Answered step by step

Verified Expert Solution

Question

1 Approved Answer

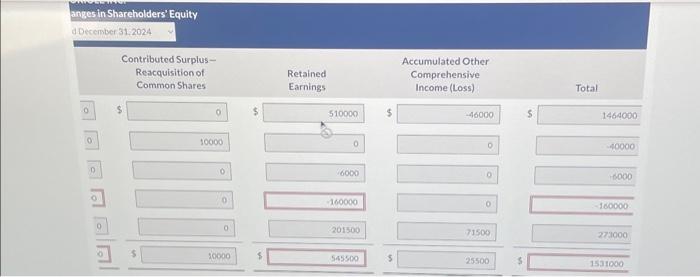

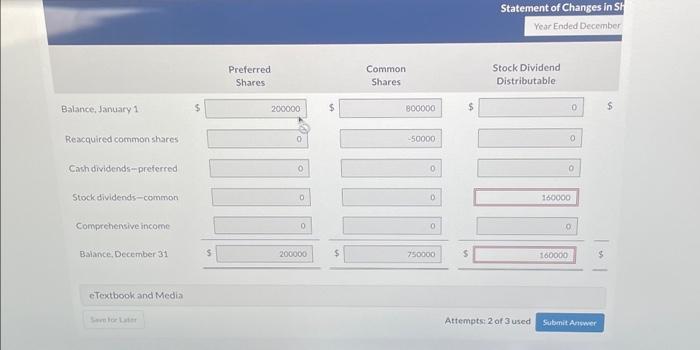

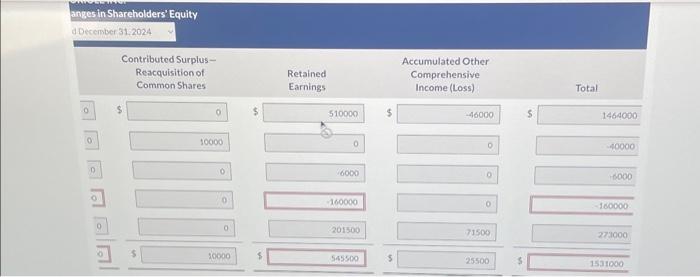

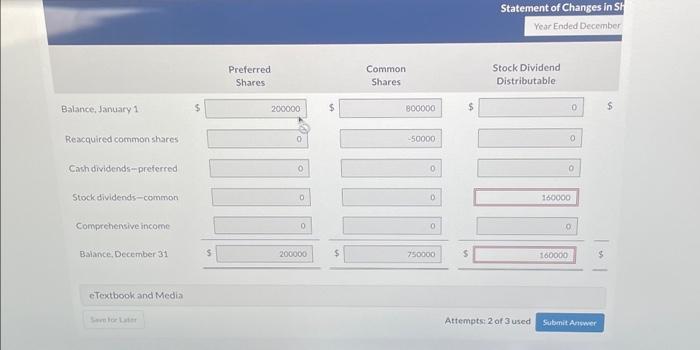

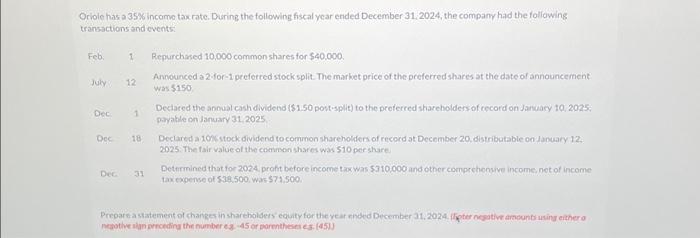

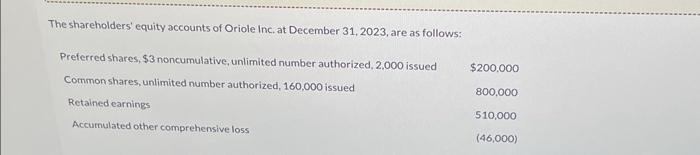

please answer last try added balance sheet please answer anges in Shareholders' Equity aDecember 31.2024 Statement of Changes in SH Year Ended December Preferred Shares

please answer last try

added balance sheet please answer

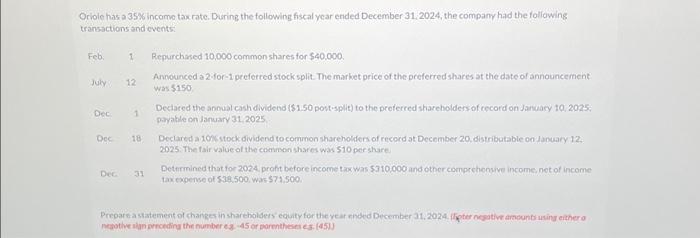

anges in Shareholders' Equity aDecember 31.2024 Statement of Changes in SH Year Ended December Preferred Shares Common Shares Stock Dividend Distributable Balance, January 1 Reacquired common shares Cash dividends-preferred Stock dividends-common Comprehensive income Balance, December 31 o 0 5 o o 0 o 160000 eTextbook and Media Attempts: 2 of 3 used The shareholders' equity accounts of Oriole Inc, at December 31, 2023, are as follows: Statement of Changes in SH Year Ended December Preferred Shares Common Shares Stock Dividend Distributable Balance, January 1 Reacquired common shares Cash dividends-preferred Stock dividends-common Comprehensive income Balance, December 31 o 0 5 o o 0 o 160000 eTextbook and Media Attempts: 2 of 3 used Oriole has a 35% income tax ratc. During the following fiscal ycar ended December 31; 2024, the company had the following transactions and events: Feb. I Repurchased 10,000 common shares for $40,000. July 12 Announced a 2 -for-1 pecferred stock split. The market price of the preferred shares at the date of announcement was $150. Dec: 1 Dectared the annual cash dividend (\$1.50 post-split) to the peterred shareholders of cecord on January 10,2025 . payable on January 31,2025 . Dec 18 Declared a 1OOKs stock dividend to commen sharehoiders of record at December 20, distributable on January 12 . 2025. The tair value of the cotrimon thares was 510 per share. Dec 31 Determined that for 2024, profit before income tax was $310,000 and other comprehensive income, net of income taxeopense of 539.500 , war $71,500. Prepare a statement of charikes in shareholders' equity for the vear ended December 31, 2024, if pter negative amounit using eithero negothe alan proceding the number es -45 or parentheses es. (45)] The shareholders' equity accounts of Oriole Inc, at December 31, 2023, are as follows: Oriole has a 35% income tax ratc. During the following fiscal ycar ended December 31; 2024, the company had the following transactions and events: Feb. I Repurchased 10,000 common shares for $40,000. July 12 Announced a 2 -for-1 pecferred stock split. The market price of the preferred shares at the date of announcement was $150. Dec: 1 Dectared the annual cash dividend (\$1.50 post-split) to the peterred shareholders of cecord on January 10,2025 . payable on January 31,2025 . Dec 18 Declared a 1OOKs stock dividend to commen sharehoiders of record at December 20, distributable on January 12 . 2025. The tair value of the cotrimon thares was 510 per share. Dec 31 Determined that for 2024, profit before income tax was $310,000 and other comprehensive income, net of income taxeopense of 539.500 , war $71,500. Prepare a statement of charikes in shareholders' equity for the vear ended December 31, 2024, if pter negative amounit using eithero negothe alan proceding the number es -45 or parentheses es. (45)] anges in Shareholders' Equity aDecember 31.2024 anges in Shareholders' Equity aDecember 31.2024 Statement of Changes in SH Year Ended December Preferred Shares Common Shares Stock Dividend Distributable Balance, January 1 Reacquired common shares Cash dividends-preferred Stock dividends-common Comprehensive income Balance, December 31 o 0 5 o o 0 o 160000 eTextbook and Media Attempts: 2 of 3 used The shareholders' equity accounts of Oriole Inc, at December 31, 2023, are as follows: Statement of Changes in SH Year Ended December Preferred Shares Common Shares Stock Dividend Distributable Balance, January 1 Reacquired common shares Cash dividends-preferred Stock dividends-common Comprehensive income Balance, December 31 o 0 5 o o 0 o 160000 eTextbook and Media Attempts: 2 of 3 used Oriole has a 35% income tax ratc. During the following fiscal ycar ended December 31; 2024, the company had the following transactions and events: Feb. I Repurchased 10,000 common shares for $40,000. July 12 Announced a 2 -for-1 pecferred stock split. The market price of the preferred shares at the date of announcement was $150. Dec: 1 Dectared the annual cash dividend (\$1.50 post-split) to the peterred shareholders of cecord on January 10,2025 . payable on January 31,2025 . Dec 18 Declared a 1OOKs stock dividend to commen sharehoiders of record at December 20, distributable on January 12 . 2025. The tair value of the cotrimon thares was 510 per share. Dec 31 Determined that for 2024, profit before income tax was $310,000 and other comprehensive income, net of income taxeopense of 539.500 , war $71,500. Prepare a statement of charikes in shareholders' equity for the vear ended December 31, 2024, if pter negative amounit using eithero negothe alan proceding the number es -45 or parentheses es. (45)] The shareholders' equity accounts of Oriole Inc, at December 31, 2023, are as follows: Oriole has a 35% income tax ratc. During the following fiscal ycar ended December 31; 2024, the company had the following transactions and events: Feb. I Repurchased 10,000 common shares for $40,000. July 12 Announced a 2 -for-1 pecferred stock split. The market price of the preferred shares at the date of announcement was $150. Dec: 1 Dectared the annual cash dividend (\$1.50 post-split) to the peterred shareholders of cecord on January 10,2025 . payable on January 31,2025 . Dec 18 Declared a 1OOKs stock dividend to commen sharehoiders of record at December 20, distributable on January 12 . 2025. The tair value of the cotrimon thares was 510 per share. Dec 31 Determined that for 2024, profit before income tax was $310,000 and other comprehensive income, net of income taxeopense of 539.500 , war $71,500. Prepare a statement of charikes in shareholders' equity for the vear ended December 31, 2024, if pter negative amounit using eithero negothe alan proceding the number es -45 or parentheses es. (45)] anges in Shareholders' Equity aDecember 31.2024 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started