please answer i dont understand how to balance a bank statement

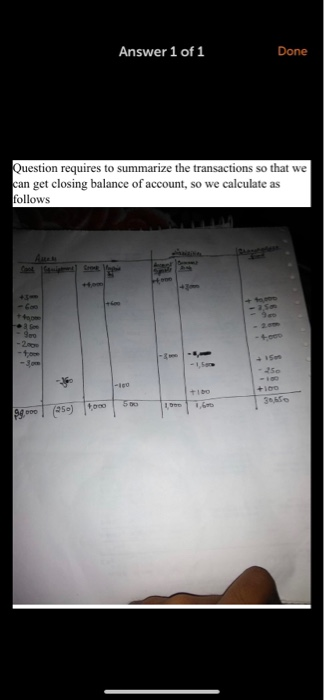

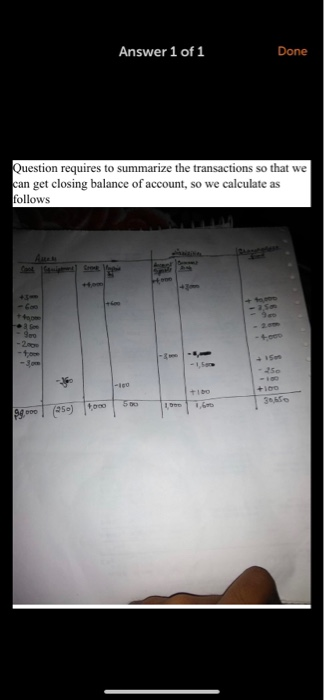

Stockholders' Equity ACCT Names Amount Act Supplies SO La Ace . Cush Tags Am . S. INCTN Cash Sce MINH Cash +S40000 Service Se Salaries Expense ACCT Names Amour Cash SLO ACCT Names Amon Cash - SO Les Cash $2.000 Secoders qui Rent 2000 Amount Liabilis NCCT Names Amount Aucts Cash -S4,000 Sched Div 540 T ailies Supplies Expense Supplies SO - - 54000 51.000 53.000 Sex Leared Senec ACCT Names Amen SIS NCCTV AD 5250 NH Am Som-S100 Prepaid -S100 Incepand 5100 Assets Pwe ACCT Names Amen. $20,000/1001/12 Stockholders Interest Expense 5100 - 100 Answer 1 of 1 Done Question requires to summarize the transactions so that we can get closing balance of account, so we calculate as follows j (25) 500 Be sure to include all the necessary subtotals and totals as outlined in Chapter 2 for a Classified Balance Sheet. You may not need all the lines. Smith Contractors, Inc. Balance Sheet As of October 31, 2017 Name inancial Statement Homework Answers must be handwritten. Please staple your pages together! Smith Contractors, Inc. began operations on October 1, 2017. The first three business transactions for the company have already been recorded as reflected in the transactions below and on the rial statement tabular analysis on page 3. For transactions 4-16. record the effect on the nting equation and then on the tabular analysis on page 3. You will then write Financial nents on pages 4 and 5. Received $50,000 cash in exchange for common stock Assets Liabilities + Stockholder's Equity ACCT NAMES: Cash Common Stock Amount +/- +$50,000 +$50,000 2. Borrowed $20,000 from First National Bank to finance operations, signing a 5 year, 6% N/P Assets Liabilities + Stockholder's Equity ACCT NAMES: Cash Note Payable Amount +/- +$20,000 +$20,000 Liabilities + Stockholder's Equity 3. Purchased equipment for $15,000 cash Assets = ACCT NAMES: Cash Equipment Amount +/- -$15,000 +$15,000 Stockholder's Equity 4. Purchased $4,000 of supplies on account Assets = Liabilities + ACCT NAMES: Says DC . Paya Amount +/- L 5. Received a $3,000 cash advance from a customer for services not yet performed Assets Liabilities + Stockholder's Equity ACCT NAMES: Cas leamid SE Amount +/- ZOO -202 Stockholder's Equity 6. Purchased on October 1 a 6 month insurance policy for $600 Assets = Liabilities + ACCT NAMES: Cantimiz Amount +). 00 PD 7. Provided services to customers during October and received $40,000 cash Assets = Liabilities + Stockholder's Equity ACCT NAMES: CAS service revenne Amount +/- 130 I uoooo 8. Paid wages of $3,500 to employees for the month of October Assets = Liabilities + ACCT NAMES: Amount +/- 5500 Stockholder's Equipen Gas T-300 Liabilities - 9. Paid $900 for the October utility bill Assets ACCT NAMES: 43 Amount +/- Stockholder's Equity _ US + Stockholder's Equity 10.Paid rent of $2,000 for October's office rental Assets Liabilities ACCT NAMES: CASI Amount +/- VDU Stockholder's Equity 11. Paid dividends of $4,000 during October Assets = ACCT NAMESTAS Amount +/- -4D At the end of the month, Smith Contractors, Inc. needs to record the following adjusting transactions to update their accounting records: 12. The company completed a physical count of supplies and determined that $1,000 of supplies are still on hand. Record the use of supplies. Assets Stockholder's Equity ACCT NAMES: SP5 -3 pe Amount + 13. The company provided services of $1,500 to the customer that paid in advance (in #5) Assets = Liabilities + Stockholder's Equity ACCT NAMES: 2 4124 SK Servis Amount +- Stockholder's Equity 4 14. Depreciation expense on equipment of $250 needs to be recorded Assets = Liabilities ACCT NAMES: Apprend - Z Amount +/- 15. Record insurance expense for the month of October Assets Liabilities + ACCT NAMES: Pred A Sur Cymise Amount + Stockholder's Equyo se 100 16 Record accrual of Interest expense on Note Payable for the month of October Liabilities Assets = + Stockholder's Equity ACCT NAMES: Wo Yohld I T 100 Amount + Using the tabular analysis on the next page, summarize transactions 4-16 above to determine the ending balance in each account. Write the account names in the top row and the dollar amount increase or decrease of each transaction that effects that account in each row underneath Retained Earnings has been effected, be sure to note the specific revenue expense, or dividend account. You will need that information to complete the Income Statement. Total up all of the transactions (1-16) on the tabular analysis to determine the ending balance in each account and note it in the bottom row. You will use these totals to write the financial statements Stockholders' Equity ACCT Names Amount Act Supplies SO La Ace . Cush Tags Am . S. INCTN Cash Sce MINH Cash +S40000 Service Se Salaries Expense ACCT Names Amour Cash SLO ACCT Names Amon Cash - SO Les Cash $2.000 Secoders qui Rent 2000 Amount Liabilis NCCT Names Amount Aucts Cash -S4,000 Sched Div 540 T ailies Supplies Expense Supplies SO - - 54000 51.000 53.000 Sex Leared Senec ACCT Names Amen SIS NCCTV AD 5250 NH Am Som-S100 Prepaid -S100 Incepand 5100 Assets Pwe ACCT Names Amen. $20,000/1001/12 Stockholders Interest Expense 5100 - 100 Answer 1 of 1 Done Question requires to summarize the transactions so that we can get closing balance of account, so we calculate as follows j (25) 500 Be sure to include all the necessary subtotals and totals as outlined in Chapter 2 for a Classified Balance Sheet. You may not need all the lines. Smith Contractors, Inc. Balance Sheet As of October 31, 2017 Name inancial Statement Homework Answers must be handwritten. Please staple your pages together! Smith Contractors, Inc. began operations on October 1, 2017. The first three business transactions for the company have already been recorded as reflected in the transactions below and on the rial statement tabular analysis on page 3. For transactions 4-16. record the effect on the nting equation and then on the tabular analysis on page 3. You will then write Financial nents on pages 4 and 5. Received $50,000 cash in exchange for common stock Assets Liabilities + Stockholder's Equity ACCT NAMES: Cash Common Stock Amount +/- +$50,000 +$50,000 2. Borrowed $20,000 from First National Bank to finance operations, signing a 5 year, 6% N/P Assets Liabilities + Stockholder's Equity ACCT NAMES: Cash Note Payable Amount +/- +$20,000 +$20,000 Liabilities + Stockholder's Equity 3. Purchased equipment for $15,000 cash Assets = ACCT NAMES: Cash Equipment Amount +/- -$15,000 +$15,000 Stockholder's Equity 4. Purchased $4,000 of supplies on account Assets = Liabilities + ACCT NAMES: Says DC . Paya Amount +/- L 5. Received a $3,000 cash advance from a customer for services not yet performed Assets Liabilities + Stockholder's Equity ACCT NAMES: Cas leamid SE Amount +/- ZOO -202 Stockholder's Equity 6. Purchased on October 1 a 6 month insurance policy for $600 Assets = Liabilities + ACCT NAMES: Cantimiz Amount +). 00 PD 7. Provided services to customers during October and received $40,000 cash Assets = Liabilities + Stockholder's Equity ACCT NAMES: CAS service revenne Amount +/- 130 I uoooo 8. Paid wages of $3,500 to employees for the month of October Assets = Liabilities + ACCT NAMES: Amount +/- 5500 Stockholder's Equipen Gas T-300 Liabilities - 9. Paid $900 for the October utility bill Assets ACCT NAMES: 43 Amount +/- Stockholder's Equity _ US + Stockholder's Equity 10.Paid rent of $2,000 for October's office rental Assets Liabilities ACCT NAMES: CASI Amount +/- VDU Stockholder's Equity 11. Paid dividends of $4,000 during October Assets = ACCT NAMESTAS Amount +/- -4D At the end of the month, Smith Contractors, Inc. needs to record the following adjusting transactions to update their accounting records: 12. The company completed a physical count of supplies and determined that $1,000 of supplies are still on hand. Record the use of supplies. Assets Stockholder's Equity ACCT NAMES: SP5 -3 pe Amount + 13. The company provided services of $1,500 to the customer that paid in advance (in #5) Assets = Liabilities + Stockholder's Equity ACCT NAMES: 2 4124 SK Servis Amount +- Stockholder's Equity 4 14. Depreciation expense on equipment of $250 needs to be recorded Assets = Liabilities ACCT NAMES: Apprend - Z Amount +/- 15. Record insurance expense for the month of October Assets Liabilities + ACCT NAMES: Pred A Sur Cymise Amount + Stockholder's Equyo se 100 16 Record accrual of Interest expense on Note Payable for the month of October Liabilities Assets = + Stockholder's Equity ACCT NAMES: Wo Yohld I T 100 Amount + Using the tabular analysis on the next page, summarize transactions 4-16 above to determine the ending balance in each account. Write the account names in the top row and the dollar amount increase or decrease of each transaction that effects that account in each row underneath Retained Earnings has been effected, be sure to note the specific revenue expense, or dividend account. You will need that information to complete the Income Statement. Total up all of the transactions (1-16) on the tabular analysis to determine the ending balance in each account and note it in the bottom row. You will use these totals to write the financial statements