Please answer it ASAP,please step by step

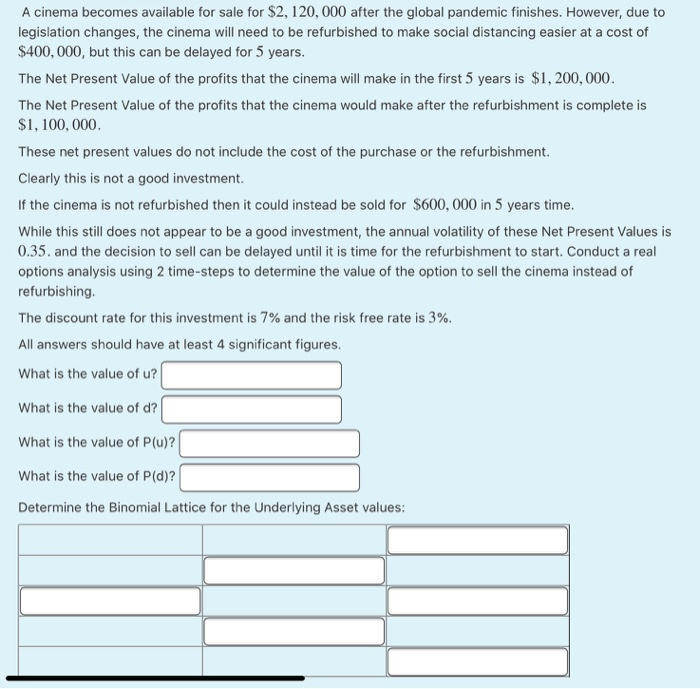

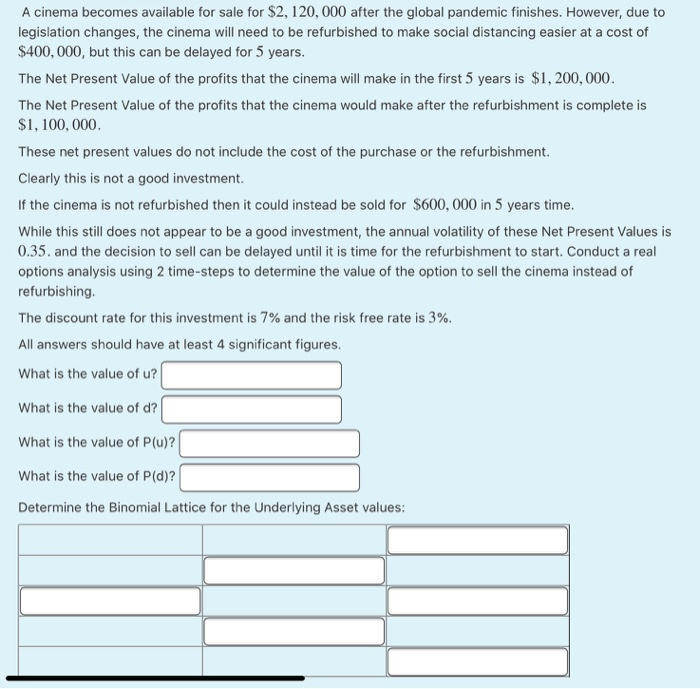

A cinema becomes available for sale for $2,120,000 after the global pandemic finishes. However, due to legislation changes, the cinema will need to be refurbished to make social distancing easier at a cost of $400,000, but this can be delayed for 5 years. The Net Present Value of the profits that the cinema will make in the first 5 years is $1,200,000. The Net Present Value of the profits that the cinema would make after the refurbishment is complete is $1,100,000 These net present values do not include the cost of the purchase or the refurbishment. Clearly this is not a good investment. If the cinema is not refurbished then it could instead be sold for $600,000 in 5 years time. While this still does not appear to be a good investment, the annual volatility of these Net Present Values is 0.35. and the decision to sell can be delayed until it is time for the refurbishment to start. Conduct a real options analysis using 2 time-steps to determine the value of the option to sell the cinema instead of refurbishing. The discount rate for this investment is 7% and the risk free rate is 3%. All answers should have at least 4 significant figures. What is the value of u? What is the value of d? What is the value of P(u)? What is the value of P(d)? Determine the Binomial Lattice for the underlying Asset values: A cinema becomes available for sale for $2,120,000 after the global pandemic finishes. However, due to legislation changes, the cinema will need to be refurbished to make social distancing easier at a cost of $400,000, but this can be delayed for 5 years. The Net Present Value of the profits that the cinema will make in the first 5 years is $1,200,000. The Net Present Value of the profits that the cinema would make after the refurbishment is complete is $1,100,000 These net present values do not include the cost of the purchase or the refurbishment. Clearly this is not a good investment. If the cinema is not refurbished then it could instead be sold for $600,000 in 5 years time. While this still does not appear to be a good investment, the annual volatility of these Net Present Values is 0.35. and the decision to sell can be delayed until it is time for the refurbishment to start. Conduct a real options analysis using 2 time-steps to determine the value of the option to sell the cinema instead of refurbishing. The discount rate for this investment is 7% and the risk free rate is 3%. All answers should have at least 4 significant figures. What is the value of u? What is the value of d? What is the value of P(u)? What is the value of P(d)? Determine the Binomial Lattice for the underlying Asset values

Please answer it ASAP,please step by step

Please answer it ASAP,please step by step