Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer much as possible and I wil give you a like!! Question 1 (15 marks) Assume you are Mr Tim Chan, an audit partner

please answer much as possible and I wil give you a like!!

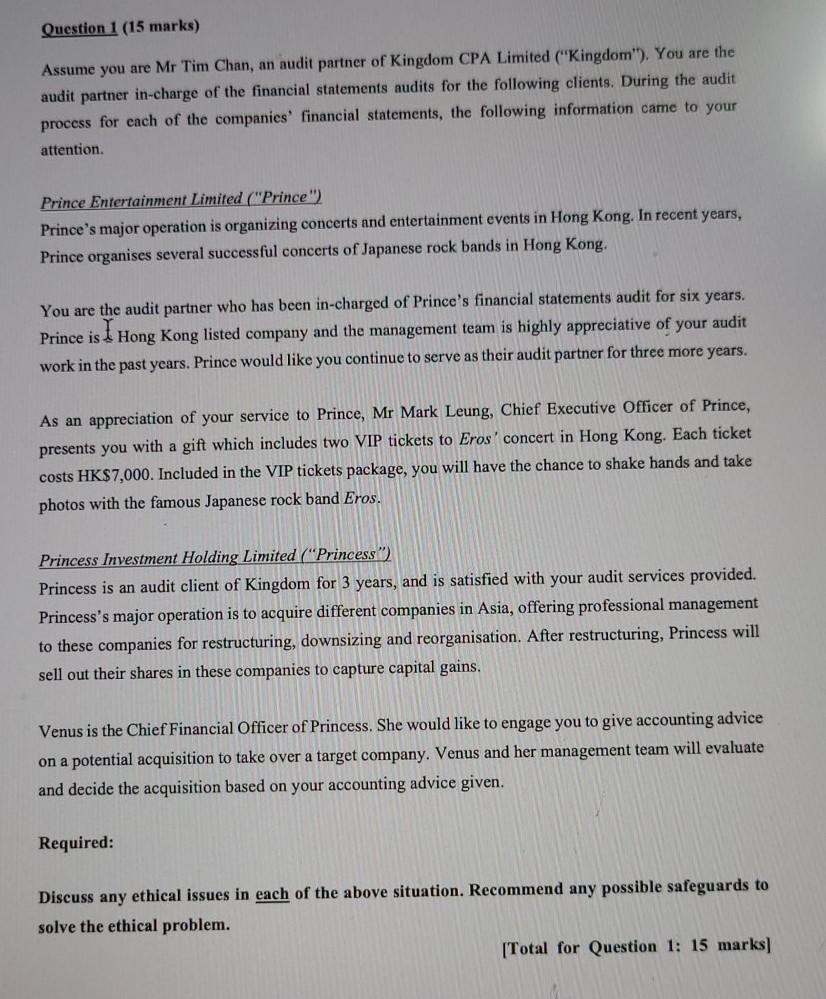

Question 1 (15 marks) Assume you are Mr Tim Chan, an audit partner of Kingdom CPA Limited ("Kingdom"). You are the audit partner in-charge of the financial statements audits for the following clients. During the audit process for each of the companies financial statements, the following information came to your attention. Prince Entertainment Limited ("Prince") Prince's major operation is organizing concerts and entertainment events in Hong Kong. In recent years, Prince organises several successful concerts of Japanese rock bands in Hong Kong. You are the audit partner who has been in-charged of Prince's financial statements audit for six years. Prince is Hong Kong listed company and the management team is highly appreciative of your audit work in the past years. Prince would like you continue to serve as their audit partner for three more years. As an appreciation of your service to Prince, Mr Mark Leung, Chief Executive Officer of Prince, presents you with a gift which includes two VIP tickets to Eros' concert in Hong Kong. Each ticket costs HK$7,000. Included in the VIP tickets package, you will have the chance to shake hands and take photos with the famous Japanese rock band Eros. Princess Investment Holding Limited ("Princess") Princess is an audit client of Kingdom for 3 years, and is satisfied with your audit services provided. Princess's major operation is to acquire different companies in Asia, offering professional management to these companies for restructuring, downsizing and reorganisation. After restructuring, Princess will sell out their shares in these companies to capture capital gains. Venus is the Chief Financial Officer of Princess. She would like to engage you to give accounting advice on a potential acquisition to take over a target company. Venus and her management team will evaluate and decide the acquisition based on your accounting advice given. Required: Discuss any ethical issues in each of the above situation. Recommend any possible safeguards to solve the ethical problem. [Total for Question 1: 15 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started