Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer only if you're 100% sure this is the whole question I can't find extra information.. please help Suppose that, at age 30, you

please answer only if you're 100% sure

this is the whole question I can't find extra information.. please help

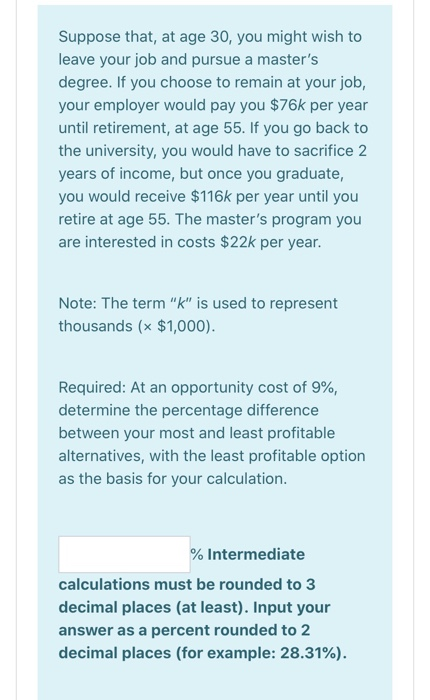

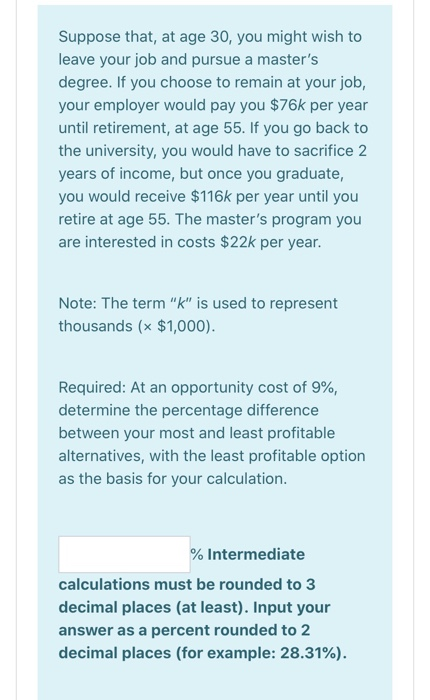

Suppose that, at age 30, you might wish to leave your job and pursue a master's degree. If you choose to remain at your job, your employer would pay you $76k per year until retirement, at age 55. If you go back to the university, you would have to sacrifice 2 years of income, but once you graduate, you would receive $116k per year until you retire at age 55. The master's program you are interested in costs $22k per year. Note: The term "k" is used to represent thousands (* $1,000). Required: At an opportunity cost of 9%, determine the percentage difference between your most and least profitable alternatives, with the least profitable option as the basis for your calculation. % Intermediate calculations must be rounded to 3 decimal places (at least). Input your answer as a percent rounded to 2 decimal places (for example: 28.31%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started