PLEASE ANSWER JUST NEED FINANCIAL STATEMENTS WILL RATE VERY WELL

Based on the information in the problem, create pro-forma financial statements (I/S, SRE, B/S and SCF) for John Keeley's Black Hole Bar and Grill for the next 5 years.

John Keeley begins operating his Black Hole Bar and Grill on 1/1/19 with an equity investment of $100,000. Keeley assumes that he will earn $77,000 in cash revenues and incur cash operating expenses of 36.00% of revenues each year. The corporate tax rate is assumed to be 21.00%.

Also on 1/1/19, Keeley leases Equipment to be used in his business. The term of the lease is for 5.00 years and is not cancellable. The present value of the Equipment is $37,500. The economic life of the Equipment is assumed to be 5.00 years with Guaranteed Residual Value $5,625; Expected Residual Value $1,125 and Actual Residual Value $5,625. The company uses straight line depreciation for financial reporting purposes and for tax purposes. Furthermore assume that Keeley knows that the lease company's cost of funds is 6.50%.

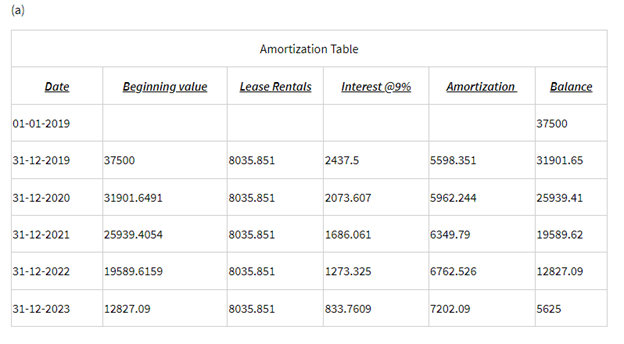

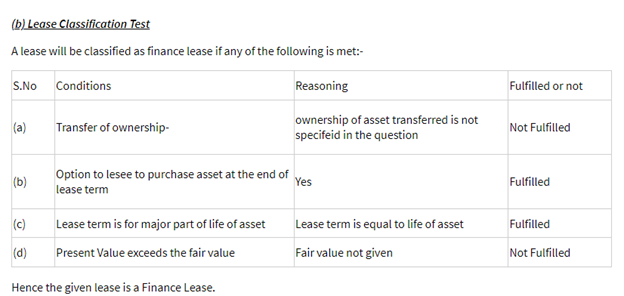

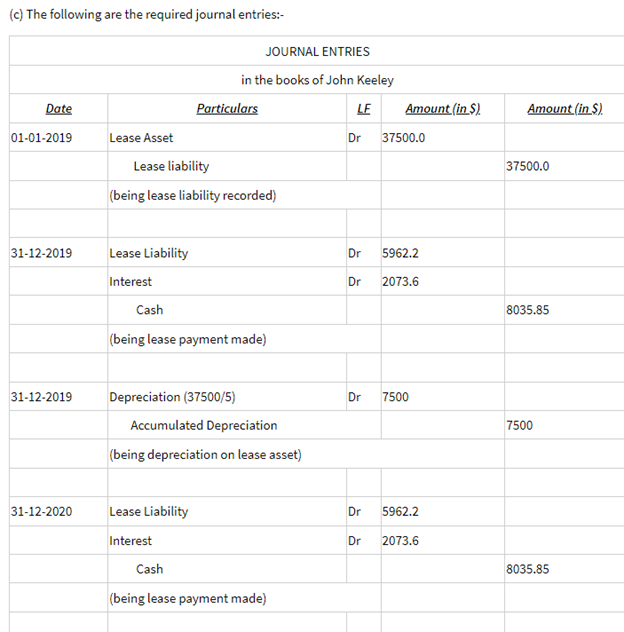

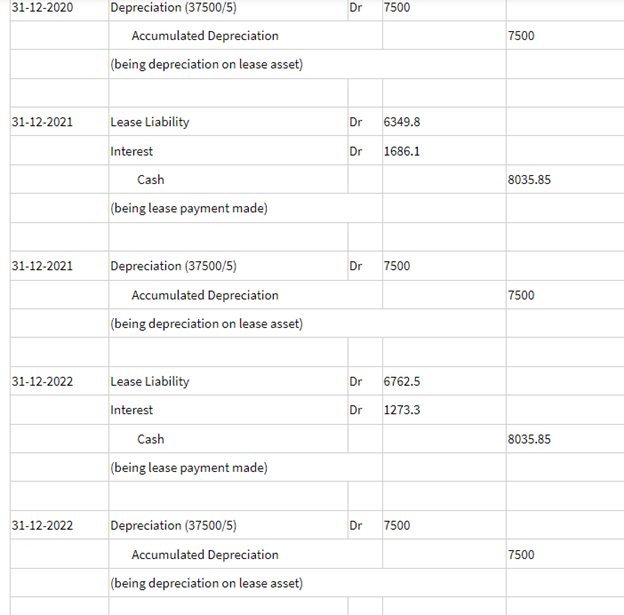

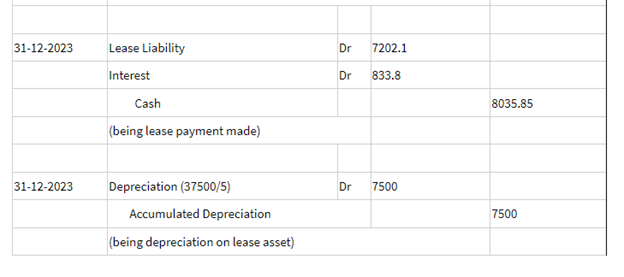

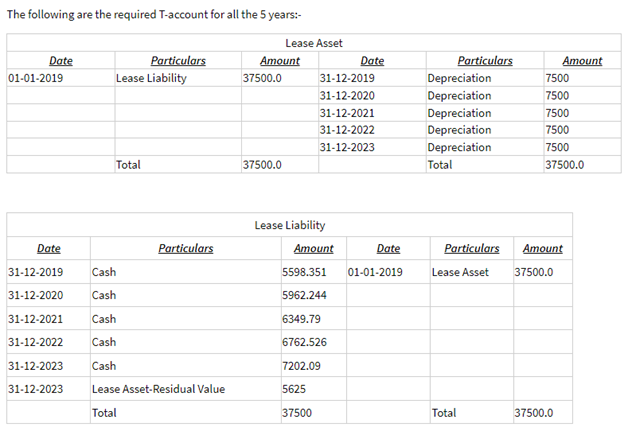

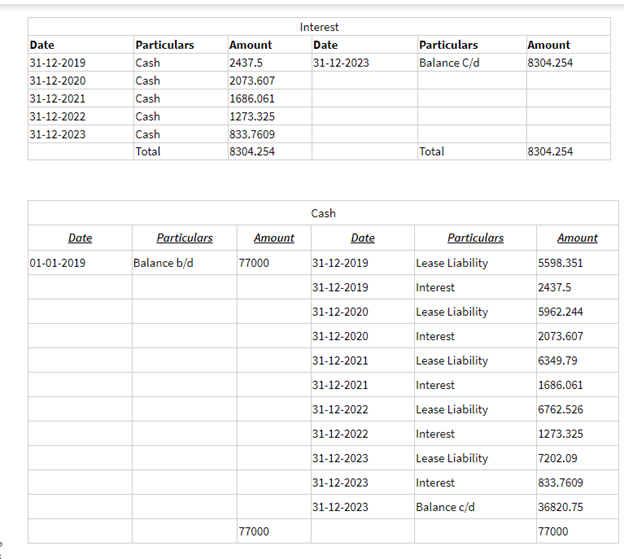

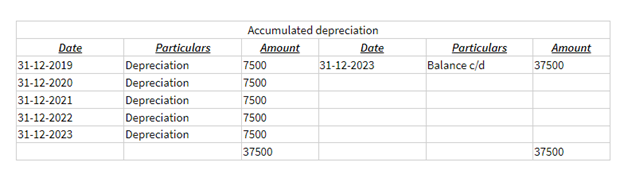

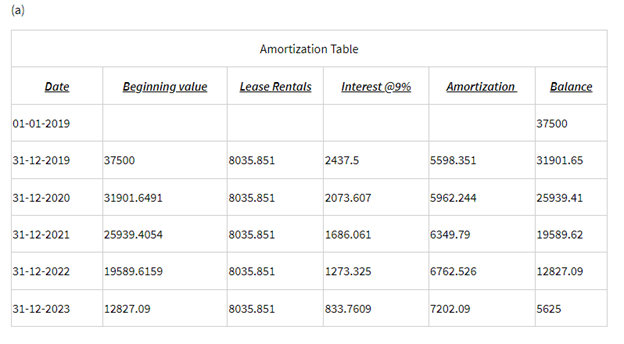

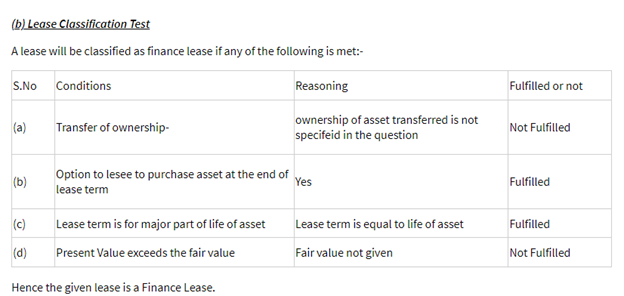

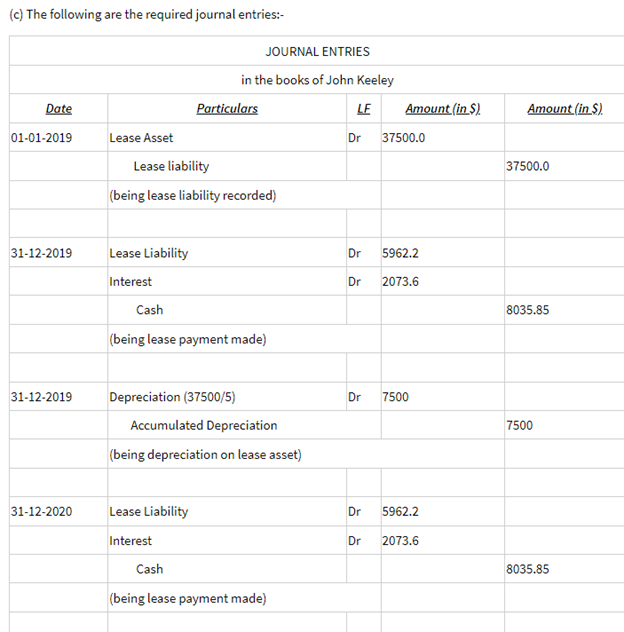

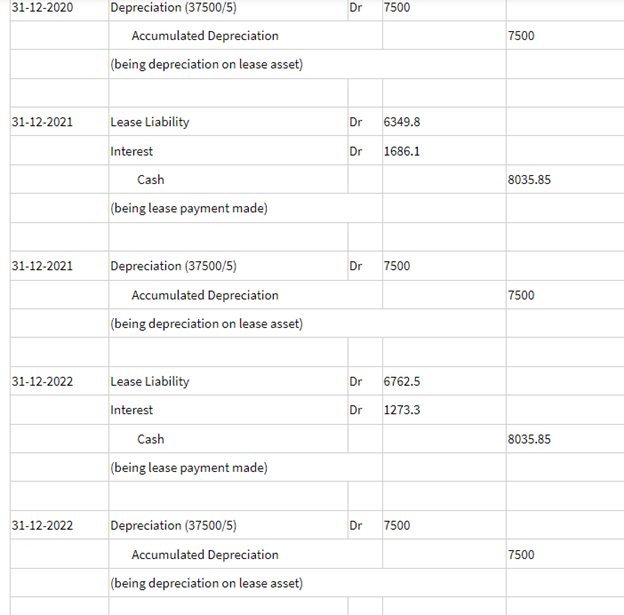

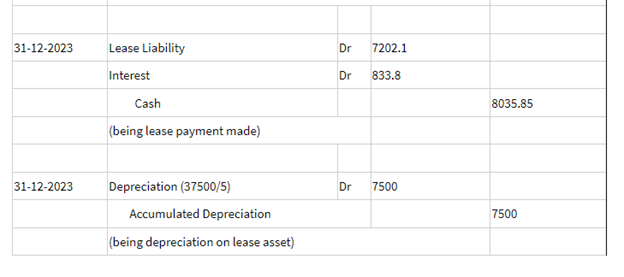

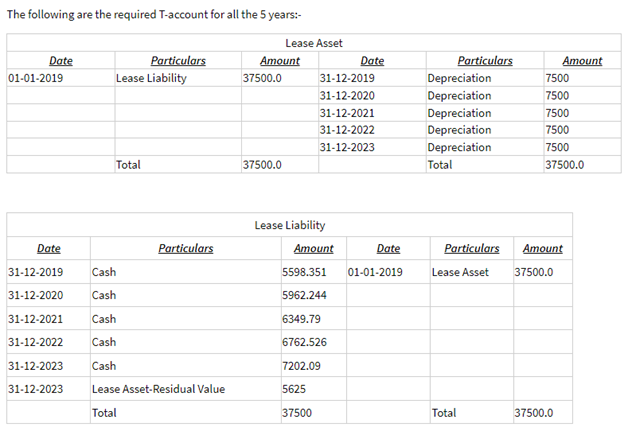

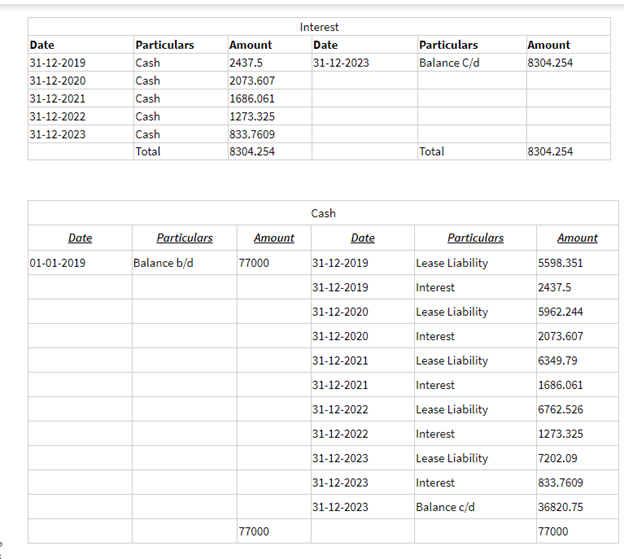

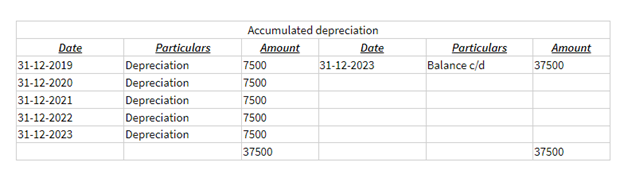

(a) Amortization Table Date Beginning value Lease Rentals Interest@9% Amortization Balance 01-01-2019 37500 31-12-2019 37500 8035.851 2437.5 5598.351 31901.65 31-12-2020 31901.6491 8035.851 2073.607 5962.244 25939.41 31-12-2021 25939.4054 8035.851 1686.061 6349.79 19589.62 31-12-2022 19589.6159 8035.851 1273.325 6762.526 12827.09 31-12-2023 12827.09 8035.851 833.7609 7202.09 5625 (b) Lease Classification Test A lease will be classified as finance lease if any of the following is met:- S.No Conditions Reasoning Fulfilled or not (a) Transfer of ownership ownership of asset transferred is not specifeid in the question Not Fulfilled (b) Option to lesee to purchase asset at the end of Yes lease term Fulfilled (c) Fulfilled Lease term is for major part of life of asset Present Value exceeds the fair value Lease term is equal to life of asset Fair value not given (d) Not Fulfilled Hence the given lease is a Finance Lease. (c) The following are the required journal entries:- Date Amount (in $) JOURNAL ENTRIES in the books of John Keeley Particulars LE Amount (in $ Lease Asset 37500.0 Lease liability (being lease liability recorded) 01-01-2019 Dr 37500.0 31-12-2019 Dr 5962.2 Dr 2073.6 Lease Liability Interest Cash (being lease payment made) 8035.85 31-12-2019 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 31-12-2020 Dr 5962.2 Lease Liability Interest Cash Dr 2073.6 8035.85 (being lease payment made) 31-12-2020 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 31-12-2021 Dr 6349.8 Dr 1686.1 Lease Liability Interest Cash (being lease payment made) 8035.85 31-12-2021 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 31-12-2022 Dr 6762.5 Lease Liability Interest Dr 1273.3 Cash 8035.85 (being lease payment made) 31-12-2022 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 31-12-2023 Dr 7202.1 Dr 833.8 Lease Liability Interest Cash (being lease payment made) 8035.85 31-12-2023 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 The following are the required T-account for all the 5 years:- Date 01-01-2019 Particulars Lease Liability Lease Asset Amount Date 37500.0 31-12-2019 31-12-2020 31-12-2021 31-12-2022 31-12-2023 37500.0 Particulars Depreciation Depreciation Depreciation Depreciation Depreciation Total Amount 7500 7500 7500 7500 7500 37500.0 Total Date Particulars Lease Liability Amount 5598.351 Date Particulars Amount 31-12-2019 Cash 01-01-2019 Lease Asset 37500.0 31-12-2020 Cash 5962.244 31-12-2021 Cash 6349.79 31-12-2022 Cash 6762.526 31-12-2023 Cash 7202.09 31-12-2023 Lease Asset-Residual Value 5625 Total 37500 Total 37500.0 Interest Date 31-12-2023 Particulars Balance C/d Amount 8304.254 Date 31-12-2019 31-12-2020 31-12-2021 31-12-2022 31-12-2023 Particulars Cash Cash Cash Cash Cash Total Amount 2437.5 2073.607 1686.061 1273.325 833.7609 8304.254 Total 8304.254 Cash Date Particulars Amount Date Amount 01-01-2019 Balance b/d 77000 31-12-2019 5598.351 31-12-2019 2437.5 31-12-2020 5962.244 31-12-2020 2073.607 31-12-2021 Particulars Lease Liability Interest Lease Liability Interest Lease Liability Interest Lease Liability Interest Lease Liability Interest 6349.79 31-12-2021 1686.061 31-12-2022 6762.526 31-12-2022 1273.325 31-12-2023 7202.09 31-12-2023 833.7609 31-12-2023 Balance c/d 36820.75 77000 77000 Particulars Balance c/d Amount 37500 Date 31-12-2019 31-12-2020 31-12-2021 31-12-2022 31-12-2023 Particulars Depreciation Depreciation Depreciation Depreciation Depreciation Accumulated depreciation Amount Date 7500 31-12-2023 7500 7500 7500 7500 37500 37500 (a) Amortization Table Date Beginning value Lease Rentals Interest@9% Amortization Balance 01-01-2019 37500 31-12-2019 37500 8035.851 2437.5 5598.351 31901.65 31-12-2020 31901.6491 8035.851 2073.607 5962.244 25939.41 31-12-2021 25939.4054 8035.851 1686.061 6349.79 19589.62 31-12-2022 19589.6159 8035.851 1273.325 6762.526 12827.09 31-12-2023 12827.09 8035.851 833.7609 7202.09 5625 (b) Lease Classification Test A lease will be classified as finance lease if any of the following is met:- S.No Conditions Reasoning Fulfilled or not (a) Transfer of ownership ownership of asset transferred is not specifeid in the question Not Fulfilled (b) Option to lesee to purchase asset at the end of Yes lease term Fulfilled (c) Fulfilled Lease term is for major part of life of asset Present Value exceeds the fair value Lease term is equal to life of asset Fair value not given (d) Not Fulfilled Hence the given lease is a Finance Lease. (c) The following are the required journal entries:- Date Amount (in $) JOURNAL ENTRIES in the books of John Keeley Particulars LE Amount (in $ Lease Asset 37500.0 Lease liability (being lease liability recorded) 01-01-2019 Dr 37500.0 31-12-2019 Dr 5962.2 Dr 2073.6 Lease Liability Interest Cash (being lease payment made) 8035.85 31-12-2019 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 31-12-2020 Dr 5962.2 Lease Liability Interest Cash Dr 2073.6 8035.85 (being lease payment made) 31-12-2020 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 31-12-2021 Dr 6349.8 Dr 1686.1 Lease Liability Interest Cash (being lease payment made) 8035.85 31-12-2021 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 31-12-2022 Dr 6762.5 Lease Liability Interest Dr 1273.3 Cash 8035.85 (being lease payment made) 31-12-2022 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 31-12-2023 Dr 7202.1 Dr 833.8 Lease Liability Interest Cash (being lease payment made) 8035.85 31-12-2023 Dr 7500 Depreciation (37500/5) Accumulated Depreciation (being depreciation on lease asset) 7500 The following are the required T-account for all the 5 years:- Date 01-01-2019 Particulars Lease Liability Lease Asset Amount Date 37500.0 31-12-2019 31-12-2020 31-12-2021 31-12-2022 31-12-2023 37500.0 Particulars Depreciation Depreciation Depreciation Depreciation Depreciation Total Amount 7500 7500 7500 7500 7500 37500.0 Total Date Particulars Lease Liability Amount 5598.351 Date Particulars Amount 31-12-2019 Cash 01-01-2019 Lease Asset 37500.0 31-12-2020 Cash 5962.244 31-12-2021 Cash 6349.79 31-12-2022 Cash 6762.526 31-12-2023 Cash 7202.09 31-12-2023 Lease Asset-Residual Value 5625 Total 37500 Total 37500.0 Interest Date 31-12-2023 Particulars Balance C/d Amount 8304.254 Date 31-12-2019 31-12-2020 31-12-2021 31-12-2022 31-12-2023 Particulars Cash Cash Cash Cash Cash Total Amount 2437.5 2073.607 1686.061 1273.325 833.7609 8304.254 Total 8304.254 Cash Date Particulars Amount Date Amount 01-01-2019 Balance b/d 77000 31-12-2019 5598.351 31-12-2019 2437.5 31-12-2020 5962.244 31-12-2020 2073.607 31-12-2021 Particulars Lease Liability Interest Lease Liability Interest Lease Liability Interest Lease Liability Interest Lease Liability Interest 6349.79 31-12-2021 1686.061 31-12-2022 6762.526 31-12-2022 1273.325 31-12-2023 7202.09 31-12-2023 833.7609 31-12-2023 Balance c/d 36820.75 77000 77000 Particulars Balance c/d Amount 37500 Date 31-12-2019 31-12-2020 31-12-2021 31-12-2022 31-12-2023 Particulars Depreciation Depreciation Depreciation Depreciation Depreciation Accumulated depreciation Amount Date 7500 31-12-2023 7500 7500 7500 7500 37500 37500