please answer only correctly

thank you

data table

requirements

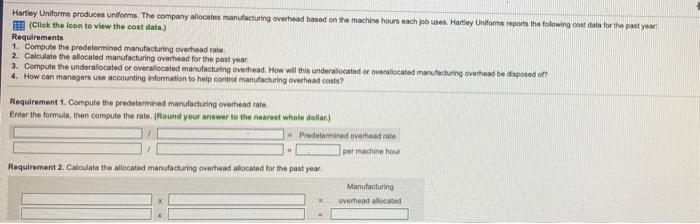

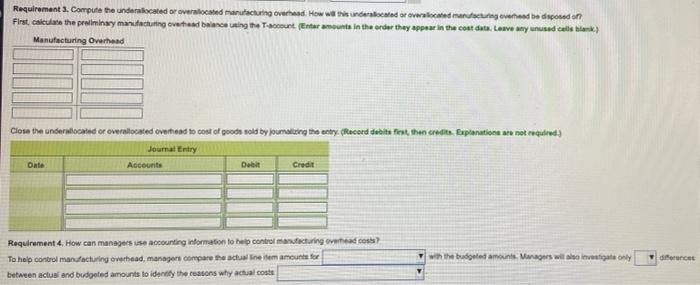

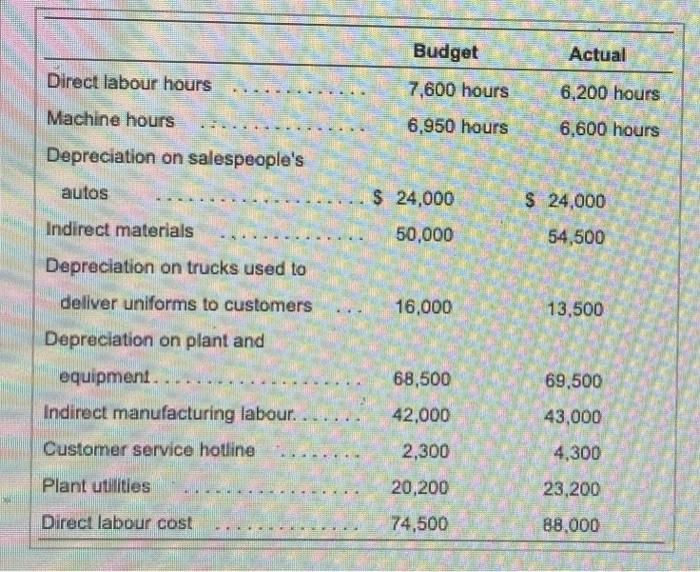

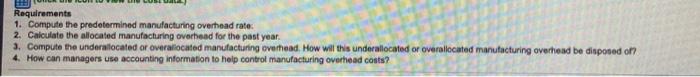

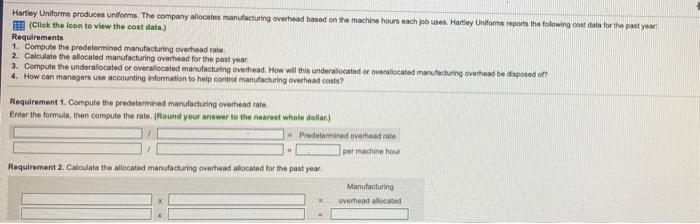

Hartley Uniforms produces uniforms. The company allocate manufacturing overhead based on the machine hours aachbuses Hartley Uniform reports the following cost data for the past (Click the loon to view the cost data) Requirements 1. Compute the predetermined manufacturing overhead rate 2. Calculate the allocated manufacturing overhead for the past year 3. Compute the under located or overallocated manufacturing overhead. How will this under located or overallocated mancing overhead be disposed of 4. How can managers use accounting information to help control manufacturing overhead co? Requirement 1. Compute the predetermined manufacturing overhead rate Enter the formula, then compute the rate (Round your answer to the nearest whole dolar) Predetmined overdrate por machine hour Requirement 2. Calculate the allocated manufacturing overhead allocated for the past year Manufacturing overhead allocated Requirements. Compute the underlocated or overlocated manufacturing overed. How wondered or owoce managed be doned on First, calculate the periliminay manufacturing overras bancs uting the Taccount (Enter amounts in the order they appear in the coat data. Lewe any unused cells blank) Manufacturing Overhead Close the under located or overallocated overhead to cost of goods sold by oumating the entry Record debts first, then credit. Buplanations are not required) Journal Entry Date Accounts De Credit Requirement 4. How can managers use accounting information to the control manufacturing overhead cost? with the budgeted amount Managers wing only To help control manufacturing overhead, managers compare the actual neem amounts for between actual and budgeted amounts to identify the rotons why actual costs Budget Actual Direct labour hours 7,600 hours 6,200 hours Machine hours 6,950 hours 6,600 hours Depreciation on salespeople's autos $ 24,000 $ 24,000 Indirect materials 50,000 54,500 Depreciation on trucks used to deliver uniforms to customers 16,000 13,500 Depreciation on plant and equipment 68,500 69,500 Indirect manufacturing labour. 42,000 43,000 . Customer service hotline 2,300 4,300 Plant utilities 20,200 23,200 Direct labour cost 74,500 88,000 Requirements 1. Compute the predetermined manufacturing overhead rate: 2. Calculate the allocated manufacturing overhead for the past year 3. Compute the under located or overallocated manufacturing overhead. How will this underallocated or overallocated manufacturing overhead be disposed of? 4. How can managers use accounting information to help control manufacturing overhead costs