Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer if you're 100% CERTAIN ON YOUR RESPONSES. For question 1, I got 3,751,000 as a book value answer but 1) I'm not sure

Please answer if you're 100% CERTAIN ON YOUR RESPONSES. For question 1, I got 3,751,000 as a book value answer but 1) I'm not sure if this is correct and 2) How to convert into dollars. Please show all steps and again, ANSWER IF YOU ARE 100% CERTAIN ON YOUR RESPONSES, thank you!

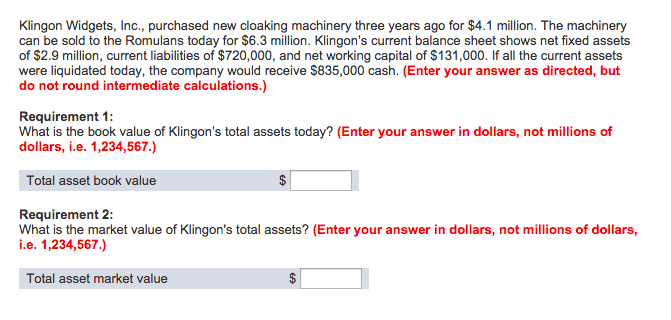

Klingon Widgets, Inc., purchased new cloaking machinery three years ago for $4.1 million. The machinery can be sold to the Romulans today for $6.3 million. Klingon's current balance sheet shows net fixed assets of $2.9 million, current liabilities of $720,000, and net working capital of $131,000. If all the current assets were liquidated today, the company would receive $835,000 cash. (Enter your answer as directed, but do not round intermediate calculations.) Requirement 1: What is the book value of Klingon's total assets today? (Enter your answer in dollars, not millions of dollars, i.e. 1,234,567.) Total asset book value Requirement 2: What is the market value of Klingon's total assets? (Enter your answer in dollars, not millions of dollars, i.e. 1,234,567.) Total asset market valueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started