Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER IMMEDIATELY WRONG ANSWER WILL GET A DOWNVOTE I WILL IMMEDIATELY DOWNVOTE IF THE ANSWER IS WRONG In 2020, Rashaun (62 years old) retired

PLEASE ANSWER IMMEDIATELY WRONG ANSWER WILL GET A DOWNVOTE I WILL IMMEDIATELY DOWNVOTE IF THE ANSWER IS WRONG

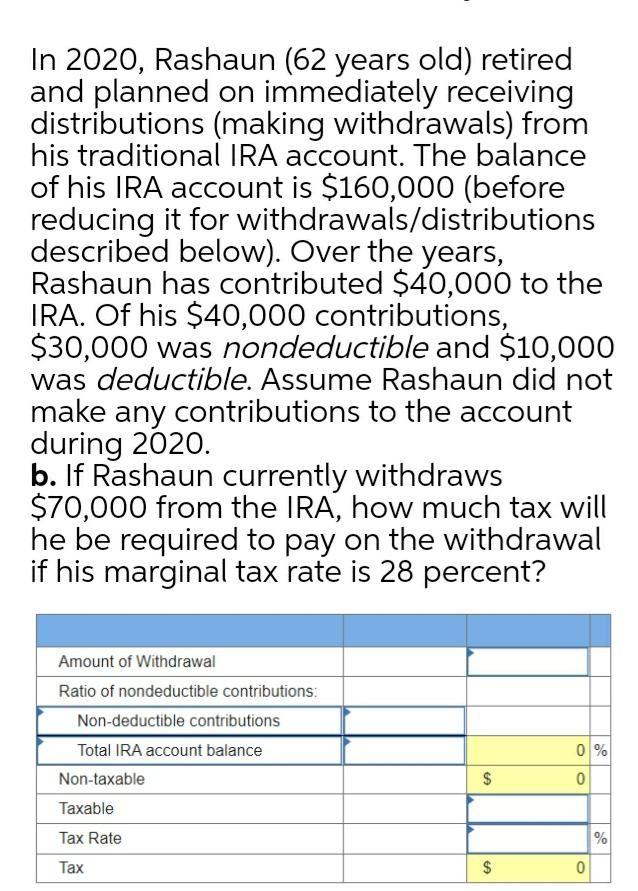

In 2020, Rashaun (62 years old) retired and planned on immediately receiving distributions (making withdrawals) from his traditional IRA account. The balance of his IRA account is $160,000 (before reducing it for withdrawals/distributions described below). Over the years, Rashaun has contributed $40,000 to the IRA. Of his $40,000 contributions, $30,000 was nondeductible and $10,000 was deductible. Assume Rashaun did not make any contributions to the account during 2020. b. If Rashaun currently withdraws $70,000 from the IRA, how much tax will he be required to pay on the withdrawal if his marginal tax rate is 28 percent? Amount of Withdrawal Ratio of nondeductible contributions: Non-deductible contributions Total IRA account balance Non-taxable Taxable Tax Rate 0 % 0 $ $ % Tax $ 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started