Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Before Takeover Compute Ying Co. after-tax profits (orlosses if negative) : At the up state : $________million. At the down state: $_________million. What are the

Before Takeover

- Compute Ying Co. after-tax profits (orlosses if negative):

- At the "up" state : $________million.

- At the "down" state: $_________million.

- What are the expected after-tax profits at "t=0"? (value-weightusing states' probabilities) A: $_________million.

- Compute Yang Co. after-tax profits (orlosses if negative) :

- At the "up" state : $________million.

- At the "down" state: $_________million.

- What are the expected after-tax profits at "t=0"? A:$__________million.

- Note that the companies aggregate after-taxprofits expected at "t=0" adds up to $13 million.(use this to double check your previous results)

After Takeover

- Compute Ying-Yang Co. after-taxprofits (or losses if negative):

- At the "up" state : $_________million.

- At the "down" state: $________million.

- What are the expected after-tax profits at "t=0"? A:$??million.??(verify that your answer islarger than $13 million)

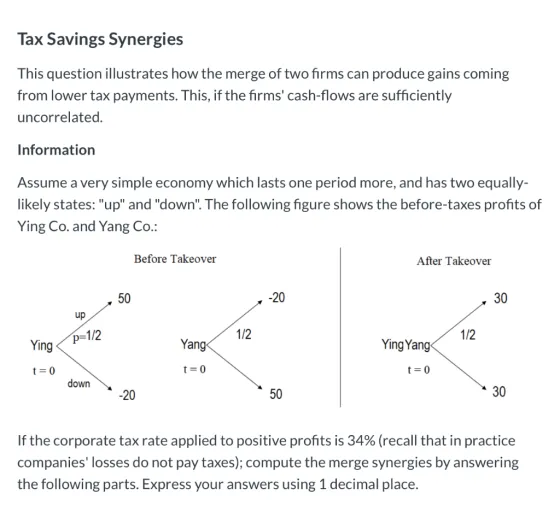

Tax Savings Synergies This question illustrates how the merge of two firms can produce gains coming from lower tax payments. This, if the firms' cash-flows are sufficiently uncorrelated. Information Assume a very simple economy which lasts one period more, and has two equally- likely states: "up" and "down". The following figure shows the before-taxes profits of Ying Co. and Yang Co.: Before Takeover Ying t=0 up p=1/2 down 50 -20 Yang t=0 1/2 , -20 50 After Takeover Ying Yang t=0 1/2 30 30 If the corporate tax rate applied to positive profits is 34% (recall that in practice companies' losses do not pay taxes); compute the merge synergies by answering the following parts. Express your answers using 1 decimal place.

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

After Takeover Analysis Before Takeover Ying Co Up state Profit 50 Tax 50 034 17 Aftertax profit 50 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started