Question

PLEASE ANSWER IN A DETAILED MANNER, WITH EACH ANSWER PROPERLY RESPONDED TO EACH QUESTION. NOT IN A SLOPPY MANNER. I WOULD LIKE TO KNOW WHICH

PLEASE ANSWER IN A DETAILED MANNER, WITH EACH ANSWER PROPERLY RESPONDED TO EACH QUESTION. NOT IN A SLOPPY MANNER. I WOULD LIKE TO KNOW WHICH ANSWER GOES WITH EACH QUESTION. THANK YOU.

Image transcription text

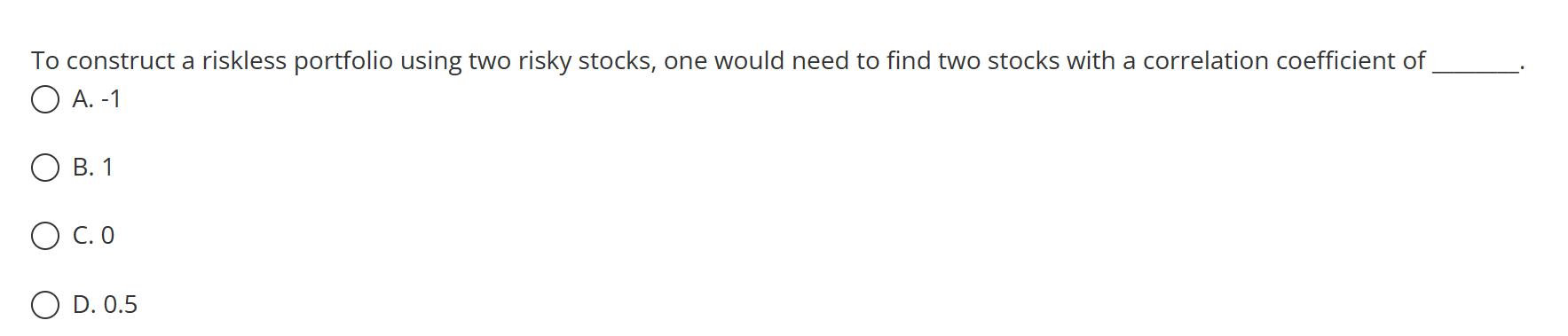

To construct a riskless portfolio using two risky stocks, one would need to find two stocks with a

correlation coefficient of

Image transcription text

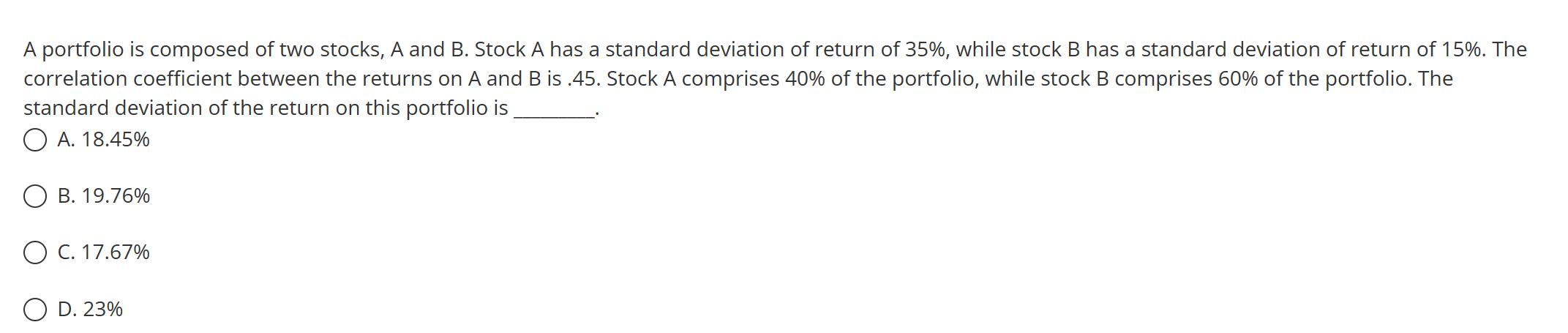

A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 35%, while stock B has a standard deviation of return of 15%. The correlation coefficient between the returns on A and B is .45. Stock A comprises 40% of the portfolio, while stock B comprises 60% of the portfolio. The standard deviation of the return on this portfolio is A. 18.45% O B. 19.76% O C. 17.67% O D. 23%

Image transcription text

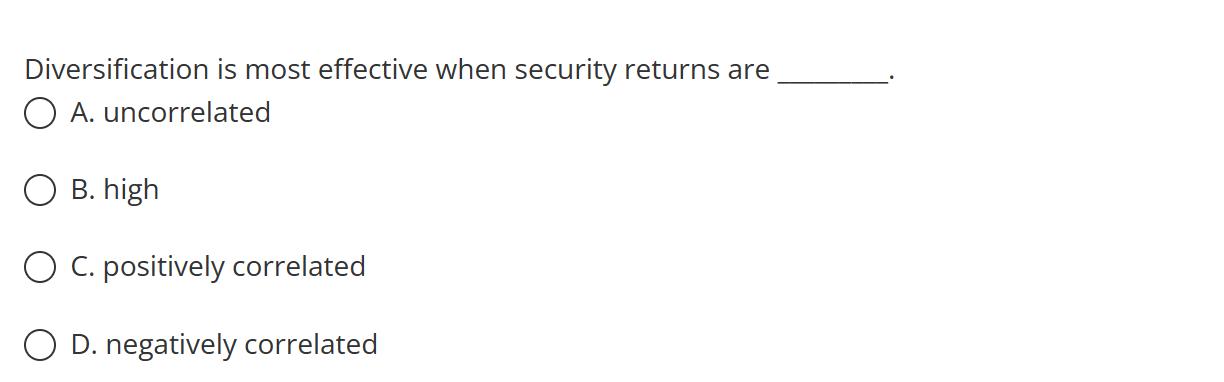

Diversification is most effective when security returns are 0 A. uncorrelated O B. high Q C. positively

correlated O D. negatively correlated

Image transcription text

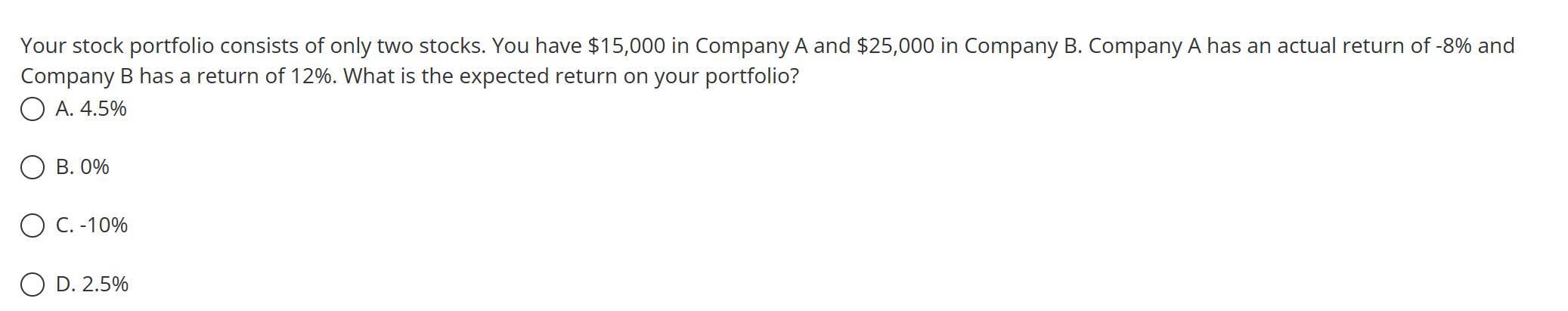

Your stock portfolio consists of only two stocks. You have $15,000 in Company A and $25,000 in

Company B. Company A has an actual return of -8% and Company B has a return of 12%. What is the

expected return on your portfolio? O A. 4.5% O B. 0% O C. -10% O D. 2.5%

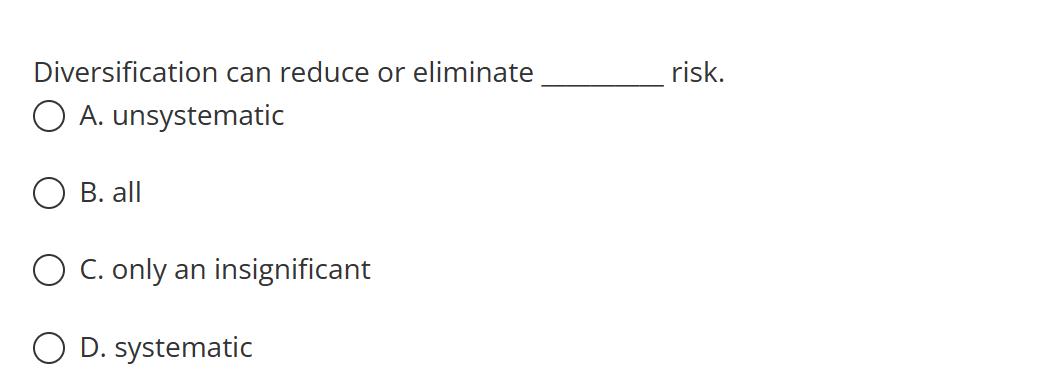

Image transcription text

Diversification can reduce or eliminate risk. O A. unsystematic O B.a|l O C. only an insignificant O D.

systematic

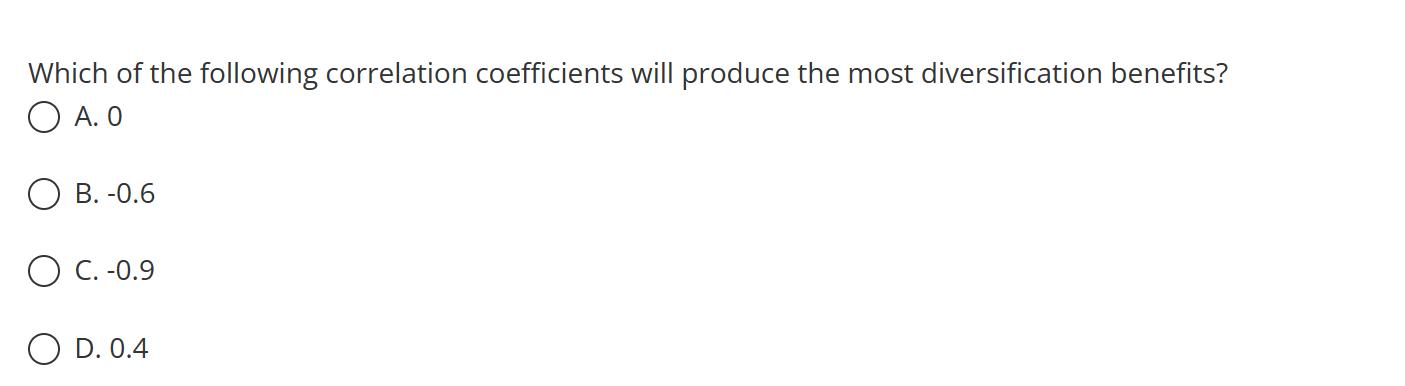

Image transcription text

Which of the following correlation coefficients will produce the most diversification benefits?

Image transcription text

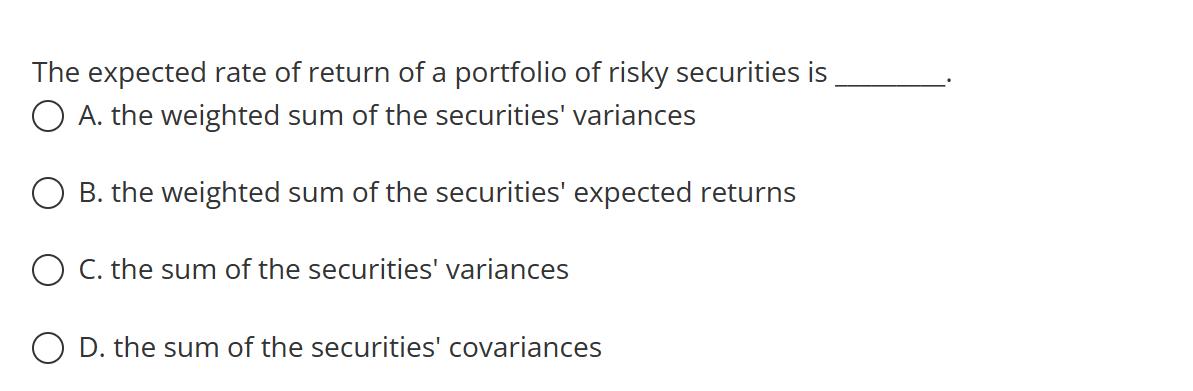

The expected rate of return of a portfolio of risky securities is A. the weighted sum of the securities'

variances O B. the weighted sum of the securities' expected returns O C. the sum of the securities'

variances O D. the sum of the securities' covariances

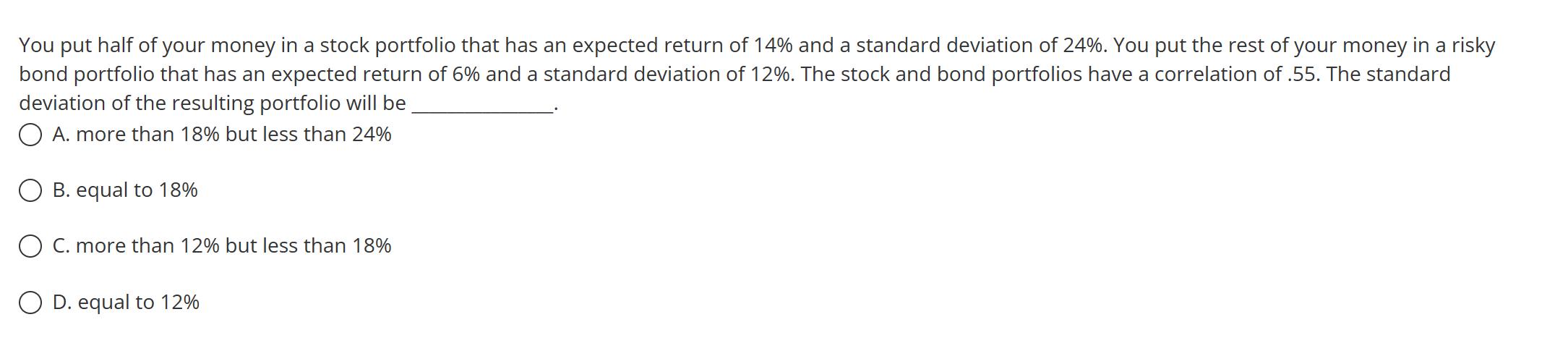

Image transcription text

You put half of your money in a stock portfolio that has an expected return of 14% and a standard deviation of 24%. You put the rest ofyour money in a risky bond portfolio that has an expected return of 6% and a standard deviation of12%. The stock and bond portfolios have a correlation of '55. The standard deviation of the resulting portfolio will be O A more than 18% but less than 24% O B. equal to 18% O C. more than 12% but less than 18% O D equal to 12%

Image transcription text

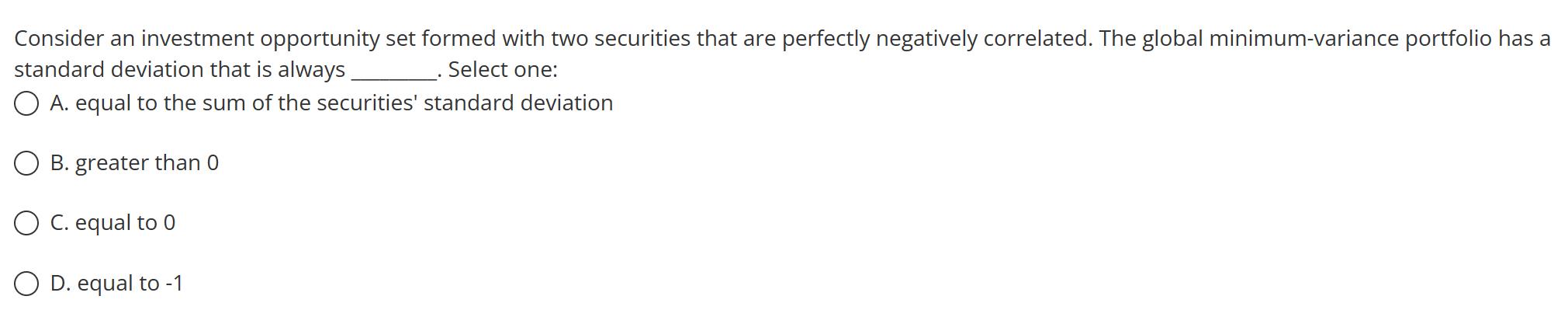

Consider an investment opportunity set formed with two securities that are perfectly negatively correlated. The global minimum-variance portfolio has a standard deviation that is always . Select one: Q A. equal to the sum of the securities' standard deviation 0 B. greater than 0 O C. equal to 0 O D' equal to —1

Image transcription text

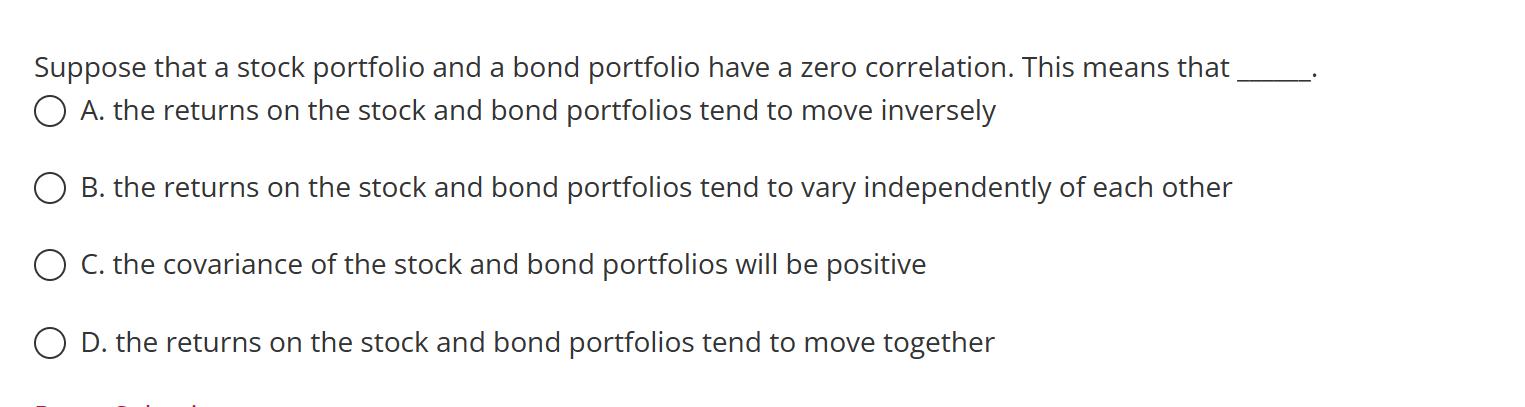

Suppose that a stock portfolio and a bond portfolio have a zero correlation. This means that . O A. the returns on the stock and bond portfolios tend to move inversely O B. the returns on the stock and bond portfolios tend to vary independently of each other 0 C. the covariance ofthe stock and bond portfolios will be positive 0 D. the returns on the stock and bond portfolios tend to move together

Image transcription text

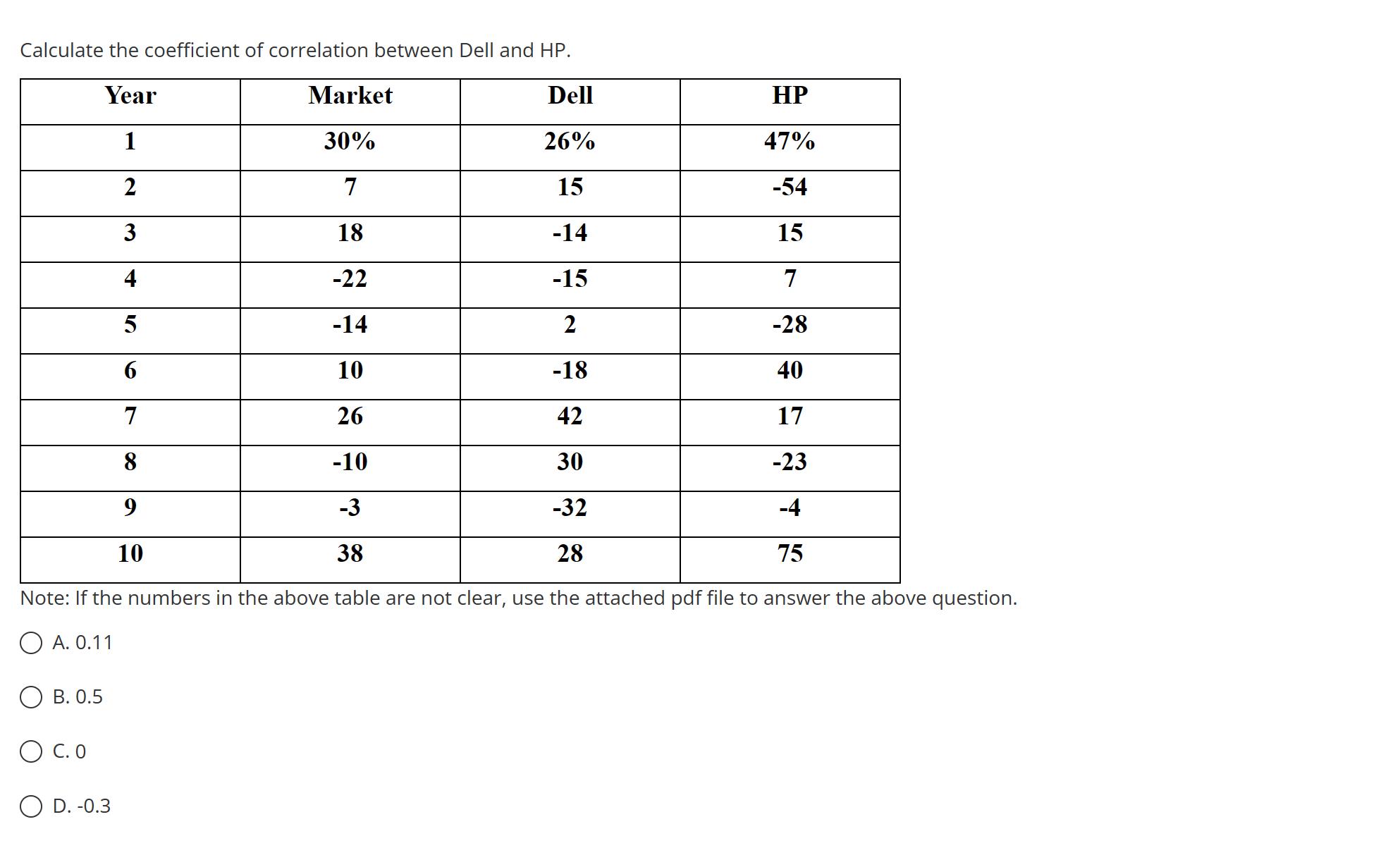

Calculate the coefficient of correlation between Dell and HP. Year Market Dell HP 1 30% 26% 47% 2 7 15 -54 3 18 -14 15 4 -22 -15 7 5 -14 2 -28 6 10 -18 40 7 26 42 17 8 -10 30 -23 9 -3 -32 -4 10 38 28 75 Vote: If the numbers in the above table are not clear, use the attached pdf file to answer the above question. 0 A. 0 11 O B, 0 5 O c. 0

Image transcription text

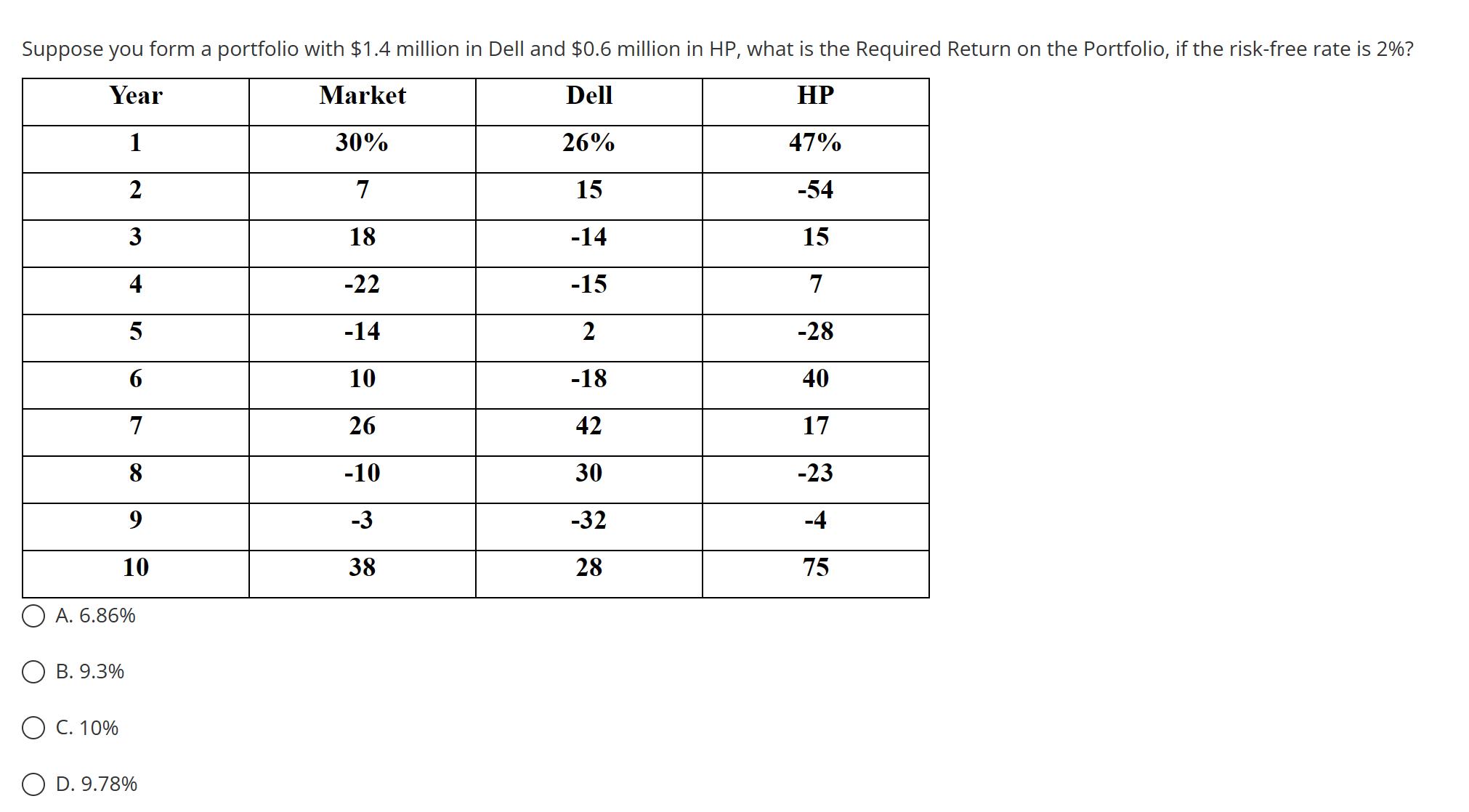

Suppose you form a portfolio with $1.4 million in Dell and $0.6 million in HP, what is the Required Return

on the Portfolio, if the risk-free rate is 2%? O A. 6.86% O B, 9.3% O c. 10% O D. 978%

To construct a riskless portfolio using two risky stocks, one would need to find two stocks with a correlation coefficient of A. -1 B. 1 . D. 0.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started