Answered step by step

Verified Expert Solution

Question

1 Approved Answer

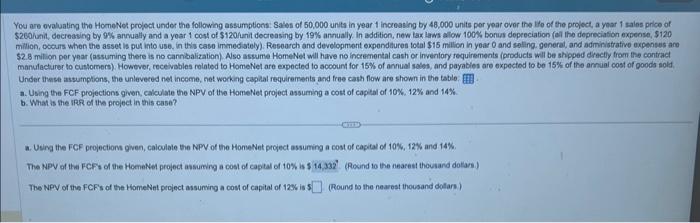

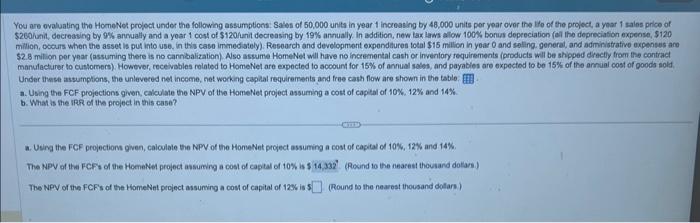

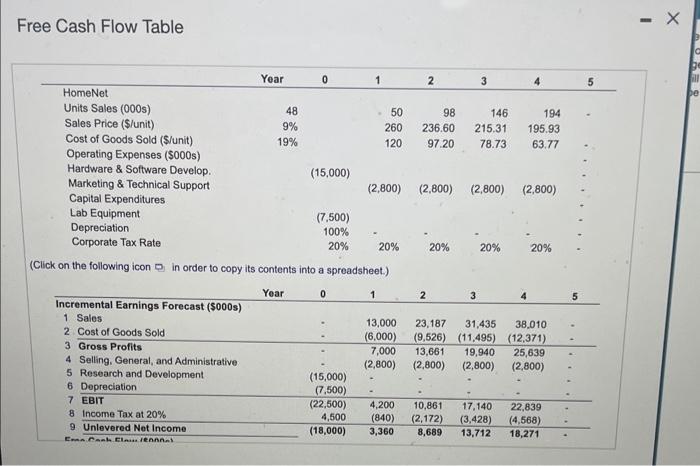

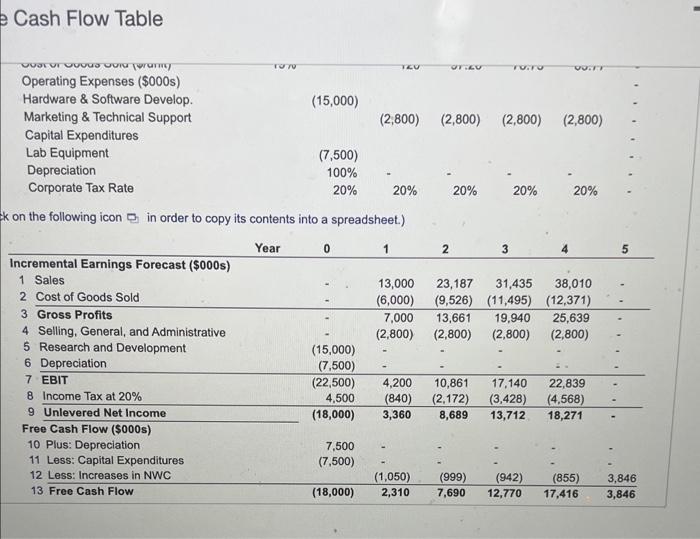

please answer part a 12% and 14% and part b question You are ovaluating the HomeNet prolect under the following assumptions: Sales of 50,000 units

please answer part a 12% and 14% and part b question

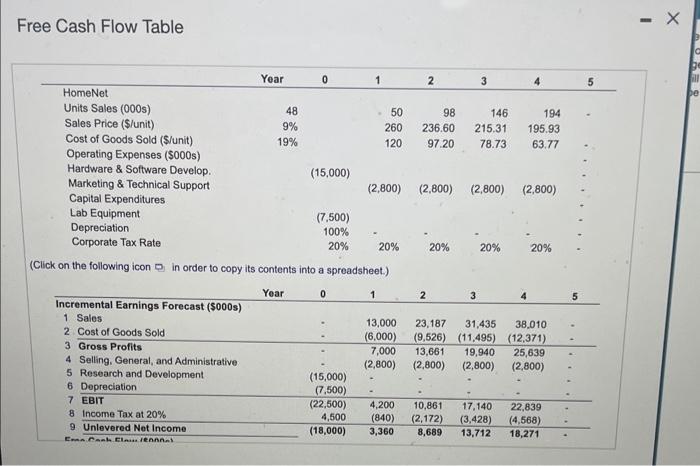

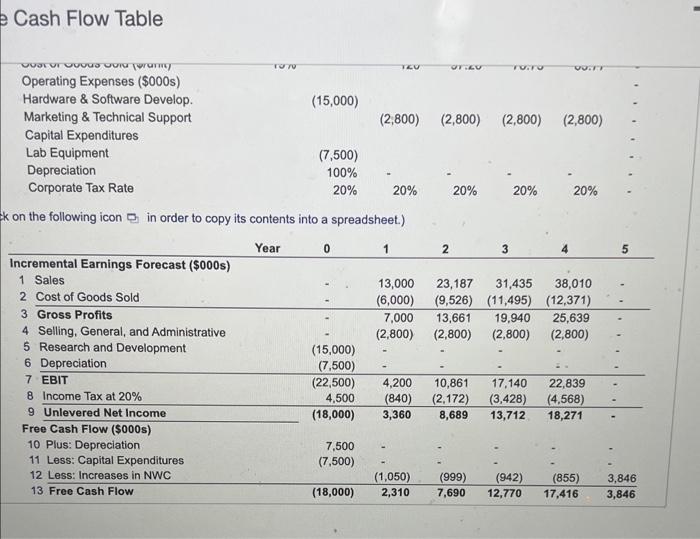

You are ovaluating the HomeNet prolect under the following assumptions: Sales of 50,000 units in year 1 incroasing by 48,000 units por year over the lto of the project, a yoar 1 sales price of $260/ unit, decreasing by 9% annually and a yoar 1 cost of \$120/unit decreasing by 19% annualy. In addition, new lax laws allow 100% bonus dopreciation (el the depreciation expeose, \$120 milion, oocurs when the asset is put into use. in this caso immediately). Resoarch and devolopmont expenditures total $15 million in yoar 0 and selling. generat and administrative expenses are $2.8 milion per ynar (assuming there is no cannibalization). Aso aswume HameNet wil have no incremental cash or invenilary requirements (products will be shpped diecty from the contract manulacturer to oustomers): However, receivables rolated to HomeNet are expected to acoount for 15% of annual soles, and payables are expectod to be 15% of the arnual cost of poods sold Under these assumptions, the unlevered net income, net woking caplal requirements and free cath flow are shown in the table. fTH. a. Using the FCF projections given, calculate the NPV of the HomeNet project assuming a cott of captal of 10%,12% and 14%. b. What is the IRR of the prolect in this case? a. Uing the FCF projections given, caloulate the NPV of the HoneNet project assuming a cost of capital of 10%,12% and 14%. The NPV of tha FCFis of the HoeneNe1 project assuring a cost of captal of 10% is 514,332 . (Round to the neareat thoutand dotare.) The NPV of the FCF's of the HomeNat peoject assuming a cost of capital of 12% is 3 (Round to the nearest thousand dolars) Free Cash Flow Table (Click on the following icon in order to copy its contents into a spreadsheet.) Cash Flow Table k on the following icon in order to copy its contents into a spreadsheet.) You are ovaluating the HomeNet prolect under the following assumptions: Sales of 50,000 units in year 1 incroasing by 48,000 units por year over the lto of the project, a yoar 1 sales price of $260/ unit, decreasing by 9% annually and a yoar 1 cost of \$120/unit decreasing by 19% annualy. In addition, new lax laws allow 100% bonus dopreciation (el the depreciation expeose, \$120 milion, oocurs when the asset is put into use. in this caso immediately). Resoarch and devolopmont expenditures total $15 million in yoar 0 and selling. generat and administrative expenses are $2.8 milion per ynar (assuming there is no cannibalization). Aso aswume HameNet wil have no incremental cash or invenilary requirements (products will be shpped diecty from the contract manulacturer to oustomers): However, receivables rolated to HomeNet are expected to acoount for 15% of annual soles, and payables are expectod to be 15% of the arnual cost of poods sold Under these assumptions, the unlevered net income, net woking caplal requirements and free cath flow are shown in the table. fTH. a. Using the FCF projections given, calculate the NPV of the HomeNet project assuming a cott of captal of 10%,12% and 14%. b. What is the IRR of the prolect in this case? a. Uing the FCF projections given, caloulate the NPV of the HoneNet project assuming a cost of capital of 10%,12% and 14%. The NPV of tha FCFis of the HoeneNe1 project assuring a cost of captal of 10% is 514,332 . (Round to the neareat thoutand dotare.) The NPV of the FCF's of the HomeNat peoject assuming a cost of capital of 12% is 3 (Round to the nearest thousand dolars) Free Cash Flow Table (Click on the following icon in order to copy its contents into a spreadsheet.) Cash Flow Table k on the following icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started