Question

PLEASE ANSWER ONLY THE FOLLOWING QUESTIONS BELOW WITH EXPLANATION AND WORK. Thank you. Answer the following questions regarding the creditworthiness of Nocturnal Departures Home Improvement

PLEASE ANSWER ONLY THE FOLLOWING QUESTIONS BELOW WITH EXPLANATION AND WORK. Thank you.

Answer the following questions regarding the creditworthiness of Nocturnal Departures Home Improvement Co.

a. Based on the information provided on November 20:

1) What is Nocturnals ratio of cash to short-term liabilities?

2) What is its ratio of Total Liabilities to Total Assets?

3) Using the same credit standards that BWLC applied to Beacon, does it appear that Nocturnal meets Beacons standards for trade credit? (Per p. 5, BWLC required that Beacons ratio of debt to total assets not exceed .7, and that its current ratio not fall below 2.45.)

b. Using the revised information from Nocturnals bank:

1) What is Nocturnals ratio of cash to short-term liabilities?

2) What is its Debt to Assets ratio?

3) Does your answer to part 1.c above change? Explain why or why not?

4) What is Nocturnals stockholders equity?

5) Do lenders or owners appear to have a great interest in the assets of Nocturnal? Explain.

2. Analyze Beacon Lumbers performance

a. Calculation ROA and ROE for December and January.

b. Calculate Debt to Equity for all three months.

c. Write a short memo (max. 300 words) to the Board of Directors commenting on BLs financial performance during its first three months. Include any other ratios you think are notable.

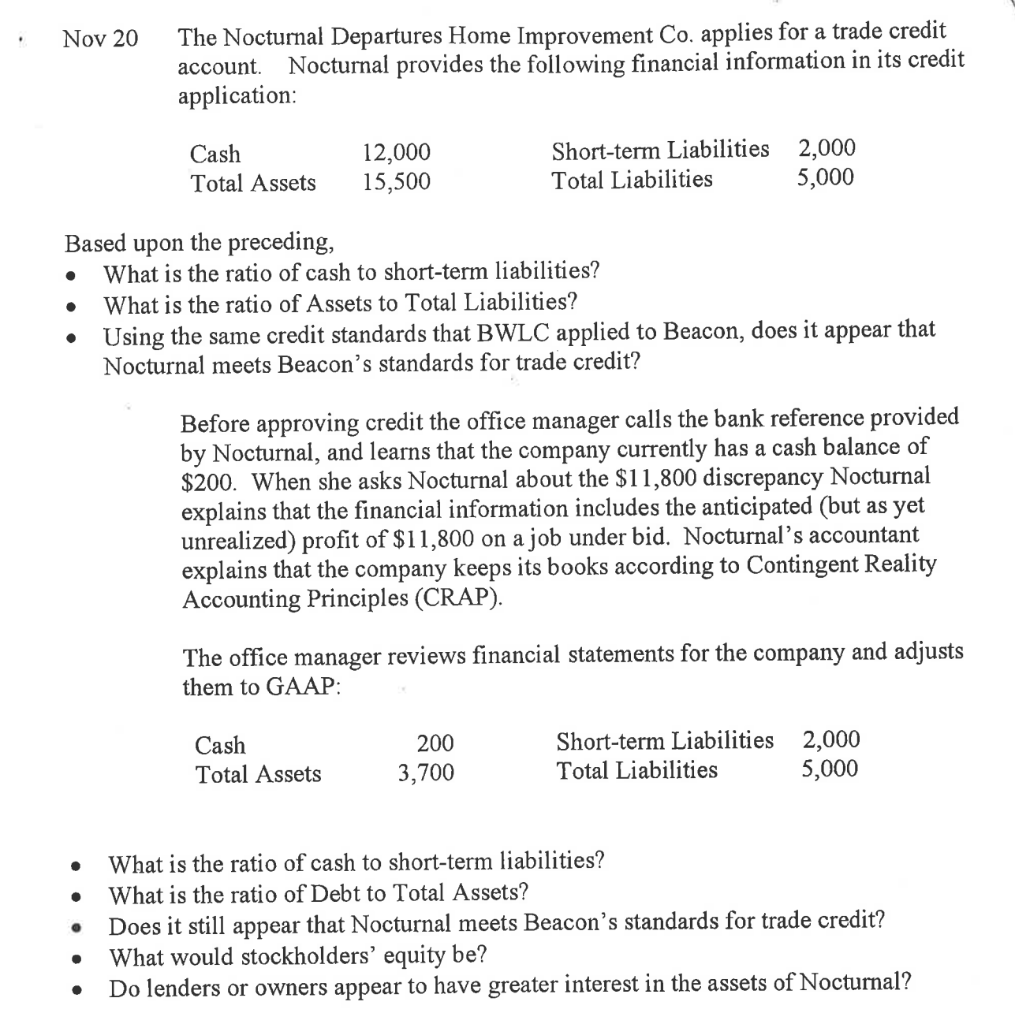

Nov 20 The Noctunal Departures Home Improvement Co. applies for a trade credit account. Nocturnal provides the following financial information in its credit application Short-term Liabilities Total Liabilities 2,000 5,000 12,000 Cash Total Assets 15,500 Based upon the preceding, . What is the ratio of cash to short-term liabilities? What is the ratio of Assets to Total Liabilities? Using the same credit standards that BWLC applied to Beacon, does it appear that Nocturnal meets Beacon's standards for trade credit? Before approving credit the office manager calls the bank reference provided by Nocturnal, and learns that the company currently has a cash balance of $200. When she asks Nocturnal about the $11,800 discrepancy Nocturnal explains that the financial information includes the anticipated (but as yet unrealized) profit of $11,800 on a job under bid. Nocturnal's accountant explains that the company keeps its books according to Contingent Reality Accounting Principles (CRAP) The office manager reviews financial statements for the company and adjusts them to GAAP Short-term Liabilities Total Liabilities 2,000 5,000 200 3,700 as Total Assets . What is the ratio of cash to short-term liabilities? . What is the ratio of Debt to Total Assets? Does it still appear that Nocturnal meets Beacon's standards for trade credit? What would stockholders' equity be? Do lenders or owners appear to have greater interest in the assets of NocturnalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started