please Answer only Q3

Please answer only Q.3

Please answer only Q.3

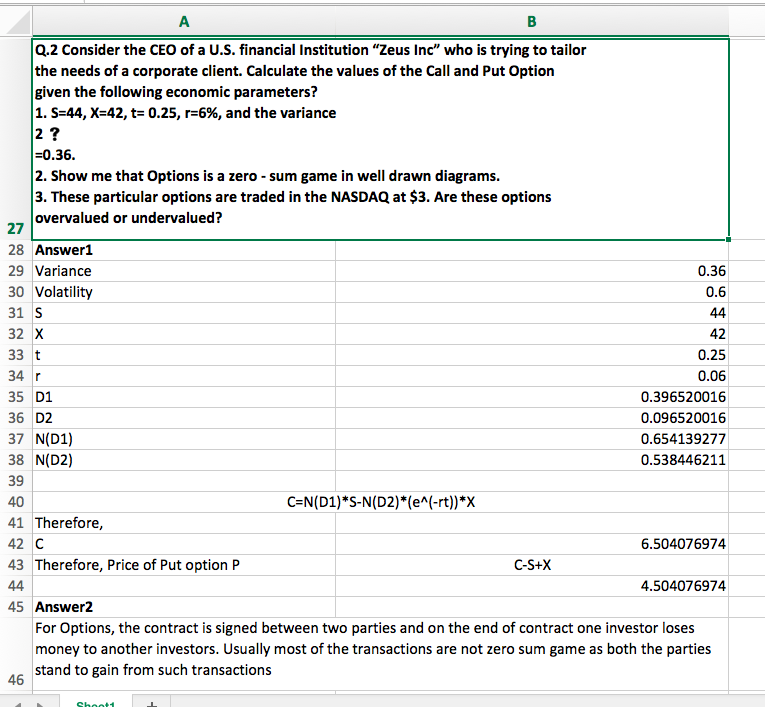

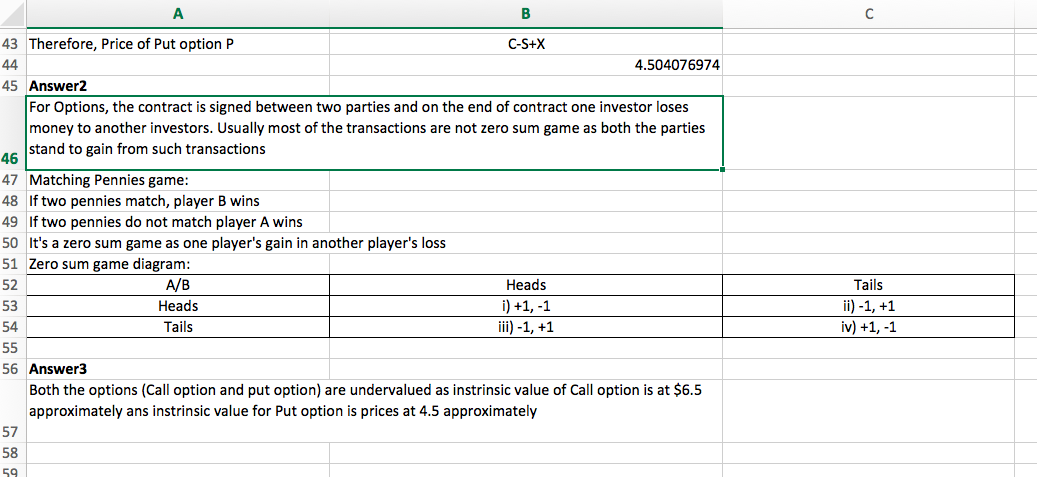

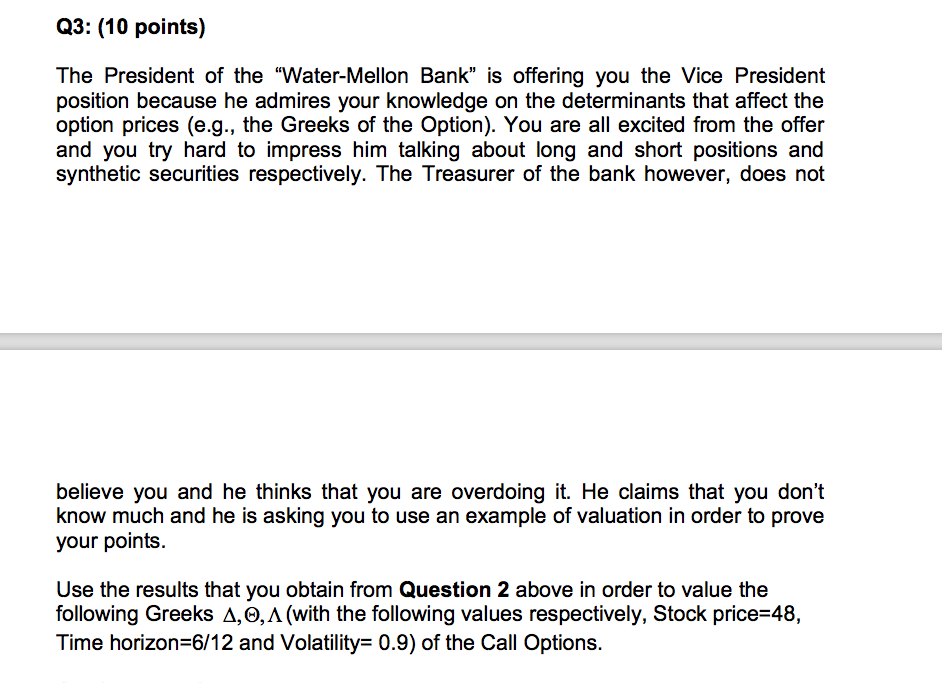

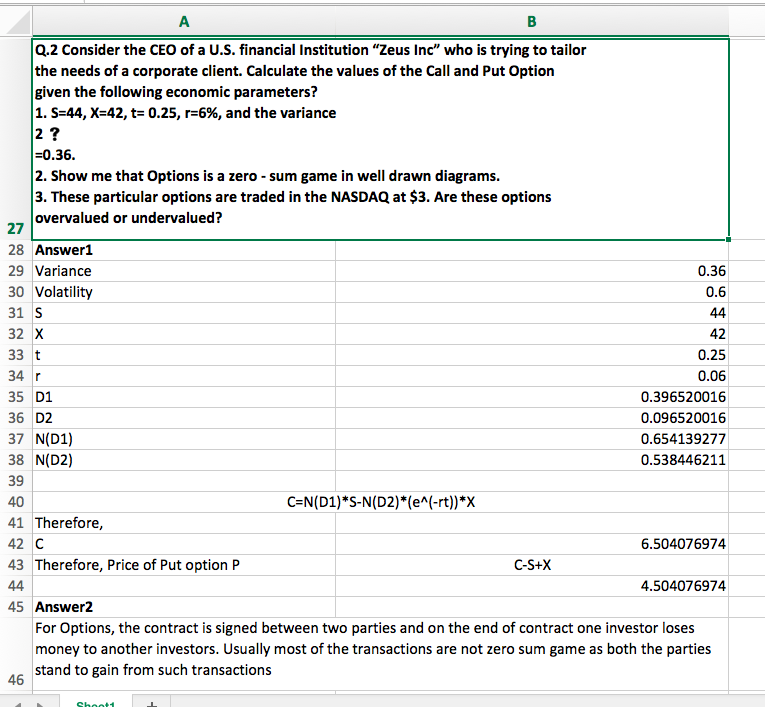

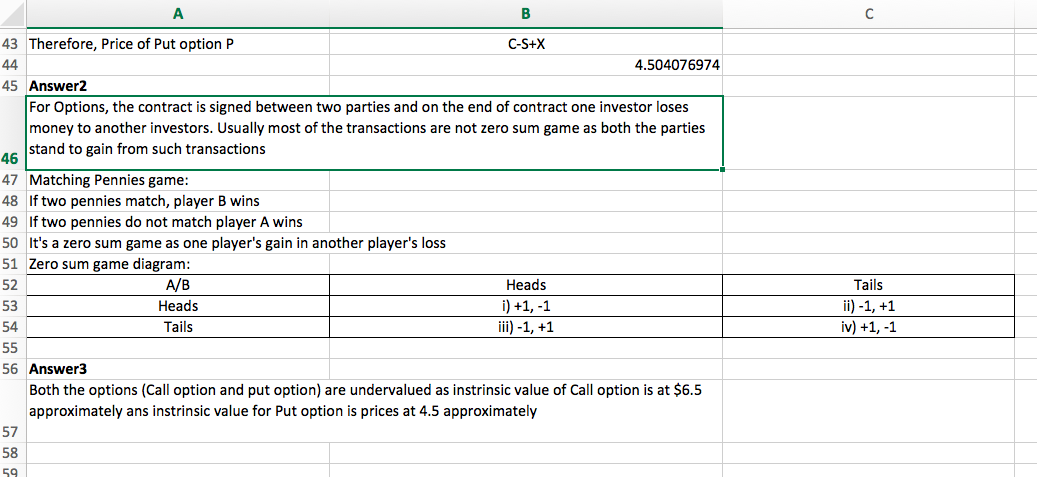

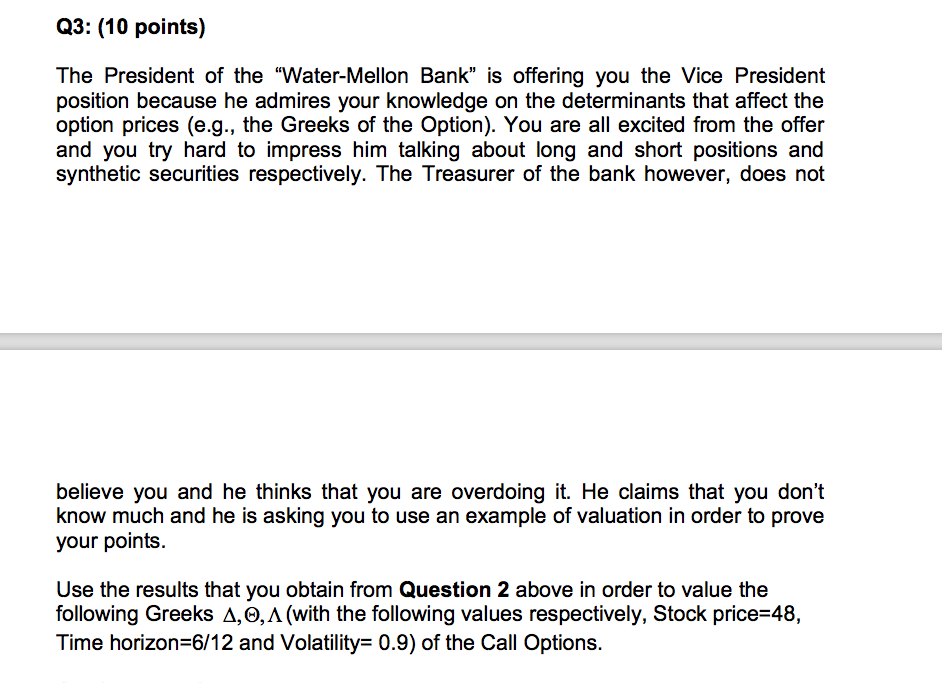

Q3: (10 points) The President of the "Water-Mellon Bank" is offering you the Vice President position because he admires your knowledge on the determinants that affect the option prices (e.g., the Greeks of the Option). You are all excited from the offer and you try hard to impress him talking about long and short positions and synthetic securities respectively. The Treasurer of the bank however, does not believe you and he thinks that you are overdoing it. He claims that you don't know much and he is asking you to use an example of valuation in order to prove your points. Use the results that you obtain from Question 2 above in order to value the following Greeks A, O, A (with the following values respectively, Stock price=48, Time horizon=6/12 and Volatility= 0.9) of the Call Options. A B Q.2 Consider the CEO of a U.S. financial Institution "Zeus Inc" who is trying to tailor the needs of a corporate client. Calculate the values of the Call and Put Option given the following economic parameters? 1. S=44, X=42, t= 0.25, r=6%, and the variance 2 ? 1=0.36. 2. Show me that Options is a zero- sum game in well drawn diagrams. 3. These particular options are traded in the NASDAQ at $3. Are these options overvalued or undervalued? 27 28 Answer1 29 Variance 0.36 30 Volatility 0.6 31 S 44 32 X 42 33 t 0.25 34 r 0.06 35 D1 0.396520016 36 D2 0.096520016 37 N(D1) 0.654139277 38 N(D2) 0.538446211 39 40 C=N(D1)*S-N(D2)*(e^(-rt))*X 41 Therefore, 42 C 6.504076974 43 Therefore, Price of Put option P C-S+X 44 4.504076974 45 Answer2 For Options, the contract is signed between two parties and on the end of contract one investor loses money to another investors. Usually most of the transactions are not zero sum game as both the parties stand to gain from such transactions 46 Sbatt A 43 Therefore, Price of Put option P C-S+X 44 4.504076974 45 Answer2 For Options, the contract is signed between two parties and on the end of contract one investor loses money to another investors. Usually most of the transactions are not zero sum game as both the parties stand to gain from such transactions 46 47 Matching Pennies game: 48 If two pennies match, player B wins 49 If two pennies do not match player A wins 50 It's a zero sum game as one player's gain in another player's loss 51 Zero sum game diagram: 52 A/B Heads 53 Heads i) +1,-1 54 Tails iii) -1, +1 55 56 Answer3 Both the options (Call option and put option) are undervalued as instrinsic value of Call option is at $6.5 approximately ans instrinsic value for Put option is prices at 4.5 approximately 57 58 59 Tails ii) -1, +1 iv) +1, -1 Q3: (10 points) The President of the "Water-Mellon Bank" is offering you the Vice President position because he admires your knowledge on the determinants that affect the option prices (e.g., the Greeks of the Option). You are all excited from the offer and you try hard to impress him talking about long and short positions and synthetic securities respectively. The Treasurer of the bank however, does not believe you and he thinks that you are overdoing it. He claims that you don't know much and he is asking you to use an example of valuation in order to prove your points. Use the results that you obtain from Question 2 above in order to value the following Greeks A, O, A (with the following values respectively, Stock price=48, Time horizon=6/12 and Volatility= 0.9) of the Call Options. A B Q.2 Consider the CEO of a U.S. financial Institution "Zeus Inc" who is trying to tailor the needs of a corporate client. Calculate the values of the Call and Put Option given the following economic parameters? 1. S=44, X=42, t= 0.25, r=6%, and the variance 2 ? 1=0.36. 2. Show me that Options is a zero- sum game in well drawn diagrams. 3. These particular options are traded in the NASDAQ at $3. Are these options overvalued or undervalued? 27 28 Answer1 29 Variance 0.36 30 Volatility 0.6 31 S 44 32 X 42 33 t 0.25 34 r 0.06 35 D1 0.396520016 36 D2 0.096520016 37 N(D1) 0.654139277 38 N(D2) 0.538446211 39 40 C=N(D1)*S-N(D2)*(e^(-rt))*X 41 Therefore, 42 C 6.504076974 43 Therefore, Price of Put option P C-S+X 44 4.504076974 45 Answer2 For Options, the contract is signed between two parties and on the end of contract one investor loses money to another investors. Usually most of the transactions are not zero sum game as both the parties stand to gain from such transactions 46 Sbatt A 43 Therefore, Price of Put option P C-S+X 44 4.504076974 45 Answer2 For Options, the contract is signed between two parties and on the end of contract one investor loses money to another investors. Usually most of the transactions are not zero sum game as both the parties stand to gain from such transactions 46 47 Matching Pennies game: 48 If two pennies match, player B wins 49 If two pennies do not match player A wins 50 It's a zero sum game as one player's gain in another player's loss 51 Zero sum game diagram: 52 A/B Heads 53 Heads i) +1,-1 54 Tails iii) -1, +1 55 56 Answer3 Both the options (Call option and put option) are undervalued as instrinsic value of Call option is at $6.5 approximately ans instrinsic value for Put option is prices at 4.5 approximately 57 58 59 Tails ii) -1, +1 iv) +1, -1

Please answer only Q.3

Please answer only Q.3