Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer in word form and not in note pad. QUESTION 3 i) Sakura Manufacturing Bhd. purchased a plant at a gross cost of RM1.6

Please answer in word form and not in note pad.

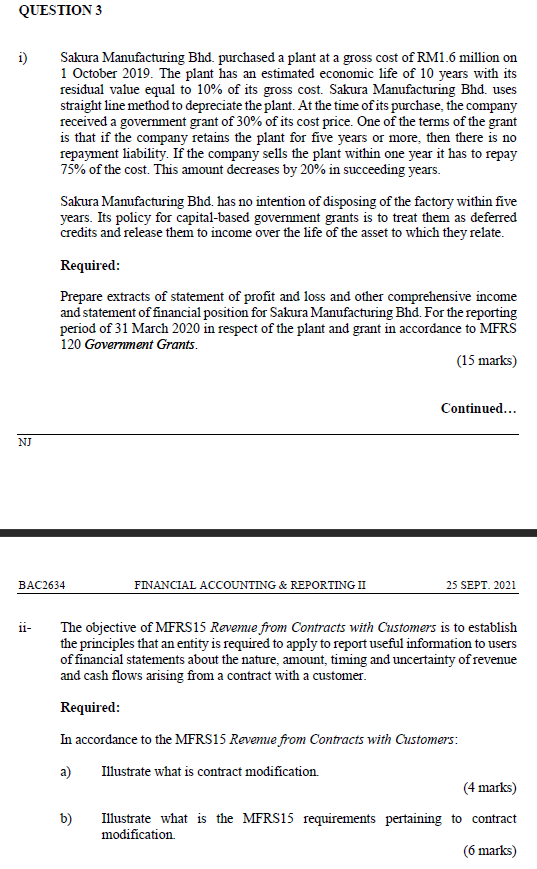

QUESTION 3 i) Sakura Manufacturing Bhd. purchased a plant at a gross cost of RM1.6 million on 1 October 2019. The plant has an estimated economic life of 10 years with its residual value equal to 10% of its gross cost. Sakura Manufacturing Bhd. uses straight line method to depreciate the plant. At the time of its purchase, the company received a government grant of 30% of its cost price. One of the terms of the grant is that if the company retains the plant for five years or more, then there is no repayment liability. If the company sells the plant within one year it has to repay 75% of the cost. This amount decreases by 20% in succeeding years. Sakura Manufacturing Bhd. has no intention of disposing of the factory within five years. Its policy for capital-based government grants is to treat them as deferred credits and release them to income over the life of the asset to which they relate. Required: Prepare extracts of statement of profit and loss and other comprehensive income and statement of financial position for Sakura Manufacturing Bhd. For the reporting period of 31 March 2020 in respect of the plant and grant in accordance to MFRS 120 Government Grants. (15 marks) Continued... NJ BAC2634 FINANCIAL ACCOUNTING & REPORTING II 25 SEPT. 2021 ii- The objective of MFRS15 Revenue from Contracts with Customers is to establish the principles that an entity is required to apply to report useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue and cash flows arising from a contract with a customer. Required: In accordance to the MFRS15 Revenue from Contracts with Customers: a) Illustrate what is contract modification. (4 marks) b) Illustrate what is the MFRS15 requirements pertaining to contract modification (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started