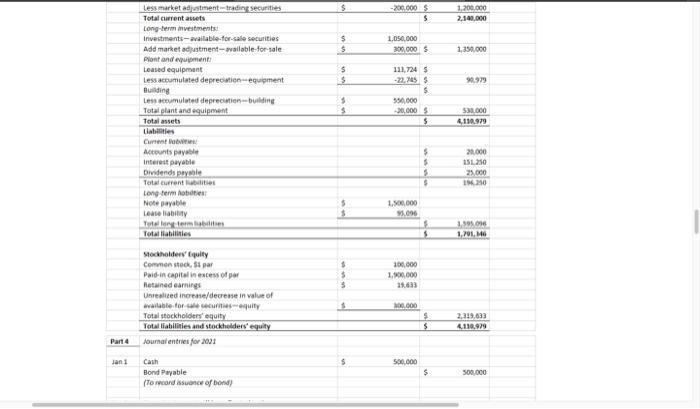

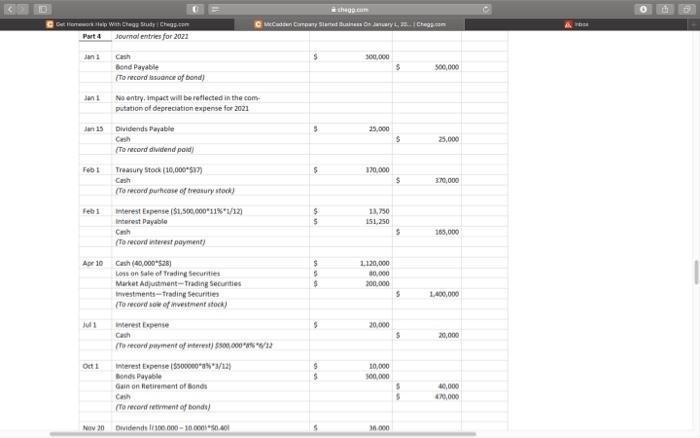

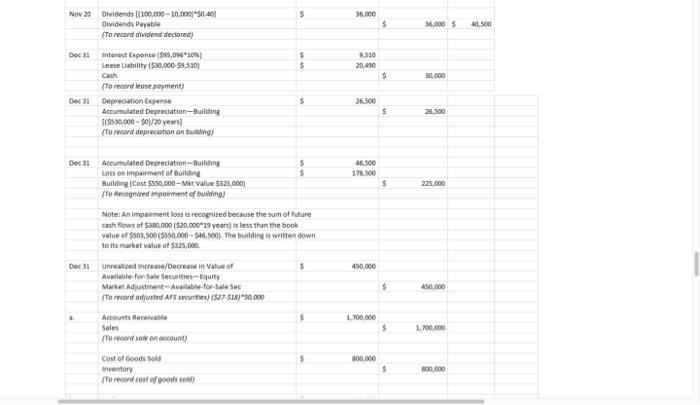

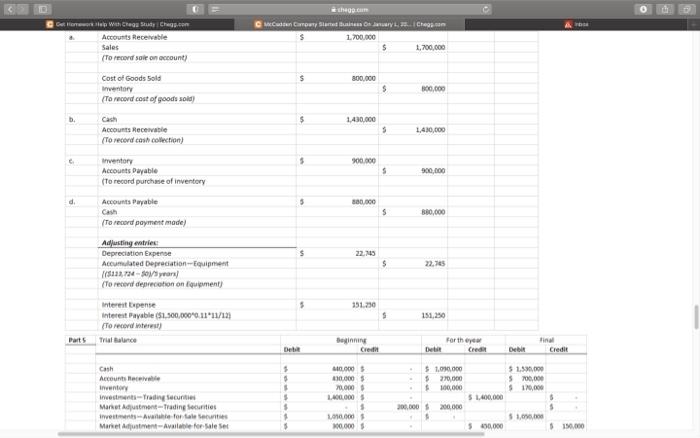

Please answer only part 6.

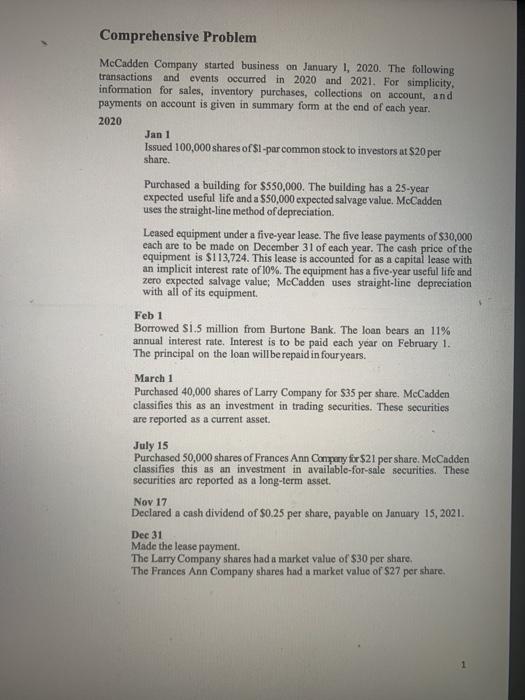

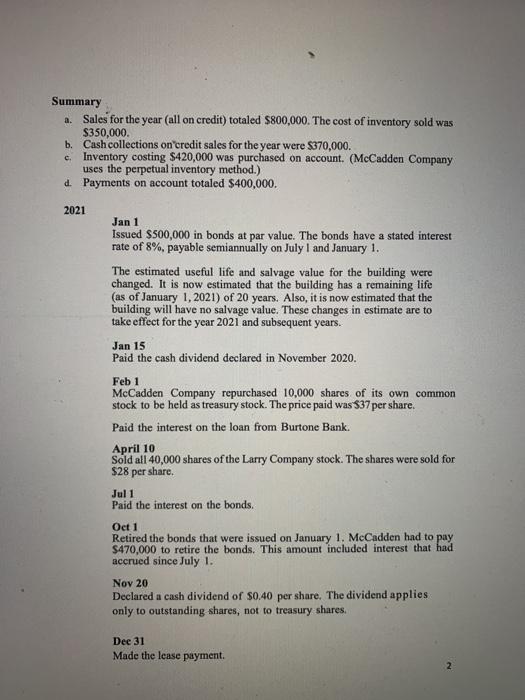

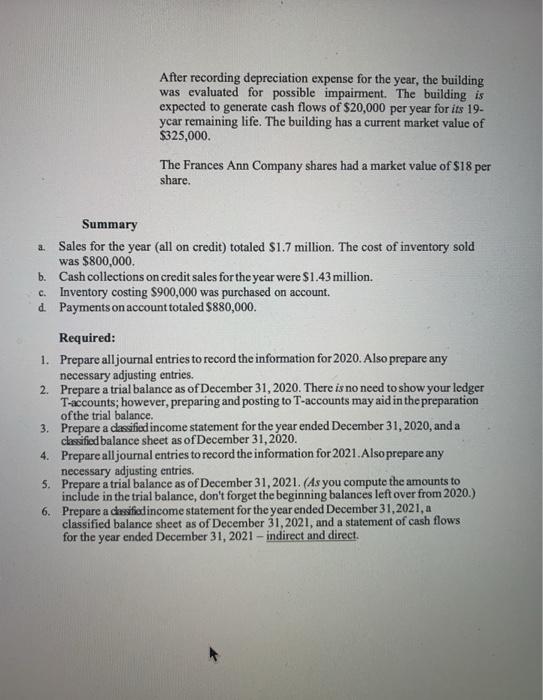

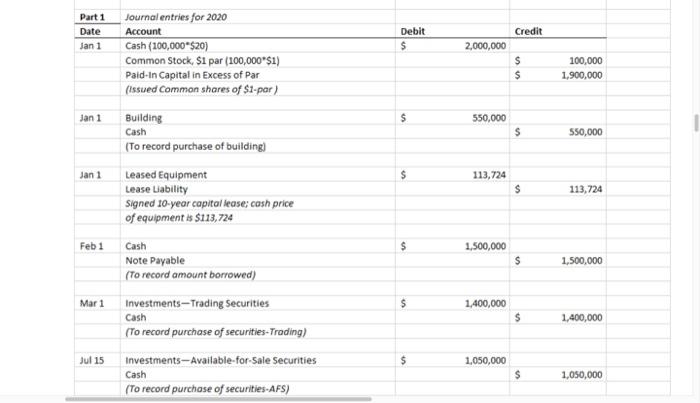

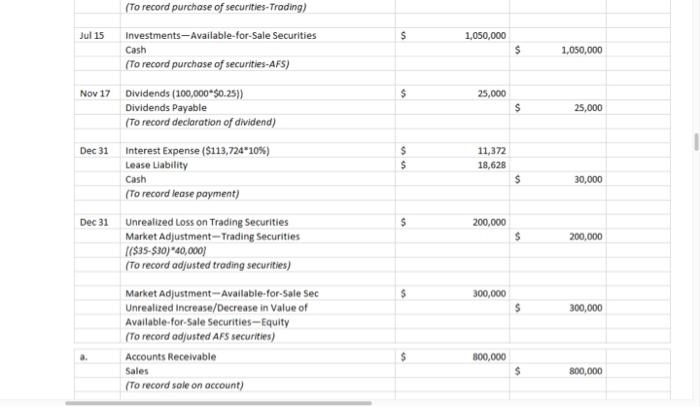

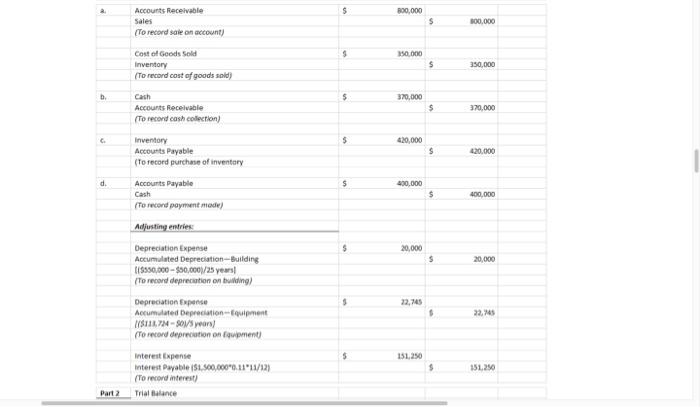

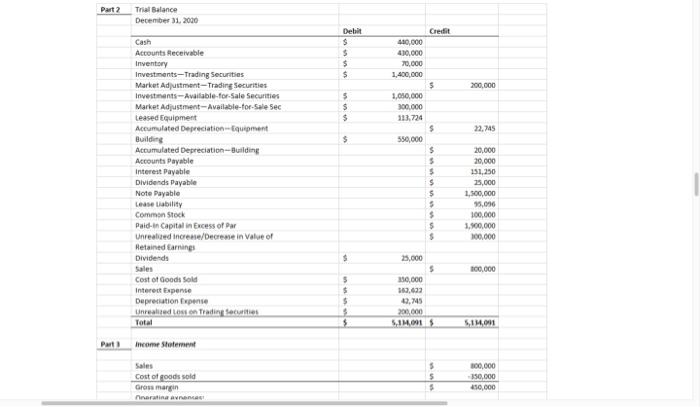

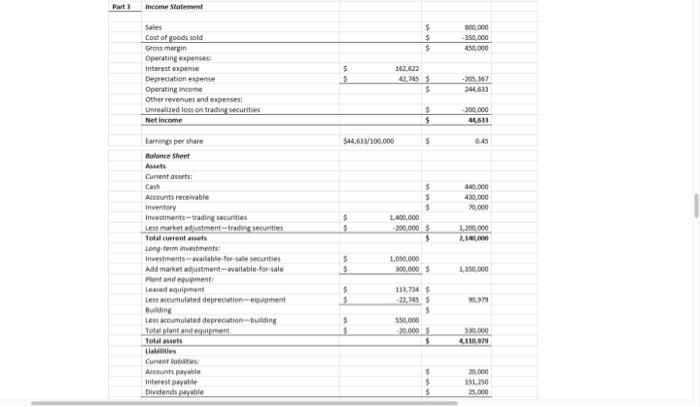

Comprehensive Problem McCadden Company started business on January 1, 2020. The following transactions and events occurred in 2020 and 2021. For simplicity, information for sales, inventory purchases, collections on account, and payments on account is given in summary form at the end of each year. 2020 Jan 1 Issued 100,000 shares of $1-par common stock to investors at $20 per share. Purchased a building for $550,000. The building has a 25-year expected useful life and a $50,000 expected salvage value. McCadden uses the straight-line method of depreciation. Leased equipment under a five-year lease. The five lease payments of $30,000 each are to be made on December 31 of each year. The cash price of the equipment is $113,724. This lease is accounted for as a capital lease with an implicit interest rate of 10%. The equipment has a five-year useful life and zero expected salvage value; McCadden uses straight-line depreciation with all of its equipment. Feb 1 Borrowed S1.5 million from Burtone Bank. The loan bears an 11% annual interest rate. Interest is to be paid each year on February 1. The principal on the loan will be repaid in four years. March 1 Purchased 40,000 shares of Larry Company for $35 per share. McCadden classifies this as an investment in trading securities. These securities are reported as a current asset. July 15 Purchased 50,000 shares of Frances Ann Company for $21 per share. McCadden classifies this as an investment in available-for-sale securities. These securities are reported as a long-term asset. Nov 17 Declared a cash dividend of $0.25 per share, payable on January 15,2021. Dec 31 Made the lease payment. The Larry Company shares had a market value of $30 per share, The Frances Ann Company shares had a market value of $27 per share. a. Summary Sales for the year (all on credit) totaled $800,000. The cost of inventory sold was $350,000 b. Cash collections on credit sales for the year were $370,000. c. Inventory costing $420,000 was purchased on account. (McCadden Company uses the perpetual inventory method.) d. Payments on account totaled $400,000. 2021 Jan 1 Issued $500,000 in bonds at par value. The bonds have a stated interest rate of 8%, payable semiannually on July 1 and January 1. The estimated useful life and salvage value for the building were changed. It is now estimated that the building has a remaining life (as of January 1, 2021) of 20 years. Also, it is now estimated that the building will have no salvage value. These changes in estimate are to take effect for the year 2021 and subsequent years. Jan 15 Paid the cash dividend declared in November 2020. Feb 1 McCadden Company repurchased 10,000 shares of its own common stock to be held as treasury stock. The price paid was $37 per share. Paid the interest on the loan from Burtone Bank. April 10 Sold all 40,000 shares of the Larry Company stock. The shares were sold for $28 per share. Jul 1 Paid the interest on the bonds. Oct 1 Retired the bonds that were issued on January 1. McCadden had to pay $470,000 to retire the bonds. This amount included interest that had accrued since July 1. Nov 20 Declared a cash dividend of $0.40 per share. The dividend applies only to outstanding shares, not to treasury shares. Dee 31 Made the lease payment. After recording depreciation expense for the year, the building was evaluated for possible impairment. The building is expected to generate cash flows of $20,000 per year for its 19- ycar remaining life. The building has a current market value of $325,000 The Frances Ann Company shares had a market value of $18 per share. Summary a Sales for the year (all on credit) totaled $1.7 million. The cost of inventory sold was $800,000. b. Cash collections on credit sales for the year were $1.43 million. c. Inventory costing $900,000 was purchased on account. d Payments on account totaled $880,000. Required: 1. Prepare all journal entries to record the information for 2020. Also prepare any necessary adjusting entries. 2. Prepare a trial balance as of December 31, 2020. There is no need to show your ledger T-accounts; however, preparing and posting to T-accounts may aid in the preparation of the trial balance 3. Prepare a dessified income statement for the year ended December 31, 2020, and a classified balance sheet as of December 31, 2020. 4. Prepare all journal entries to record the information for 2021. Also prepare any necessary adjusting entries. 5. Prepare a trial balance as of December 31, 2021. (As you compute the amounts to include in the trial balance, don't forget the beginning balances left over from 2020.) 6. Prepare a desified income statement for the year ended December 31, 2021, a classified balance sheet as of December 31, 2021, and a statement of cash flows for the year ended December 31, 2021 - indirect and direct. Part 1 Credit Date Jan 1 Debit $ 2,000,000 Journal entries for 2020 Account Cash (100,000-$20) Common Stock $1 par (100,000 $1) Paid-in Capital in excess of Par (issued Common shares of $1.par) $ $ 100,000 1,900,000 Jan 1 $ 550,000 Building Cash (To record purchase of building) $ 550,000 Jan 1 $ 113,724 $ 113,724 Leased Equipment Lease Liability Signed 10-year capital fease: cash price of equipment is $113,724 Feb 1 $ 1,500,000 Cash Note Payable (To record amount borrowed) $ 1,500,000 Mar 1 $ 1,400,000 Cash $ 1,400,000 Investments-Trading Securities (To record purchase of securities-Trading) Investments-Available-for-Sale Securities Cash (To record purchase of securities-AFS) Jul 15 $ 1,050,000 $ 1,050,000 Jul 15 $ 1,050,000 s 1,050,000 $ 25,000 $ 25,000 Dec 31 $ $ 11,372 18,628 $ 30,000 (To record purchase of securities-Trading) Investments-Available for Sale Securities Cash (To record purchase of securities-AFS) Nov 17 Dividends (100,000-$0.25) Dividends Payable (To record declaration of dividend) Interest Expense ($113,724*10%) Lease Liability Cash (To record lease payment) Dec 31 Unrealized Loss on Trading Securities Market Adjustment --Trading Securities f($35-$30)*40,000 (To record adjusted trading securities) Market Adjustment--Available for Sale Sec Unrealized increase/Decrease in Value of Available for Sale Securities-Equity (To record adjusted AFS securities) Accounts Receivable Sales To record sale on account) un 200,000 $ 200,000 $ 300,000 300,000 $ 800,000 $ 800,000 $ 800,000 Accounts Receivable Sales To record sale on account) $ 300.000 $ 150.000 $ 350,000 Cost of Goods Sold Inventory (To record cost of goods sold) Cash Accounts Receivable (To record cash collection) $ 370,000 $ 370,000 $ 420,000 Inventory Accounts Payable (To record purchase of inventory $ 420.000 d. $ 490,000 Accounts Payable Cash To record payment med $ 400,000 Adjusting entries $ 20,000 $ 20,000 Depreciation Expense Accumulated Depreciation-Building [/S550,000-$30,0001/25 years To record depreciation on building) Depreciation Expense Accumulated Depreciation Equipment SUAT-SO/years) To record deprecation on Equipment 22,745 $ 22,745 $ 151,250 $ 151.250 Interest Expense Interest Payable 151.500.000 0.1111/12) (To record interest Trial Balance Part 2 Part 2 Trial Balance December 31, 2020 Debit $ $ $ $ 200,000 5 $ $ 22,745 Credit 440,000 410.000 70.000 1,400,000 $ 1,050,000 300.000 113.724 $ 550,000 $ $ $ $ $ 5 $ $ $ Cash Accounts Receivable Inventory Investments-Trading Securities Market Adjustment --Trading Securities Investments Available for Sale Securities Market Adjustment-Available for Sale Sec teased Equipment Accumulated Depreciation Equipment Building Accumulated Depreciation Building Accounts Payable Interest Payable Dividends Payable Note Payable Lease Liability Common Stock Paid in Capital in Excess of Par Unrealized increase/Decrease in value of Retained Earnings Dividends Sales Cost of Goods Sold Interest Expense Depreciation Expense inrealed Lot Trading Total $ 20,000 20,000 151,250 25,000 1,500,000 95,096 100,000 3.500.000 100.000 $ 35,000 $ 100.000 5 $ $ $ 350,000 103,622 42,745 200.000 SIMON SIMON Part income Statement Sales Cost of foods sold Gross margin narating an 5 $ 5 300,000 350,000 450,000 Part Income Statement $ $ $ 800.000 -350,000 450,000 Sales Cost of goods sold Grontmar Operating expenses: Interest expense Depreciation expense Operating income Other revenues and expenses Unrealized loss on trading securities Net Income $ $ 162.622 7.745 -206.167 244,633 $ $ $ -300.000 41619 344611/100,000 $ 6.45 400.000 430,000 0.000 $ $ $ 1,400,000 2000005 $ S S 1.200.000 2.100,00 5 Earrings per share Balance Sheet Aves Current assets: Cash Accounts receivable Inventory Investments-trading securities Les market ajustment-trading securities Total current assets Long-term mestments Investments-vailable for sale securities Add market adjustment-available for sale Pantandement Leared equipment Less tumulated depreciation equipment Big Les accumulated depreciation building Tot plant and equipment Total assets Untities Curwa Accounts payable interest petite Dividends payable 1.050,000 300.000 $ 110,000 $ $ 111.7245 22,245 0.979 $ 550.000 20.000 9000 4,110,99 5 200000 151.250 23.000 -200.000 1.200.000 2,140,000 $ $ $ 1.050,000 200,000 $ 1,350.000 $ 90.979 111,724 5 -22,7455 $ 550.000 20.000 $ $ $ 530.000 4.110.979 1.000 less market adjustment-trading securities Total current aus Long-term investments Investments available for sale securities Add market adjustment-wilable for sale plant and equipment Leased equipment Less accumulated depreciation equipment Building Les mulated depreciation--building Total slant and equipment Total met Labs Currento Accounts payable Interest payable Dividends payale Total current Long termes Notepayable Lease by Totem Total flatlines Stockholfer quity Common stock 51 par Paid in capital in excess of Retained earnings Unrealed increase/decrease in value of vitable for a quity Total stockholders' equity Total liabilities and stockholders' equity Journal entries for 2011 $ $ 5 $ 151250 25.000 IN 1.500,000 9.000 1.500 1.2016 200.000 1.500,000 21.6 3 00.000 $ $ 2,311.633 4.110.929 Part 4 Jani 500.000 Cash Bond Payable (Tomcord issuence of bond $ 500.000 hoc Can Carrot Started Business Oy, Chego AO Geo Wa Chege Studes.com Part 4 Journal entries for 2021 300.000 $ 500,000 man Bond Payable To record fasuance of bond) Ne entry, impact will be reflected in the com putation of depreciation expense for 2021 Jan 15 Dividends Payable Cash To record dividend pold Feb Treasury Stok (10,000 (To record purces of toxury stock) 25.000 $ 25,000 $ 370,000 $ 370,000 Feb1 $ $ 13,750 IS1.250 Interest Expense (S1,500,000"11"1/12 Interest Payable Cash (To record interest payment) 165,000 Apr 10 Cash (40,000-$28) Loss on sale of Trading Securities Market Adjustment-Trading Securities investments --Trading Securities To record of stent stock $ 5 $ 1,120,000 30.000 200,000 $ 1.400,000 20,000 $ 20,000 10,000 500,000 To record payment of t) 800.000 Oct 1 interest Expense 00000/12) Bonds Payable Gain on Retirement of Bonds Cash (To record rement of bonds) Nov 30 Dividend 200.000 - 10.0001080401 10,000 60,000 5 10.000 Nov 20 $ 30.000 Dividends (100,000-10.000 50.00 Dividends Payable To record dividend declared 5 36,000 10.500 Dec 1 $ 50 20,450 5 $ 30.000 Interest Expente 1.09620) Lease Liability ($30,000-$9,530) Cash To record lease payment) Depreciation Expertise Accumulated Depreciation-Building 175330.000-501/20 years To record depreciation on building) $ 26.500 $ 26.500 Dec 3: $ 46 500 17.500 Accumulated Depreciation-Building Loss or impairment of building Building Cost $850,000-Mkt Value $325,000) (To Recognized imparment of building) $ 225.000 Note: An impairment loss is recognized because the sum of future cash flows of $380,000 $20.000*29 years) is less than the book value of $801.500 (550.000 - 16.00. The building is written down to its market value of $125,000 Unrealed increase/Decrease in value of $ Available for Sale Securities-quity Market Adjustment-Awate for Sale Sec To recordated APS ure) $27.5*30.000 Dec 13 450.000 5 450,000 1.700.000 $ 1,700.000 Accounts Receivable Sales To record so on.count Cost of Goods Sold Inventory for cost of woods 100.000 0.000 A wao wa Chuo chas.com Accounts Receivable Sales To record sole on account) sh McCuren Computy Surtes Bains Oy, Cheson 1.700.000 $ 1.700.000 $ 300,000 Cost of Goods Sold Inventory (To record cost of goods sold $ 300.000 $ 1.430.000 Cash Accounts Receivable To record cash collection) 5 1.430,000 $ 900.000 Inventory Accounts Payable to record purchase of inventory $ 900,000 d. Accounts Payable 3 380.000 190,00 s 380,000 To record payment mode) $ 22.15 Adjusting entries Depreciation Experte Accumulated Depreciation Equipment (5122-year (To record deprecation on Equipment) $ 5 351230 s 151,250 Interest pense Interest Payable ($1.500.000 0.11 11/12 To record terest Trial Balance Parts Beginn Credit Det For they Cred Credit $ $ . 5 5 10.000 $ $ 100,000 2.000 Cash Account Receive Inventory Inwest-Trading securitie Market Adjustment Trading securities inweste fortalesete Marie Aument-avate for Sale Set $ 1.590.000 5200,000 $ 120,000 10.000 $ 110.000 70.000 L.400.000 5 $ 000 $ 0.000 5 1.400,000 200,000 $ 200.000 $ 1.0. 5 40.000 150.000 Part 5 Trial Balance Beginning Credit For theyear Credit Deb De Debit Credit Cash Acconceivable $ $ $ $ $ 5 $ $ 0,000 $ 30,000 $ 20,000 1 400,000 $ $ 1.000.000 300,000 111.7265 $ 550,000 5 $ $ $ 5 $ $ $ Investments-Trading Securities Market Adjustment-Trading Securities Investments-Avalable for Sale Securities Market Adjustments Available for sale sex Leased oviment Acculated Depreciation foment Building Accumulated Deprecation-wulaing Accounts Payable Interest Payable Dividends Payable Note Payable Lease Commen Stock Paisin Capital in of Dar Metained frings Unrealed increase/Decrease in value o Treasury Stock Dividende Sales Cost of Goods Sold Interest Expense Depreciation Expense Urried Loss on Trading Secunties Loss on sale of Trading Securities Los on Impairment Building Gain on Retirement of Bonds Total $ 1090.000 $ 1.500.000 $ 20,000 $ 700.000 $ 300,000 $ 170.000 $ 1400,000 200.000 $ 200,000 $ $ 1.050.000 $ 450,000 $150.000 5 $ 113.72 22,165 5 $ $225,000 335.000 20,000 20.000 20.000 $ 20.000 $ 40.000 13.250 $ $ 151.350 25.000 $ 11.00 $ 36.000 1.100.000 5 $ 1.500.000 15.05 300.000 $ $100,00 1.500.000 $ $ 1,900.000 $ 33 300.000 5 450,000 $ 150.000 5 110,000 $ 370.000 $ 1,000 1.000 $7,000 $ 1,200.00 $ 800,000 $ 100.000 $ 204,510 $ 204 510 5 M 40 41 $ $ $ 30.000 $ 30.000 $ 171.500 $ 1711.500 40.000 40.000 43MUI 8,745 U455 5.256,928 55.756.78 5 5 4153,7245