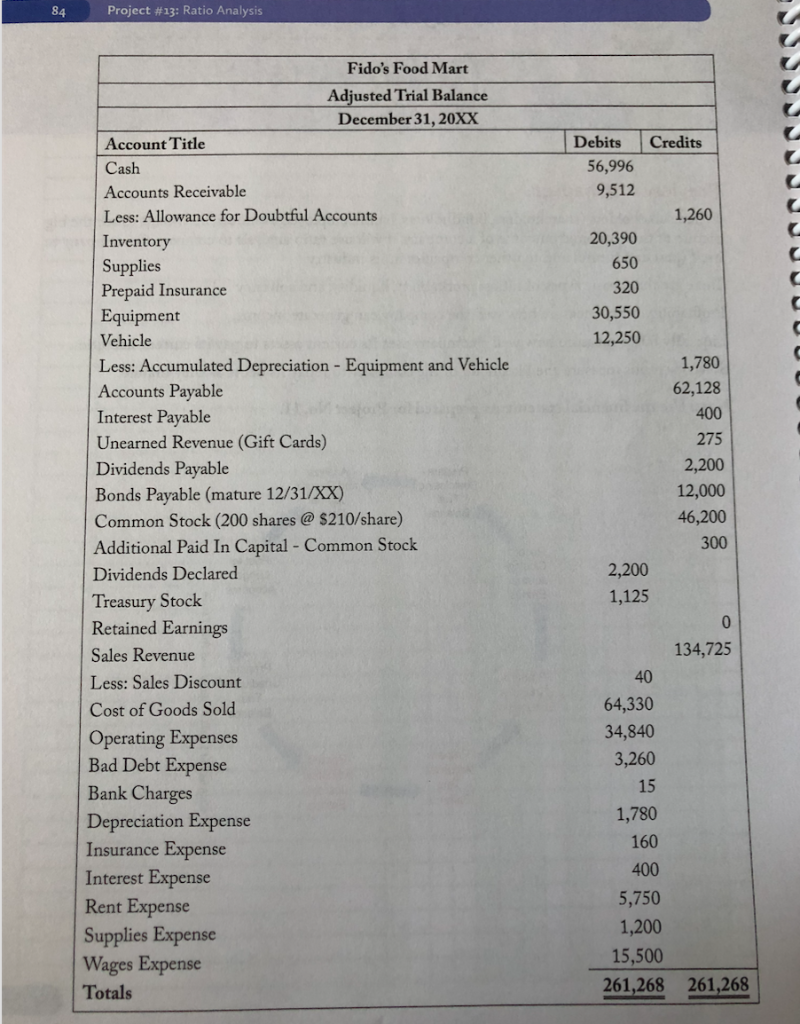

A=L+E 79 954. 957.18 770.96 768.62 S8875 78266 Project #13 Ratio Analysis 1.99 43 Preview of Chapter When stakeholders (shareholders, bondholders, banks, employees, vendors, etc.) want to see the big picture of the economic outcome of a company, it will use ratio analysis to compare the company to itself (past and future) and to other companies in its industry. There are three basic types of ratios: profitability, liquidity, and solvency Profitability ratios measure how well the company can generate income. Liquidity ratios measure how well a company uses its current assets to pay its current liabilities. Solvency ratios measure the likelihood of the company to repay its debts as they mature. Note: Use the financial statements prepared for Project No. 11. Prepare Postclosing Trial Balance Analyze and Record Journal Entries Record Closing Journal Entries Post to Ledger Accounts Prepare Financial Statements Prepare Unadjusted Trial Balance Courtesy of Laura K. Bantz and Ann Esarco Prepare Adjusted Trial Balance Record Adjusting Journal Entries 84 Project #13: Ratio Analysis Credits Debits 56,996 9,512 1,260 20,390 650 320 30,550 12,250 Fido's Food Mart Adjusted Trial Balance December 31, 20XX Account Title Cash Accounts Receivable Less: Allowance for Doubtful Accounts Inventory Supplies Prepaid Insurance Equipment Vehicle Less: Accumulated Depreciation - Equipment and Vehicle Accounts Payable Interest Payable Unearned Revenue (Gift Cards) Dividends Payable Bonds Payable (mature 12/31/XX) Common Stock (200 shares @ $210/share) Additional Paid In Capital - Common Stock Dividends Declared Treasury Stock Retained Earnings Sales Revenue Less: Sales Discount Cost of Goods Sold Operating Expenses Bad Debt Expense Bank Charges Depreciation Expense Insurance Expense Interest Expense Rent Expense Supplies Expense Wages Expense Totals 1,780 62,128 400 275 2,200 12,000 46,200 300 2,200 1,125 134,725 40 64,330 34,840 3,260 15 1,780 160 400 5,750 1,200 15,500 261,268 261,268 Project #13: Ratio Analysis 85 Delighted by their apparent success, Fido's Food Mart wanted to ensure that they really understood what was going on in their organization. They sat down with their accountant and asked for the following ratios to be computed and explained: Required: Reference the Financial Statements from Project No. 11 1. Debt-to-Assets Ratio (Solvency Ratio) a. Compute the ratio. Be sure to include a label, if it applies. b. Write a full sentence to explain the nature of this as it applies to Fido's Food Mart. c. Write a full sentence to provide suggestions to move the ratio in a better direction. 2. Quick Ratio (Liquidity Ratio) a. Compute the ratio. Be sure to include a label, if it applies. b. Write a full sentence to explain the nature of this as it applies to Fido's Food Mart. c. Write a full sentence to provide suggestions to move the ratio in a better direction. 3. Gross Profit Percentage (Profitability Ratio) a. Compute the ratio. Be sure to include a label, if it applies. b. Write a full sentence to explain the nature of this as it applies to Fido's Food Mart. c. Write a full sentence to provide suggestions to move the ratio in a better direction. 4. Net Profit Margin (Profitability Ratio) a. Compute the ratio. Be sure to include a label, if it applies. b. Write a full sentence to explain the nature of this as it applies to Fido's Food Mart. c. Write a full sentence to provide suggestions to move the ratio in a better direction. Solvency Ratio YuRi Photolife/Shutterstock.com Liquidity Ratio Profitability Ratios YuRi Photolife/Shutterstock.com YuRi Photolife/Shutterstock.comStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started