Answered step by step

Verified Expert Solution

Question

1 Approved Answer

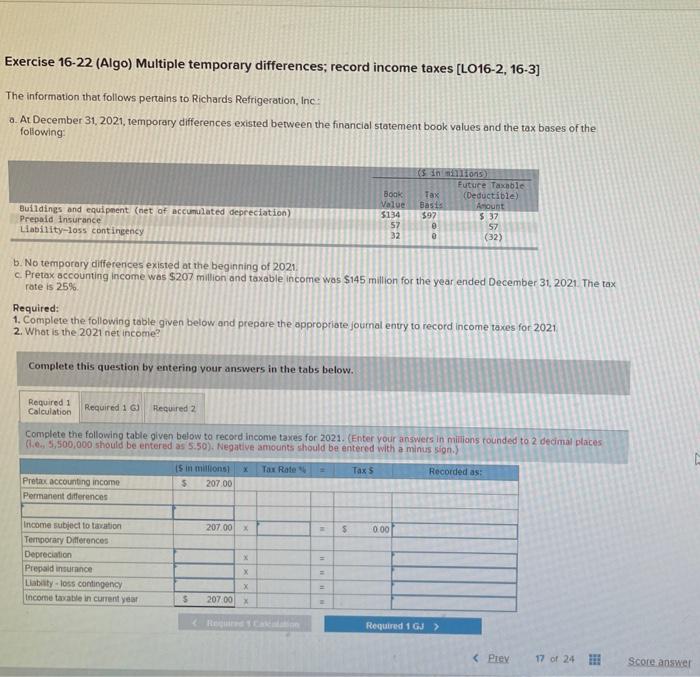

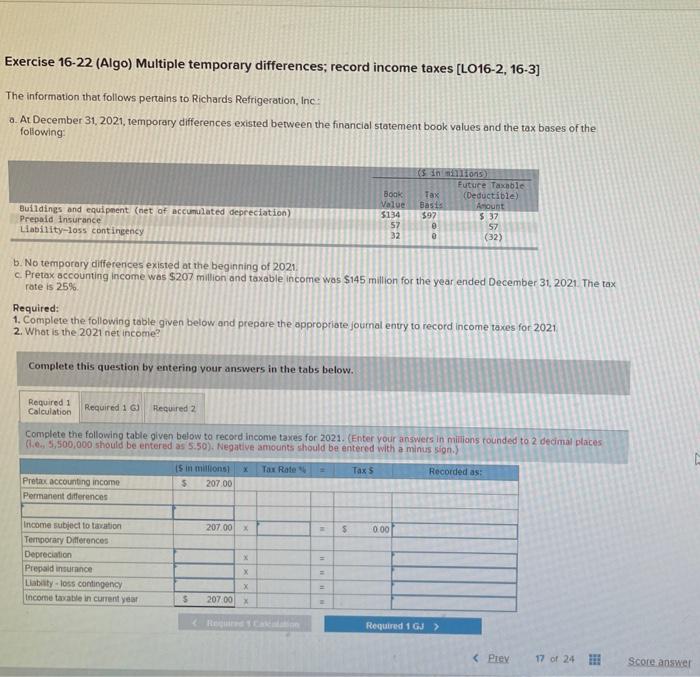

please answer in the same format! will up vote ! Exercise 16-22 (Algo) Multiple temporary differences; record income taxes [LO16-2, 16-3] The information that follows

please answer in the same format! will up vote !

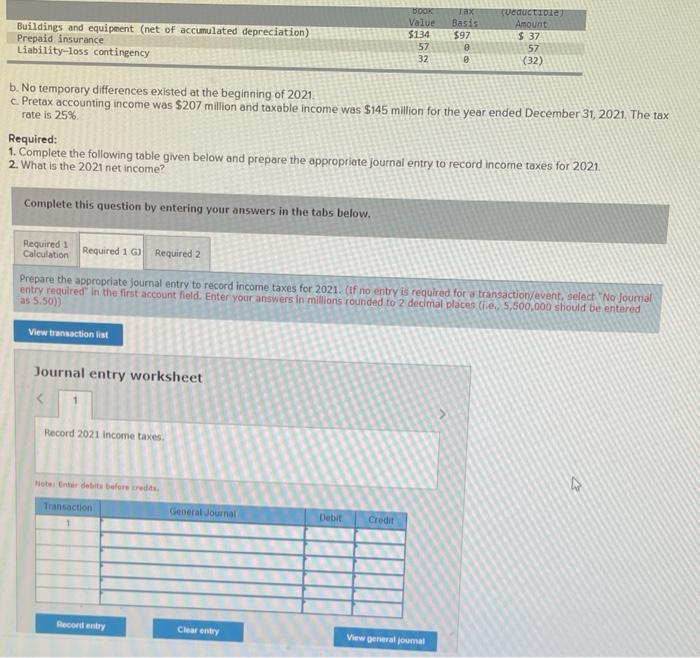

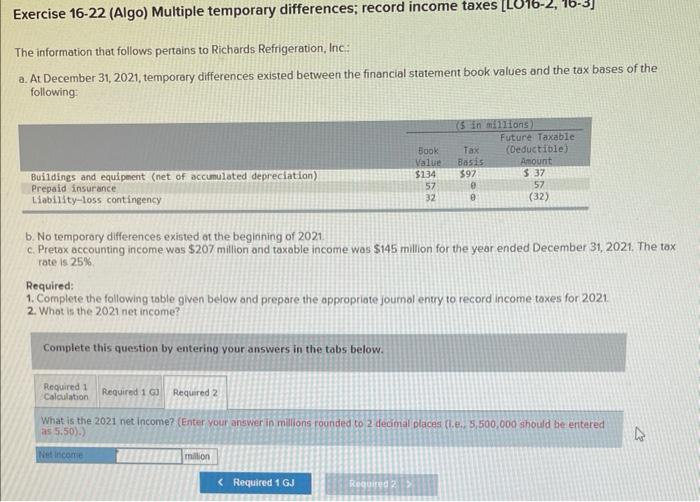

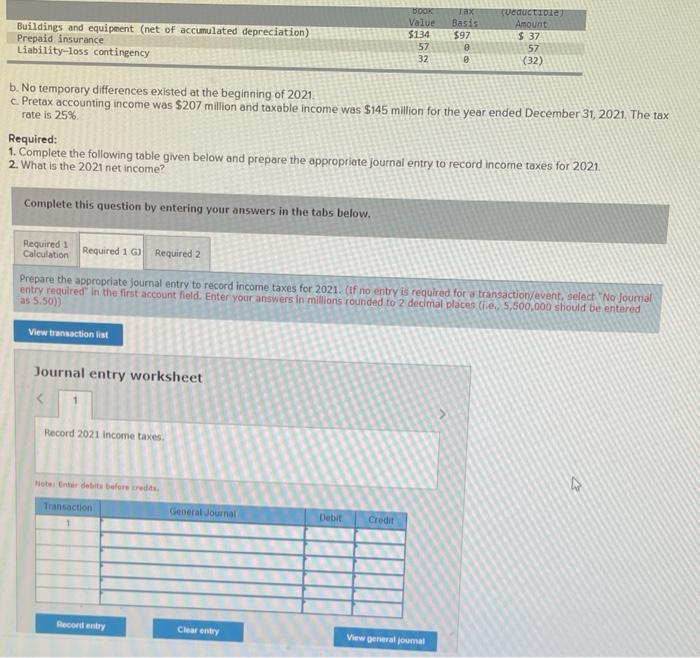

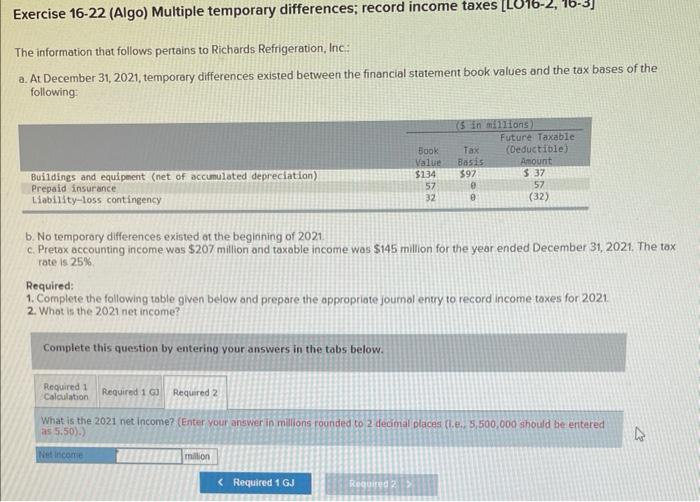

Exercise 16-22 (Algo) Multiple temporary differences; record income taxes [LO16-2, 16-3] The information that follows pertains to Richards Refrigeration, Inc: a. At December 31, 2021, temporary differences existed between the financial statement book values and the tax bases of the following: b. No temporary differences existed at the beginning of 2021 . c. Pretax accounting income was $207 million and taxable income was $145 million for the year ended December 31,2021 . The tax rate is 25%. Required: 1. Complete the following table given below and prepare the appropriate joumal entry to record income taxes for 2021 2. What is the 2021 net income? Complete this question by entering your answers in the tabs below. Complete the following table given below to record income taxes for 2021 . (Enter your answers in minitions rounded to 2 decimal places (t.e.s 5,500,000 should be entered as 5.50). Negative amounts should be entered with a minus sign.) b. No temporary differences existed at the beginning of 2021 . c. Pretax accounting income was $207 million and taxable income was $145 million for the year ended December 31,2021 . The tax rate is 25%. Required: 1. Complete the following table given below and prepare the appropriate journal entry to record income taxes for 2021. 2. What is the 2021 net income? Complete this question by entering your answers in the tabs below, Prepare the appropriate journal entry to record income taxes for 2021 . (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places, (i.e., 5,500,000 should be entered as 5.50)} Journal entry worksheet Record 2021 income taxes. Hieter Eries detits befose wrettasy Exercise 16-22 (Algo) Multiple temporary differences; record income taxes [LO16-2, 165] The information that follows pertains to Richards Refrigeration, Inc: a. At December 31,2021 , temporary differences existed between the financial statement book values and the tax bases of the following: b. No temporary differences existed at the beginning of 2021 . c. Pretax accounting income was $207 milion and taxable income was $145 million for the year ended December 31,2021 . The tax rate is 25% Required: 1. Complete the following table given below and prepare the oppropriate journal entry to record income toxes for 2021 . 2. What is the 2021 net income? Complete this question by entering your answers in the tabs below. What is the 2021 net income? (Enter your answer in millons foonded to 2 decinal places fl.e., 5,500,000 should be entered

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started