Answered step by step

Verified Expert Solution

Question

1 Approved Answer

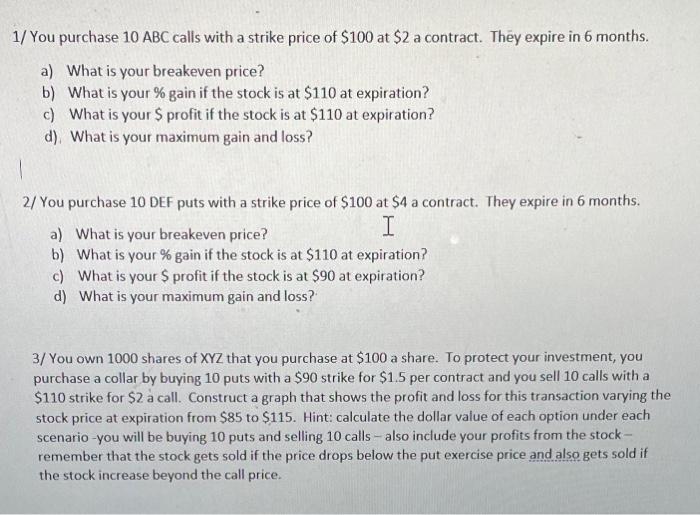

please answer in excel format 1/ You purchase 10ABC calls with a strike price of $100 at $2 a contract. Thy expire in 6 months.

please answer in excel format

1/ You purchase 10ABC calls with a strike price of $100 at $2 a contract. Thy expire in 6 months. a) What is your breakeven price? b) What is your \% gain if the stock is at $110 at expiration? c) What is your $ profit if the stock is at $110 at expiration? d). What is your maximum gain and loss? 2/ You purchase 10 DEF puts with a strike price of $100 at $4 a contract. They expire in 6 months. a) What is your breakeven price? b) What is your % gain if the stock is at $110 at expiration? c) What is your $ profit if the stock is at $90 at expiration? d) What is your maximum gain and loss? 3/ You own 1000 shares of XYZ that you purchase at $100 a share. To protect your investment, you purchase a collar by buying 10 puts with a $90 strike for $1.5 per contract and you sell 10 calls with a $110 strike for $2 a call. Construct a graph that shows the profit and loss for this transaction varying the stock price at expiration from $85 to $115. Hint: calculate the dollar value of each option under each scenario -you will be buying 10 puts and selling 10 calls - also include your profits from the stock remember that the stock gets sold if the price drops below the put exercise price and also gets sold if the stock increase beyond the call price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started