Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer only QUESTION #3 in the context of Apple In. (in details) The second picture shows all the necessary info needed. (cost of equity,

Please answer only QUESTION #3 in the context of Apple In. (in details)

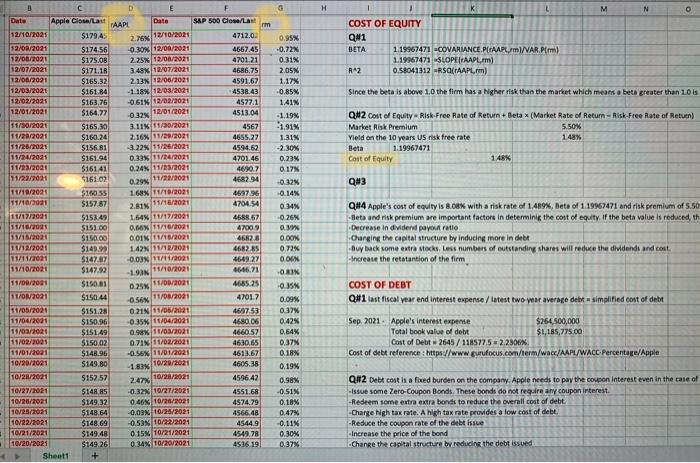

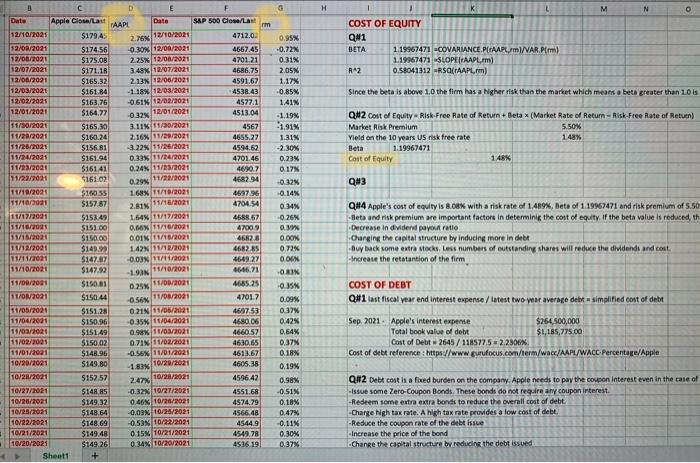

Download 5 years of stock price data for your selected company as well as market (S&P500 for example), calculate monthly returns. Cost of equity analysis 1. Estimate beta and discuss if your firm has higher market risk than the market 2. Estimate cost of equity using the beta you estimated from previous step 3. Compare cost of equity with the realized stock return. What do you find and how do you interpret the result? 4. How can you lower cost of equity for the firm(try to make some strategic advices)? Cost of debt 1. Estimate cost of debt for your firm 2. How can you lower cost of debt for the firm? H M N 0 Data 2.76 12/10/2021 COST OF EQUITY Q41 BETA 1.19967471 COVARIANCE.PAPI/VAR.Pim) 1.19967471 SLOPETTAAPL) RAZ 0.58041312 RSGAAPL) Since the beta is above 1.0 the firm has a higher risk than the market which means a beta greater than 10 is Q#2 Cost of Equity - Risk Free Rate of Return + Beta (Market Rate of Retur-Risk Free Rate of Return) Market Risk Premium 5.50% Vield on the 10 years US risk free rate 1.48% Beta 1.19967471 Cost of Equity 148% 0.29/11/22/2001 Q#3 2.IN 11/16/2021 B D E G Apple Close/Last Data TAAPI SAP 500 Close/Last rm 12/10/2021 $1794 4712.02 0.95% 12/09/2021 $174.56 -0.30% 12/09/2021 4667.45 -0.72 12/06/2021 $175.08 2.25% 12/05/2021 470121 0.31% 12/07/2021 $171.18 3.48% 12/07/2021 4686.75 2.05N 12/08/2021 $165.32 2.13 12/06/2021 4591.67 1.17% 12/03/2020 $161.84 - 1.18% 12/03/2021 4538.43 0.85% 12/02/2011 $163.76 -0.61N12/02/2021 4577.1 141N 12/01/2021 $164.77 -0.32% 12/01/2021 4513.04 -1.19% 11/30/2020 $165.0 3.113 11/20/2021 4567 1.91 11/20/2021 $160.24 2.16% 11/20/2021 4655.27 1.31% 51/26/2021 $156 81 -3.22% 11/26/2021 4594.62 -2.30% 11/24/2011 $161.94 0.33% 11/24/2021 4701.46 0.23% 11/25/20 $161 41 0.2411/25/2021 4690.7 0.17% 11/22/2021 416101 4682.94 -0.32% 11/19/2021 $160 55 168% 11/19/2021 4697.96 -0.14% 11/10/01 $157.57 4704.54 0.34% 11/17/2001 $15149 1.64% 11/17/2021 4588.67 0.26 11/100 515100 0.60 11/16721 47009 11/167201 $150.00 0.015/11/16/2021 46826 O.OON 11/12/2021 $149.99 14215712/2011 4682.85 0.72% 11/11/201 5147.87 -0.03% 11/11/20 4649.27 O OGN 11/10/2021 $147.32 4646.71 -ORIN 11/09/2011 $150.81 4685.25 O.SK 11/01/2011 $150.44 47017 0.09% 51/05/2021 S151.28 021N 11/05/2021 4697.53 0.37% 11/04/2001 $150.96 0 3511/04/2021 4680.06 0.42% 15/03/2020 $151.49 098/03/2021 4660.57 0.64% 11/02/2021 $150.02 0.71% 11/02/2021 4630.65 0.37% 11/01/01 $148.96 -0.56% 11/01/2021 4613.67 0.18% 10/20/2021 $149.80 4605.38 0.19% 10/20/2021 $152.57 4596.42 0.98% 10/27/2021 $14885 -0.3210/27/2021 4551.68 -0.SIN 10/20/2021 $149.32 0.46% 10/26/2021 4574.79 0.18% 10/25/2021 $148.64 -0.09 10/25/2021 4566,48 0.47% 10/22/2021 $148.69 -0.535 10/22/2021 4544.9 -0.11% 10/21/2021 $149.48 0.15 10/21/2021 4549.78 0.304 10/20/2021 $149.26 0.34% 10/20/2021 4536 19 0.37% Sheet1 Q#4 Apple's cost of equity is 8.08% with a risk rate of 1.489%, Beta of 1.19967471 and risk premium of 5.50 -Beta and risk premium are important factors in determine the cost of equity. If the beta value is reduced, th Decrease in dividend payout ratio Charging the capital structure by inducing more in debt Buy back some extra stocks, Less numbers of outstanding shares will reduce the dividends and cost Increase the rettantion of the firm -LIN1/10/2020 0 25 11/20 OSEN 11/03/2001 COST OF DEBT Q#1 last fiscal year end interest expense / latest two year average debt simplified cost of debt Sep 2021. Apple's interest expense $264,500,000 Total book value of debt $1,185,775.00 Cost of Debt - 2645/118577.5 2.2300% Cost of debt reference: https://www gurufocus.com/term/wacc/AAPL/WACC Percentage/Apple -18 10/20/2021 2.47 102/2011 Q#2 Debt costh a fixed burden on the company. Apple needs to pay the coupon interest even in the care of Issue some Zero-Coupon Bonds. These bonds do not require any coupon Interest. -Redeem some extra extra bonds to reduce the overall cost of debt. Charge Ngh tax rate. A high tax rate provides a low cost of debt. -Reduce the coupon rate of the debt issue - Increase the price of the bond -Change the capital structure by reducing the debt issued The second picture shows all the necessary info needed. (cost of equity, return on Applw etc.)

*rAAPL ( return of Apple)

*rm (Return of Market)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started