Please Answer

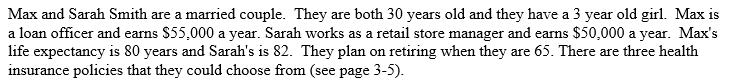

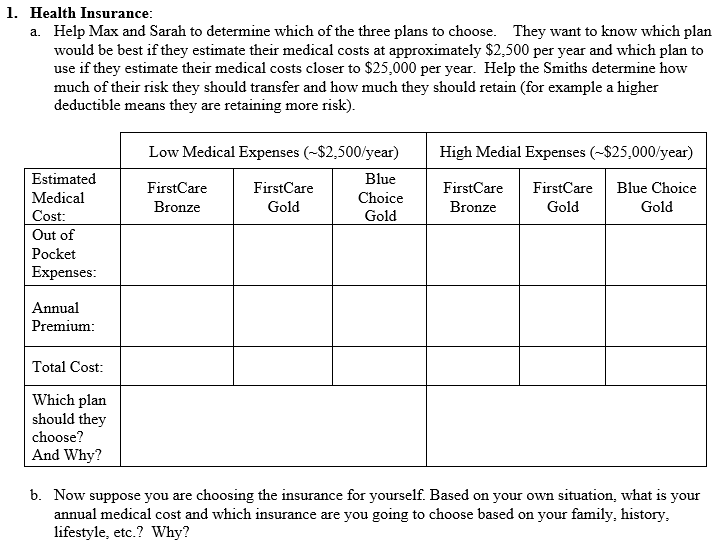

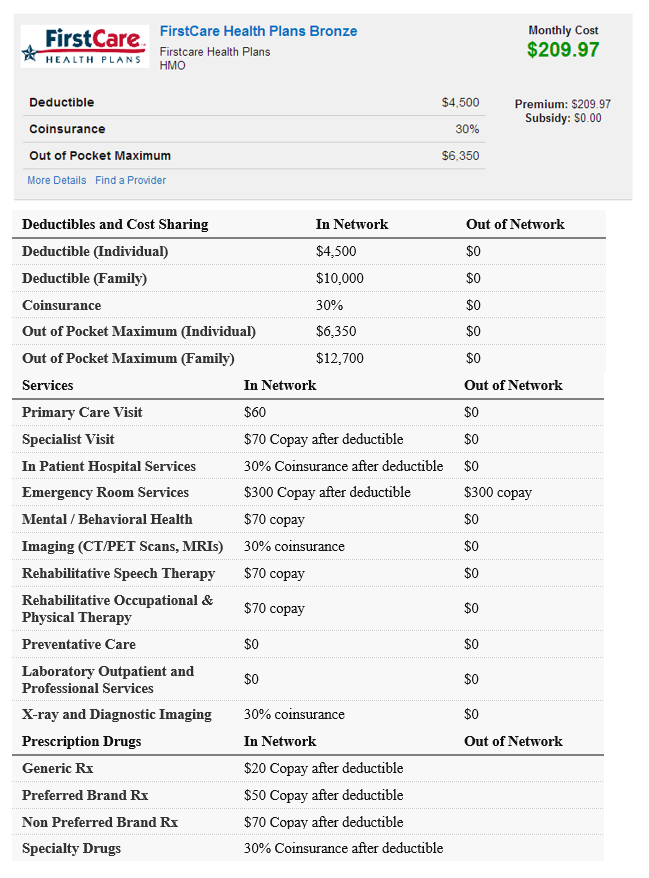

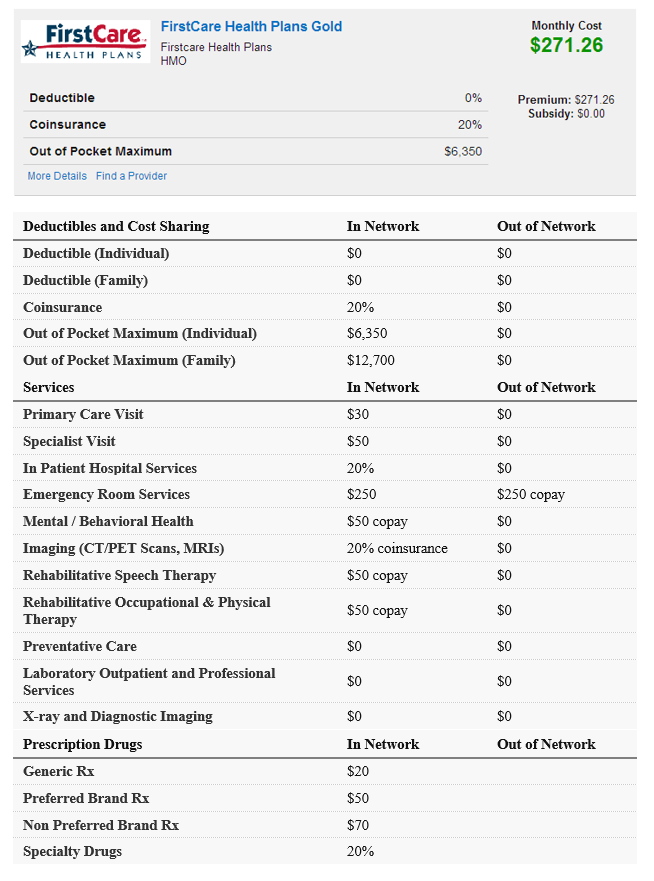

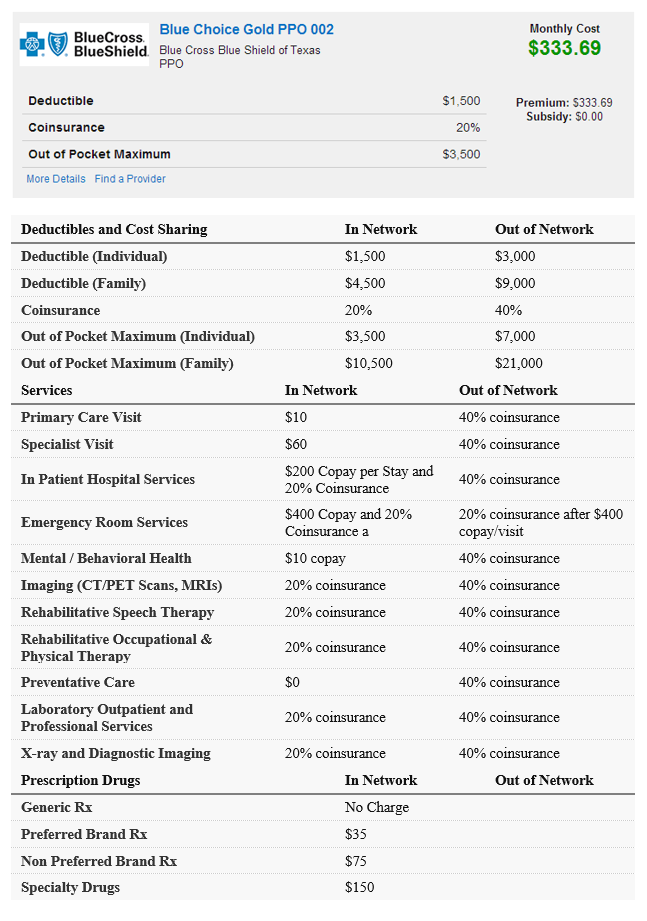

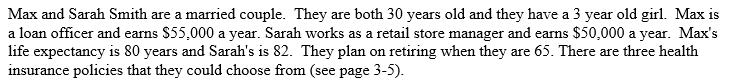

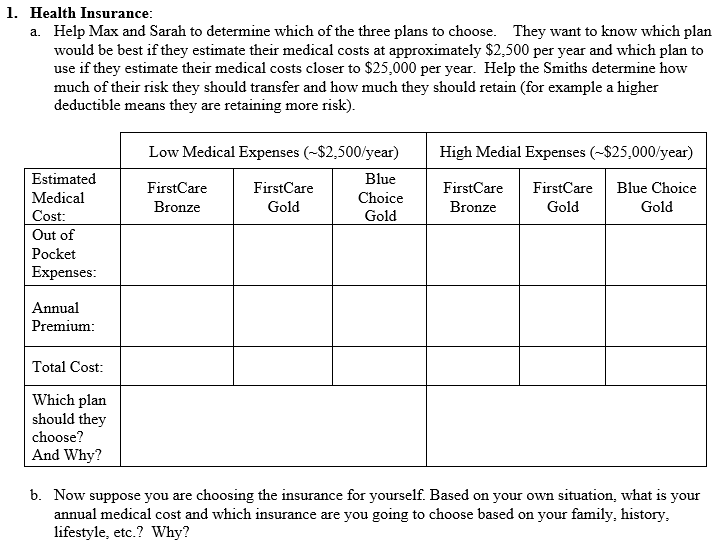

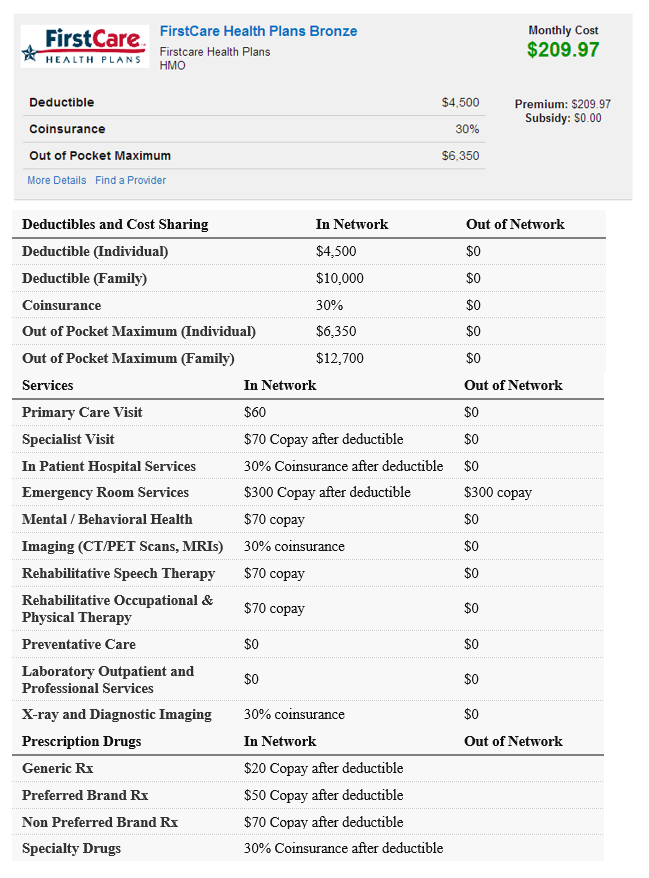

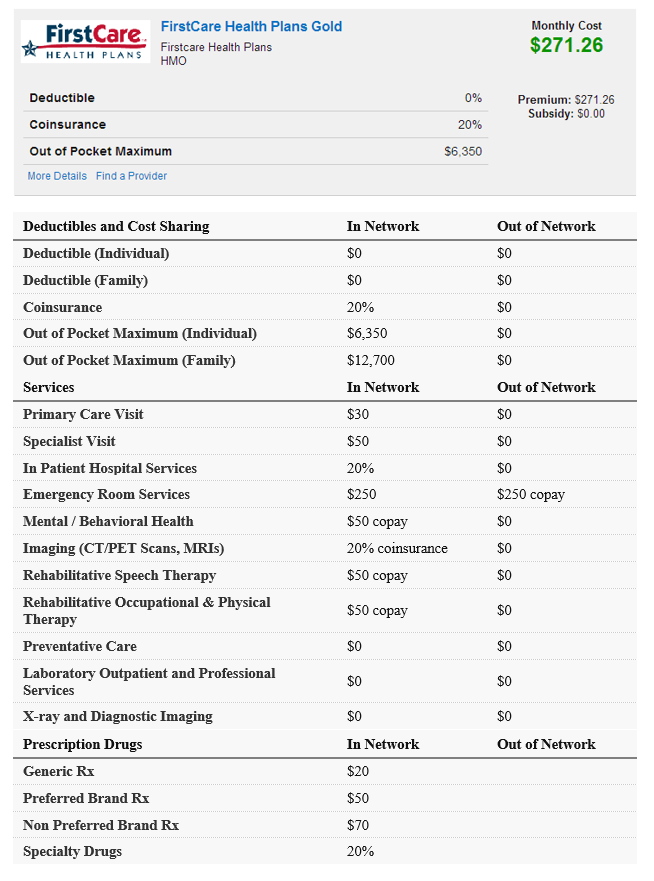

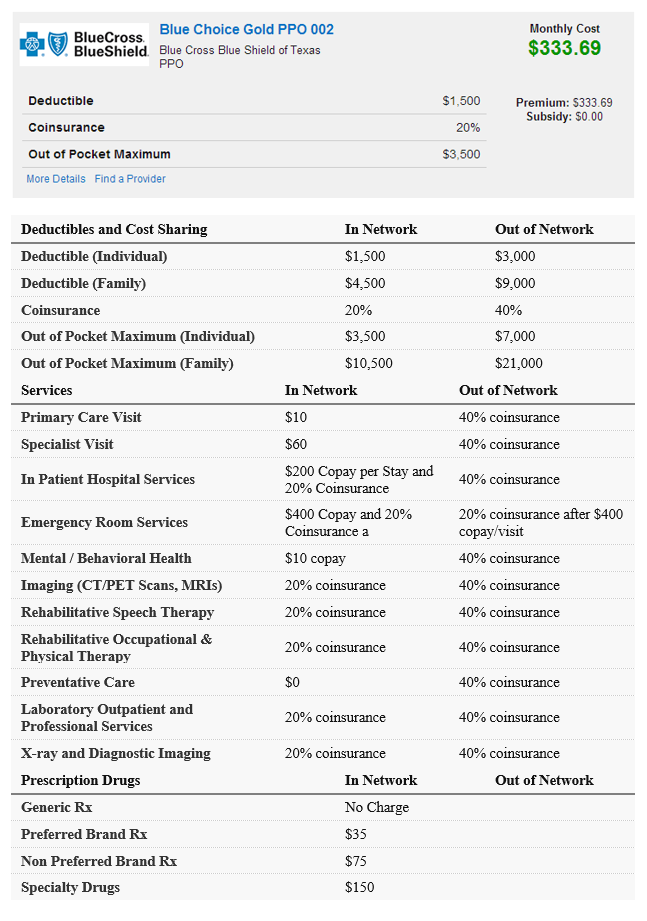

Max and Sarah Smith are a married couple. They are both 30 years old and they have a 3 year old girl. Max is a loan officer and earns $55.000 a year. Sarah works as a retail store manager and earns $50,000 a year. Max's life expectancy is 80 years and Sarah's is 82. They plan on retiring when they are 65. There are three health insurance policies that they could choose from (see page 3-5). 1. Health Insurance: a. Help Max and Sarah to determine which of the three plans to choose. They want to know which plan would be best if they estimate their medical costs at approximately $2,500 per year and which plan to use if they estimate their medical costs closer to $25,000 per year. Help the Smiths determine how much of their risk they should transfer and how much they should retain (for example a higher deductible means they are retaining more risk). High Medial Expenses (-$25,000/year) Low Medical Expenses (--$2,500/year) Blue FirstCare FirstCare Choice Bronze Gold Gold FirstCare Bronze FirstCare Gold Blue Choice Gold Estimated Medical Cost: Out of Pocket Expenses: Annual Premium: Total Cost: Which plan should they choose? And Why? b. Now suppose you are choosing the insurance for yourself. Based on your own situation, what is your annual medical cost and which insurance are you going to choose based on your family, history, lifestyle, etc.? Why? FirstCare Health Plans Bronze FirstCare Firstcare Health Plans HEALTH PLANS HMO Monthly Cost $209.97 $4,500 30% Premium: $209.97 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider $6,350 Out of Network $0 $0 $0 $0 $0 Out of Network $0 $0 $0 $300 copay $0 Deductibles and Cost Sharing In Network Deductible (Individual) $4,500 Deductible (Family) $10,000 Coinsurance 30% Out of Pocket Maximum (Individual) $6,350 Out of Pocket Maximum (Family) $12,700 Services In Network Primary Care Visit $60 Specialist Visit $70 Copay after deductible In Patient Hospital Services 30% Coinsurance after deductible Emergency Room Services $300 Copay after deductible Mental / Behavioral Health $70 copay Imaging (CT/PET Scans, MRIS) 30% coinsurance Rehabilitative Speech Therapy $70 copay Rehabilitative Occupational & Physical Therapy Preventative Care $0 Laboratory Outpatient and $0 Professional Services X-ray and Diagnostic Imaging 30% coinsurance Prescription Drugs In Network Generic Rx $20 Copay after deductible Preferred Brand Rx $50 Copay after deductible Non Preferred Brand Rx $70 Copay after deductible Specialty Drugs 30% Coinsurance after deductible $0 $0 $70 copay $0 $0 $0 $0 Out of Network FirstCare Health Plans Gold FirstCare Firstcare Health Plans HEALTH PLANS HMO Monthly Cost $271.26 0% Premium: $271.26 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider 20% $6,350 In Network $0 Out of Network $0 $0 $0 20% $0 $6,350 $0 $0 $12,700 In Network $30 Out of Network $0 $50 $0 20% $0 $250 $250 copay $0 Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIS) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rs Non Preferred Brand Rx Specialty Drugs $50 copay 20% coinsurance $50 copay $0 $0 $50 copay $0 $0 $0 $0 $0 $0 $0 In Network Out of Network $20 $50 $70 20% BlueCross Blue Choice Gold PPO 002 BlueShield. Blue Cross Blue Shield of Texas PPO Monthly Cost $333.69 $1,500 20% Premium: 5333.69 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider $3,500 Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Network $1,500 $4,500 20% $3,500 $10,500 Out of Network $3,000 $9,000 40% $7,000 $21,000 Out of Network 40% coinsurance 40% coinsurance In Network $10 $60 In Patient Hospital Services 40% coinsurance Emergency Room Services $200 Copay per Stay and 20% Coinsurance $400 Copay and 20% Coinsurance a $10 copay 20% coinsurance 20% coinsurance 20% coinsurance after $400 copay/visit 40% coinsurance 40% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance $0 40% coinsurance Mental / Behavioral Health Imaging (CT/PET Scans, MRIS) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs 20% coinsurance 40% coinsurance 40% coinsurance Out of Network 20% coinsurance In Network No Charge $35 $75 $150 Max and Sarah Smith are a married couple. They are both 30 years old and they have a 3 year old girl. Max is a loan officer and earns $55.000 a year. Sarah works as a retail store manager and earns $50,000 a year. Max's life expectancy is 80 years and Sarah's is 82. They plan on retiring when they are 65. There are three health insurance policies that they could choose from (see page 3-5). 1. Health Insurance: a. Help Max and Sarah to determine which of the three plans to choose. They want to know which plan would be best if they estimate their medical costs at approximately $2,500 per year and which plan to use if they estimate their medical costs closer to $25,000 per year. Help the Smiths determine how much of their risk they should transfer and how much they should retain (for example a higher deductible means they are retaining more risk). High Medial Expenses (-$25,000/year) Low Medical Expenses (--$2,500/year) Blue FirstCare FirstCare Choice Bronze Gold Gold FirstCare Bronze FirstCare Gold Blue Choice Gold Estimated Medical Cost: Out of Pocket Expenses: Annual Premium: Total Cost: Which plan should they choose? And Why? b. Now suppose you are choosing the insurance for yourself. Based on your own situation, what is your annual medical cost and which insurance are you going to choose based on your family, history, lifestyle, etc.? Why? FirstCare Health Plans Bronze FirstCare Firstcare Health Plans HEALTH PLANS HMO Monthly Cost $209.97 $4,500 30% Premium: $209.97 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider $6,350 Out of Network $0 $0 $0 $0 $0 Out of Network $0 $0 $0 $300 copay $0 Deductibles and Cost Sharing In Network Deductible (Individual) $4,500 Deductible (Family) $10,000 Coinsurance 30% Out of Pocket Maximum (Individual) $6,350 Out of Pocket Maximum (Family) $12,700 Services In Network Primary Care Visit $60 Specialist Visit $70 Copay after deductible In Patient Hospital Services 30% Coinsurance after deductible Emergency Room Services $300 Copay after deductible Mental / Behavioral Health $70 copay Imaging (CT/PET Scans, MRIS) 30% coinsurance Rehabilitative Speech Therapy $70 copay Rehabilitative Occupational & Physical Therapy Preventative Care $0 Laboratory Outpatient and $0 Professional Services X-ray and Diagnostic Imaging 30% coinsurance Prescription Drugs In Network Generic Rx $20 Copay after deductible Preferred Brand Rx $50 Copay after deductible Non Preferred Brand Rx $70 Copay after deductible Specialty Drugs 30% Coinsurance after deductible $0 $0 $70 copay $0 $0 $0 $0 Out of Network FirstCare Health Plans Gold FirstCare Firstcare Health Plans HEALTH PLANS HMO Monthly Cost $271.26 0% Premium: $271.26 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider 20% $6,350 In Network $0 Out of Network $0 $0 $0 20% $0 $6,350 $0 $0 $12,700 In Network $30 Out of Network $0 $50 $0 20% $0 $250 $250 copay $0 Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Patient Hospital Services Emergency Room Services Mental / Behavioral Health Imaging (CT/PET Scans, MRIS) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rs Non Preferred Brand Rx Specialty Drugs $50 copay 20% coinsurance $50 copay $0 $0 $50 copay $0 $0 $0 $0 $0 $0 $0 In Network Out of Network $20 $50 $70 20% BlueCross Blue Choice Gold PPO 002 BlueShield. Blue Cross Blue Shield of Texas PPO Monthly Cost $333.69 $1,500 20% Premium: 5333.69 Subsidy: $0.00 Deductible Coinsurance Out of Pocket Maximum More Details Find a Provider $3,500 Deductibles and Cost Sharing Deductible (Individual) Deductible (Family) Coinsurance Out of Pocket Maximum (Individual) Out of Pocket Maximum (Family) Services Primary Care Visit Specialist Visit In Network $1,500 $4,500 20% $3,500 $10,500 Out of Network $3,000 $9,000 40% $7,000 $21,000 Out of Network 40% coinsurance 40% coinsurance In Network $10 $60 In Patient Hospital Services 40% coinsurance Emergency Room Services $200 Copay per Stay and 20% Coinsurance $400 Copay and 20% Coinsurance a $10 copay 20% coinsurance 20% coinsurance 20% coinsurance after $400 copay/visit 40% coinsurance 40% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance $0 40% coinsurance Mental / Behavioral Health Imaging (CT/PET Scans, MRIS) Rehabilitative Speech Therapy Rehabilitative Occupational & Physical Therapy Preventative Care Laboratory Outpatient and Professional Services X-ray and Diagnostic Imaging Prescription Drugs Generic Rx Preferred Brand Rx Non Preferred Brand Rx Specialty Drugs 20% coinsurance 40% coinsurance 40% coinsurance Out of Network 20% coinsurance In Network No Charge $35 $75 $150