please answer no curvise writing

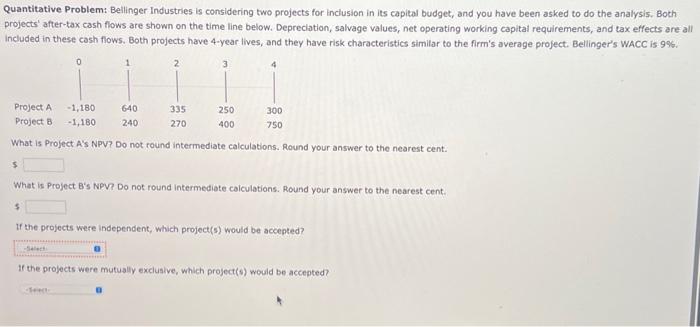

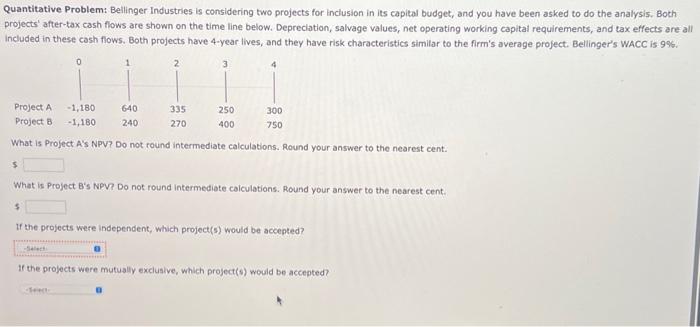

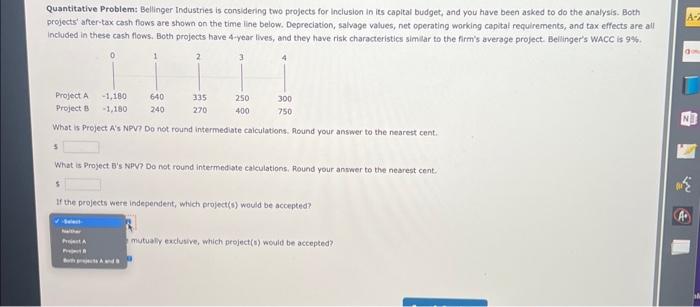

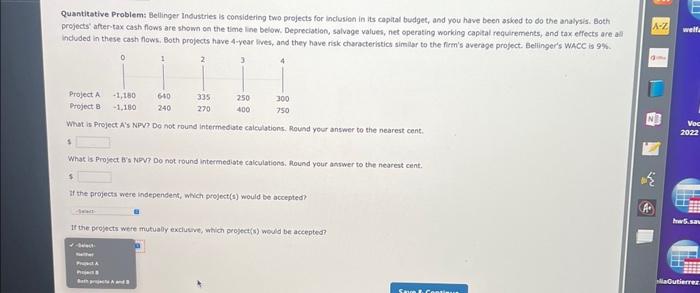

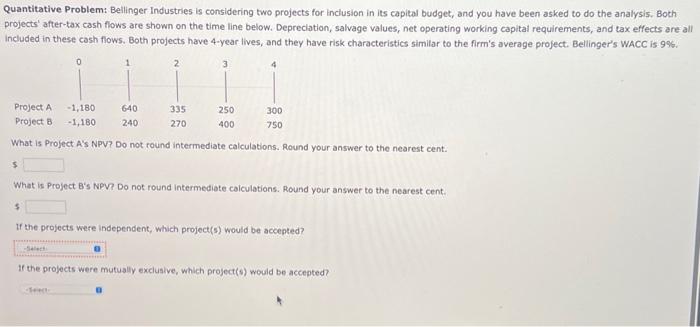

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is gos. What is Project A's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. 5 What is Project B's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. 5 If the projects were independent, which project(s) would be accepted? If the projects were mutually exclusive, which project(6) would be accepted? Quantitative Problem: Bellinger Industries is considering two projects for Inclusion in its capltal budget, and you have been asked to do the analysis. Both projects after-tax cash flows are shown on the time line below, Depreciation, salvage values, net operating working copital requlrements, and tax effects are all Incluoed in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WAcC is 9% What is Project A's NPV? Do not round intermediate calculations. Mound your answer to the nearest cent. 5 What is Project B's NPV? Do not round intermed ste calculations. Round your answer to the nearest cent. 5 If the projects were independent, which project(s) would be accepted? mutualy exclusive, which project(o) would be accepted? Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the anafysis. Both projects" aftertax cash flows are sbown on the time line below. Depreciation, salvage valuen, net operating working capital requirements, and tax effects are as Induded in these cash fows. Both projects have 4 -year Bives, and they have risk characteristics simlar to the firm's averape project. Bellinger's Whce is 9%. What is Project A's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. 4 What is Project B's NDV? Do not round intermediate calculations. Alound your answer to the nearest cent. 4 if the projects were independent, which project(s) would be accepted? It the projicts were mutuaby exclucive, which project(s) would be accepted