Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer in formulas or financial calculator values and round decimals to two decimal places for interest rates and dollar amounts in the final answer.

please answer in formulas or financial calculator values and round decimals to two decimal places for interest rates and dollar amounts in the final answer. please answer in text that can be copied and pasted instead of an image or excel worksheet. assume no issues with bond taxes

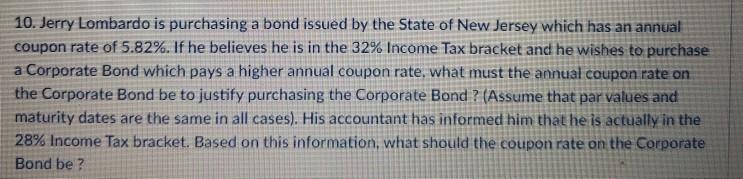

10. Jerry Lombardo is purchasing a bond issued by the State of New Jersey which has an annual coupon rate of 5.82%. If he believes he is in the 32% Income Tax bracket and he wishes to purchase a Corporate Bond which pays a higher annual coupon rate, what must the annual coupon rate on the Corporate Bond be to justify purchasing the Corporate Bond ? (Assume that par values and maturity dates are the same in all cases). His accountant has informed him that he is actually in the 28% Income Tax bracket. Based on this information, what should the coupon rate on the Corporate Bond be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started