Please answer it carefully

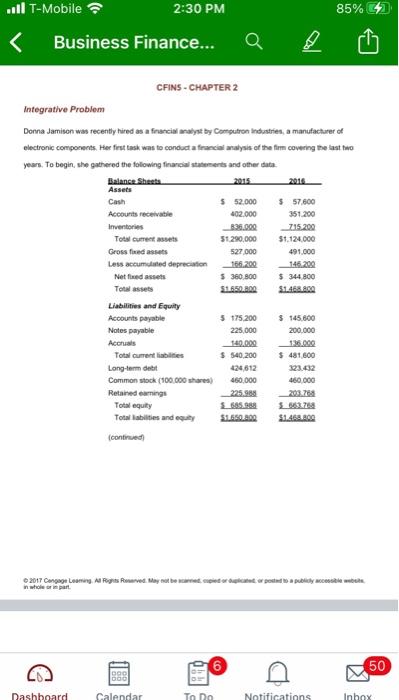

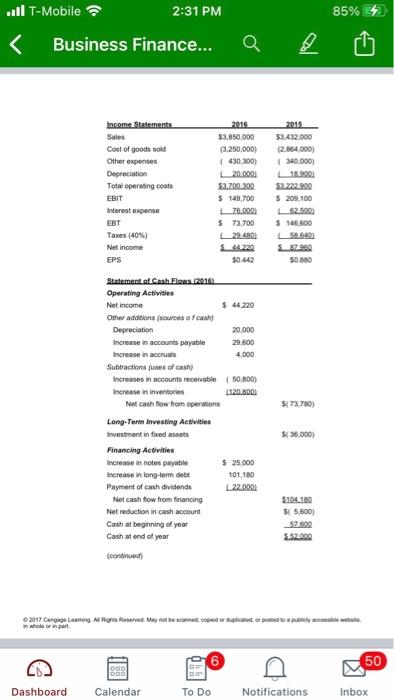

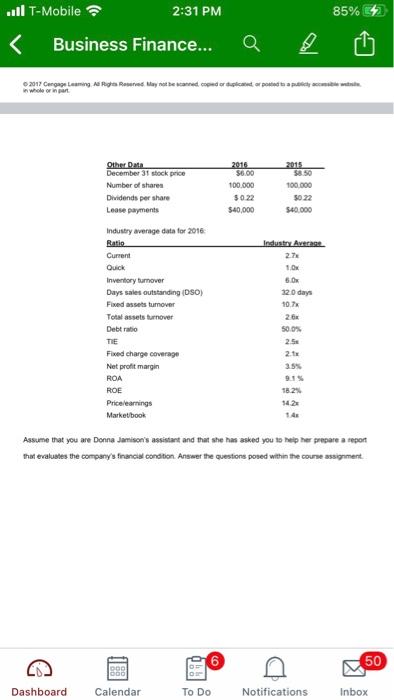

Integrative Problem Donna Jamison was recently hired as a financial analyst by Computron Industries, a manufacturer of electronic components. Her first task was to conduct a financial analysis of the firm covering the last two years. To begin, she gathered the following financial statements and other data. Balance Sheets 2015 2016 Assets Cash $ 52,000 $ 57,600 Accounts receivable 402,000 351,200 Inventories 836,000 715,200 Total current assets $1,290,000 $1,124,000 Gross fixed assets 527,000 491,000 Less accumulated depreciation 166,200 146,200 Net fixed assets $ 360,800 $ 344,800 Total assets $1,650,800 $1,468,800 Liabilities and Equity Accounts payable $ 175,200 $ 145,600 Notes payable 225,000 200,000 Accruals 140,000 136,000 Total current liabilities $ 540,200 $ 481,600 Long-term debt 424,612 323,432 Common stock (100,000 shares) 460,000 460,000 Retained earnings 225,988 203,768 Total equity $ 685,988 $ 663,768 Total liabilities and equity $1,650,800 $1,468,800 (continued) 2017 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Income Statements 2016 2015 Sales $3,850,000 $3,432,000 Cost of goods sold (3,250,000) (2,864,000) Other expenses ( 430,300) ( 340,000) Depreciation ( 20,000) ( 18,900) Total operating costs $3,700,300 $3,222,900 EBIT $ 149,700 $ 209,100 Interest expense ( 76,000) ( 62,500) EBT $ 73,700 $ 146,600 Taxes (40%) ( 29,480) ( 58,640) Net income $ 44,220 $ 87,960 EPS $0.442 $0.880 Statement of Cash Flows (2016) Operating Activities Net income $ 44,220 Other additions (sources o f cash) Depreciation 20,000 Increase in accounts payable 29,600 Increase in accruals 4,000 Subtractions (uses of cash) Increases in accounts receivable ( 50,800) Increase in inventories (120,800) Net cash flow from operations $( 73,780) Long-Term Investing Activities Investment in fixed assets $( 36,000) Financing Activities Increase in notes payable $ 25,000 Increase in long-term debt 101,180 Payment of cash dividends ( 22,000) Net cash flow from financing $104,180 Net reduction in cash account $( 5,600) Cash at beginning of year 57,600 Cash at end of year $ 52,000 (continued) 2017 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. Other Data 2016 2015 December 31 stock price $6.00 $8.50 Number of shares 100,000 100,000 Dividends per share $ 0.22 $0.22 Lease payments $40,000 $40,000 Industry average data for 2016: Ratio Industry Average Current 2.7x Quick 1.0x Inventory turnover 6.0x Days sales outstanding (DSO) 32.0 days Fixed assets turnover 10.7x Total assets turnover 2.6x Debt ratio 50.0% TIE 2.5x Fixed charge coverage 2.1x Net profit margin 3.5% ROA 9.1 % ROE 18.2% Price/earnings 14.2x Market/book 1.4x Assume that you are Donna Jamisons assistant and that she has asked you to help her prepare a report that evaluates the companys financial condition. Answer the questions posed within the course assignment

- What can you conclude about the company's financial condition from its statement of cash flows? (5 points possible)

- What are Computron's current and quick ratios? What do they tell you about the company's liquidity position? (8 points possible)

- What are Computron's inventory turnover, day's sales outstanding, fixed assets turnover and total assets turnover ratios? How does the firm's utilization of assets stack up against that of the industry? (8 points possible)

Ill T-Mobile 2:30 PM 85% 4 Business Finance... CFINS - CHAPTER 2 Integrative Problem Donna Jamison was recently hired as a financial analyst by Computron Industries, a manufacturer of electronic components. Her first task was to conduct a francial analysis of the firm covering the last to years. To begin, she gathered the following financial statements and other dute Balance Sheet Assets Cash $ 52.000 $ 57,600 Accounts receivable 402.000 351.200 Inventories $36.000 715.209 Total current 51290,000 $1.124.000 Gross feed assets 527 000 491.000 Less accumulated depreciation 166.200 145.200 Netfied assets $ 350.800 $ 344.800 Total assets 51.650.000 $1468.800 Liabilities and Equity Accounts payable 5 175.200 $ 145.600 Notes payable 225,000 200.000 Accruals 140.000 Total current liabilities $540,200 $ 481.600 Long-term det 424 612 323.632 Common stock (100.000 shares) 450,000 460.000 Retained earnings 225.988 203.768 Total equity 585.888 3.764 Total abilities and SL650.000 1.46.2 (continued 2017 Corpoot Loting Rigs Rearved. May not be cate orice ora publiky blue in part 50 Dashboard Calendar To Do Notifications Inbox ..1 T-Mobile 2:31 PM 85% Business Finance... Q 2015 $3,432,000 (2.864.000) 340.0001 Income Statements Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net income EPS 2016 53.850.000 (3.250,000) (430,300) 20.0001 $3.700.000 $ 149,700 76.0001 $ 73.700 29.4801 44220 $0.462 52.222.000 $ 209.100 62.500 $ 146.600 58.640) 50.800 ${73,780) Statement of Cash Flow 2016 Operating Activities Net Income $44.220 Other additions (sources of Depreciation 20,000 Increase in accounts payable 29.500 Increase in acciais 4.000 Subtractions as of cash) Increases in accounts receivable (50 800) Increase in inventories 120.000 Nel cash flow from operations Long-Term Investing Activities Investment in foed assets Financing Activities Increase in notes payable $ 25,000 Increase in long-term debe 101,180 Payment of cash dividende 22.000 Net cash flow from financing Net reduction in cash account Cash at beginning of your Cash at end of year (continued $38,000) $104.162 $5.500) 57.800 352.00 2017 Caraming Rig Red. May not be copied or duplicate in woor 05! 6 50 Dashboard Calendar To Do Notifications Inbox 85% ..1 T-Mobile 2:31 PM Business Finance... Q 2017 Cargas Laming Riga Ray not be cand copied or lidera Whole or not Other Data December 31 stock price Number of shares Dividends per share Lease payments 2016 $6.00 100.000 $0.22 $40,000 2015 $8.50 100.000 $40.000 Industry average data for 2016 Ratio Current Quick Inventory turnover Days sales outstanding (DSO) Fixed assets tumover Total assets turnover Debt ratio TIE Fixed charge coverage Net profit margin ROA ROE Price learnings Marketbook Industry Average 2.74 1.0 5. 120 days 10.7 26 50.0% 25 2.1 3.5% 18.2% 54.23 Assume that you are Donna Jamison's assistant and that she has asked you to help her prepare a report that evaluates the companys financial condition. Answer the questions posed within the course assignment. 6 50 140 Dashboard Calendar To Do Notifications Inbox 85% 14 Il T-Mobile 2:30 PM Business Finance... CFINS - CHAPTER 2 Integrative Problem Donna Jamison was recently hired as a financial analyst by Computron Industries, a manufacturer of electronic components. Her first task was to conduct a francial analysis of the firm covering the last tio years. To begin, she gathered the following financial statements and other data Balance Sheet Assets Cash $ 52,000 $ 57,600 Accounts receivable 402.000 351.200 Inventories 836.000 715.200 Total current 51.290,000 $1.124.000 Gross feed assets 527000 491.000 Less accumulated depreciation 166.200 145.209 Netfud assets $360,800 $ 344.800 Total assets $1.650.000 $1.468.800 Liabilities and Equity Accounts payable 5 175.200 $ 145.600 Notes payable 225.000 200.000 Accruals 140.000 Total current liabilities $ 540.200 $ 481.600 Long-term debit 424 612 23.432 Common stock (100.000 shares) 460,000 460.000 Retained earnings 225.988 _203.76 Total equity $85.000 5.683.768 Total abilities and $1650.800 $1.46.2 (continued 2017 Corporating Rigs Romerved. May not be called or doorsted publicly be in part 50 Dashboard Calendar To Do Notifications Inbox Ill T-Mobile 2:30 PM 85% 4 Business Finance... CFINS - CHAPTER 2 Integrative Problem Donna Jamison was recently hired as a financial analyst by Computron Industries, a manufacturer of electronic components. Her first task was to conduct a francial analysis of the firm covering the last to years. To begin, she gathered the following financial statements and other dute Balance Sheet Assets Cash $ 52.000 $ 57,600 Accounts receivable 402.000 351.200 Inventories $36.000 715.209 Total current 51290,000 $1.124.000 Gross feed assets 527 000 491.000 Less accumulated depreciation 166.200 145.200 Netfied assets $ 350.800 $ 344.800 Total assets 51.650.000 $1468.800 Liabilities and Equity Accounts payable 5 175.200 $ 145.600 Notes payable 225,000 200.000 Accruals 140.000 Total current liabilities $540,200 $ 481.600 Long-term det 424 612 323.632 Common stock (100.000 shares) 450,000 460.000 Retained earnings 225.988 203.768 Total equity 585.888 3.764 Total abilities and SL650.000 1.46.2 (continued 2017 Corpoot Loting Rigs Rearved. May not be cate orice ora publiky blue in part 50 Dashboard Calendar To Do Notifications Inbox ..1 T-Mobile 2:31 PM 85% Business Finance... Q 2015 $3,432,000 (2.864.000) 340.0001 Income Statements Sales Cost of goods sold Other expenses Depreciation Total operating costs EBIT Interest expense EBT Taxes (40%) Net income EPS 2016 53.850.000 (3.250,000) (430,300) 20.0001 $3.700.000 $ 149,700 76.0001 $ 73.700 29.4801 44220 $0.462 52.222.000 $ 209.100 62.500 $ 146.600 58.640) 50.800 ${73,780) Statement of Cash Flow 2016 Operating Activities Net Income $44.220 Other additions (sources of Depreciation 20,000 Increase in accounts payable 29.500 Increase in acciais 4.000 Subtractions as of cash) Increases in accounts receivable (50 800) Increase in inventories 120.000 Nel cash flow from operations Long-Term Investing Activities Investment in foed assets Financing Activities Increase in notes payable $ 25,000 Increase in long-term debe 101,180 Payment of cash dividende 22.000 Net cash flow from financing Net reduction in cash account Cash at beginning of your Cash at end of year (continued $38,000) $104.162 $5.500) 57.800 352.00 2017 Caraming Rig Red. May not be copied or duplicate in woor 05! 6 50 Dashboard Calendar To Do Notifications Inbox 85% ..1 T-Mobile 2:31 PM Business Finance... Q 2017 Cargas Laming Riga Ray not be cand copied or lidera Whole or not Other Data December 31 stock price Number of shares Dividends per share Lease payments 2016 $6.00 100.000 $0.22 $40,000 2015 $8.50 100.000 $40.000 Industry average data for 2016 Ratio Current Quick Inventory turnover Days sales outstanding (DSO) Fixed assets tumover Total assets turnover Debt ratio TIE Fixed charge coverage Net profit margin ROA ROE Price learnings Marketbook Industry Average 2.74 1.0 5. 120 days 10.7 26 50.0% 25 2.1 3.5% 18.2% 54.23 Assume that you are Donna Jamison's assistant and that she has asked you to help her prepare a report that evaluates the companys financial condition. Answer the questions posed within the course assignment. 6 50 140 Dashboard Calendar To Do Notifications Inbox 85% 14 Il T-Mobile 2:30 PM Business Finance... CFINS - CHAPTER 2 Integrative Problem Donna Jamison was recently hired as a financial analyst by Computron Industries, a manufacturer of electronic components. Her first task was to conduct a francial analysis of the firm covering the last tio years. To begin, she gathered the following financial statements and other data Balance Sheet Assets Cash $ 52,000 $ 57,600 Accounts receivable 402.000 351.200 Inventories 836.000 715.200 Total current 51.290,000 $1.124.000 Gross feed assets 527000 491.000 Less accumulated depreciation 166.200 145.209 Netfud assets $360,800 $ 344.800 Total assets $1.650.000 $1.468.800 Liabilities and Equity Accounts payable 5 175.200 $ 145.600 Notes payable 225.000 200.000 Accruals 140.000 Total current liabilities $ 540.200 $ 481.600 Long-term debit 424 612 23.432 Common stock (100.000 shares) 460,000 460.000 Retained earnings 225.988 _203.76 Total equity $85.000 5.683.768 Total abilities and $1650.800 $1.46.2 (continued 2017 Corporating Rigs Romerved. May not be called or doorsted publicly be in part 50 Dashboard Calendar To Do Notifications Inbox